mod note:

Author states:

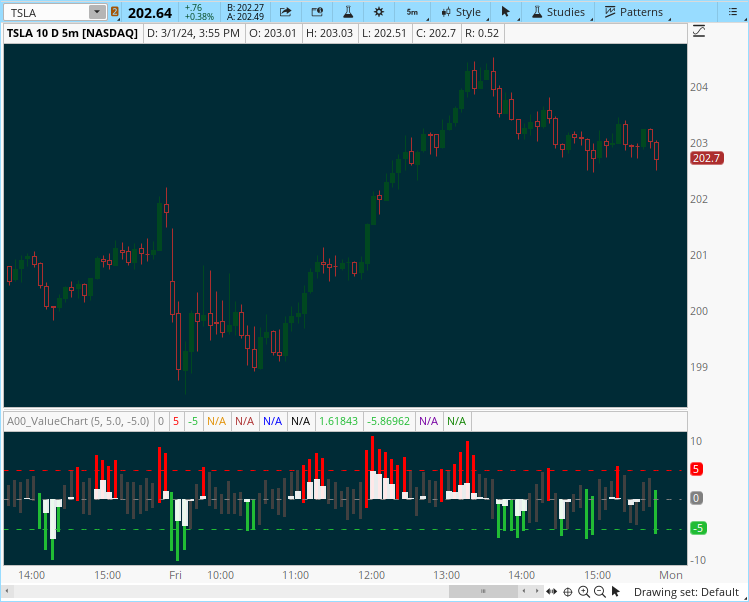

This is my version of a Value Charts Indicator

The VCI identify areas of relative high and low value that provide low-risk entry opportunities and turning points that can be traded in all timeframes.

You can use the indicator as confirmation indicator based on your trading style.

CODE :

updated version from @SleepyZ can be found:

https://usethinkscript.com/threads/value-chart-indicator-for-thinkorswim.12423/#post-138932

Author states:

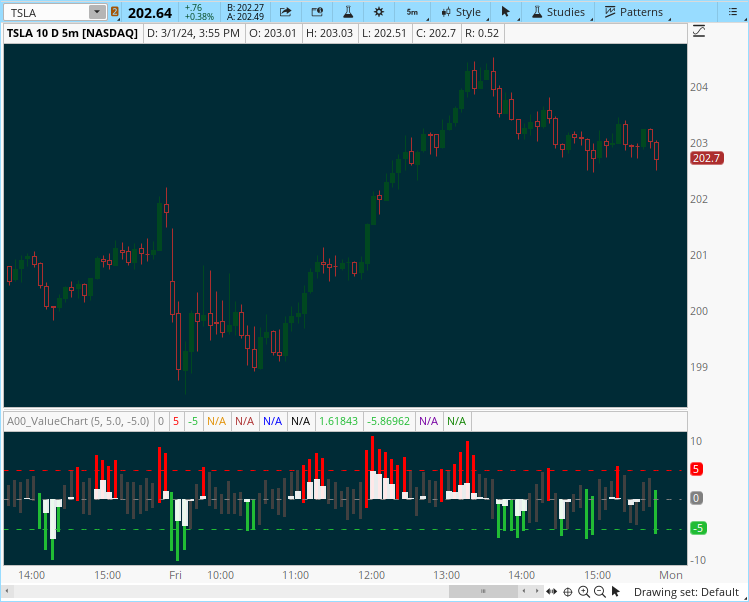

This is my version of a Value Charts Indicator

The VCI identify areas of relative high and low value that provide low-risk entry opportunities and turning points that can be traded in all timeframes.

You can use the indicator as confirmation indicator based on your trading style.

CODE :

CSS:

#https://www.tradingview.com/script/ryWO2cGg-Value-Chart/

#study (title="Value Chart",shorttitle="VC",overlay=false)

## Converted and mod by Sam4Cok@ 08/2022 ##

declare lower;

#### Input ###

input length = 5; # 'Length'

input sigTop = 5.0; # 'Top Line'

input sigBot = -5.0; # 'Bottom Line'

def na = Double.NaN;

#prev(s,i) =>

script prev {

input s = close;

input i = 0;

def y = AbsValue(Round(i, 0));

def prev = s[y];

plot return = prev;

}

def varp = Round(length / 5, 0);

def h_f = length > 7;

###### Calculation

def vara = If(h_f, Highest(high, varp) - Lowest(low, varp), 0);

def varr1 = If(h_f, If(vara == 0 and varp == 1, AbsValue(close - prev(close, -varp)), vara), 0);

def varb = If(h_f, prev(Highest(high, varp), -varp + 1) - prev(Lowest(low, varp), -varp), 0);

def varr2 = If(h_f, If(varb == 0 and varp == 1, AbsValue( prev(close, -varp) - prev(close, -varp * 2) ), varb), 0);

def varc = If(h_f, prev(Highest(high, varp), -varp * 2) - prev(Lowest(low, varp), -varp * 2), 0);

def varr3 = If(h_f, If(varc == 0 and varp == 1, AbsValue(prev(close, -varp * 2) - prev(close, -varp * 3)), varc), 0);

def vard = If (h_f, prev(Highest(high, varp), -varp * 3) - prev(Lowest(low, varp), -varp * 3), 0);

def varr4 = If(h_f, If(vard == 0 and varp == 1, AbsValue(prev(close, -varp * 3) - prev(close, -varp * 4)), vard), 0);

def vare = If(h_f, prev(Highest(high, varp), -varp * 4) - prev(Lowest(low, varp), -varp * 4), 0);

def varr5 = If(h_f, If(vare == 0 and varp == 1, AbsValue(prev(close, -varp * 4) - prev(close, -varp * 5)), vare), 0);

def cdelta = AbsValue(close - prev(close, -1));

def var0 = If(!h_f, If((cdelta > (high - low)) or (high == low), cdelta, (high - low)), 0);

def lrange = If(h_f, ((varr1 + varr2 + varr3 + varr4 + varr5) / 5) * .2, SimpleMovingAvg(var0, 5) * .2);

def mba = SimpleMovingAvg( (high + low) / 2, length);

def vhigh = (high - mba) / lrange;

def vlow = (low - mba) / lrange;

def obos = if vhigh >= sigTop then 1 else

if vlow <= sigBot then -1 else 0;

plot ZeroLine = 0;

ZeroLine.SetDefaultColor(Color.GRAY);

ZeroLine.SetStyle(Curve.SHORT_DASH);

plot top_l = sigTop;

top_l.SetDefaultColor(Color.RED);

top_l.SetStyle(Curve.SHORT_DASH);

plot bot_l = sigBot;

bot_l.SetDefaultColor(CreateColor(33, 188, 52));

bot_l.SetStyle(Curve.SHORT_DASH);

plot high1 = if vhigh > 0 then na else vhigh;

high1.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

high1.AssignValueColor(Color.WHITE);

plot high2 = if vhigh > 0 then na else vhigh;

high2.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

high2.AssignValueColor(Color.WHITE);

plot low1 = if vlow < 0 then na else vlow;

low1.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

low1.AssignValueColor( Color.WHITE);

plot low2 = if vlow < 0 then na else vlow;

low2.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

low2.AssignValueColor( Color.WHITE);

plot vHiHis1 = if obos == 0 then na else vhigh;

vHiHis1.SetLineWeight(3);

vHiHis1.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

vHiHis1.AssignValueColor(if obos > 0 then Color.RED else CreateColor(33, 188, 52));

plot vLoHis1 = if obos == 0 then na else vlow;

vLoHis1.SetLineWeight(3);

vLoHis1.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

vLoHis1.AssignValueColor( if obos > 0 then Color.RED else CreateColor(33, 188, 52));

plot vHiHis2 = if obos == 0 then vhigh else na;

vHiHis2.SetLineWeight(3);

vHiHis2.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

vHiHis2.AssignValueColor(Color.DARK_GRAY);

plot vLoHis2 = if obos == 0 then vlow else na;

vLoHis2.SetLineWeight(3);

vLoHis2.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

vLoHis2.AssignValueColor(Color.DARK_GRAY);

#-- END

Last edited by a moderator: