declare upper;

input price = close;

input reversalAmount = 1.0;

input reversalMode = {default price, percent};

def mode = if reversalMode == reversalMode.price then ZigZagTrendSign(price = price, reversalAmount = reversalAmount) else ZigZagTrendPercent(price = price, reversalAmount = reversalAmount);

def inflection = if reversalMode == reversalMode.price then if !IsNaN(ZigZagSign(price = price, reversalAmount = reversalAmount)) then 1 else 0 else if !IsNaN(ZigZagPercent(price = price, reversalAmount = reversalAmount)) then 1 else 0;

rec trend = if inflection == 1 and mode == -1 then 1 else if inflection == 1 and mode == 1 then -1 else trend[1];

plot wave = if reversalMode == reversalMode.price then ZigZagSign(price = price, reversalAmount = reversalAmount, "show bubbles" = Yes) else ZigZagPercent(price = price, reversalAmount = reversalAmount);

wave.EnableApproximation();

wave.AssignValueColor(if trend[1] == 1 then color.red else color.red);

wave.SetDefaultColor(Color.RED);

wave.SetLineWeight(1);

def zzoth = if !IsNaN(wave) then wave else zzoth[1];

def chgzzoth = AbsValue(zzoth[1] - zzoth);

def count = if !IsNaN(wave) then BarNumber() else count[1];

input show_price_bubble = yes;

input show_change_bubble = yes;

input show_count_bubble = yes;

input show_wave_bubble = yes;

input bubbleoffset = .0005;

AddChartBubble(!IsNaN(wave) and show_count_bubble,

if zzoth>zzoth[1]

then high * (1 + bubbleoffset)

else low * (1 - bubbleoffset) ,

"Bars: " + (count - count[1]),

color.yellow,

if zzoth>zzoth[1] then yes else no);

AddChartBubble(!IsNaN(wave) and show_change_bubble,

if zzoth>zzoth[1]

then high * (1 + bubbleoffset)

else low * (1 - bubbleoffset) ,

"Chg: " + AsText(chgzzoth) ,

Color.CYAN,

if zzoth>zzoth[1] then yes else no);

AddChartBubble(!IsNaN(wave) and show_price_bubble,

if zzoth>zzoth[1]

then high * (1 + bubbleoffset)

else low * (1 - bubbleoffset) ,

(if wave == close then "C: " else "C: ") + AsText(wave) ,

if !isnan(wave) > !isnan(wave[1]) then Color.GREEN else Color.RED,

if zzoth>zzoth[1] then yes else no);

#Prior Bubbles defined--------------------------------------------

def zzoth1 = if zzoth!=zzoth[1] then zzoth[1] else zzoth1[1];

def zzoth2 = if zzoth1!=zzoth1[1] then zzoth1[1] else zzoth2[1];

def zzoth3 = if zzoth2!=zzoth2[1] then zzoth2[1] else zzoth3[1];

input debug = no;

addlabel(debug,zzoth+" "+zzoth1+" "+zzoth2);

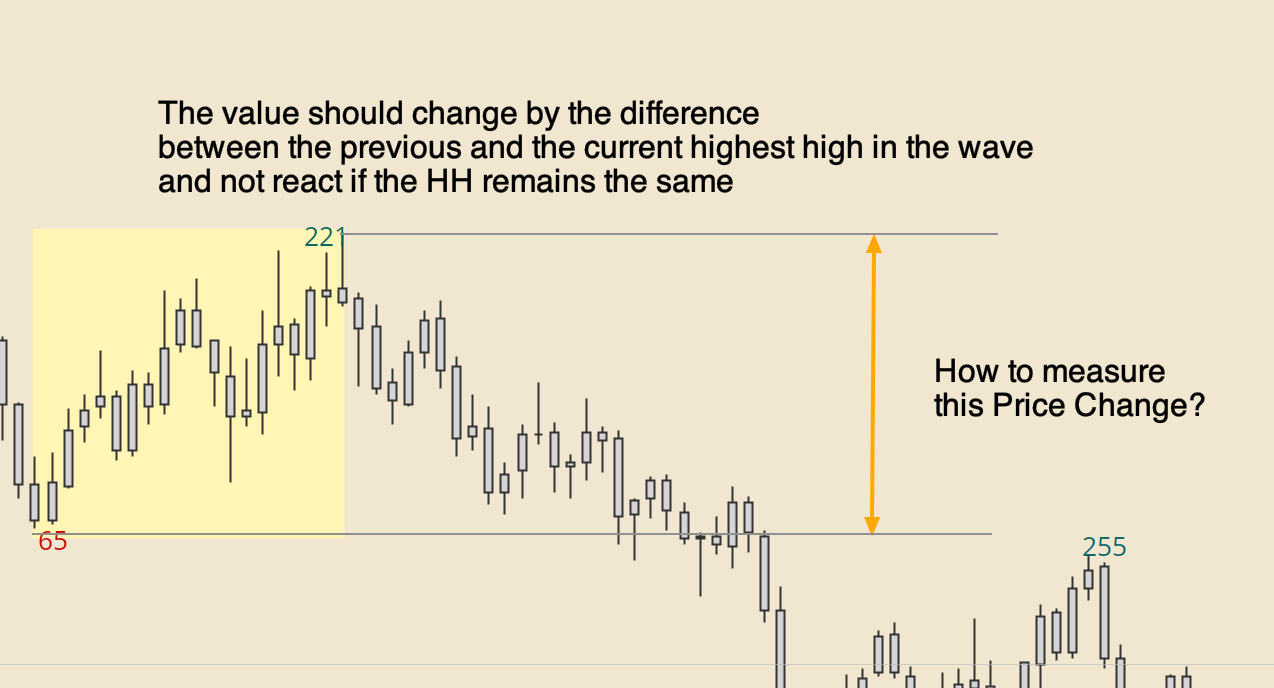

#Waves where higher high or lower high are cumulative

def wavehighext = if zzoth>zzoth[1] and zzoth>zzoth2 then wavehighext[1]+chgzzoth else if zzoth>zzoth[1] and zzoth<=zzoth2 then 0 else wavehighext[1];

addchartBubble(!IsNaN(wave) and show_wave_bubble,

if zzoth>zzoth[1]

then high * (1 + bubbleoffset)

else double.nan ,

(if wave == close then "W: " else "W: ") + AsText(wavehighext) ,

if !isnan(wave) > !isnan(wave[1]) then Color.GREEN else Color.RED,

if zzoth>zzoth[1] then yes else no);

def wavelowext = if zzoth<zzoth[1] and zzoth>zzoth2 then wavelowext[1]+chgzzoth else if zzoth<zzoth[1] and zzoth<=zzoth2 then 0 else wavelowext[1];

addchartBubble(!IsNaN(wave) and show_wave_bubble,

if zzoth<zzoth[1]

then low * (1 - bubbleoffset)

else double.nan ,

(if wave == close then "W: " else "W: ") + AsText(wavelowext) ,

if !isnan(wave) > !isnan(wave[1]) then Color.GREEN else Color.RED,

if zzoth>zzoth[1] then yes else no);