@whats up Take a look at this article https://www.investopedia.com/terms/v/vwap.asp

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Z-Score Distance From VWAP for ThinkorSwim

- Thread starter horserider

- Start date

-

- Tags

- oscillator

@Welkin I found this interesting. Copied and modded the study so it can be used in the scanner. Only one VWAP can be compiled at a time or else TOS didn't like it. So, I eliminated week/month running in parallel with day, and added the option to switch between them.

Code:

#[email protected]

#version 7.29.2020

#modded by theLEMband to use with TOS scan tab

declare lower;

def NA = Double.NaN;

input thresh =50;

input threshWk = 50;

input threshMnth = 50;

def o = open;

def h = high;

def l = low;

def c = close;

#VWAP Daily, Weekly, and Monthly

input tframe = {default "DAY", "WEEK", "MONTH"};

def VWAPDAY = reference VWAP("time frame" = tframe);

#VWAP UpperBand and LowerBand values

def VWAPDAYLB = reference VWAP("num dev dn" = -4.0, "time frame" = "DAY")."LowerBand";

def VWAPDAYHB = reference VWAP("num dev up" = 4.0, "time frame" = "DAY")."UpperBand";

#VWAP Deviation Bands

def VWAPUB = reference VWAP("num dev up" = 4.0, "time frame" = "DAY")."UpperBand";

def VWAPLB = reference VWAP("num dev dn" = -4.0, "time frame" = "DAY")."LowerBand";

input price = close;

input avgType = AverageType.HULL;

input avgLength = 5;

def VWDayBP = c - VWAPLB;

def VWDaySP = VWAPUB - c;

def VWDayBPh= h - VWAPLB;

def VWDaySPh = VWAPUB - h;

def VWDayBPl = l - VWAPLB;

def VWDaySPl = VWAPUB - l;

def VWDayRange = VWAPUB - VWAPLB;

#VWDayRange.Hide();

def VWDayBandWidthU = ((VWAPUB - VWAPLB)/VWAPDAY)*1000;

def VWDayBandWidthD = ((VWAPLB - VWAPUB)/VWAPDAY)*1000;

def VWAPDayZh1 = MovingAverage(avgType,(((VWDayBPh - VWDaySPh)/(VWDayRange))*100),avgLength);

def VWAPDayZl1 = MovingAverage(avgType,(((VWDayBPl - VWDaySPl)/(VWDayRange))*100),avgLength);

def VWAPDayZc1 = MovingAverage(avgType,(((VWDayBP - VWDaySP)/(VWDayRange))*100),avgLength);

def VWAPDayZh = if AbsValue(VWAPDayZh1) > 120 then NA else VWAPDayZh1;

def VWAPDayZl = if AbsValue(VWAPDayZl1) > 120 then NA else VWAPDayZl1;

plot VWAPDayZc = if AbsValue(VWAPDayZc1) > 120 then NA else VWAPDayZc1;

VWAPDayZc.Hide();

def bb = VWAPDayZc > VWAPDayZc[1];

plot VWAPDaytopsig = if VWAPDayZc >= threshWk then 100 else NA;

plot VWAPDaybotsig = if VWAPDayZc <= -threshWk then -100 else NA;It's a translation of the script from Tradingview. The math itself is to find the z-score. It then changes to moving average of the z-scores for the period. I may not be saying it correctly, have yet to hit the coffee. But yeah, it's out right Stat 101 mathematical calculation of z-score in the bars and then an MA on top of that to show proximity.@megahead34 I think VicD has done some crazy math calculations and is coming up with some sort of 20 bar average of the VWAP, it is not a Z score of the VWAP. Your description of a Z score as far as I understand is correct.

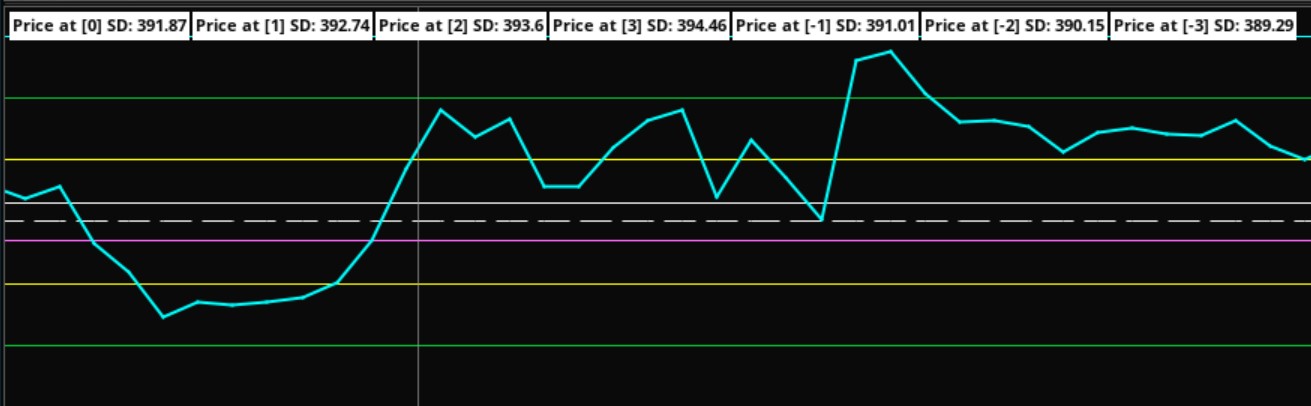

Here u go folks, @bp805, double check with yours Vscore

Code:

#posted by @bp805

#edited by @mjlinhle

declare lower;

input anchorDate = 20200820;

input barsGoBack = 120;

#Zero

input showStopLabelZero = yes;

input devStopZero = {default Zero};# {default One, Two, Three, Zero, NegOne, NegTwo, NegThree, Custom}

#One

input showStopLabelOne = yes;

input devStopOne = {default One};

#Two

input showStopLabelTwo = yes;

input devStopTwo = {default Two};

#Three

input showStopLabelThree = yes;

input devStopThree = {default Three};

#NegOne

input showStopLabelNegOne = yes;

input devStopNegOne = {default NegOne};

#NegTwo

input showStopLabelNegTwo = yes;

input devStopNegTwo = {default NegTwo};

#***NegThree

input showStopLabelNegThree = yes;

input devStopNegThree = {default NegThree};

#***custom

input showStopLabelCustom = yes;

input devStopCustom = {default Custom};

input customDev = 0.15;

def postAnchorDate = if GetYYYYMMDD() >= anchorDate then 1 else 0;

def yyyyMmDd = GetYYYYMMDD();

def periodIndx = if GetAggregationPeriod() < AggregationPeriod.HOUR then yyyyMmDd else postAnchorDate;

def isPeriodRolled = CompoundValue(1, periodIndx != periodIndx[1], yes);

def volumeSum;

def volumeVwapSum;

def volumeVwap2Sum;

if (isPeriodRolled) {

volumeSum = volume;

volumeVwapSum = volume * vwap;

volumeVwap2Sum = volume * Sqr(vwap);

} else {

volumeSum = CompoundValue(1, volumeSum[1] + volume, volume);

volumeVwapSum = CompoundValue(1, volumeVwapSum[1] + volume * vwap, volume * vwap);

volumeVwap2Sum = CompoundValue(1, volumeVwap2Sum[1] + volume * Sqr(vwap), volume * Sqr(vwap));

}

def price = volumeVwapSum / volumeSum;

def deviation = Sqrt(Max(volumeVwap2Sum / volumeSum - Sqr(price), 0));

plot VScore = if (((price - close) * (-1)) / deviation) > 5 or (((price - close) * (-1)) / deviation) < -5 then 0 else (((price - close) * (-1)) / (deviation));

plot zero = 0;

plot one = 1;

plot two = 2;

plot three = 3;

plot negOne = -1;

plot negTwo = -2;

plot negThree = -3;

plot posInt = 0.3;

plot negInt = -0.3;

#Zero

def stopPriceZero = (0) * (deviation) + (price);

AddLabel(showStopLabelZero, "Price at [" + 0 + "] SD: " + AsPrice(Round(stopPriceZero, 2)), Color.WHITE);

#One

def stopPriceOne = (1) * (deviation) + (price);

AddLabel(showStopLabelOne, "Price at [" + 1 + "] SD: " + AsPrice(Round(stopPriceOne, 2)), Color.WHITE);

#Two

def stopPriceTwo = (2) * (deviation) + (price);

AddLabel(showStopLabelTwo, "Price at [" + 2 + "] SD: " + AsPrice(Round(stopPriceTwo, 2)), Color.WHITE);

#Three

def stopPriceThree = (3) * (deviation) + (price);

AddLabel(showStopLabelThree, "Price at [" + 3 + "] SD: " + AsPrice(Round(stopPriceThree, 2)), Color.WHITE);

#NegOne

def stopPriceNegOne = (-1) * (deviation) + (price);

AddLabel(showStopLabelNegOne, "Price at [" + -1 + "] SD: " + AsPrice(Round(stopPriceNegOne, 2)), Color.WHITE);

#NegTwo

def stopPriceNegTwo = (-2) * (deviation) + (price);

AddLabel(showStopLabelNegTwo, "Price at [" + -2 + "] SD: " + AsPrice(Round(stopPriceNegTwo, 2)), Color.WHITE);

#NegThree

def stopPriceNegThree = (-3) * (deviation) + (price);

AddLabel(showStopLabelNegThree, "Price at [" + -3 + "] SD: " + AsPrice(Round(stopPriceNegThree, 2)), Color.WHITE);

def zeroAndOne = if VScore > zero and VScore <= one then 1 else 0;

def oneAndTwo = if VScore > one and VScore <= two then 1 else 0;

def twoAndThree = if VScore > two and VScore <= three then 1 else 0;

def negZeroAndOne = if VScore > negOne and VScore < zero then 1 else 0;

def negOneAndTwo = if VScore > negTwo and VScore <= negOne then 1 else 0;

def negTwoAndThree = if VScore > negThree and VScore <= negTwo then 1 else 0;

def cloud1;

def cloud2;

if Sum(zeroAndOne, barsGoBack) > Sum(oneAndTwo, barsGoBack) and Sum(zeroAndOne, barsGoBack) > Sum(twoAndThree, barsGoBack) and Sum(zeroAndOne, barsGoBack) > Sum(negZeroAndOne, barsGoBack) and Sum(zeroAndOne, barsGoBack) > Sum(negOneAndTwo, barsGoBack) and Sum(zeroAndOne, barsGoBack) > Sum(negTwoAndThree, barsGoBack) {

cloud1 = zero;

cloud2 = one;

}

else if Sum(oneAndTwo, barsGoBack) > Sum(zeroAndOne, barsGoBack) and Sum(oneAndTwo, barsGoBack) > Sum(twoAndThree, barsGoBack) and Sum(oneAndTwo, barsGoBack) > Sum(negZeroAndOne, barsGoBack) and Sum(oneAndTwo, barsGoBack) > Sum(negOneAndTwo, barsGoBack) and Sum(oneAndTwo, barsGoBack) > Sum(negTwoAndThree, barsGoBack) {

cloud1 = one;

cloud2 = two;

}

else if Sum(twoAndThree, barsGoBack) > Sum(zeroAndOne, barsGoBack) and Sum(twoAndThree, barsGoBack) > Sum(oneAndTwo, barsGoBack) and Sum(twoAndThree, barsGoBack) > Sum(negZeroAndOne, barsGoBack) and Sum(twoAndThree, barsGoBack) > Sum(negOneAndTwo, barsGoBack) and Sum(twoAndThree, barsGoBack) > Sum(negTwoAndThree, barsGoBack) {

cloud1 = two;

cloud2 = three;

}

else if Sum(negZeroAndOne, barsGoBack) > Sum(zeroAndOne, barsGoBack) and Sum(negZeroAndOne, barsGoBack) > Sum(oneAndTwo, barsGoBack) and Sum(negZeroAndOne, barsGoBack) > Sum(twoAndThree, barsGoBack) and Sum(negZeroAndOne, barsGoBack) > Sum(negOneAndTwo, barsGoBack) and Sum(negZeroAndOne, barsGoBack) > Sum(negTwoAndThree, barsGoBack) {

cloud1 = zero;

cloud2 = negOne;

}

else if Sum(negOneAndTwo, barsGoBack) > Sum(zeroAndOne, barsGoBack) and Sum(negOneAndTwo, barsGoBack) > Sum(oneAndTwo, barsGoBack) and Sum(negOneAndTwo, barsGoBack) > Sum(twoAndThree, barsGoBack) and Sum(negOneAndTwo, barsGoBack) > Sum(negZeroAndOne, barsGoBack) and Sum(negOneAndTwo, barsGoBack) > Sum(negTwoAndThree, barsGoBack) {

cloud1 = negOne;

cloud2 = negTwo;

}

else if Sum(negTwoAndThree, barsGoBack) > Sum(zeroAndOne, barsGoBack) and Sum(negTwoAndThree, barsGoBack) > Sum(oneAndTwo, barsGoBack) and Sum(negTwoAndThree, barsGoBack) > Sum(twoAndThree, barsGoBack) and Sum(negTwoAndThree, barsGoBack) > Sum(negZeroAndOne, barsGoBack) and Sum(negTwoAndThree, barsGoBack) > Sum(negOneAndTwo, barsGoBack) {

cloud1 = negTwo;

cloud2 = negThree;

}

else {

cloud1 = Double.NaN;

cloud2 = Double.NaN;

}

AddCloud(cloud1, cloud2, Color.LIGHT_RED, Color.LIGHT_GREEN);

plot BullSignal = if (cloud1 == one or cloud2 == one or cloud1 == two or cloud2 == two or cloud1 == three or cloud2 == three) and (VScore <= 0.3 and VScore[1] > 0) and CCI() > -100 then -2 else Double.NaN;

plot BearSignal = if (cloud1 == negOne or cloud2 == negOne or cloud1 == negTwo or cloud2 == negTwo or cloud1 == negThree or cloud2 == negThree) and (VScore >= 0.3 and VScore[1] < 0) and CCI() < 100 then 2 else Double.NaN;

BullSignal.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BearSignal.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

BullSignal.SetLineWeight(3);

BearSignal.SetLineWeight(3);

input soundAlertsOn = no;

Alert((cloud1 == one or cloud2 == one or cloud1 == two or cloud2 == two or cloud1 == three or cloud2 == three) and (VScore <= 0 and VScore[1] > 0) and (soundAlertsOn), "Bullish VScore Entry", Alert.BAR);

Alert((cloud1 == negOne or cloud2 == negOne or cloud1 == negTwo or cloud2 == negTwo or cloud1 == negThree or cloud2 == negThree) and (VScore >= 0 and VScore[1] < 0) and (soundAlertsOn), "Bearish VScore Entry", Alert.BAR);

Last edited:

petergluis

Active member

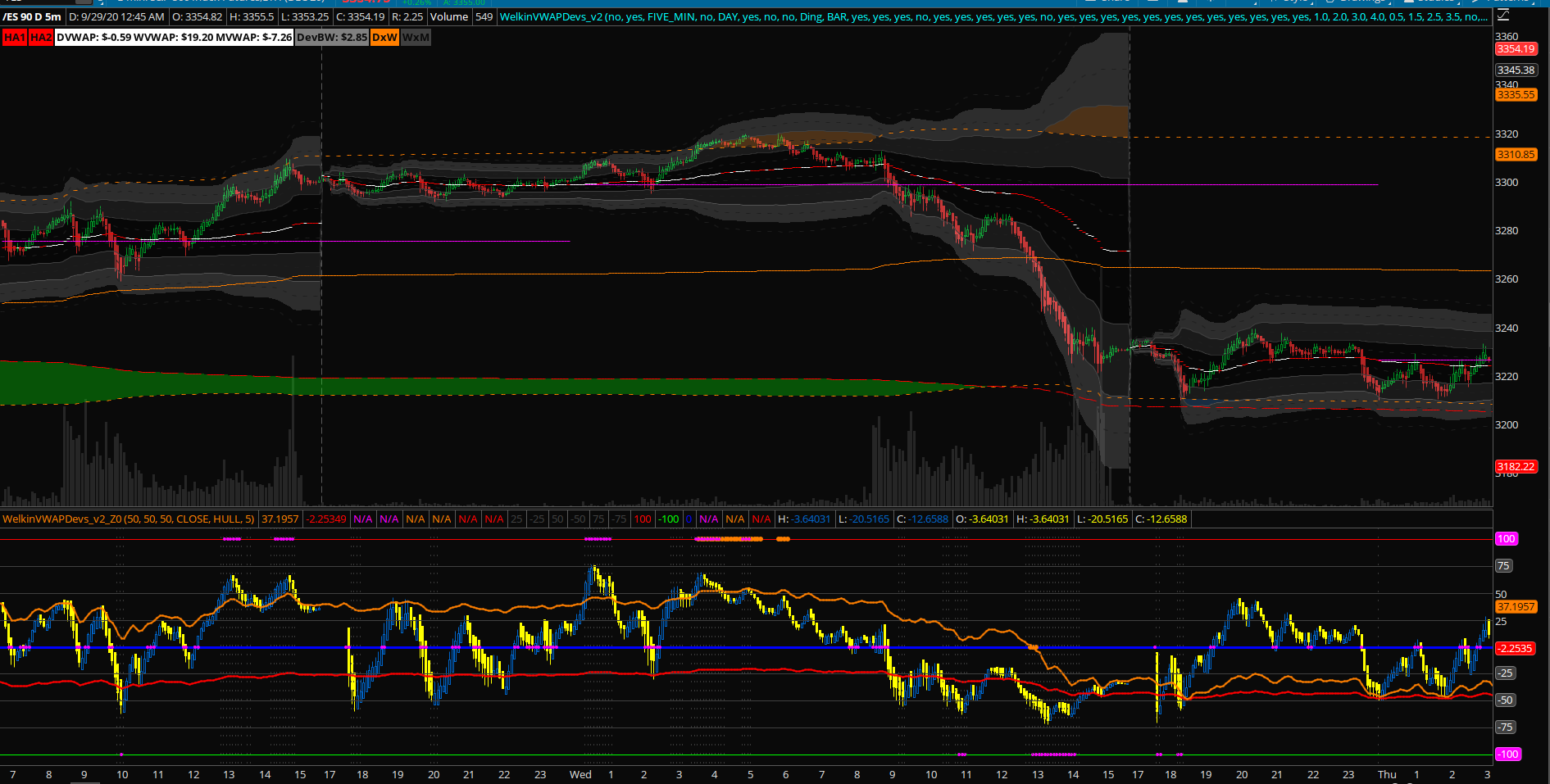

Welkin, could you please share the chart above with a link above? It seems that the code above shows the difference result from your chart in a lower study. Thank you very much.Just saw this thread. I don't know about the easycator's vwap strat or zscore indicator but I've made something similar that I've based on the vwap deviations indicator that I use. I guess you could consider this a companion to that indicator. I look for daily VWAP 2nd devs to be outside of weekly 2nd deviations and weekly 2nd deviations to be outside of the monthly 2nd deviations. I've found when price is outside of these boundaries there can be a high probability to make a large push back towards the weekly/monthly vwaps. I made this a while ago but come back to it every now and then to make some tweaks. Maybe this can give you some ideas.

A few notes:

this is best used with extended trading hours turned on

the candles are hull MAs based on the high/low/close position relative to the daily VWAP deviations

the orange and red lines are hull MA's based on the close position relative to the weekly/monthy VWAP deviations

0 = VWAP for daily(candles)/weekly(orange line)/monthly(red line)

+/- 25 is = 1st deviation

+/- 50 is = 2nd deviation

+/- 75 is = 3rd deviation

+/- 100 is = 4th deviation

when price is below or above 2nd deviations (+/- 50) a magenta dot (daily) orange dot(weekly) or red dot (monthly) will plot at the top or bottom.

when price touches the daily/weekly/monthly vwap a magenta/orange/red dot will plot on the 0 line

if daily vwap is above or below 2nd deviations dark gray vertical lines will plot

Code:#[email protected] #version 7.29.2020 declare lower; def NA = Double.NaN; input thresh =50; input threshWk = 50; input threshMnth = 50; def o = open; def h = high; def l = low; def c = close; DefineGlobalColor("Bullish", CreateColor(0,100,200)); DefineGlobalColor("Bearish", Color.YELLOW); #VWAP Daily, Weekly, and Monthly def VWAPDAY = reference VWAP("time frame" = "DAY"); def VWAPWK = reference VWAP("time frame" = "WEEK"); def VWAPMNTH = reference VWAP("time frame" = "MONTH"); #VWAP UpperBand and LowerBand values def VWAPDAYLB = reference VWAP("num dev dn" = -4.0, "time frame" = "DAY")."LowerBand"; def VWAPWKLB = reference VWAP("num dev dn" = -4.0, "time frame" = "WEEK")."LowerBand"; def VWAPMNTHLB = reference VWAP("num dev dn" = -4.0, "time frame" = "MONTH")."LowerBand"; def VWAPDAYHB = reference VWAP("num dev up" = 4.0, "time frame" = "DAY")."UpperBand"; def VWAPWKHB = reference VWAP("num dev up" = 4.0, "time frame" = "WEEK")."UpperBand"; def VWAPMNTHHB = reference VWAP("num dev up" = 4.0, "time frame" = "MONTH")."UpperBand"; #VWAP Deviation Bands def VWAPUB = reference VWAP("num dev up" = 4.0, "time frame" = "DAY")."UpperBand"; def VWAPLB = reference VWAP("num dev dn" = -4.0, "time frame" = "DAY")."LowerBand"; ############################## input price = close; input avgType = AverageType.HULL; input avgLength = 5; def VWDayBP = c - VWAPLB; def VWDaySP = VWAPUB - c; def VWDayBPh= h - VWAPLB; def VWDaySPh = VWAPUB - h; def VWDayBPl = l - VWAPLB; def VWDaySPl = VWAPUB - l; def VWDayRange = VWAPUB - VWAPLB; #VWDayRange.Hide(); def VWDayBandWidthU = ((VWAPUB - VWAPLB)/VWAPDAY)*1000; def VWDayBandWidthD = ((VWAPLB - VWAPUB)/VWAPDAY)*1000; def VWWkBP = c - VWAPWKLB; def VWWkSP = VWAPWKHB - c; def VWWkBPh = h - VWAPWKLB; def VWWkSPh = VWAPWKHB - h; def VWWkBPl = l - VWAPWKLB; def VWWkSPl = VWAPWKHB - l; def VWWkRange = VWAPWKHB - VWAPWKLB; def VWMnthBP = c - VWAPMNTHLB; def VWMnthSP = VWAPMNTHHB - c; def VWMnthBPh = h - VWAPMNTHLB; def VWMnthSPh = VWAPMNTHHB - h; def VWMnthBPl = l - VWAPMNTHLB; def VWMnthSPl = VWAPMNTHHB - l; def VWMnthRange = VWAPMNTHHB - VWAPMNTHLB; def VWAPDayZh1 = MovingAverage(avgType,(((VWDayBPh - VWDaySPh)/(VWDayRange))*100),avgLength); def VWAPDayZl1 = MovingAverage(avgType,(((VWDayBPl - VWDaySPl)/(VWDayRange))*100),avgLength); def VWAPDayZc1 = MovingAverage(avgType,(((VWDayBP - VWDaySP)/(VWDayRange))*100),avgLength); def VWAPDayZh = if AbsValue(VWAPDayZh1) > 120 then NA else VWAPDayZh1; def VWAPDayZl = if AbsValue(VWAPDayZl1) > 120 then NA else VWAPDayZl1; plot VWAPDayZc = if AbsValue(VWAPDayZc1) > 120 then NA else VWAPDayZc1; VWAPDayZc.Hide(); def bb = VWAPDayZc > VWAPDayZc[1]; def VWAPWkZ1 = MovingAverage(avgType,(((VWWkBP - VWWkSP)/(VWWkRange))*100),avgLength); plot VWAPWkZ = if AbsValue(VWAPWkZ1) > 120 then NA else VWAPWkZ1; def VWAPWkZh1 = MovingAverage(avgType,(((VWWkBPh - VWWkSPh)/(VWWkRange))*100),avgLength); def VWAPWkZl1 = MovingAverage(avgType,(((VWWkBPl - VWWkSPl)/(VWWkRange))*100),avgLength); def VWAPWkZh = if AbsValue(VWAPWkZh1) > 120 then NA else VWAPWkZh1; def VWAPWkZl = if AbsValue(VWAPWkZl1) > 120 then NA else VWAPWkZl1; def VWAPMnthZ1 = MovingAverage(avgType,(((VWMnthBP - VWMnthSP)/(VWMnthRange))*100),avgLength); plot VWAPMnthZ = if AbsValue(VWAPMnthZ1) > 120 then NA else VWAPMnthZ1; def VWAPMnthZh1 = MovingAverage(avgType,(((VWMnthBPh - VWMnthSPh)/(VWMnthRange))*100),avgLength); def VWAPMnthZl1 = MovingAverage(avgType,(((VWMnthBPl - VWMnthSPl)/(VWMnthRange))*100),avgLength); def VWAPMnthZh = if AbsValue(VWAPMnthZh1) > 120 then NA else VWAPMnthZh1; def VWAPMnthZl = if AbsValue(VWAPMnthZl1) > 120 then NA else VWAPMnthZl1; VWAPWkZ.SetHiding(VWAPWkZ == VWAPDayZc); AddChart(VWAPDayZh,VWAPDayZl,if bb then VWAPDayZl else NA,VWAPDayZc,ChartType.CANDLE, GlobalColor("Bullish")); AddChart(VWAPDayZh,VWAPDayZl,if !bb then VWAPDayZh else NA,VWAPDayZc,ChartType.CANDLE, GlobalColor("Bearish")); AddVerticalLine((AbsValue(VWAPDayZh) >= thresh) or (AbsValue(VWAPDayZl) >= thresh) or (AbsValue(VWAPDayZc) >= thresh),"", Color.DARK_GRAY, Curve.POINTS); plot VWAPDaytopsig = if VWAPDayZc >= threshWk then 100 else NA; plot VWAPDaybotsig = if VWAPDayZc <= -threshWk then -100 else NA; plot VWAPWktopsig = if VWAPWkZ >= threshWk then 100 else NA; plot VWAPWkbotsig = if VWAPWkZ <= -threshWk then -100 else NA; plot VWAPMnthtopsig = if VWAPMnthZ >= threshMnth then 100 else NA; plot VWAPMnthbotsig = if VWAPMnthZ <= -threshMnth then -100 else NA; plot Dev1Pos = 25; plot Dev1Neg = -25; plot Dev2Pos = 50; plot Dev2Neg = -50; plot Dev3Pos = 75; plot Dev3Neg = -75; plot Dev4Pos = 100; plot Dev4Neg = -100; plot zero = 0; zero.SetLineWeight(3); zero.SetDefaultColor(Color.BLUE); def VWAPtestD = VWAPDayZl <= 0 and VWAPDayZh >= 0; def VWAPtestW = VWAPWkZl <= 0 and VWAPWkZh >= 0; def VWAPtestM = VWAPMnthZl <= 0 and VWAPMnthZh >= 0; plot VWAPztestD = if VWAPtestD then 0 else NA; plot VWAPztestW = if VWAPtestW then 0 else NA; plot VWAPztestM = if VWAPtestM then 0 else NA; def VWAPDev1PosTest = VWAPDayZl <= Dev1Pos and VWAPDayZh >= Dev1Pos; def VWAPDev1NegTest = VWAPDayZl <= Dev1Neg and VWAPDayZh >= Dev1Neg; def VWAPDev2PosTest = VWAPDayZl <= Dev2Pos and VWAPDayZh >= Dev2Pos; def VWAPDev2NegTest = VWAPDayZl <= Dev2Neg and VWAPDayZh >= Dev2Neg; def VWAPDev3PosTest = VWAPDayZl <= Dev3Pos and VWAPDayZh >= Dev3Pos; def VWAPDev3NegTest = VWAPDayZl <= Dev3Neg and VWAPDayZh >= Dev3Neg; def VWAPDev4PosTest = VWAPDayZl <= Dev4Pos and VWAPDayZh >= Dev4Pos; def VWAPDev4NegTest = VWAPDayZl <= Dev4Neg and VWAPDayZh >= Dev4Neg; zero.SetDefaultColor(Color.BLUE); VWAPztestD.SetDefaultColor(Color.MAGENTA); VWAPztestW.SetDefaultColor(Color.DARK_ORANGE); VWAPztestM.SetDefaultColor(Color.RED); VWAPztestD.SetPaintingStrategy(PaintingStrategy.POINTS); VWAPztestW.SetPaintingStrategy(PaintingStrategy.POINTS); VWAPztestM.SetPaintingStrategy(PaintingStrategy.POINTS); VWAPztestD.SetLineWeight(1); VWAPztestW.SetLineWeight(3); VWAPztestM.SetLineWeight(5); Dev1Pos.SetDefaultColor(Color.DARK_GRAY); Dev1Neg.SetDefaultColor(Color.DARK_GRAY); Dev2Pos.SetDefaultColor(Color.DARK_GRAY); Dev2Neg.SetDefaultColor(Color.DARK_GRAY); Dev3Pos.SetDefaultColor(Color.DARK_GRAY); Dev3Neg.SetDefaultColor(Color.DARK_GRAY); Dev4Pos.SetDefaultColor(Color.RED); Dev4Neg.SetDefaultColor(Color.GREEN); VWAPDayZc.SetDefaultColor(Color.YELLOW); VWAPWkZ.SetDefaultColor(Color.DARK_ORANGE); VWAPWkZ.SetLineWeight(2); VWAPMnthZ.SetDefaultColor(Color.RED); VWAPMnthZ.SetLineWeight(2); #VWDayBandWidthU.SetDefaultColor(Color.GRAY); #VWDayBandWidthD.SetDefaultColor(Color.GRAY); VWAPDaytopsig.SetPaintingStrategy(PaintingStrategy.POINTS); VWAPDaybotsig.SetPaintingStrategy(PaintingStrategy.POINTS); VWAPDaytopsig.SetDefaultColor(Color.MAGENTA); VWAPDaybotsig.SetDefaultColor(Color.MAGENTA); VWAPWktopsig.SetPaintingStrategy(PaintingStrategy.POINTS); VWAPWkbotsig.SetPaintingStrategy(PaintingStrategy.POINTS); VWAPWktopsig.SetDefaultColor(Color.DARK_ORANGE); VWAPWkbotsig.SetDefaultColor(Color.DARK_ORANGE); VWAPWktopsig.SetLineWeight(3); VWAPWkbotsig.SetLineWeight(3); VWAPMnthtopsig.SetPaintingStrategy(PaintingStrategy.POINTS); VWAPMnthbotsig.SetPaintingStrategy(PaintingStrategy.POINTS); VWAPMnthtopsig.SetDefaultColor(Color.RED); VWAPMnthbotsig.SetDefaultColor(Color.RED); VWAPMnthtopsig.SetLineWeight(5); VWAPMnthbotsig.SetLineWeight(5);

Did you know that clicking on a member's avatar will allow you to see when a member was last seen on the uTS forum? @Welkin has not been seen in a long while.Welkin, could you please share the chart above with a link above? It seems that the code above shows the difference result from your chart in a lower study. Thank you very much.

MagicQuotes

Member

@Harleym2009 Not really an indicator setup. Just a few examples to show deviation from the VWAP as someone had asked about VWAP deviation.

Each study is a different way to show basically the same info. That is deviation of price from the VWAP. The idea would be a larger deviation may result in a reversion. In any deviation from the mean two things can happen, reversion to the mean or mean catches up to the deviation. So price moves back to the VWAP or the VWAP catches up with the price. Nothing is ever certain except at some point the two will come together. So just look those over and see if any can be useful to you. Ask questions about any particular one if you have any.

https://usethinkscript.com/threads/...nergy-for-thinkorswim.1270/page-3#post-115151

Last edited by a moderator:

krahsloop

Member

Hi, I pasted this in the thinkScript editor of the custom study filter and am getting an error on the following block of code:

Ruby:

def VScore = if (((price - close)(-1))/deviation) > 5 or (((price - close)(-1))/deviation) < -5

then 0

else (((price - close)*(-1))/(deviation));

Last edited by a moderator:

The "VScore" definition was not complete in that post, so it has been taken down.Hi, I pasted this in the thinkScript editor of the custom study filter and am getting an error on the following block of code:

Ruby:def VScore = if (((price - close)(-1))/deviation) > 5 or (((price - close)(-1))/deviation) < -5 then 0 else (((price - close)*(-1))/(deviation));

Recommend that you use the working script in the top post.

Last edited:

I am having trouble finding a fix for some issues with the original code. I use a 1 day 5min chart as my main timeframe. The issue is, the VWAP Z score is skewed (especially at the beginning of the day); which I believe is happening because the script is pulling day from the whole chart, not just the current day.

I attached a screenshot for reference. As you can see, the price is still relatively close to VWAP, but the Z Score is skewed to a value of -4.

Also attached is a copy of my current script: http://tos.mx/!C4pwJVSI

Can anyone help provide me with updated script that fixes this? Possibly by starting the calculation at market open each day?

my current script: http://tos.mx/!C4pwJVSI

Thanks so much.

I attached a screenshot for reference. As you can see, the price is still relatively close to VWAP, but the Z Score is skewed to a value of -4.

Also attached is a copy of my current script: http://tos.mx/!C4pwJVSI

Can anyone help provide me with updated script that fixes this? Possibly by starting the calculation at market open each day?

my current script: http://tos.mx/!C4pwJVSI

Thanks so much.

Attachments

I am having trouble finding a fix for some issues with the original code. I use a 1 day 5min chart as my main timeframe. The issue is, the VWAP Z score is skewed (especially at the beginning of the day); which I believe is happening because the script is pulling day from the whole chart, not just the current day.

I attached a screenshot for reference. As you can see, the price is still relatively close to VWAP, but the Z Score is skewed to a value of -4.

Also attached is a copy of my current script: http://tos.mx/!C4pwJVSI

Can anyone help provide me with updated script that fixes this? Possibly by starting the calculation at market open each day?

my current script: http://tos.mx/!C4pwJVSI

Thanks so much.

The issue is that you must have enough data on your chart for the study to calculate the plots.

The lookback requires a minimum of 3 days of data.

Change to 4D5min chart to be safe; and your data issues will be resolved.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Z-Score Probability Indicator for ThinkOrSwim | Indicators | 32 | |

|

|

Z-Score Upper Indicator for ThinkorSwim | Indicators | 43 | |

|

|

Trend Score Indicator for ThinkorSwim | Indicators | 21 | |

| V | Multiple-Day Anchored VWAP For ThinkOrSwim | Indicators | 12 | |

|

|

RSI (or MACD) with VWAP & MA & div for ThinkOrSwim | Indicators | 12 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

592

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.