# creatred by Sam4Cok@Samer800 based on © Steversteves code

#https://www.tradingview.com/v/zrc6tWT4/

#// © Steversteves

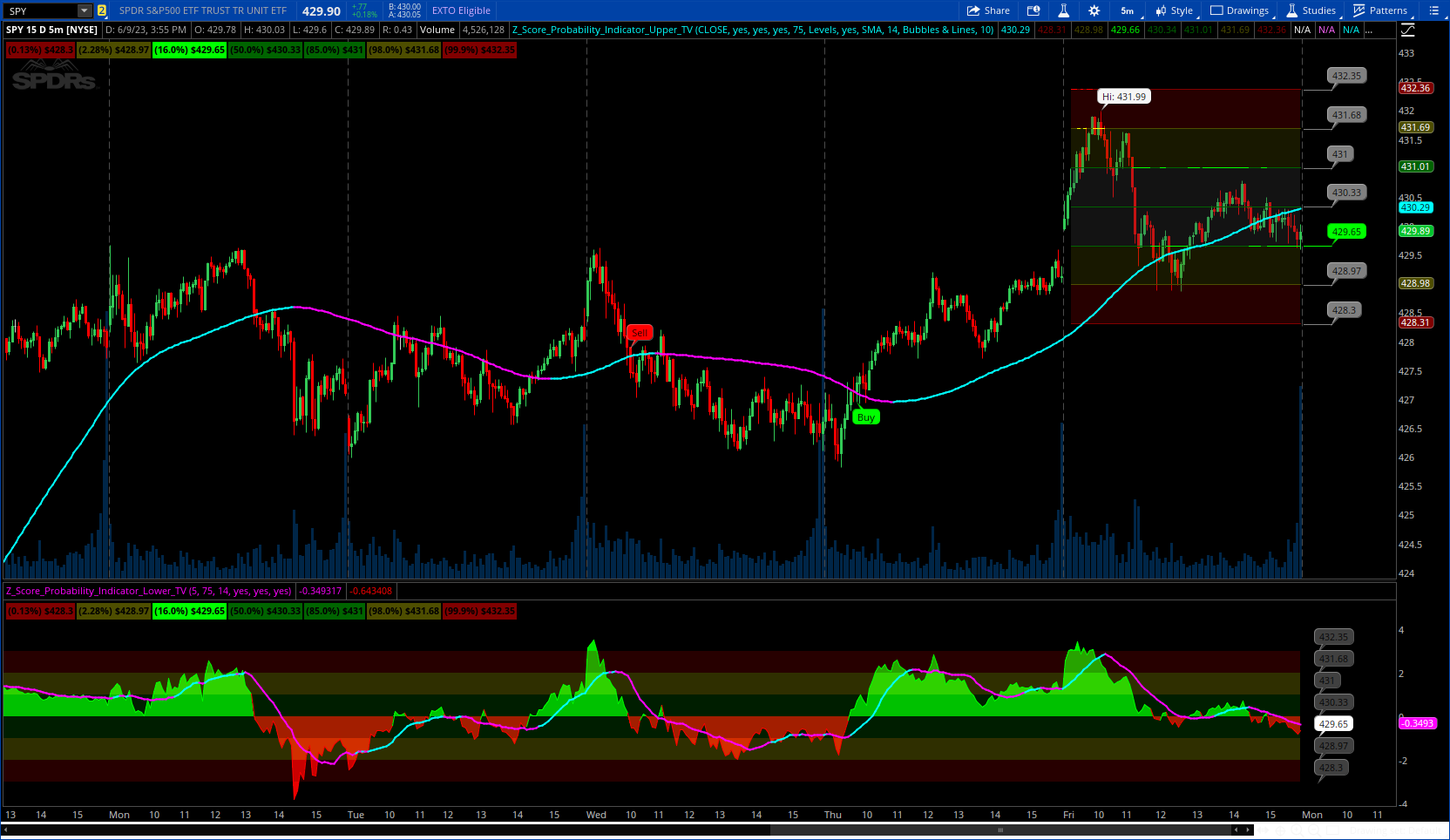

#indicator("Z-Score Probability Indicator")

input source = close;

input showLabel = yes; # "Show Z-Table"

input HighlightLevels = yes;

input ShowSignals = yes;

input LookbackLength = 75; # "Lookback Length"

input chartStyle = {Default "Levels", "Band", "Levels & Band", "Don't Show"};

input showMovAvgLine = yes; # "Show SMA"

input movAvgType = {default SMA, EMA, WMA, HullMA, VWMA, RMA, TEMA};

input movAvgLength = 14; # "SMA Length"

input onChartPriceProbaiblity = {"Bubbles", "Lines",Default "Bubbles & Lines", "Don't Show"};

input priceBubbleLocatation = 5;

def na = Double.NaN;

def n = priceBubbleLocatation;

def last = isNaN(close);

def loc = last[n] and !last[n+1];

def lines = chartStyle==chartStyle."Levels" or chartStyle==chartStyle."Levels & Band";

def band = chartStyle==chartStyle."Band" or chartStyle==chartStyle."Levels & Band";

def propLines = onChartPriceProbaiblity==onChartPriceProbaiblity."Lines" or

onChartPriceProbaiblity==onChartPriceProbaiblity."Bubbles & Lines";

def propBubbles = onChartPriceProbaiblity==onChartPriceProbaiblity."Bubbles" or

onChartPriceProbaiblity==onChartPriceProbaiblity."Bubbles & Lines";

#get_ma(src, ma_type, len) =>

script get_ma {

input ma_type = "TEMA";

input src = close;

input len = 100;

def hullma = HullMovingAvg(src, len);

def vwma = Average(src * volume, len) / Average(volume, len);

def ema1 = ExpAverage(src, len);

def ema2 = ExpAverage(ema1, len);

def ema3 = ExpAverage(ema2, len);

def tema = 3 * (ema1 - ema2) + ema3;

def ma = if ma_type == "SMA" then Average(src, len) else

if ma_type == "EMA" then ExpAverage(src, len) else

if ma_type == "WMA" then WMA(src, len) else

if ma_type == "HullMA" then hullma else

if ma_type == "VWMA" then vwma else

if ma_type == "RMA" then WildersAverage(src, len) else tema;

plot out = ma;

}

def cl_sma = Average(source, LookbackLength);

def cl_sd = StDev(source, LookbackLength);

def z = (source - cl_sma) / cl_sd;

#// Logical Assessments ///

def "0" = 0;

def "1" = 1;

def "2" = 2;

def "3" = 3;

def "-1" = -1;

def "-2" = -2;

def "-3" = -3;

def negThree = z < "-3";

def negTwo = z <= "-2" and z >= "-3";

def negOne = z < "0" and z > "-1";

def zero = z >= "1" and z <= "-1";

def posOne = z >= "0" and z < "1";

def posTwo = z >= "2" and z <= "3";

def posThree = z > "3";

#/// Price Level Calculations ///

def bar_index = AbsValue(CompoundValue(1, BarNumber(), 0));

#def loc = ShowPriceProbaiblity and last and !last[1];

def neutral_price = (cl_sma) + ("0" * cl_sd);

def onesd_price = (cl_sma) + ("1" * cl_sd);

def twosd_price = (cl_sma) + ("2" * cl_sd);

def threesd_price = (cl_sma) + ("3" * cl_sd);

def neg_onesd_price = (cl_sma) + ("-1" * cl_sd);

def neg_twosd_price = (cl_sma) + ("-2" * cl_sd);

def neg_threesd_price = (cl_sma) + ("-3" * cl_sd);

def zero1;

def posOne1;

def posTwo1;

def posThree1;

def negOne1;

def negTwo1;

def negThree1;

if bar_index >= LookbackLength {

negThree1 = neg_threesd_price;

negTwo1 = neg_twosd_price;

negOne1 = neg_onesd_price;

zero1 = neutral_price;

posOne1 = onesd_price;

posTwo1 = twosd_price;

posThree1 = threesd_price;

} else {

zero1 = na;

posOne1 = na;

posTwo1 = na;

posThree1 = na;

negOne1 = na;

negTwo1 = na;

negThree1 = na;

}

def zsma = get_ma(movAvgType, zero1, movAvgLength);

def z_sma = if showMovAvgLine then zsma else na;

def falling = zsma <= lowest(zsma, 3);

def rising = zsma >= highest(zsma,3);

plot avgZscore = z_sma;

avgZscore.AssignValueColor(if rising then Color.CYAN else Color.MAGENTA);

avgZscore.SetLineWeight(2);

def negThree11 = inertiaAll(highestAll(inertiaAll(negThree1, 2)), LookbackLength+1);

def negTwo11 = inertiaAll(highestAll(inertiaAll(negTwo1, 2)), LookbackLength+1);

def negOne11 = inertiaAll(highestAll(inertiaAll(negOne1, 2)), LookbackLength+1);

def zero11 = inertiaAll(highestAll(inertiaAll(zero1, 2)), LookbackLength+1);

def one11 = inertiaAll(highestAll(inertiaAll(posOne1, 2)), LookbackLength+1);

def two11 = inertiaAll(highestAll(inertiaAll(posTwo1, 2)), LookbackLength+1);

def three11 = inertiaAll(highestAll(inertiaAll(posThree1, 2)), LookbackLength+1);

#-- Lines

plot negThree_22 = if lines then negThree11 else na;

plot negTwo_22 = if lines then negTwo11 else na;

plot negOne_22 = if lines then negOne11 else na;

plot zero_22 = if lines then zero11 else na;

plot posOne_22 = if lines then one11 else na;

plot two_22 = if lines then two11 else na;

plot three_22 = if lines then three11 else na;

negThree_22.AssignValueColor(if negThree then Color.RED else Color.DARK_RED);

negTwo_22.AssignValueColor(if negTwo then Color.YELLOW else CreateColor(78,78,0));

negOne_22.AssignValueColor(if negOne then Color.GREEN else Color.DARK_GREEN);

zero_22.AssignValueColor(if zero then Color.GREEN else Color.DARK_GREEN);

posOne_22.AssignValueColor(if posOne then Color.GREEN else Color.DARK_GREEN);

two_22.AssignValueColor(if posTwo then Color.YELLOW else CreateColor(78,78,0));

three_22.AssignValueColor(if posThree then Color.RED else Color.DARK_RED);

#--- Band

plot negThree22 = if band then negThree1 else na;

plot negTwo22 = if band then negTwo1 else na;

plot negOne22 = if band then negOne1 else na;

plot zero22 = if band then zero1 else na;

plot one22 = if band then posone1 else na;

plot two22 = if band then postwo1 else na;

plot three22 = if band then posthree1 else na;

negThree22.AssignValueColor(if negThree then Color.RED else Color.DARK_RED);

negTwo22.AssignValueColor(if negTwo then Color.YELLOW else CreateColor(78,78,0));

negOne22.AssignValueColor(if negOne then Color.GREEN else Color.DARK_GREEN);

zero22.AssignValueColor(if zero then Color.GREEN else Color.DARK_GREEN);

one22.AssignValueColor(if posOne then Color.GREEN else Color.DARK_GREEN);

two22.AssignValueColor(if posTwo then Color.YELLOW else CreateColor(78,78,0));

three22.AssignValueColor(if posThree then Color.RED else Color.DARK_RED);

#--

plot negThree_2 = if negThree then negThree22 else na;

plot negTwo_2 = if negTwo then negTwo22 else na;

plot negOne_2 = if negOne then negOne22 else na;

plot zero_2 = if zero then zero22 else na;

plot posOne_2 = if posOne then one22 else na;

plot posTwo_2 = if posTwo then two22 else na;

plot posThree_2 = if posThree then three22 else na;

negThree_2.SetDefaultColor(Color.RED);

negTwo_2.SetDefaultColor(Color.YELLOW);

negOne_2.SetDefaultColor(Color.GREEN);

zero_2.SetDefaultColor(Color.GREEN);

posone_2.SetDefaultColor(Color.GREEN);

postwo_2.SetDefaultColor(Color.YELLOW);

posthree_2.SetDefaultColor(Color.RED);

negThree_2.SetLineWeight(2);

negTwo_2.SetLineWeight(2);

negOne_2.SetLineWeight(2);

zero_2.SetLineWeight(2);

posone_2.SetLineWeight(2);

postwo_2.SetLineWeight(2);

posthree_2.SetLineWeight(2);

def negThree33 = if last then na else negThree1;

def negTwo33 = if last then na else negTwo1;

def negOne33 = if last then na else negOne1;

def zero33 = if last then na else zero1;

def posOne33 = if last then na else posOne1;

def posTwo33 = if last then na else posTwo1;

def posThree33 = if last then na else posThree1;

def negThree3 = CompoundValue(1, if IsNaN(negThree33) then negThree3[1] else negThree1, negThree1);

def negTwo3 = CompoundValue(1, if IsNaN(negTwo33) then negTwo3[1] else negTwo1, negTwo1);

def negOne3 = CompoundValue(1, if IsNaN(negOne33) then negOne3[1] else negOne1, negOne1);

def zero3 = CompoundValue(1, if IsNaN(zero33) then zero3[1] else zero1, zero1);

def posOne3 = CompoundValue(1, if IsNaN(posOne33) then posOne3[1] else posOne1, posOne1);

def posTwo3 = CompoundValue(1, if IsNaN(posTwo33) then posTwo3[1] else posTwo1, posTwo1);

def posThree3 = CompoundValue(1, if IsNaN(posThree33) then posThree3[1] else posThree1, posThree1);

plot negThree_3 = if !last or last[n] then na else negThree3;

plot negTwo_3 = if !last or last[n] then na else negTwo3;

plot negOne_3 = if !last or last[n] then na else negOne3;

plot zero_3 = if !last or last[n] then na else zero3;

plot posOne_3 = if !last or last[n] then na else posOne3;

plot posTwo_3 = if !last or last[n] then na else posTwo3;

plot posThree_3 = if !last or last[n] then na else posThree3;

negThree_3.AssignValueColor(if negThree[n] then Color.RED else Color.GRAY);

negTwo_3.AssignValueColor(if negTwo[n] then Color.YELLOW else Color.GRAY);

negOne_3.AssignValueColor(if negOne[n] then Color.GREEN else Color.GRAY);

zero_3.AssignValueColor(if zero[n] then Color.GREEN else Color.GRAY);

posone_3.AssignValueColor(if posone[n] then Color.GREEN else Color.GRAY);

postwo_3.AssignValueColor(if postwo[n] then Color.YELLOW else Color.GRAY);

posthree_3.AssignValueColor(if posthree[n] then Color.RED else Color.GRAY);

negThree_3.SetHiding(!propLines);

negTwo_3.SetHiding(!propLines);

negOne_3.SetHiding(!propLines);

zero_3.SetHiding(!propLines);

posone_3.SetHiding(!propLines);

postwo_3.SetHiding(!propLines);

posthree_3.SetHiding(!propLines);

#-- Label

Addlabel(showLabel, "(0.13%) $" + Round(negThree1,2), if negThree then Color.RED else Color.DARK_RED);

Addlabel(showLabel, "(2.28%) $" + Round(negTwo1,2), if negTwo then Color.YELLOW else CreateColor(78,78,0));

Addlabel(showLabel, "(16.0%) $" + Round(negOne1,2), if negOne then Color.GREEN else Color.DARK_GREEN);

Addlabel(showLabel, "(50.0%) $" + Round(zero1,2), if zero then Color.GREEN else Color.DARK_GREEN);

Addlabel(showLabel, "(85.0%) $" + Round(posOne1,2), if posOne then Color.GREEN else Color.DARK_GREEN);

Addlabel(showLabel, "(98.0%) $" + Round(posTwo1,2), if posTwo then Color.YELLOW else CreateColor(78,78,0));

Addlabel(showLabel, "(99.9%) $" + Round(posThree1,2), if posThree then Color.RED else Color.DARK_RED);

# -- Bubbles

AddChartBubble(negThree_3 and negThree_3[n-1] and propBubbles, negThree_3 ,round(negThree1[n],2),

if negThree[n] then Color.RED else Color.GRAY, yes);

AddChartBubble(negTwo_3 and negTwo_3[n-1] and propBubbles, negTwo_3 ,round(negTwo1[n],2),

if negTwo[n] then Color.YELLOW else Color.GRAY, yes);

AddChartBubble(negOne_3 and negOne_3[n-1] and propBubbles, negOne_3 ,round(negOne1[n],2),

if negOne[n] then Color.GREEN else color.GRAY, yes);

AddChartBubble(zero_3 and zero_3[n-1] and propBubbles, zero_3 ,round(zero1[n],2),

if zero[n] then Color.GREEN else Color.GRAY, yes);

AddChartBubble(posOne_3 and posOne_3[n-1] and propBubbles, posOne_3 ,round(posOne1[n],2),

if posOne[n] then Color.GREEN else Color.GRAY, yes);

AddChartBubble(posTwo_3 and posTwo_3[n-1] and propBubbles, posTwo_3 ,round(posTwo1[n],2),

if posTwo[n] then Color.YELLOW else Color.GRAY, yes);

AddChartBubble(posThree_3 and posThree_3[n-1] and propBubbles, posThree_3 ,round(posThree1[n],2),

if posThree[n] then Color.RED else Color.GRAY, yes);

#-- Clouds

#HighlightLevels

AddCloud(if !HighlightLevels then na else three22, two22, Color.DARK_RED);

AddCloud(if !HighlightLevels then na else two22, one22, CreateColor(78,78,0));

AddCloud(if !HighlightLevels then na else one22, negOne22, Color.DARK_GRAY);

AddCloud(if !HighlightLevels then na else negOne22, negTwo22, CreateColor(78,78,0));

AddCloud(if !HighlightLevels then na else negTwo22, negThree22, Color.DARK_RED);

AddCloud(if !HighlightLevels then na else three_22, two_22, Color.DARK_RED);

AddCloud(if !HighlightLevels then na else two_22, posOne_22, CreateColor(78,78,0));

AddCloud(if !HighlightLevels then na else posOne_22, negOne_22, Color.DARK_GRAY);

AddCloud(if !HighlightLevels then na else negOne_22, negTwo_22, CreateColor(78,78,0));

AddCloud(if !HighlightLevels then na else negTwo_22, negThree_22, Color.DARK_RED);

#-- Signals

def zRising = z >= highest(average(z, 5), 5);

def zFalling = z <= lowest(average(z, 5), 5);

def sigUp = (source crosses above zsma) and zRising and z>0.5;

def sigDn = (source crosses below zsma) and zFalling and z<-0.5;

AddChartBubble(ShowSignals and sigUp, low, "Buy", Color.GREEN, no);

AddChartBubble(ShowSignals and sigDn, high, "Sell", Color.RED, yes);

#END of CODE