You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

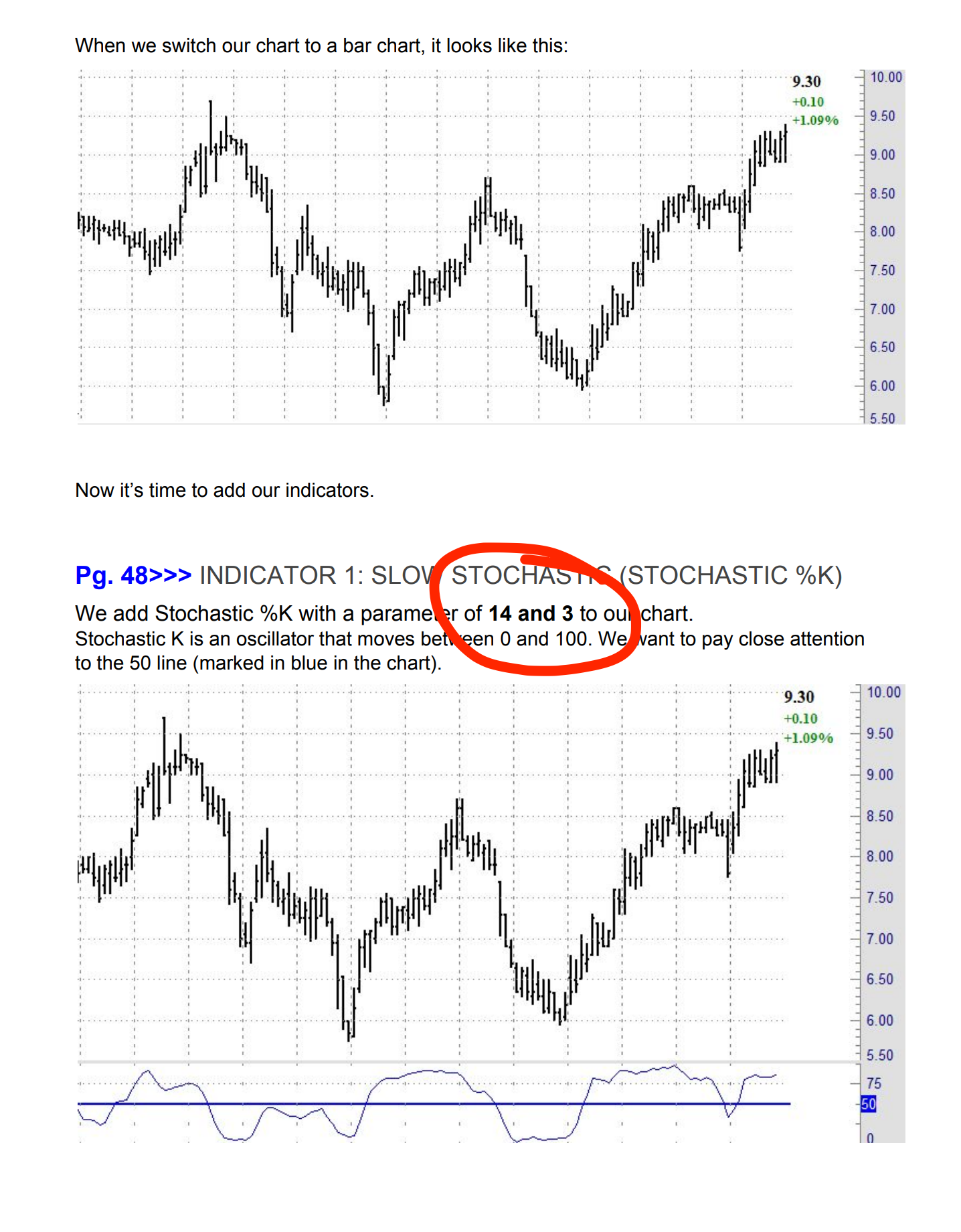

Mimicking "Power X Strategy" by Markus Heitkoetter

- Thread starter Joseph Patrick 18

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

@SuryaKiranC - love your comment man! thx so much!

Thanks @cos251@barbaros - that was per the initial requirements of the OP. It can be adjusted in settings.

Original doc from the author refers to the default settings. After your comment, I realized that @Joseph Patrick 18 recommended "Stoch Slow 5(not14) and 3 WILDERS" after he observed the signals line up better.

Is everyone using K 5 or 14 is better at 5min?

ApeX Predator

Well-known member

What @cos251 said. He coded based on the original request and kept on improving the asked enhancements. as for values, you can change them to what you want and even match the setting on the Original Strategy settings, K to 14.@cos251 This just occurred to me. Why is K set at 5 instead of the default 14? Everything else is set to default values.

I did mine and I am painting the choppy zone bars White, as I use dark background on TOS.

-S

Pardon me @barbaros - you are correct sir. Couldn't remember where that came from originally.Thanks @cos251

Original doc from the author refers to the default settings. After your comment, I realized that @Joseph Patrick 18 recommended "Stoch Slow 5(not14) and 3 WILDERS" after he observed the signals line up better.

Is everyone using K 5 or 14 is better at 5min?

R

RickAns

Guest

Very nice!

Brettser16

New member

is there a script of this new setup that anyone can share? thanks

is there a script of this new setup that anyone can share? thanks

https://usethinkscript.com/threads/mimicking-power-x-strategy-by-markus-heitkoetter.4283/post-42978

Joseph Patrick 18

Active member

Cos this is amazing!! Thanks so much!!!!Hi All.... - so sorry for the delay. I've had a rough go of trying to figure out a few updates for the latest version of the code but I think I have at least a decent working version. There are many additions in this code now and it is getting a little heavy. I apologize if this particular version does not have what you are looking for. I am happy to continue plugging away at further enhancements.

For now here are the updates available in Version 1.4 of the Standard Code (single TF/Tick version) Added the updates to this version as it is the most reliable at this time for quick and easy use.

Link to updated code - https://usethinkscript.com/threads/mimicking-power-x-strategy-by-markus-heitkoetter.4283/post-42978

Again Version 1.4

Updates are as follows

It has taken me a good while to get all these plots down correctly but I think this is a good point

- Dynamic ATR/ADR Targets/Plots on the start of an UpTrend or DownTrend

- Dynamic Stop Loss at 1x the ATR/ADR

- Dynamic Stop Loss adjustment in settings; currently set to 1.0

- Shading for ATR/ADR Targets/Plots - can be turned on or off

- Extra Targets (4-6) - can be enabled in settings

- Option to only show Dynamic Targets for TodayOnly

- Ability to plot ATR/ADR and all settings described above for Daily Chart - BUT MUST TURN OFF "showTodayOnly"

- Dynamic ATR/ADR Target Labels at top of chart for current trend

- Dynamic Trend Labels will display when trend started, at what price and how many bars are in current trend

- Debug function - miscellaneous labels that can be used for debug purposes - remove if you like

Now I will say this can make the chart look a little messy depending on your taste. I'll let you guys be the judge. I also have the same copy in MTF version but there is an issue with the Target Plots once the trend starts. It does not plot correctly but eventually straightens out. I'll see if I can figure out how to adjust it.

The ATR/ADR calculations are also pretty standard, if you see issues with them please let me know so I can adjust the script and ensure accurate calculation for all.

I'll add edits below as I think of them. For now see fresh version of code with link above and screenshots for reference below.

Thanks so much for your patience.

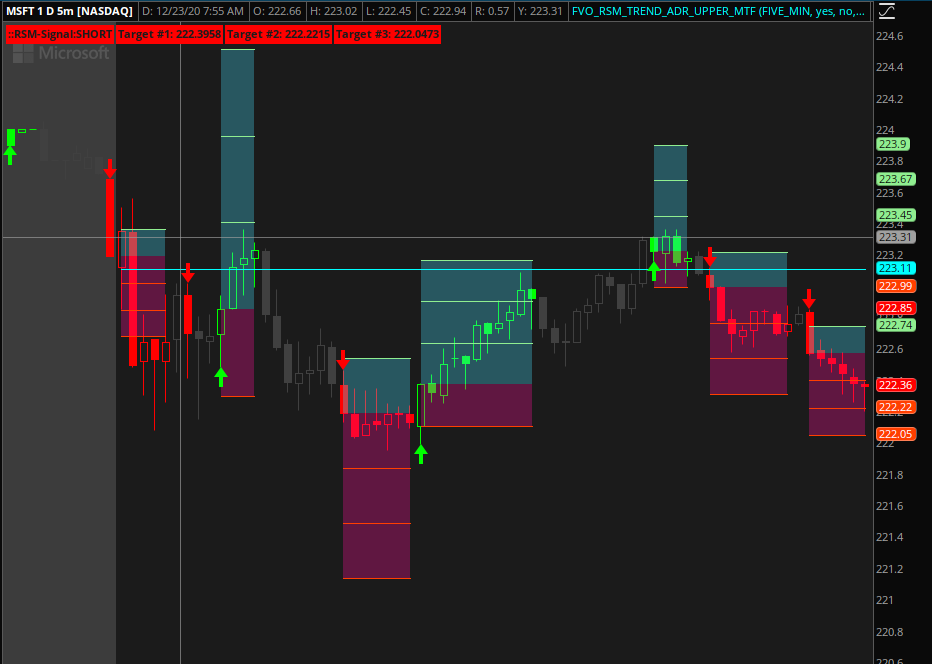

MSFT Today on 5m TF with "showTodayOnly" set to "yes"

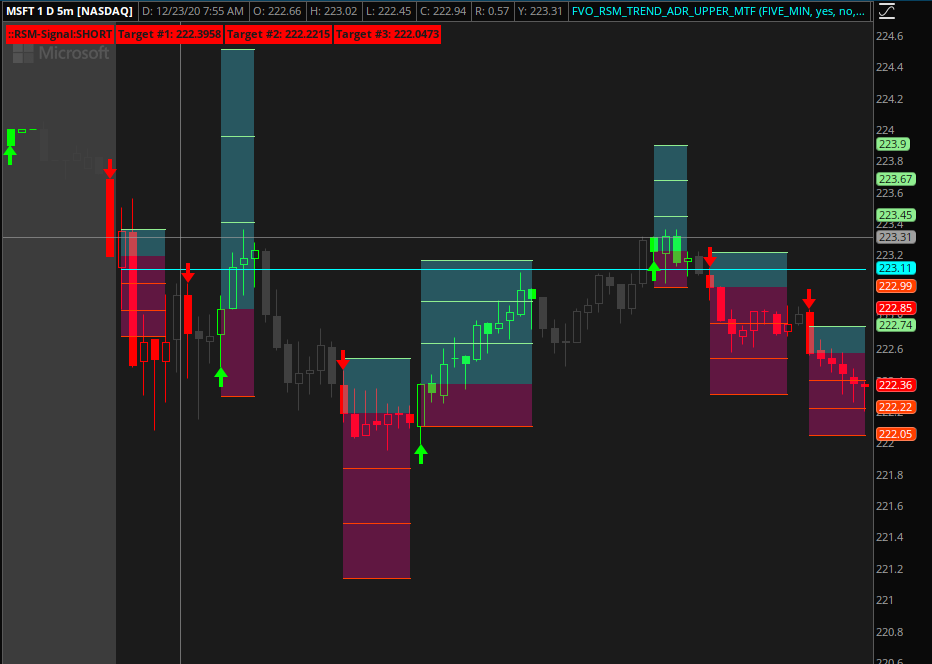

MSFT on Daily Chart with "showTodayOnly" set to "no" (Must be set to "no" so plots will work on daily)

Trend Labels set to "yes" for example purposes

Cos and all contributors - thank you so much for all the effort and time invested developing this script and making it available for the community. It's great. I have been following it and informally testing in SIM and the results are amazing. Again, THANK YOU!!Hi All.... - so sorry for the delay. I've had a rough go of trying to figure out a few updates for the latest version of the code but I think I have at least a decent working version. There are many additions in this code now and it is getting a little heavy. I apologize if this particular version does not have what you are looking for. I am happy to continue plugging away at further enhancements.

For now here are the updates available in Version 1.4 of the Standard Code (single TF/Tick version) Added the updates to this version as it is the most reliable at this time for quick and easy use.

Link to updated code - https://usethinkscript.com/threads/mimicking-power-x-strategy-by-markus-heitkoetter.4283/post-42978

Again Version 1.4

Updates are as follows

It has taken me a good while to get all these plots down correctly but I think this is a good point

- Dynamic ATR/ADR Targets/Plots on the start of an UpTrend or DownTrend

- Dynamic Stop Loss at 1x the ATR/ADR

- Dynamic Stop Loss adjustment in settings; currently set to 1.0

- Shading for ATR/ADR Targets/Plots - can be turned on or off

- Extra Targets (4-6) - can be enabled in settings

- Option to only show Dynamic Targets for TodayOnly

- Ability to plot ATR/ADR and all settings described above for Daily Chart - BUT MUST TURN OFF "showTodayOnly"

- Dynamic ATR/ADR Target Labels at top of chart for current trend

- Dynamic Trend Labels will display when trend started, at what price and how many bars are in current trend

- Debug function - miscellaneous labels that can be used for debug purposes - remove if you like

Now I will say this can make the chart look a little messy depending on your taste. I'll let you guys be the judge. I also have the same copy in MTF version but there is an issue with the Target Plots once the trend starts. It does not plot correctly but eventually straightens out. I'll see if I can figure out how to adjust it.

The ATR/ADR calculations are also pretty standard, if you see issues with them please let me know so I can adjust the script and ensure accurate calculation for all.

I'll add edits below as I think of them. For now see fresh version of code with link above and screenshots for reference below.

Thanks so much for your patience.

MSFT Today on 5m TF with "showTodayOnly" set to "yes"

MSFT on Daily Chart with "showTodayOnly" set to "no" (Must be set to "no" so plots will work on daily)

Trend Labels set to "yes" for example purposes

Pablobar

New member

Could you please share the url for TOS of your work? ThanksHere is my interpretation.

Total of 12 tradable signals.

9 wins.

2 losses.

1 questionable.

Edit: I forgot to label 2 good long trades in the screenshot below.

Thoughts?

Hi @Gvaro - you can add the following to the bottom of the script. This is a very simple, feel free to tweak the sound type, text and alert frequency.

Code:

#### ALERTS Sound

alert(upArrow,"RSM UpTrend Started",alert.BAR,sound.DING);

alert(downArrow,"RSM DownTrend Started",alert.BAR,sound.DING);Gvaro

New member

Perfect!! Thank you! @cos251Hi @Gvaro - you can add the following to the bottom of the script. This is a very simple, feel free to tweak the sound type, text and alert frequency.

Code:#### ALERTS Sound alert(upArrow,"RSM UpTrend Started",alert.BAR,sound.DING); alert(downArrow,"RSM DownTrend Started",alert.BAR,sound.DING);

ApeX Predator

Well-known member

In my opinion, we shouldn't try to line them up, but give the alert based on, each of the 3 when they cross their respective mid lines. specially if you are using 3 different instances of studies, each set to RSI, Stoch and MACD respectively.

I use 14 for Stoch K.

-S

I use 14 for Stoch K.

-S

Joseph Patrick 18

Active member

Thanks SuryaKiranC, I adjusted it back to 14...I didn't realize but now understand what you are saying and appreciate your help! Thanks and Happy Holidays to you and your family! ThanksIn my opinion, we shouldn't try to line them up, but give the alert based on, each of the 3 when they cross their respective mid lines. specially if you are using 3 different instances of studies, each set to RSI, Stoch and MACD respectively.

I use 14 for Stoch K.

-S

Dumb question, what do you have for all 3 of your settings for the RSI settings, the Stoch, and MACD settings? Thanks appreciate it...I will adjust once you get back to me.

Sorry Everyone for the miscommunication it was unintentional!

Last edited:

- Status

- Not open for further replies.

Volatility Trading Range

VTR is a momentum indicator that shows if a stock is overbought or oversold based on its Weekly and Monthly average volatility trading range.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| C | Bull Bear Power VOID Oscillator For ThinkOrSwim | Indicators | 21 | |

| I | PMF (Power Momentum Formula) for ThinkorSwim | Indicators | 10 | |

|

|

Balance of Power Trend Indicator for ThinkorSwim | Indicators | 34 | |

|

|

Hima Reddy RSI Power Zones Indicator for ThinkorSwim | Indicators | 11 | |

|

|

Power Earnings Gaps (PEG) Scanner for ThinkorSwim | Indicators | 14 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1186

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.