This post is a condensed compilation of Dr. Rajeev Shukla’s Study of Multicollinearity of Technical Indicators

The use of multiple indicators is a fundamental basis of technical analysis. Two or more different types of indicators confirming entry greatly increase the odds of a profitable trade.

Ahhhh. But there is the rub. They must be different types of indicators. Half of all retail investors trading technical indicators have poor overall results due to using multicollinear analysis. Meaning their strategy is using multiple indicators but one or more of them are the same type of indicator.

So look at your charts. Indicators are collinear with another one if they rise, fall, make bottoms and tops in about the same locations.

https://chartschool.stockcharts.com/table-of-contents/overview/multicollinearity

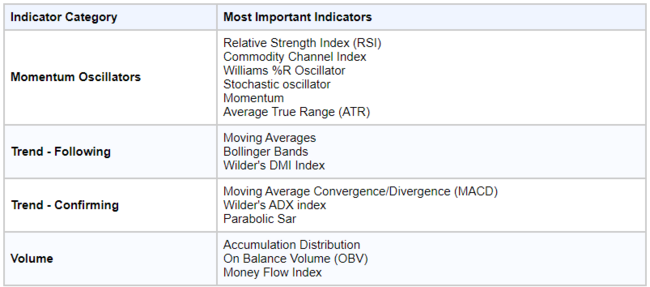

Here are some of the most common indicators that investors use together under the mistaken assumption that they are confirming their entry signal:

The study linked at the top of this post provides a more complete list of common indicators that cannot be used together to confirm signal.

A good strategy must use two or more of these different types of indicators:

Trend indicators

Volatility indicators

Momentum indicators

Cycle indicators

Market strength indicators

Support and resistance indicators

Advantages of unrelated indicators:

• The best regression models are those in which the predictor variables each correlate highly with the dependent (outcome) variable but correlate at most only minimally with each other.

• Such a model is often called "low noise" and will be statistically robust (that is, it will predict reliably across numerous samples of variable sets drawn from the same statistical population).

Some examples of indicators when used together in certain strategies provide strong confirmation of entry:

Traders who use technical indicators carefully and effectively can more accurately pinpoint high probability trading set-ups, increasing their odds of success in the markets. However, combining different types of indicators in a strategy results in much fewer trade possibilities, as only strong confirmations are triggered. It takes maturity, experience, confidence, and patience to wait for a strong confirmation signal. As a result, a majority of retail traders don't follow the concepts laid out here. They still have a chance of making profitable trades. The problem with trading lower probability setups is that you will have profits but you will chance incurring significant unprofitable trades.

Technical analysis deals in probabilities rather than certainties. There is no combination of indicators that will accurately predict the markets' moves 100% of the time. The point is that the use of different types of indicators has been shown to statistically significantly increase those probabilities. If your strategy isn't working for you or is working but also incurs large losses, try adding one of the above combinations to your strategy. You will make fewer trades but increase profitability.

PS: This doesn’t mean you never use same-type, non-repainting indicators. Same-type indicators using different lengths and lookbacks are useful in weeding out false signals of any one indicator. But you then still need a different type of indicator for confirmation of entry. (Multiple repainting indicators are redundant. The repainting has already eliminated all the false signals).

HTH

The use of multiple indicators is a fundamental basis of technical analysis. Two or more different types of indicators confirming entry greatly increase the odds of a profitable trade.

Ahhhh. But there is the rub. They must be different types of indicators. Half of all retail investors trading technical indicators have poor overall results due to using multicollinear analysis. Meaning their strategy is using multiple indicators but one or more of them are the same type of indicator.

So look at your charts. Indicators are collinear with another one if they rise, fall, make bottoms and tops in about the same locations.

https://chartschool.stockcharts.com/table-of-contents/overview/multicollinearity

Here are some of the most common indicators that investors use together under the mistaken assumption that they are confirming their entry signal:

The study linked at the top of this post provides a more complete list of common indicators that cannot be used together to confirm signal.

A good strategy must use two or more of these different types of indicators:

Trend indicators

Volatility indicators

Momentum indicators

Cycle indicators

Market strength indicators

Support and resistance indicators

Advantages of unrelated indicators:

• The best regression models are those in which the predictor variables each correlate highly with the dependent (outcome) variable but correlate at most only minimally with each other.

• Such a model is often called "low noise" and will be statistically robust (that is, it will predict reliably across numerous samples of variable sets drawn from the same statistical population).

Some examples of indicators when used together in certain strategies provide strong confirmation of entry:

- Standard deviation + MACD + OBV

- MA crossover + MFI

- Bollinger bands + RSI + Volume Oscillator

- PSAR + ROC + Trendlines

- PSAR + MFI+ Trendlines

Traders who use technical indicators carefully and effectively can more accurately pinpoint high probability trading set-ups, increasing their odds of success in the markets. However, combining different types of indicators in a strategy results in much fewer trade possibilities, as only strong confirmations are triggered. It takes maturity, experience, confidence, and patience to wait for a strong confirmation signal. As a result, a majority of retail traders don't follow the concepts laid out here. They still have a chance of making profitable trades. The problem with trading lower probability setups is that you will have profits but you will chance incurring significant unprofitable trades.

Technical analysis deals in probabilities rather than certainties. There is no combination of indicators that will accurately predict the markets' moves 100% of the time. The point is that the use of different types of indicators has been shown to statistically significantly increase those probabilities. If your strategy isn't working for you or is working but also incurs large losses, try adding one of the above combinations to your strategy. You will make fewer trades but increase profitability.

PS: This doesn’t mean you never use same-type, non-repainting indicators. Same-type indicators using different lengths and lookbacks are useful in weeding out false signals of any one indicator. But you then still need a different type of indicator for confirmation of entry. (Multiple repainting indicators are redundant. The repainting has already eliminated all the false signals).

HTH

Last edited by a moderator: