ZigZag Study with Auto Fibonacci Levels For ThinkOrSwim

This is a fib extension study that I posted here using a zigzag study. I have added labels for the fib extensions that are already plotted on the script.

Also, added are labels for fib retracements. It seems to be working correctly, although I have not extensively tested it.

Zig Zag Study with Auto Fibonacci Levels For ThinkOrSwim

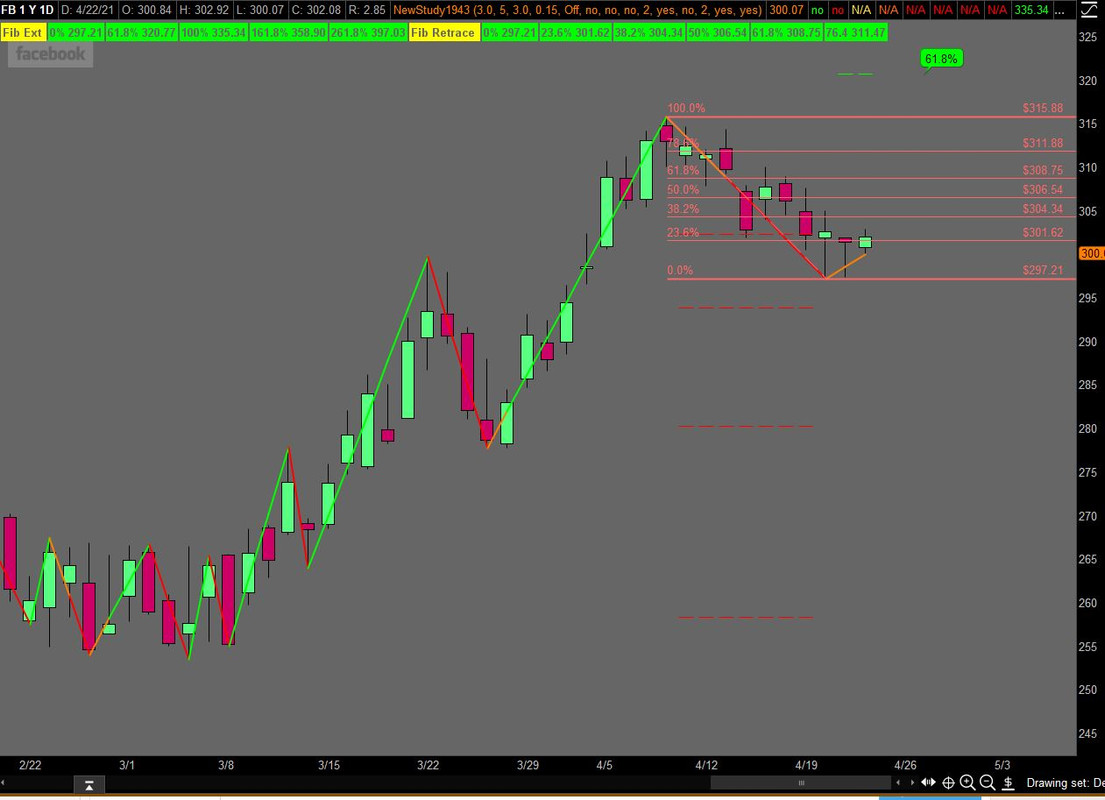

The FB chart below shows the 2 sets of labels, a manually drawn fib retracement for testing and a green fib retracement bubble as part of the code. The fib retracements do not plot, just labels.

Rember, the underlying zigzag study can 'repaint'

This is a fib extension study that I posted here using a zigzag study. I have added labels for the fib extensions that are already plotted on the script.

Also, added are labels for fib retracements. It seems to be working correctly, although I have not extensively tested it.

Zig Zag Study with Auto Fibonacci Levels For ThinkOrSwim

The FB chart below shows the 2 sets of labels, a manually drawn fib retracement for testing and a green fib retracement bubble as part of the code. The fib retracements do not plot, just labels.

Rember, the underlying zigzag study can 'repaint'

Ruby:

## AO_SupplyDemandCompositeVer2_2

## START CODE

## ZigZagSign TOMO modification, v0.2 written by Linus @Thinkscripter Lounge adapted from

## Thinkorswim ZigZagSign Script

##8.24.13 Mod by Lar to add Supply/Demand Levels (Red Zones are Supply, Green are Demand), ability to enter percentage, amount or atr for reversalAmount (using the greater of the three at any reversal)

##2.20.14 Mod by Linus to hide non-active Supply/Demand Levels.

##2.20.14 Mods by Linus to remove everything but Supply/Demand levels and arrows.

##3.04.14 Mods by Linus to change Supply/Demand levels to start at arrows. (Ver2.1)

##3.12.14 Mods by Linus to fix first Supply/Demand levels to not start at Zero. (Ver2.2)

##6.4.14 Mods by Lar using some of Linus changes to allow showing just today's fibs and to show only a user selectable number of fib extension changes within the chart, along with their applicable bubbles (and b = number of spaces to move bubbles in expansion)

def price = close;

def priceH = high; # swing high

def priceL = low; # swing low

input ATRreversalfactor = 3.0;#Hint ATRreversalfactor: 3 is standard, adjust to whatever instrument/timeframe you are trading.

input ATRlength = 5;#Hint ATRlength: 5 is standard, adjust to whatever instrument/timeframe you are trading

input zigzagpercent = 3.0;#LAR original is 0.2, but modified in testing for 4h charting (may modify further later)

input zigzagamount = .15;

def ATR = reference ATR(length = ATRlength);

def reversalAmount = if (close * zigzagpercent / 100) > Max

(zigzagamount < ATRreversalfactor * ATR, zigzagamount) then

(close * zigzagpercent / 100) else if zigzagamount < ATRreversalfactor * ATR then

ATRreversalfactor * ATR else zigzagamount;

input showSupplyDemand = {Off, default Arrow, Pivot};

input showArrows = no; #orignal by LAR was no

input useAlerts = no; #orignal by LAR was no

#Original TOS ZigZag code Modified by Linus

def barNumber = BarNumber();

def barCount = HighestAll(If(IsNaN(price), 0, barNumber));

rec state = {default init, undefined, uptrend, downtrend};

rec minMaxPrice;

if (GetValue(state, 1) == GetValue(state.init, 0)) {

minMaxPrice = price;

state = state.undefined;

} else if (GetValue(state, 1) == GetValue(state.undefined, 0)) {

if (price <= GetValue(minMaxPrice, 1) - reversalAmount) {

state = state.downtrend;

minMaxPrice = priceL;

} else if (price >= GetValue(minMaxPrice, 1) + reversalAmount) {

state = state.uptrend;

minMaxPrice = priceH;

} else {

state = state.undefined;

minMaxPrice = GetValue(minMaxPrice, 1);

}

} else if (GetValue(state, 1) == GetValue(state.uptrend, 0)) {

if (price <= GetValue(minMaxPrice, 1) - reversalAmount) {

state = state.downtrend;

minMaxPrice = priceL;

} else {

state = state.uptrend;

minMaxPrice = Max(priceH, GetValue(minMaxPrice, 1));

}

} else {

if (price >= GetValue(minMaxPrice, 1) + reversalAmount) {

state = state.uptrend;

minMaxPrice = priceH;

} else {

state = state.downtrend;

minMaxPrice = Min(priceL, GetValue(minMaxPrice, 1));

}

}

def isCalculated = GetValue(state, 0) != GetValue(state, 1) and barNumber >= 1;

def futureDepth = barCount - barNumber;

def tmpLastPeriodBar;

if (isCalculated) {

if (futureDepth >= 1 and GetValue(state, 0) == GetValue(state, -1)) {

tmpLastPeriodBar = fold lastPeriodBarI = 2 to futureDepth + 1 with

lastPeriodBarAcc = 1

while lastPeriodBarAcc > 0

do if (GetValue(state, 0) != GetValue(state, -lastPeriodBarI))

then -lastPeriodBarAcc

else lastPeriodBarAcc + 1;

} else {

tmpLastPeriodBar = 0;

}

} else {

tmpLastPeriodBar = Double.NaN;

}

def lastPeriodBar = if (!IsNaN(tmpLastPeriodBar)) then -AbsValue

(tmpLastPeriodBar) else -futureDepth;

rec currentPriceLevel;

rec currentPoints;

if (state == state.uptrend and isCalculated) {

currentPriceLevel =

fold barWithMaxOnPeriodI = lastPeriodBar to 1 with barWithMaxOnPeriodAcc

= minMaxPrice

do Max(barWithMaxOnPeriodAcc, GetValue(minMaxPrice,

barWithMaxOnPeriodI));

currentPoints =

fold maxPointOnPeriodI = lastPeriodBar to 1 with maxPointOnPeriodAcc =

Double.NaN

while IsNaN(maxPointOnPeriodAcc)

do if (GetValue(priceH, maxPointOnPeriodI) == currentPriceLevel)

then maxPointOnPeriodI

else maxPointOnPeriodAcc;

} else if (state == state.downtrend and isCalculated) {

currentPriceLevel =

fold barWithMinOnPeriodI = lastPeriodBar to 1 with barWithMinOnPeriodAcc

= minMaxPrice

do Min(barWithMinOnPeriodAcc, GetValue(minMaxPrice,

barWithMinOnPeriodI));

currentPoints =

fold minPointOnPeriodI = lastPeriodBar to 1 with minPointOnPeriodAcc =

Double.NaN

while IsNaN(minPointOnPeriodAcc)

do if (GetValue(priceL, minPointOnPeriodI) == currentPriceLevel)

then minPointOnPeriodI

else minPointOnPeriodAcc;

} else if (!isCalculated and (state == state.uptrend or state ==

state.downtrend)) {

currentPriceLevel = GetValue(currentPriceLevel, 1);

currentPoints = GetValue(currentPoints, 1) + 1;

} else {

currentPoints = 1;

currentPriceLevel = GetValue(price, currentPoints);

}

plot "ZZ$" = if (barNumber == barCount or barNumber == 1) then if state ==

state.uptrend then priceH else priceL else if (currentPoints == 0) then

currentPriceLevel else Double.NaN;

rec zzSave = if !IsNaN("ZZ$") then if (barNumber == barCount or barNumber == 1)

then if IsNaN(barNumber[-1]) and state == state.uptrend then priceH else priceL

else currentPriceLevel else GetValue(zzSave, 1);

def chg = (if barNumber == barCount and currentPoints < 0 then priceH else if

barNumber == barCount and currentPoints > 0 then priceL else currentPriceLevel)

- GetValue(zzSave, 1);

def isUp = chg >= 0;

rec isConf = AbsValue(chg) >= reversalAmount or (IsNaN(GetValue("ZZ$", 1)) and

GetValue(isConf, 1));

"ZZ$".EnableApproximation();

"ZZ$".DefineColor("Up Trend", Color.GREEN);

"ZZ$".DefineColor("Down Trend", Color.RED);

"ZZ$".DefineColor("Undefined", Color.DARK_ORANGE);

"ZZ$".AssignValueColor(if !isConf then "ZZ$".Color("Undefined") else if isUp

then "ZZ$".Color("Up Trend") else "ZZ$".Color("Down Trend"));

"ZZ$".SetLineWeight(2);

DefineGlobalColor("Unconfirmed", Color.DARK_ORANGE);

DefineGlobalColor("Up", Color.GREEN);

DefineGlobalColor("Down", Color.RED);

#Showlabel for Confirmed/Unconfirmed Status of Current Zigzag

input show_unconfirmed_label = no;

AddLabel(show_unconfirmed_label and barNumber != 1, (if isConf then "Confirmed " else "Unconfirmed ") + "ZigZag: " + chg, if !isConf then GlobalColor("Unconfirmed") else if isUp then GlobalColor("Up") else GlobalColor("Down"));

#Arrows

def zzL = if !IsNaN("ZZ$") and state == state.downtrend then priceL else

GetValue(zzL, 1);

def zzH = if !IsNaN("ZZ$") and state == state.uptrend then priceH else GetValue

(zzH, 1);

def dir = CompoundValue(1, if zzL != zzL[1] then 1 else if zzH != zzH[1] then -1

else dir[1], 0);

def signal = CompoundValue(1,

if dir > 0 and low > zzL then

if signal[1] <= 0 then 1 else signal[1]

else if dir < 0 and high < zzH then

if signal[1] >= 0 then -1 else signal[1]

else signal[1]

, 0);

plot U1 = showArrows and signal > 0 and signal[1] <= 0;

U1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

U1.SetDefaultColor(Color.GREEN);

U1.SetLineWeight(4);

plot D1 = showArrows and signal < 0 and signal[1] >= 0;

D1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

D1.SetDefaultColor(Color.RED);

D1.SetLineWeight(4);

Alert(useAlerts and U1, "ZIG-UP", Alert.BAR, Sound.Bell);

Alert(useAlerts and D1, "ZAG-DOWN", Alert.BAR, Sound.Chimes);

#Supply Demand Areas

def idx = if showSupplyDemand == showSupplyDemand.Pivot then 1 else 0;

def rLow;

def rHigh;

if BarNumber() == 1 {

rLow = Double.NaN;

rHigh = Double.NaN;

} else if signal crosses 0 {

rLow = low[idx];

rHigh = high[idx];

} else {

rLow = rLow[1];

rHigh = rHigh[1];

}

plot HighLine = if showSupplyDemand and !IsNaN(close) then rHigh else

Double.NaN;

HighLine.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

HighLine.AssignValueColor(if signal > 0 then Color.GREEN else Color.RED);

HighLine.HideBubble();

plot LowLine = if showSupplyDemand and !IsNaN(close) then rLow else Double.NaN;

LowLine.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

LowLine.AssignValueColor(if signal > 0 then Color.GREEN else Color.RED);

LowLine.HideBubble();

def hlUp = if signal > 0 then HighLine else Double.NaN;

def hlDn = if signal < 0 then HighLine else Double.NaN;

AddCloud(hlUp, LowLine, Color.GREEN, Color.GREEN);

AddCloud(hlDn, LowLine, Color.RED, Color.RED);

#Store Previous Data

def zzsave1 = if !IsNaN(zzSave) then zzSave else zzsave1[1];

def zzsave2 = zzsave1;

rec priorzz1 = if zzsave2 != zzsave2[1] then zzsave2[1] else priorzz1[1];

rec priorzz2 = if priorzz1 != priorzz1[1] then priorzz1[1] else priorzz2[1];

rec priorzz3 = if priorzz2 != priorzz2[1] then priorzz2[1] else priorzz3[1];

rec priorzz4 = if priorzz3 != priorzz3[1] then priorzz3[1] else priorzz4[1];

rec priorzz5 = if priorzz4 != priorzz4[1] then priorzz4[1] else priorzz5[1];

rec priorzz6 = if priorzz5 != priorzz5[1] then priorzz5[1] else priorzz6[1];

rec data = CompoundValue(1, if (zzSave == priceH or zzSave == priceL) then data[1] + 1 else data[1], 0);

def datacount = (HighestAll(data) - data[1]);

input numberextfibstoshow = 2;

input showFibExtLines = yes;

input showtodayonly = no;

def today = if showtodayonly == yes then GetDay() == GetLastDay() else GetDay();

def extfib1 = if zzSave == priceH then high - AbsValue(priorzz2 - priorzz1) * 1

else extfib1[1];

plot extfib100 = if datacount <= numberextfibstoshow and today and showFibExtLines and currentPoints != 0 and !IsNaN(extfib1) and dir < 0 then extfib1[1] else Double.NaN;

extfib100.SetPaintingStrategy(PaintingStrategy.DASHES);

extfib100.SetDefaultColor(Color.RED);

extfib100.SetLineWeight(1);

extfib100.HideBubble();

def extfib2 = if zzSave == priceH then high - AbsValue(priorzz2 - priorzz1) *

0.618 else extfib2[1];

plot extfib618 = if datacount <= numberextfibstoshow and today and showFibExtLines and currentPoints != 0 and !IsNaN(extfib2) and dir < 0 then extfib2[1] else Double.NaN;

extfib618.SetPaintingStrategy(PaintingStrategy.DASHES);

extfib618.SetDefaultColor(Color.RED);

extfib618.SetLineWeight(1);

extfib618.HideBubble();

def extfib3 = if zzSave == priceH then high - AbsValue(priorzz2 - priorzz1) *

1.618 else extfib3[1];

plot extfib1618 = if datacount <= numberextfibstoshow and today and showFibExtLines and currentPoints != 0 and !IsNaN(extfib3) and dir < 0 then extfib3[1] else Double.NaN;

extfib1618.SetPaintingStrategy(PaintingStrategy.DASHES);

extfib1618.SetDefaultColor(Color.RED);

extfib1618.SetLineWeight(1);

extfib1618.HideBubble();

def extfib4 = if zzSave == priceH then high - AbsValue(priorzz2 - priorzz1) *

2.618 else extfib4[1];

plot extfib2618 = if datacount <= numberextfibstoshow and today and showFibExtLines and currentPoints != 0 and !IsNaN(extfib4) and dir < 0 then extfib4[1] else Double.NaN;

extfib2618.SetPaintingStrategy(PaintingStrategy.DASHES);

extfib2618.SetDefaultColor(Color.RED);

extfib2618.SetLineWeight(1);

extfib2618.HideBubble();

def extfib1_ = if zzSave == priceL then low + AbsValue(priorzz2 - priorzz1) * 1

else extfib1_[1];

plot extfib100_ = if datacount <= numberextfibstoshow and today and showFibExtLines and currentPoints != 0 and !IsNaN(extfib1_) and dir > 0 then extfib1_[1] else Double.NaN;

extfib100_.SetPaintingStrategy(PaintingStrategy.DASHES);

extfib100_.SetDefaultColor(Color.GREEN);

extfib100_.SetLineWeight(1);

extfib100_.HideBubble();

def extfib2_ = if zzSave == priceL then low + AbsValue(priorzz2 - priorzz1) *

0.618 else extfib2_[1];

plot extfib618_ = if datacount <= numberextfibstoshow and today and showFibExtLines and currentPoints != 0 and !IsNaN(extfib2_) and dir > 0 then extfib2_[1] else Double.NaN;

extfib618_.SetPaintingStrategy(PaintingStrategy.DASHES);

extfib618_.SetDefaultColor(Color.GREEN);

extfib618_.SetLineWeight(1);

extfib618_.HideBubble();

def extfib3_ = if zzSave == priceL then low + AbsValue(priorzz2 - priorzz1) *

1.618 else extfib3_[1];

plot extfib1618_ = if datacount <= numberextfibstoshow and today and showFibExtLines and currentPoints != 0 and !IsNaN(extfib3_) and dir > 0 then extfib3_[1] else Double.NaN;

extfib1618_.SetPaintingStrategy(PaintingStrategy.DASHES);

extfib1618_.SetDefaultColor(Color.GREEN);

extfib1618_.SetLineWeight(1);

extfib1618_.HideBubble();

def extfib4_ = if zzSave == priceL then low + AbsValue(priorzz2 - priorzz1) *

2.618 else extfib4_[1];

plot extfib2618_ = if datacount <= numberextfibstoshow and today and showFibExtLines and currentPoints != 0 and !IsNaN(extfib4_) and dir > 0 then extfib4_[1] else Double.NaN;

extfib2618_.SetPaintingStrategy(PaintingStrategy.DASHES);

extfib2618_.SetDefaultColor(Color.GREEN);

extfib2618_.SetLineWeight(1);

extfib2618_.HideBubble();

input b = 2;

def direction = if !isUp then 1 else 0;

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close[b]), extfib1[b + 2], "100%", Color.RED, no);

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close[b]), extfib2[b + 2], "61.8%", Color.RED, no);

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close[b]), extfib3[b + 2], "161.8%", Color.RED, no);

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close[b]), extfib4[b + 2], "261.8%", Color.RED, no);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close[b]), extfib1_[b + 2], "100%", Color.GREEN, yes);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close[b]), extfib2_[b + 2], "61.8%", Color.GREEN, yes);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close[b]), extfib3_[b + 2], "161.8%", Color.GREEN, yes);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close[b]), extfib4_[b + 2], "261.8%", Color.GREEN, yes);

input showlabel_fibext = yes;

AddLabel(showlabel_fibext, "Fib Ext ", Color.YELLOW);

AddLabel( direction == 1 and showlabel_fibext , "0% " + AsText(priorzz1), Color.RED);

AddLabel( direction == 1 and showlabel_fibext , "61.8% " + AsText(extfib2), Color.RED);

AddLabel( direction == 1 and showlabel_fibext , "100% " + AsText(extfib1), Color.RED);

AddLabel( direction == 1 and showlabel_fibext , "161.8% " + AsText(extfib3) , Color.RED);

AddLabel( direction == 1 and showlabel_fibext , "261.8% " + AsText(extfib4), Color.RED);

AddLabel( direction == 0 and showlabel_fibext , "0% " + AsText(priorzz1), Color.GREEN);

AddLabel( direction == 0 and showlabel_fibext , "61.8% " + AsText(extfib2_[1]), Color.GREEN);

AddLabel( direction == 0 and showlabel_fibext , "100% " + AsText(extfib1_[1]), Color.GREEN);

AddLabel( direction == 0 and showlabel_fibext , "161.8% " + AsText(extfib3_[1]) , Color.GREEN);

AddLabel( direction == 0 and showlabel_fibext , "261.8% " + AsText(extfib4_[1]), Color.GREEN);

def fib_range = AbsValue(priorzz2 - priorzz1) ;

def fib1_0 = priorzz1 + fib_range * .236;

def fib2_0 = priorzz1 + fib_range * .382;

def fib3_0 = priorzz1 + fib_range * .500;

def fib4_0 = priorzz1 + fib_range * .618;

def fib5_0 = priorzz1 + fib_range * .764;

def fib6_0 = priorzz1;

def fib1_1 = priorzz1 - fib_range * .236;

def fib2_1 = priorzz1 - fib_range * .382;

def fib3_1 = priorzz1 - fib_range * .500;

def fib4_1 = priorzz1 - fib_range * .618;

def fib5_1 = priorzz1 - fib_range * .764;

def fib6_1 = priorzz1;

input showlabel_fibretrace = yes;

AddLabel(showlabel_fibretrace, "Fib Retrace ", Color.YELLOW);

AddLabel( direction == 0 and showlabel_fibretrace , "0% " + AsText(fib6_0), Color.GREEN);

AddLabel( direction == 0 and showlabel_fibretrace , "23.6% " + AsText(fib1_0), Color.GREEN);

AddLabel( direction == 0 and showlabel_fibretrace , "38.2% " + AsText(fib2_0), Color.GREEN);

AddLabel( direction == 0 and showlabel_fibretrace , "50% " + AsText(fib3_0), Color.GREEN);

AddLabel( direction == 0 and showlabel_fibretrace , "61.8% " + AsText(fib4_0), Color.GREEN);

AddLabel( direction == 0 and showlabel_fibretrace , "76.4 " + AsText(fib5_0), Color.GREEN);

AddLabel( direction == 1 and showlabel_fibretrace , "0% " + AsText(fib6_1), Color.RED);

AddLabel( direction == 1 and showlabel_fibretrace , "23.6% " + AsText(fib1_1), Color.RED);

AddLabel( direction == 1 and showlabel_fibretrace , "38.2% " + AsText(fib2_1), Color.RED);

AddLabel( direction == 1 and showlabel_fibretrace , "50% " + AsText(fib3_1), Color.RED);

AddLabel( direction == 1 and showlabel_fibretrace , "61.8% " + AsText(fib4_1), Color.RED);

AddLabel( direction == 1 and showlabel_fibretrace , "76.4 " + AsText(fib5_1), Color.RED);

Last edited by a moderator: