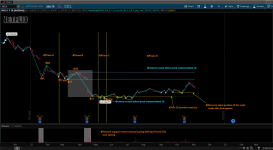

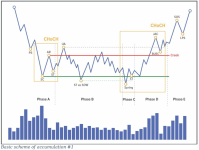

@halcyonguy have helped me get to a good point for this wyckoff indicator I've working on to identify the different phases and locate when a spring occur. I would like to share it and get some feedback on how to make it efficient and scannable.

Ruby:

# seq_peaks_valleys_01d

# https://usethinkscript.com/threads/how-do-i-code-a-sequence-of-events.11956/

# I am trying to code the sequence of events: ST then UR then LS as seen below with horizontal lines. If the sequence does not occur nothing gets plot on the chart. I have post the script and looking for some tips to do this. Thanks!

def bn = barnumber();

def na = double.nan;

def lastbn = HighestAll(If(IsNaN(close), 0, bn));

def lastbar = if (bn == lastbn) then 1 else 0;

def hibn = HighestAll(bn);

#def lastbar = !isnan(close[0]) and isnan(close[-1]);

def priceH = high;

def priceL = low;

def priceC = close;

def o = open;

def h = high;

def l = low;

def c = close;

input percentageReversal = 2;

input absoluteReversal = 0.0;

input atrLength = 2;

input atrReversal = 1;

input tickReversal = 0;

Assert(percentageReversal >= 0, "'percentage reversal' must not be negative: " + percentageReversal);

Assert(absoluteReversal >= 0, "'absolute reversal' must not be negative: " + absoluteReversal);

Assert(atrReversal >= 0, "'atr reversal' must not be negative: " + atrReversal);

Assert(tickReversal >= 0, "'ticks' must not be negative: " + tickReversal);

Assert(percentageReversal != 0 or absoluteReversal != 0 or atrReversal != 0 or tickReversal != 0, "Either 'percentage reversal' or 'absolute reversal' or 'atr reversal' or 'tick reversal' must not be zero");

def absReversal;

if (absoluteReversal != 0) {

absReversal = absoluteReversal;

} else {

absReversal = tickReversal * TickSize();

}

def hlPivot;

if (atrReversal != 0) {

hlPivot = percentageReversal / 100 + WildersAverage(TrueRange(high, close, low), atrLength) / close * atrReversal;

} else {

hlPivot = percentageReversal / 100;

}

def state = {default init, undefined, uptrend, downtrend};

def maxPriceH;

def minPriceL;

def newMax;

def newMin;

def prevMaxH = GetValue(maxPriceH, 1);

def prevMinL = GetValue(minPriceL, 1);

if GetValue(state, 1) == GetValue(state.init, 0) {

maxPriceH = priceH;

minPriceL = priceL;

newMax = yes;

newMin = yes;

state = state.undefined;

} else if GetValue(state, 1) == GetValue(state.undefined, 0) {

if priceH >= prevMaxH {

state = state.uptrend;

maxPriceH = priceH;

minPriceL = prevMinL;

newMax = yes;

newMin = no;

} else if priceL <= prevMinL {

state = state.downtrend;

maxPriceH = prevMaxH;

minPriceL = priceL;

newMax = no;

newMin = yes;

} else {

state = state.undefined;

maxPriceH = prevMaxH;

minPriceL = prevMinL;

newMax = no;

newMin = no;

}

} else if GetValue(state, 1) == GetValue(state.uptrend, 0) {

if priceL <= prevMaxH - prevMaxH * hlPivot - absReversal {

state = state.downtrend;

maxPriceH = prevMaxH;

minPriceL = priceL;

newMax = no;

newMin = yes;

} else {

state = state.uptrend;

if (priceH >= prevMaxH) {

maxPriceH = priceH;

newMax = yes;

} else {

maxPriceH = prevMaxH;

newMax = no;

}

minPriceL = prevMinL;

newMin = no;

}

} else {

if priceH >= prevMinL + prevMinL * hlPivot + absReversal {

state = state.uptrend;

maxPriceH = priceH;

minPriceL = prevMinL;

newMax = yes;

newMin = no;

} else {

state = state.downtrend;

maxPriceH = prevMaxH;

newMax = no;

if (priceL <= prevMinL) {

minPriceL = priceL;

newMin = yes;

} else {

minPriceL = prevMinL;

newMin = no;

}

}

}

def barNumber = BarNumber();

def barCount = HighestAll(If(IsNaN(priceH), 0, barNumber));

def newState = GetValue(state, 0) != GetValue(state, 1);

def offset = barCount - barNumber + 1;

def highPoint = state == state.uptrend and priceH == maxPriceH;

def lowPoint = state == state.downtrend and priceL == minPriceL;

def lastH;

if highPoint and offset > 1 {

lastH = fold iH = 1 to offset with tH = priceH while !IsNaN(tH) and !GetValue(newState, -iH) do if GetValue(newMax, -iH) or iH == offset - 1 and GetValue(priceH, -iH) == tH then Double.NaN else tH;

} else {

lastH = Double.NaN;

}

def lastL;

if lowPoint and offset > 1 {

lastL = fold iL = 1 to offset with tL = priceL while !IsNaN(tL) and !GetValue(newState, -iL) do if GetValue(newMin, -iL) or iL == offset - 1 and GetValue(priceL, -iL) == tL then Double.NaN else tL;

} else {

lastL = Double.NaN;

}

plot ZZ;

if barNumber == 1 {

ZZ = fold iF = 1 to offset with tP = Double.NaN while IsNaN(tP) do if GetValue(state, -iF) == GetValue(state.uptrend, 0) then priceL else if GetValue(state, -iF) == GetValue(state.downtrend, 0) then priceH else Double.NaN;

} else if barNumber == barCount {

ZZ = if highPoint or state == state.downtrend and priceL > minPriceL then priceH else if lowPoint or state == state.uptrend and priceH < maxPriceH then priceL else Double.NaN;

} else {

ZZ = if !IsNaN(lastH) then lastH else if !IsNaN(lastL) then lastL else Double.NaN;

}

ZZ.SetDefaultColor(GetColor(1));

ZZ.EnableApproximation();

input toggle = no;

input reversalamount = 8.0;

def ATRSave = if !IsNaN(ZZ) then ZZ else GetValue(ATRSave, 1);

def ATRSave1 = if ATRSave != ATRSave[1] then ATRSave[1] else GetValue(ATRSave1, 1);

def ATRSave2 = if ATRSave != ATRSave then ATRSave else GetValue(ATRSave1, 1);

def ATRSave3 = if ATRSave2 != ATRSave2[1] then ATRSave2[1] else GetValue(ATRSave3, 1);

def ATRSave4 = if ATRSave3 != ATRSave3[1] then ATRSave3[1] else GetValue(ATRSave4, 1);

def ATRSave5 = if ATRSave4 != ATRSave4[1] then ATRSave4[1] else GetValue(ATRSave5, 1);

def ATRSave6 = if ATRSave5 != ATRSave5[1] then ATRSave5[1] else GetValue(ATRSave6, 1);

def ATRSave7 = if ATRSave6 != ATRSave6[1] then ATRSave6[1] else GetValue(ATRSave7, 1);

#########################################################################################

#Sequence 1

#########################################################################################

input length = 20;

input trendSetup = 2;

input error = .90;

def ErrMargin = error * Average(BodyHeight(), length);

def IsWhite = open < close;

def IsAlmostEqual = AbsValue(ATRSave - ATRSave2) <= ErrMargin and IsDescending(ATRSave, trendSetup);

#def LR = isAlmostEqual;

def st1 = isAlmostEqual;

#plot test = if st1 or st1[1] or st1[2] then (low - 3 * TickSize()) else Double.NaN;

plot test = if st1 then (low - 3 * TickSize()) else Double.NaN;

Test.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

Test.SetStyle(Curve.POINTS);

Test.SetDefaultColor(Color.white);

Test.HideBubble();

Test.HideTitle();

#########################################################################################

#Sequence 2

#########################################################################################

def Upper_ID = ATRSave > ATRSave1 && ATRSave > ATRSAve2 && ATRSave > ATRSave3 && ATRSave2 > ATRSave1 && ATRSave2 > ATRSave3 && (ATRSave1 > ATRSave3 or ATRSave3 > ATRSave1) ;

plot Upper_Resistance = if Upper_ID then (high + 3 * TickSize()) else Double.NaN;

Upper_Resistance.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

Upper_Resistance.SetStyle(Curve.POINTS);

Upper_Resistance.SetDefaultColor(Color.RED);

Upper_Resistance.HideBubble();

Upper_Resistance.HideTitle();

#########################################################################################

#Sequence 3

#########################################################################################

def Lower_ID = ATRSave1 > ATRSave && ATRSave1 > ATRSAve2 && ATRSave1 > ATRSave3 && ATRSave1 > ATRSave4 && ATRSave3 > ATRSave && ATRSave3 > ATRSave2 && ATRSave3 > ATRSave4 && ATRSave4 > ATRSave && (ATRSave4 > ATRSave2 or ATRSave2 > ATRSave4) && ATRSave2 > ATRSave;

plot Lower_Range = if Lower_ID then (low - 3 * TickSize()) else Double.NaN;

Lower_Range.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

Lower_Range.SetStyle(Curve.POINTS);

Lower_Range.SetDefaultColor(Color.GREEN);

Lower_Range.HideBubble();

Lower_Range.HideTitle();

#########################################################################################

#Chartbubble

#########################################################################################

addchartBubble(toggle, Test, "ST", color.WHITE, no);

addchartBubble(toggle, Upper_Resistance, "UR", color.RED, yes);

addchartBubble(toggle, Lower_Range, "LS", color.GREEN, no);

#########################################################################################

#

#

# chg , disable these plots

#########################################################################################

#Horizontal Lines , most recent

#########################################################################################

input lineLength = 5;

#def BN = BarNumber();

def barCount1 = Highestall(If(IsNaN(test), 0.0, BN));

def closeLine = if BN == 1 then Double.NaN

else if BN == barCount1 - linelength

then test[-lineLength]

else closeLine[1];

#plot x = closeline;

def barCount2 = Highestall(If(IsNaN(Upper_Resistance), 0.0, BN));

def closeLine2 = if BN == 1 then Double.NaN

else if BN == barCount2 - linelength

then Upper_Resistance[-lineLength]

else closeLine2[1];

#plot x2 = closeline2;

def barCount3 = Highestall(If(IsNaN(Lower_Range), 0.0, BN));

def closeLine3 = if BN == 1 then Double.NaN

else if BN == barCount3 - linelength

then Lower_Range[-lineLength]

else closeLine3[1];

#plot x3 = closeline3;

#-------------------------------------------------------------------

#-------------------------------------------------------------------

#-------------------------------------------------------------------

# check for the seq of 3 vars , ST , then UR, then LS

#chg vars

def st = test;

def ur = Upper_Resistance;

def ls = Lower_Range;

def st_bn = barCount1;

def ur_bn = barCount2;

def ls_bn = barCount3;

def st_lvl = closeLine;

def ur_lvl = closeLine2;

def ls_lvl = closeLine3;

#---------------------------

def st_bn2 = if st_bn != st_bn[1] then st_bn else st_bn[1];

def signal_bn = if st then st_bn

else if ur then ur_bn

else if ls then ls_bn

else signal_bn[1];

def sigchg = if signal_bn[1] != signal_bn then 1 else 0;

def lines_en = if bn == 1 then 0

else if bn == st_bn then

fold i = 1 to (lastbn - bn +1)

with p

do p + (if (bn == getvalue(ur_bn, -i) or bn == getvalue(ls_bn, -i)) then 1 else 0)

else lines_en[1];

def st2 = st1;

def ur2 = if bn == 1 then 0

else if isnan(ur) then 0

else if ur then 1

else ur2[1];

def ls2 = if bn == 1 then 0

else if isnan(ls) then 0

else if ls then 1

else ls2[1];

# cyan line peaks/valleys

def zz2 = if bn == 1 then 0

else if isnan(zz) then 0

else zz;

# var with values, that determine when a pattern is found

# when a value of 3 occurs, a full pattern exists , ST, UR, LS

def signals = if bn == 1 then 0

else if st2 and signals[1] != 0 then 0

else if ur2 and signals[1] != 1 then 0

else if ls2 and signals[1] != 2 then 0

else if signals[1] == 3 then 0

else if st2 then 1

else if ur2 and signals[1] == 1 then 2

else if ls2 and signals[1] == 2 then 3

# if a non labeled peak or valley then 0

else if (zz2 > 0 and (!st2 or !ur2 or !ls2)) then 0

else signals[1];

def ls2_off = if bn == 1 then 0

else if lastbar then 0

else if st2 then fold j = 1 to ( (hibn+1) - bn)

with q

while !isnan(getvalue(close, -j)) and getvalue(signals, -j) > 0

do ( if getvalue(signals, -(j-1)) == 2 and getvalue(signals, -j) == 3 then j else q)

else if ls2_off[1] == 0 then 0

else ls2_off[1] - 1;

def st2_bn = if bn == 1 then 0

else if st2 and ls2_off > 0 then bn

else if signals > 0 then st2_bn[1]

else 0;

def ur2_bn = If bn == 1 then 0

else if ur2 and ls2_off > 0 then bn

else if signals > 0 then ur2_bn[1]

else 0;

def ls2_bn = if st2 then (bn + ls2_off)

else if signals > 0 then ls2_bn[1]

else 0;

def pattern = if bn == 1 then 0

else if (bn >= st2_bn and bn <= ls2_bn) then 1

else 0;

#-----------------------------

# find high of pattern rng

def rnghi = if (bn == st2_bn and ls2_bn > 0) then

Fold k = 0 to 100

with r

while getvalue(pattern, -k) > 0

do if getvalue(high, -k) > r then getvalue(high, -k) else r

else if pattern > 0 then rnghi[1]

else na;

#plot yy = rnghi;

#yy.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

def rnglo = if (bn == st2_bn and ls2_bn > 0) then

fold m = 0 to 100

with s = 99999

while getvalue(pattern, -m) > 0

do if getvalue(low, -m) < s then getvalue(low, -m) else s

else if pattern > 0 then rnglo[1]

else na;

#plot ww = rnglo;

#ww.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

input show_clouds = yes;

def factor_percent = 4.0;

def top = if show_clouds then (1+(factor_percent/100))*rnghi else na;

def bot = if show_clouds then (1-(factor_percent/100))*rnglo else na;

addcloud(top, bot, color.light_gray, color.light_gray);

#plot zp = if pattern then high * 1.05 else na;

#zp.setdefaultcolor(color.cyan);

#zp.setlineweight(4);

# ---------------------------------------

#########################################################################################

#Horizontal Lines , most recent

# chg to be when a pattern happens

#########################################################################################

#input lineLength = 5;

#def BN = BarNumber();

#def barCount1 = Highestall(If(IsNaN(test), 0.0, BN));

# plot test = if st1 then (low - 3 * TickSize()) else Double.NaN;

def diplvl = low - (3 * TickSize());

def peaklvl = high + (3 * TickSize());

def st_line = if BN == 1 then 0

else if bn == st2_bn and ls2_bn > 0 then diplvl

else st_line[1];

plot stx = if st_line > 0 then st_line else na;

stx.setdefaultcolor(color.cyan);

#stx.setlineweight(4);

stx.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Def ur_Line = if BN == 1 then Double.NaN

else if BN == ur2_bn and ls2_bn > 0 then peaklvl

else ur_line[1];

plot urx = if ur_line > 0 then ur_line else na;

urx.setdefaultcolor(color.violet);

urx.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

def ls_line = if BN == 1 then Double.NaN

else if BN == ls2_bn and signals[1] == 2 then diplvl

else ls_line[1];

plot lsx = if ls_line > 0 then ls_line else na;

lsx.setdefaultcolor(color.orange);

lsx.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#--------------------------------------------

# LR = true on st valley

input test1 = no;

addchartbubble(test1, 100,

st1 + " LR\n" +

(low - 3 * TickSize()) + "\n" +

ticksize()

#+

#test

, (if st1 then color.yellow else color.gray), no);

addchartbubble(0, low*0.88,

bn + "\n" +

st2_bn + "\n" +

st_line + "\n" +

ur2_bn + "\n" +

ls2_bn + "\n" +

signals + "\n" +

# na

#test[-lineLength] + "\n" +

pattern + "\n" +

diplvl

# cause fold error

#pattern[-lineLength]

, color.yellow, no);

#-----------------------------------------------

addchartbubble(0, low*0.96 ,

#addchartbubble(signals > 0, low*0.96 ,

bn + " \n" +

( lastbn - bn) + "\n" +

ls2_off + " off\n" +

(bn + ls2_off) + " LS bn\n" +

zz2 + " zz\n" +

st2 + " st2\n" +

ur2 + " ur2\n" +

ls2 + " ls2\n" +

signals + "\n" +

ls2_bn

, color.yellow, no);

#addverticalline( signals == 3 , "-", color.cyan);