He said he would send a new one when he had a chance. That is the same thing I get as well.

Merry Christmas!

Thank you. I was just responding to a direct question from him. Merry Christmas!

He said he would send a new one when he had a chance. That is the same thing I get as well.

Merry Christmas!

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Thanks a lot for your time. FYI, The workspace isn't working but the charts are, so that is fine. Do you use the active trader chart for options? That is all I trade. Very interesting. I hope you are open to some questions. I really do not want to bother you so just let me know. Hope you have a Merry Christmas if you celebrate it!Screenshot Edit

the whole setup: http://tos.mx/3OxJpPS

regular chart tab: http://tos.mx/YvWYK12

active trader: http://tos.mx/GUpRaTt

Ok try this one.

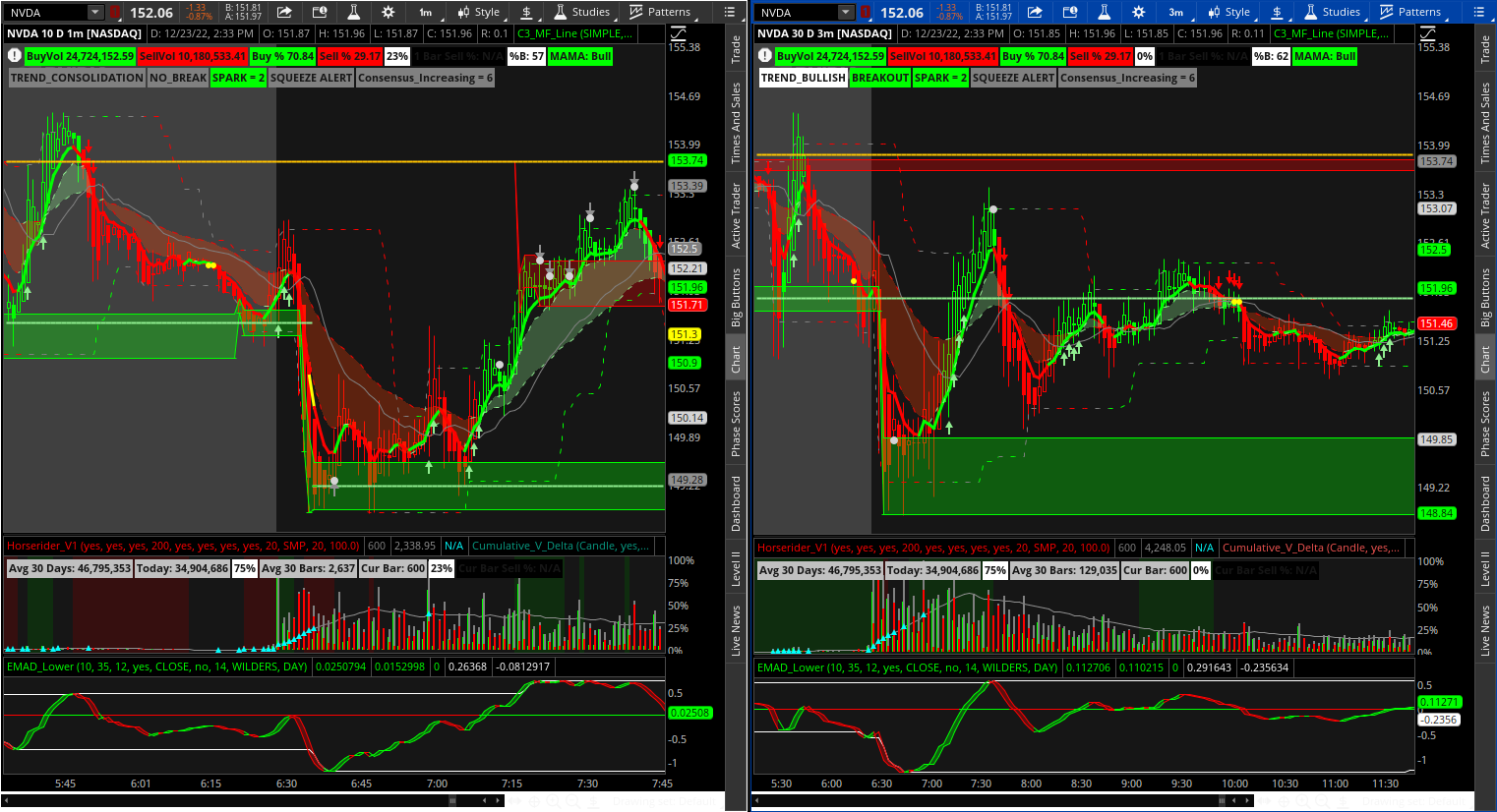

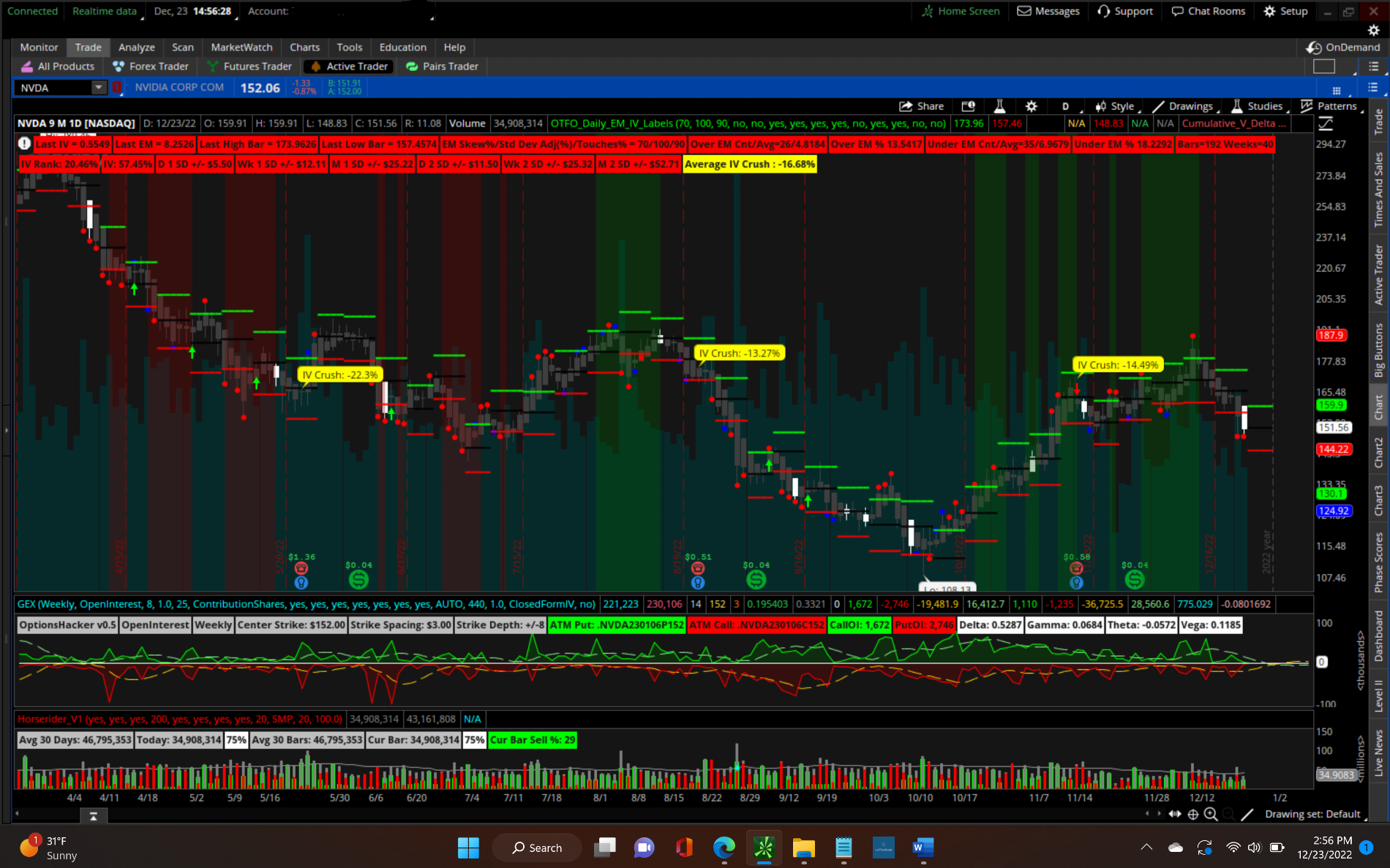

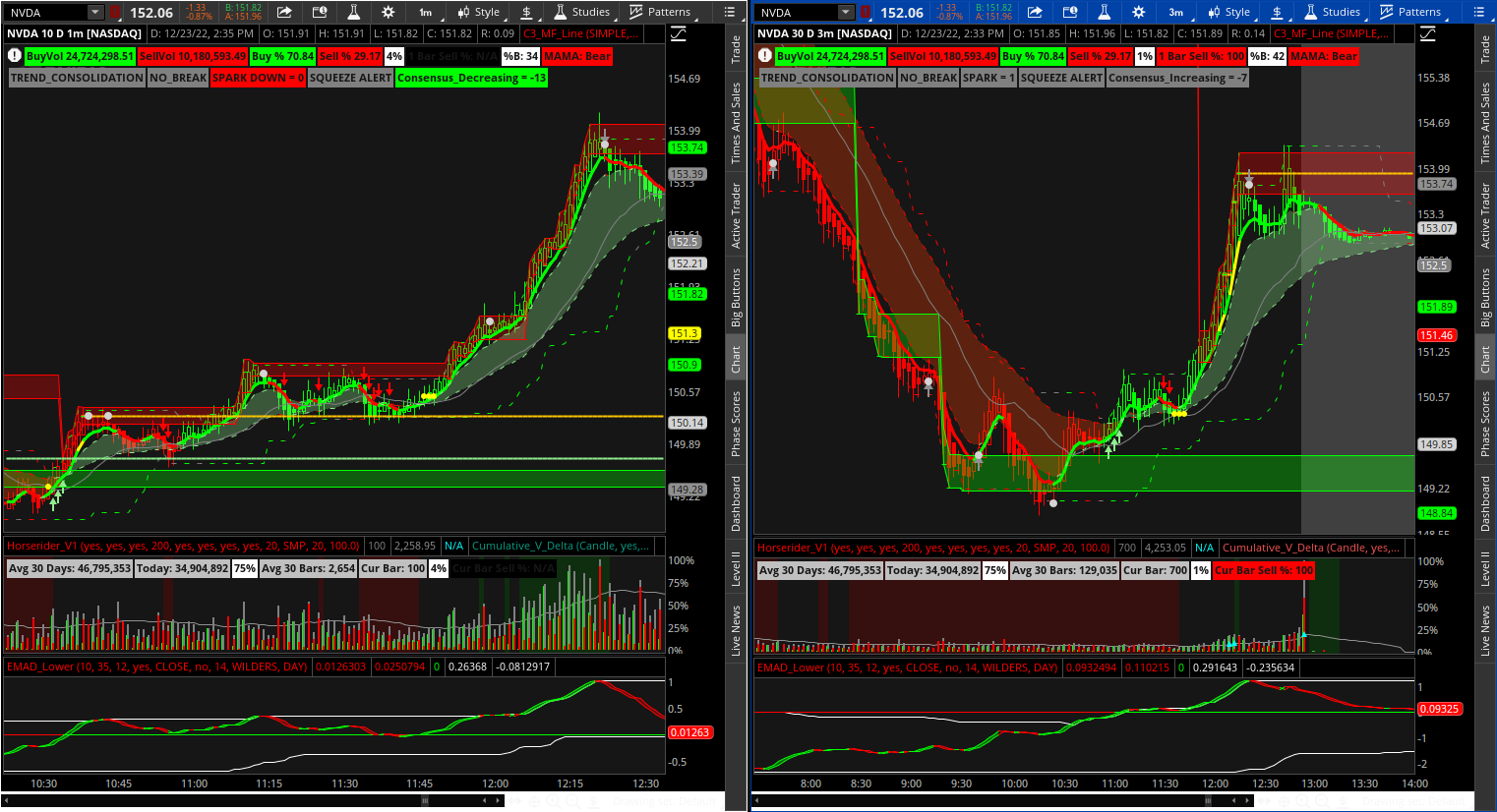

should look like this on the regular chart

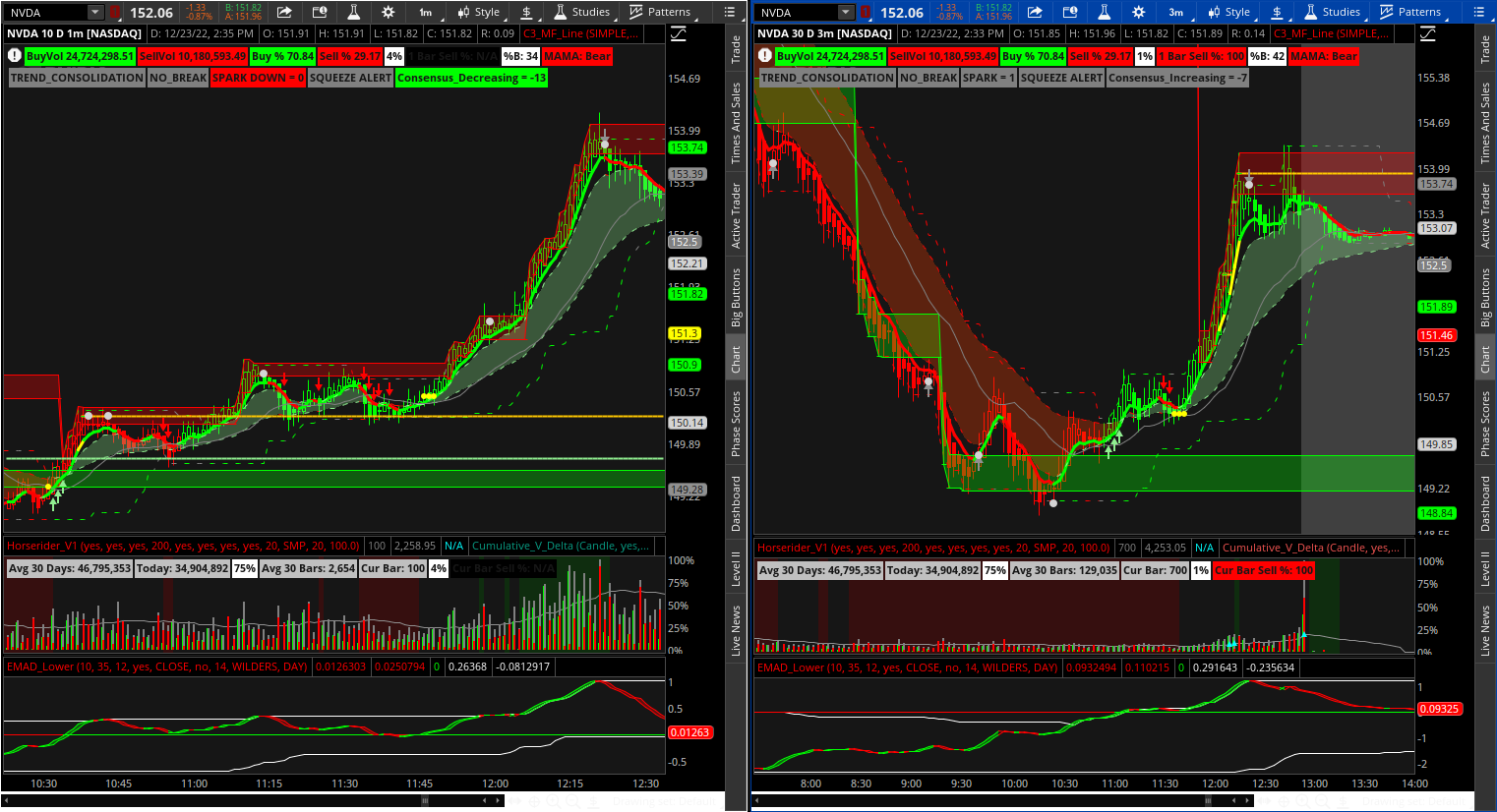

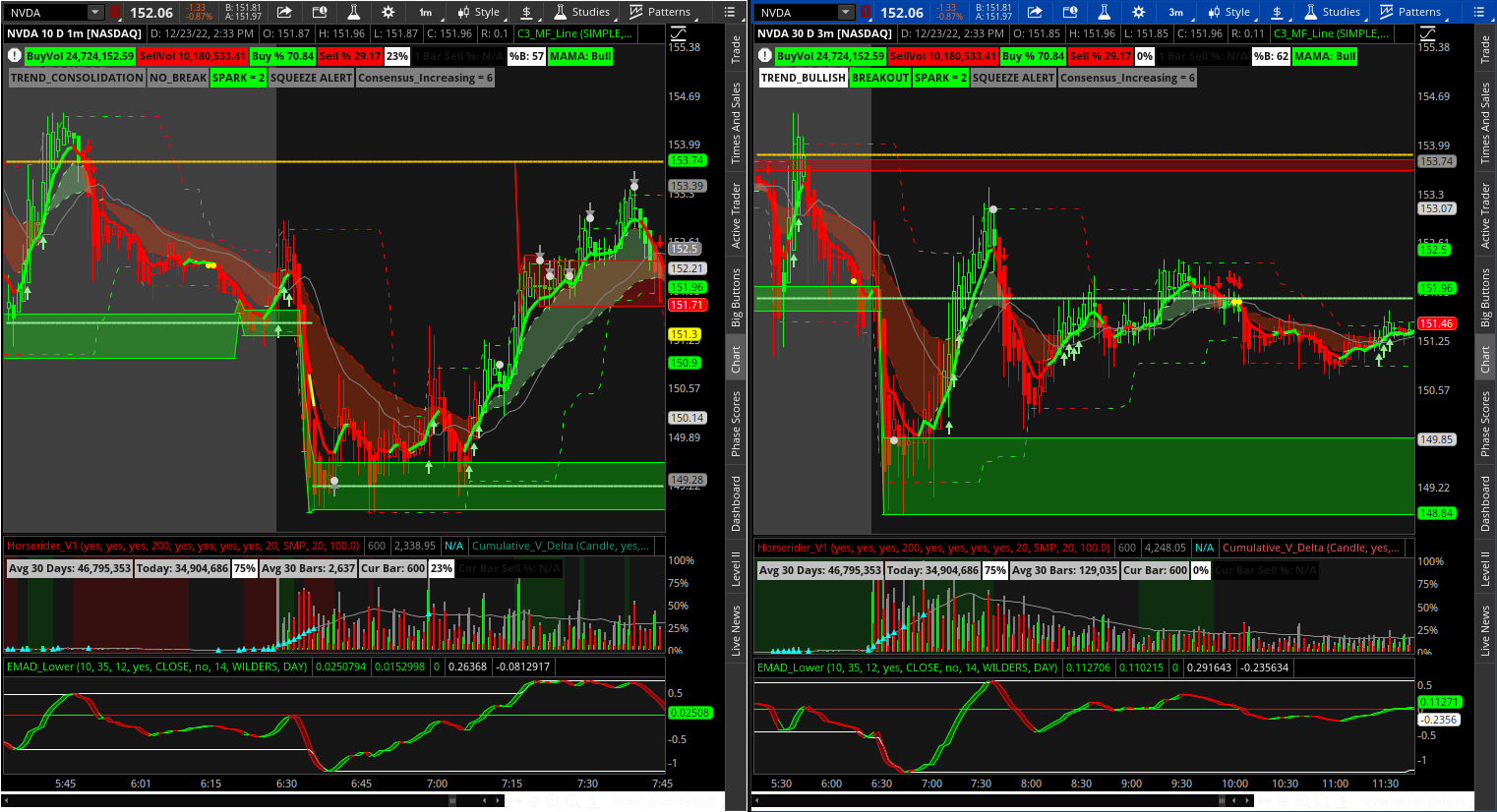

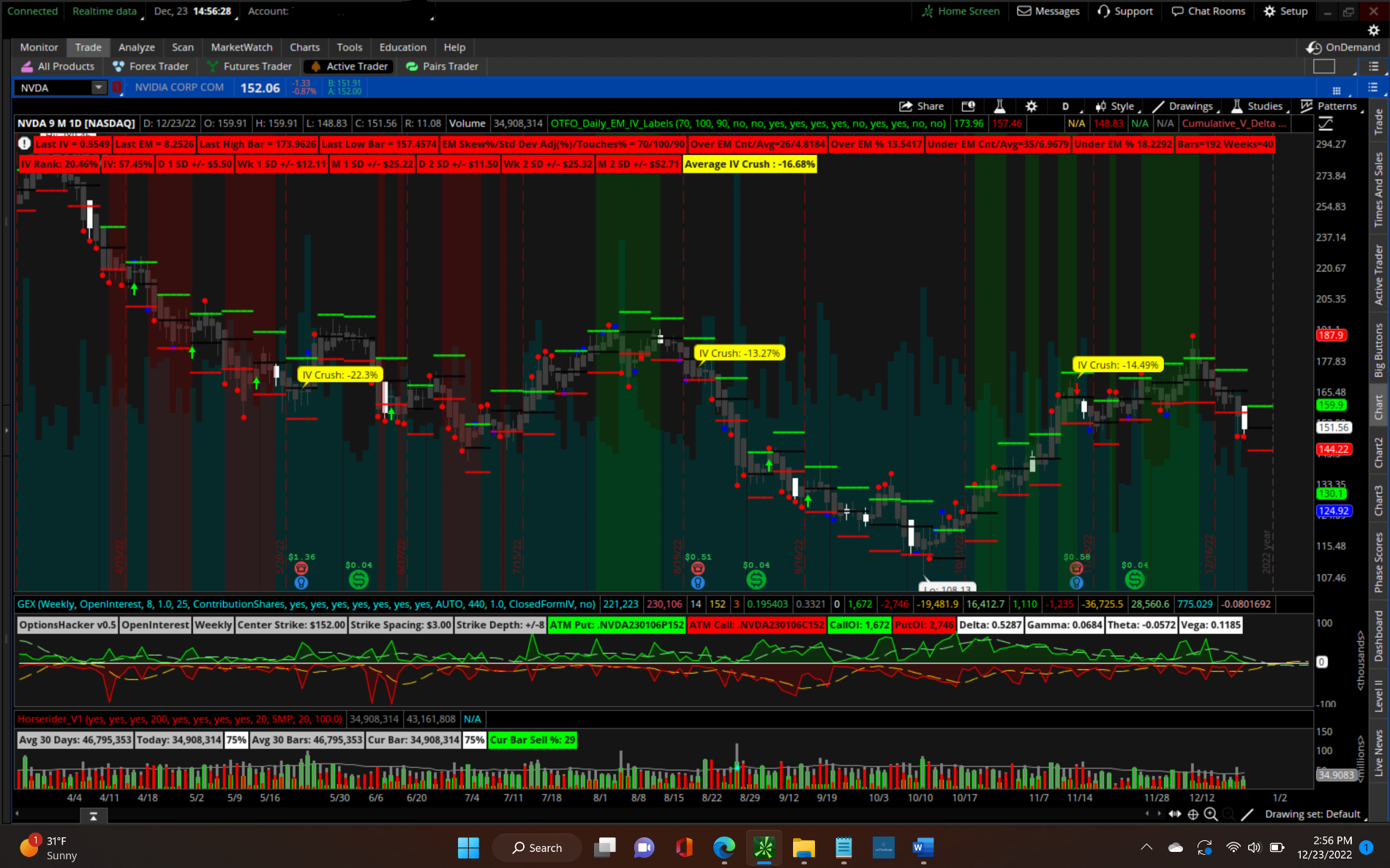

and the active trader chart (the "Gex" lower study takes up some computing power so you may want to leave it off unless you want to see it.) I only look at this one the day before.

Thanks a lot for your time. FYI, The workspace isn't working but the charts are, so that is fine. Do you use the active trader chart for options? That is all I trade. Very interesting. I hope you are open to some questions. I really do not want to bother you so just let me know. Hope you have a Merry Christmas if you celebrate it!

@HODL-Lay-HE-hoo! Man, this is great. I have the same charts but I must have messed up some settings.Screenshot Edit

the whole setup: http://tos.mx/3OxJpPS

regular chart tab: http://tos.mx/YvWYK12

active trader: http://tos.mx/GUpRaTt

Ok try this one.

should look like this on the regular chart

The Gex lower indicator did not finish loading before the screenshot was taken (computer is a new Thinkpad P1 just incase your wondering… but loads much quicker on the 6-9month)

I generally set the active trader chart to Daily 6 or 9 months if I am using the Gex lower study as it loads faster however the IV crush labels may not work unless you set it to 1 year or more.

and the active trader chart (the "Gex" lower study takes up some computing power so you may want to leave it off unless you want to see it.) I only look at this one the day before.

@HODL-Lay-HE-hoo! Man, this is great. I have the same charts but I must have messed up some settings.

Your indicators look much much cleaner. I have started to use this setup since Monday of this week and I have few questions (I am trying to add an image but its not letting me),

- In todays SPY trading (options) session on the 1min chart, would you take a trade when the first time triple exhaustion indicator/arrow showed or wait for all three (below) to occur and then enter the trade

- triple exhaustion indicator/arrow

- Candles crossed above PLD line

- Candles are green.

- Considering I do not use rules based trading it would be on a case by case basis. If you look at my previous screenshots I explain what I look for although the setup and indications can vary.

1. Verify hourly trend direction

2. Watch for the following prior to open… (probably left some out but this will get you started on what to look for)

- is price near yellow OB line?

- is the yellow OB line used as support after previously used as resistance or vis versa (and the opposite for the light green OS line)

- is price in the supply or demand zone?

- is the yellow or light green line inside the supply or demand zone? (These are major levels usually so look for rejection or bounce off them)

- did price make a strong move above or below the supply or demand zone with a long wick now heading the opposite direction?

- is price wrapping up or down? (Very strong trend)

- are Spark up or down arrow(s) present?

- did triple exhaustion occur after heavy price action near open? (This is a situation I would consider buying based on a single triple exhaustion indication - the white dots are “regular” exhaustion and the grey arrows are “extreme” exhaustion but I don’t necessarily value one over the other)

- is price in a strong trend and there have been 3 triple exhaustion indications? (Look for a pullback or reversal soon)

- is PLD crossover bullish or bearish?(if a move is made against the trend and PLD doesn’t crossover I expect a bounce back to the original trend direction)

- did PLD cross over and then cross over in the opposite direction within just a few bars? (This is usually going to indicate a good size move)

If you are using this setup then the candles are painted using Bull Bear V5 which can (if they cause you confusion) lessen the need for “Horserider Volume” and “EMAD” lowers as it essentially uses both variables to paint the candles.

If you are looking at Horserider Volume when the supply or demand zone is moving horizontal you can predict a bounce/pullback/reversal looking for buying / selling volume crossovers or above average buying or selling moving below average or total volume going below average etc. (again you can watch for this but the bull bear candles will tell you the same story essentially)

I will also look for exhaustion, Spark, and PLD crossover indications on various timeframe charts

We could also add the active trader studies to the mix and ask…

- is the price above or below the expected move?

- what percentage of the time does the price exceed the expected move?

- is call or put volume above average?

Another study I really like buy do not get to use on mobile is “Quant Open Interest” it plots lines which vary in thickness according to the top five open interest calls and puts for 14 high liquidity tickers… it is on the Quant discord for free but you have to copy and paste new code every morning as it is not calculated data from tos. The part I like about it though is the labels for total call premium and total put premium and when they are way out of balance the reversal is coming soon.

- Also, is it advised to use Enhanced Trend Reversal Indicator by BenTen with this setup?

- I am not familiar with this indicator (unless it’s the reversal indicator that is based on pivot points) but in any case I would say no. Edit I looked at the indicator and it looks interesting. I will likely add it and see what happens… mainly interested in the engulfing patterns aspect of it as C3 Max has many indicators coded in it already Edit 2 The indicator repaints so I will likely not use it (but if it helps you then use it)

Again, thanks very much for creating this and helping out the community. I really appreciate it.

- What are the grey dots (sometimes with arrows) for?

- Triple exhaustion regular is white dots and extreme is grey arrows but I do not apply more trust to one over the other an ONLY use them in the context of price action and C3 Max Spark, Bull Bear V5, etc.

- Do you have any scanners based on this study or do you only trade big caps like Apple, Tesla, SPY etc.

- I mostly use mobile and do not have the ability to scan but when I do it is mainly to scan for unusual options activity from a watchlist of SPY, TSLA, AAPL and the like.

- Is your preferred timeframe on the chart 1min or something else?

- My current go to is hourly for trend direction and the 1&3 min time frame. The one min can indicate moves sooner and the 3 min will confirm or deny them. Just depends on the volume and price action etc.

Setup notes.

If these setups get any better we will have to rename it the YOLO Indicator or something of that nature.

Wow.. thanks for great explanation, And thanks for all your help. I'll watch for these rules/setups.Expand this post to see my answers to your questions

Not a problem YOLOOOOOO

Wow.. thanks for great explanation, And thanks for all your help. I'll watch for these rules/setups.

One more question: have you considered getting into a trade in the middle of a move/reversal (up or down)? If yes, how do you know if it hasn't reached OB or OS zone already?

It is amazing that you are able to use this setup on your mobile and be able to make these profitable trades.

Depends on your definition of in the middle but sure say price breaks out if a zone with heavy price action and/or strong tend then pulls back and the wick bounces off the PLD… some prefer to enter that way… breakout or breakdown then enter when the wick of a pullback hits the PLD or an EMA of the traders choosing.

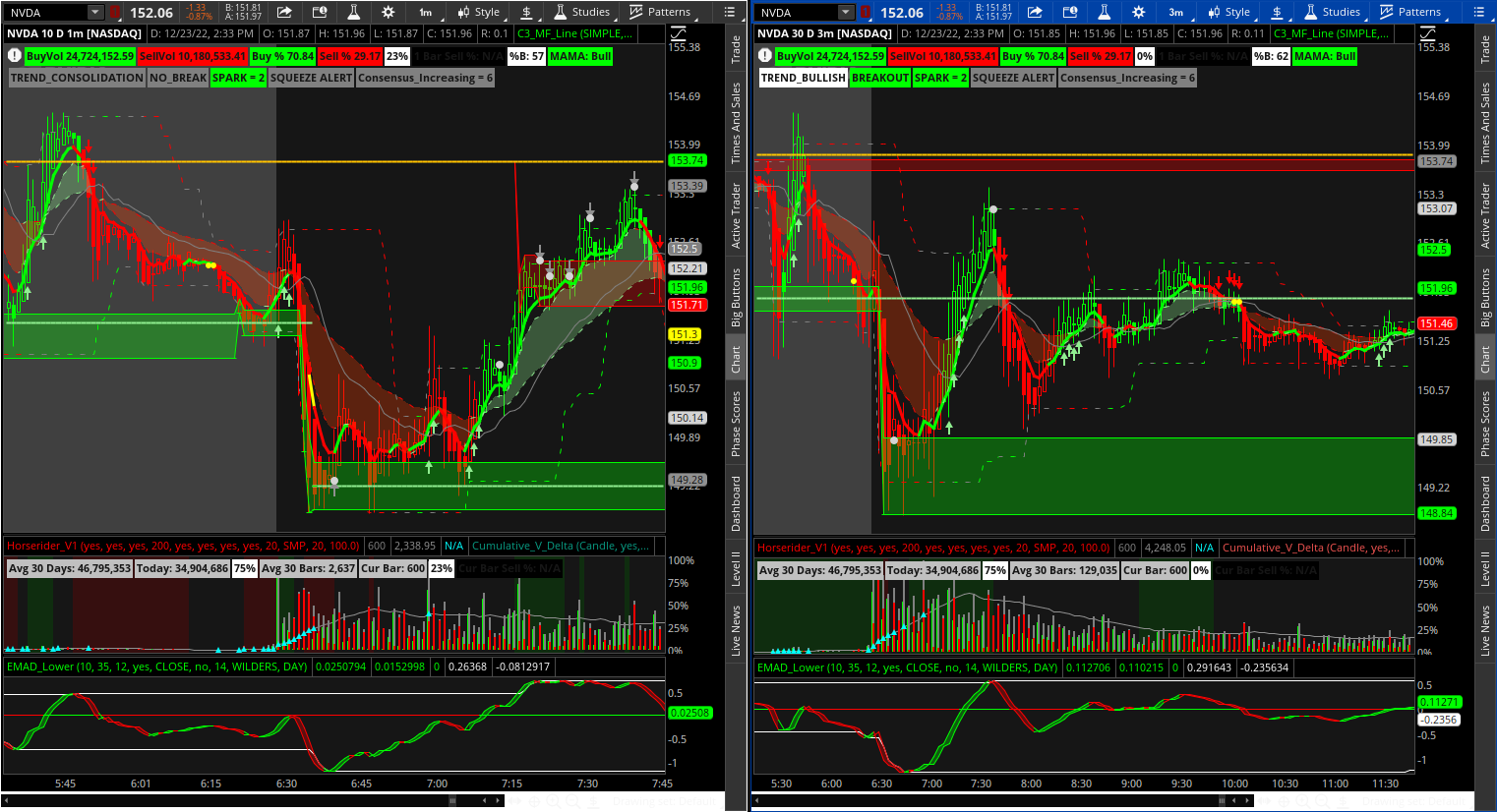

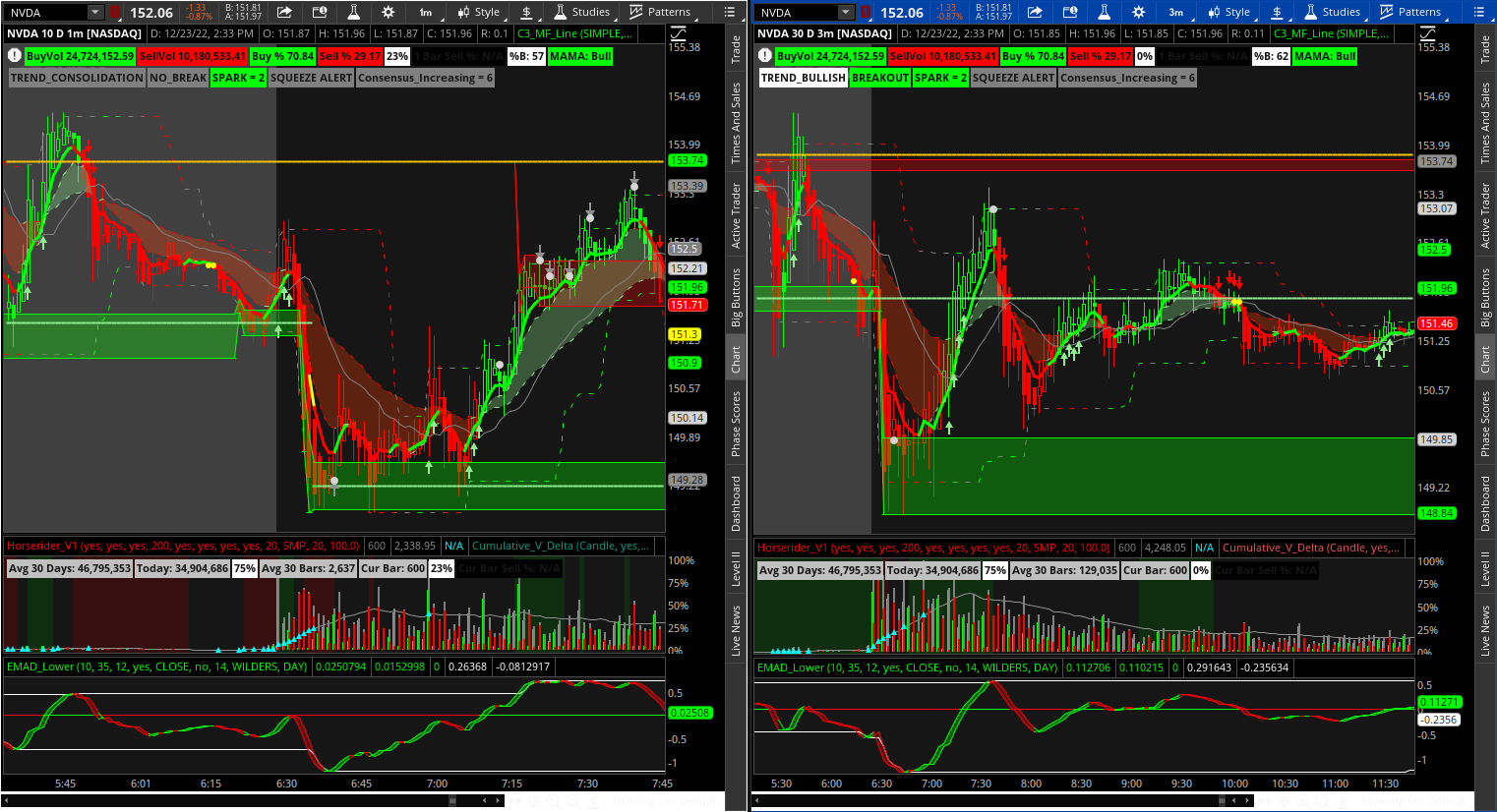

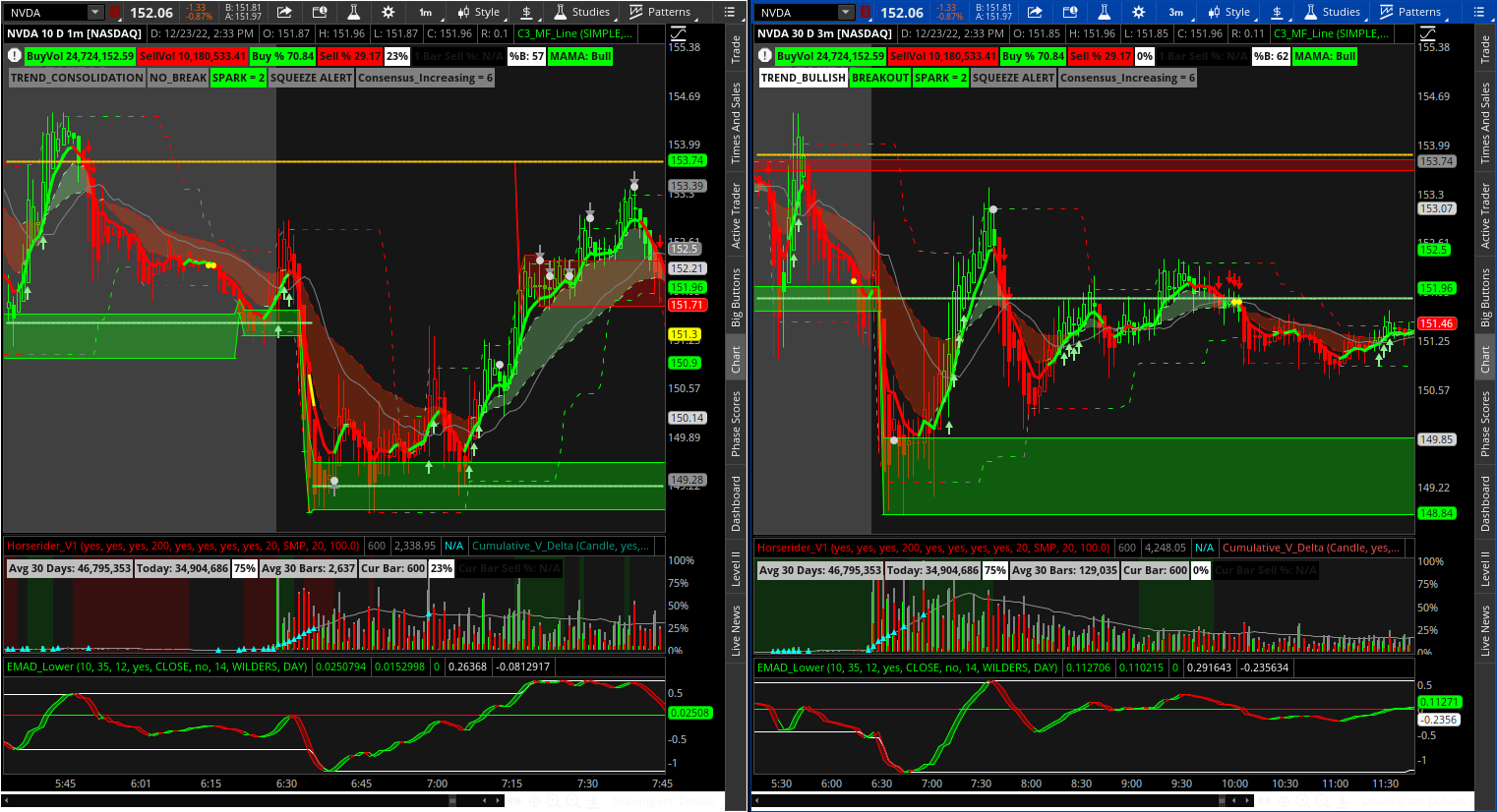

The following screenshot - left side 1Min chart you will see price breakdown then out of the demand zone. When price is in the middle of the two zones the C3 line turns green + EMA clouds cross to green + Bull Bear V5 candles turn green then the green candle with the long wick touches (or bounces off) the PLD line… that wick touching the PLD is a great entry. Also the 3 min chart confirms the entry.

It’s a pretty good example of an ideal entry in my opinion… if you got in before that you would be in a good position however you would likely be riding out some of the waves that follow - maybe getting nervous etc. whereas entry on that wick of the pullback you never see red.

This may take more discipline and experience to identify the right price action to take that trade but overall an extremely safe entry especially if you cut it quick and use a tight stop loss (which you would set up that your default order buys X number of contracts with X stop-loss). Assuming you buy more than one contract you sell all but one contract at the first sign of weakness or exhaustion and let one ride the trend.

You can trade using the worst indicators as long as you have good risk management and figure out what your doing that works and doesn’t work including setups, indicators, time of day, etc.

That being said after watching these indicators in particular for a good while now I am like the damn market whisperer… unfortunately I am not the most disciplined trader… yet.

Can you tell me about what page I should start on to understand these charts. If I go to the first page and continue I am constatantly uplaoding charts. What page or area would have the newest chart and how far back do I go to understand everything on the newest chart.Depends on your definition of in the middle but sure say price breaks out if a zone with heavy price action and/or strong tend then pulls back and the wick bounces off the PLD… some prefer to enter that way… breakout or breakdown then enter when the wick of a pullback hits the PLD or an EMA of the traders choosing.

The following screenshot - left side 1Min chart you will see price breakdown then out of the demand zone. When price is in the middle of the two zones the C3 line turns green + EMA clouds cross to green + Bull Bear V5 candles turn green then the green candle with the long wick touches (or bounces off) the PLD line… that wick touching the PLD is a great entry. Also the 3 min chart confirms the entry.

It’s a pretty good example of an ideal entry in my opinion… if you got in before that you would be in a good position however you would likely be riding out some of the waves that follow - maybe getting nervous etc. whereas entry on that wick of the pullback you never see red.

This may take more discipline and experience to identify the right price action to take that trade but overall an extremely safe entry especially if you cut it quick and use a tight stop loss (which you would set up that your default order buys X number of contracts with X stop-loss). Assuming you buy more than one contract you sell all but one contract at the first sign of weakness or exhaustion and let one ride the trend.

You can trade using the worst indicators as long as you have good risk management and figure out what your doing that works and doesn’t work including setups, indicators, time of day, etc.

That being said after watching these indicators in particular for a good while now I am like the damn market whisperer… unfortunately I am not the most disciplined trader… yet.

Thanks @HODL-Lay-HE-hoo! You are the man!! You are the market whisperer. Every time I like your posts, I don't selectDepends on your definition of in the middle but sure say price breaks out if a zone with heavy price action and/or strong tend then pulls back and the wick bounces off the PLD… some prefer to enter that way… breakout or breakdown then enter when the wick of a pullback hits the PLD or an EMA of the traders choosing.

The following screenshot - left side 1Min chart you will see price breakdown then out of the demand zone. When price is in the middle of the two zones the C3 line turns green + EMA clouds cross to green + Bull Bear V5 candles turn green then the green candle with the long wick touches (or bounces off) the PLD line… that wick touching the PLD is a great entry. Also the 3 min chart confirms the entry.

It’s a pretty good example of an ideal entry in my opinion… if you got in before that you would be in a good position however you would likely be riding out some of the waves that follow - maybe getting nervous etc. whereas entry on that wick of the pullback you never see red.

This may take more discipline and experience to identify the right price action to take that trade but overall an extremely safe entry especially if you cut it quick and use a tight stop loss (which you would set up that your default order buys X number of contracts with X stop-loss). Assuming you buy more than one contract you sell all but one contract at the first sign of weakness or exhaustion and let one ride the trend.

You can trade using the worst indicators as long as you have good risk management and figure out what your doing that works and doesn’t work including setups, indicators, time of day, etc.

That being said after watching these indicators in particular for a good while now I am like the damn market whisperer… unfortunately I am not the most disciplined trader… yet.

thumbs-up, i select the CROWN, cuz you are the King of whisperers.Can you tell me about what page I should start on to understand these charts. If I go to the first page and continue I am constatantly uplaoding charts. What page or area would have the newest chart and how far back do I go to understand everything on the newest chart.

Which code is best for trading futures on 1 min chart? /es, /mes

Hello, can you please explain what strategy are you using to trade ES?Another profitable day following the strategy. It doesn't get much easier than this. Happy trading everyone!

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.