@Babel explanation above is correct when working with TREND indicators or momentum/trend oscillators.

Moving averages and some other trend indicators LAG.

The longer the lookback, the longer the lag.

Therefore, with

Trend Indicators, shorter lengths are required on smaller timeframes to reduce the amount of lag when looking for entry.

HOWEVER, your first example is a

Channel Indicator.

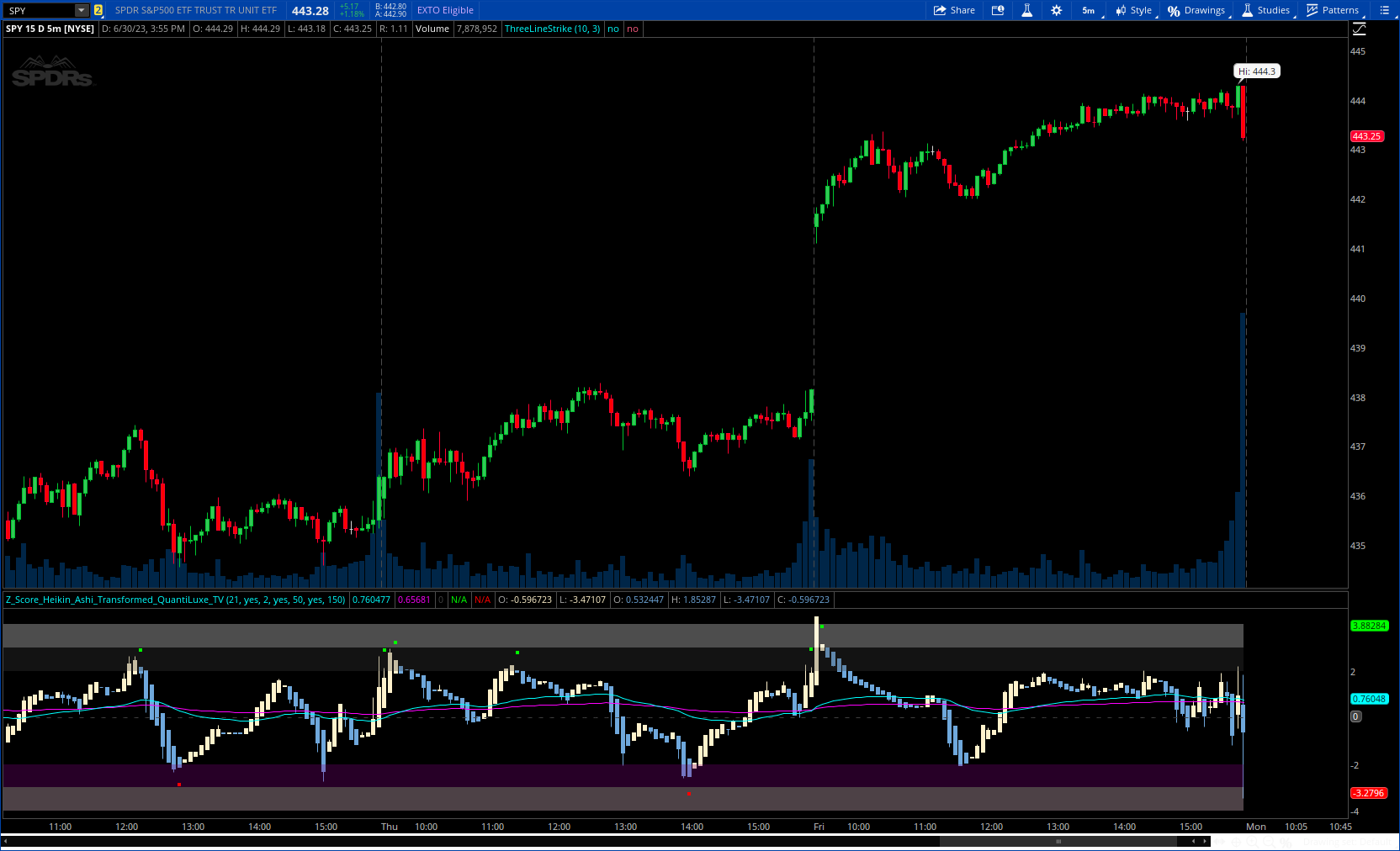

Channel / Range / Band indicators are attempting to define what dynamic range an instrument "normally" trades. To determine this, it is important to lookback over a much much longer length.

This will provide insights into price movement. High range signifies volatility, appealing to short-term traders. Also, movement outside of normal which is always of interest to traders.

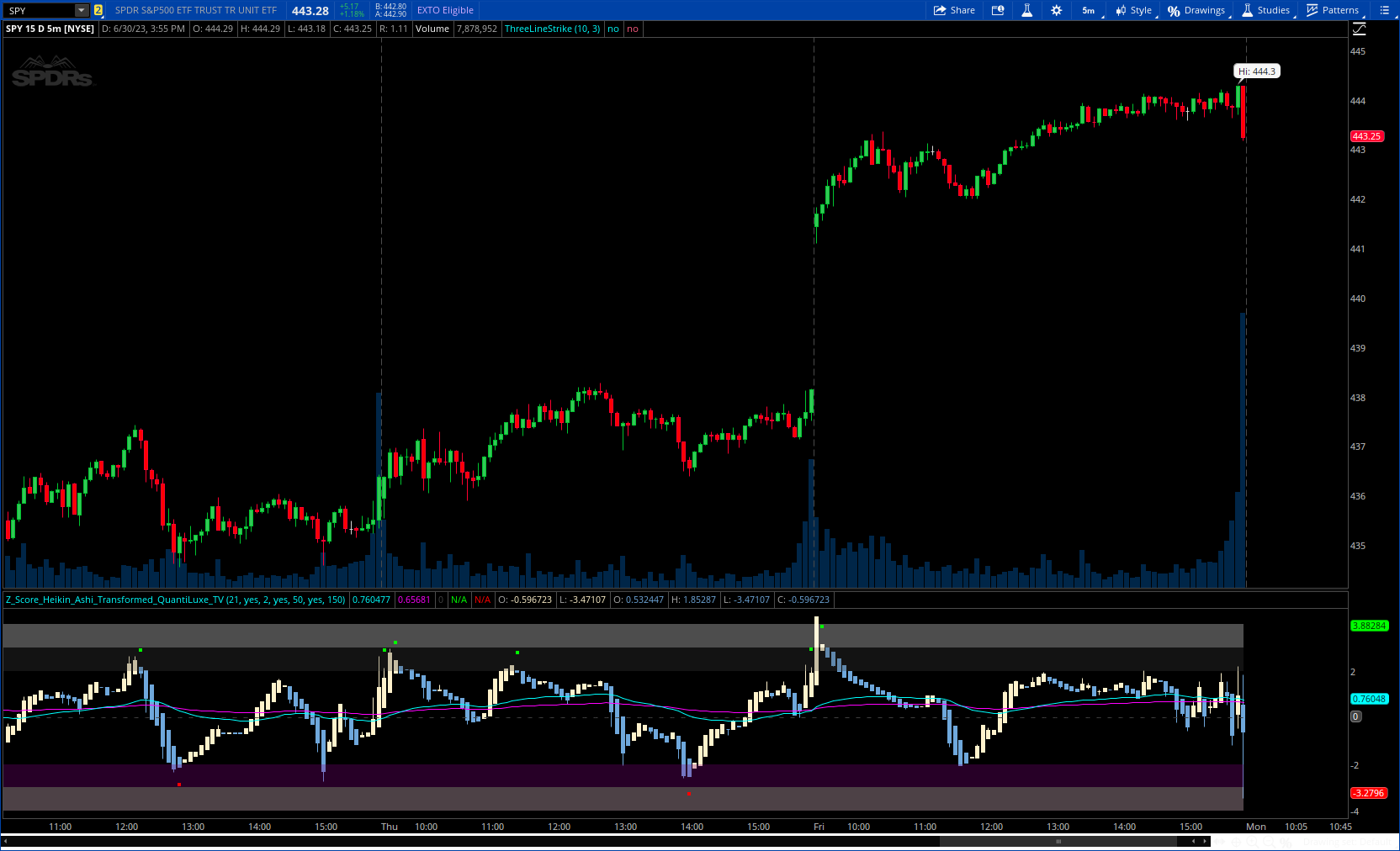

To find a normal range on daytrading aggregations, the default of 200 bars is generally textbook;

although 150 bars can also be found depending on the volatility of the instrument and the market.

This will allow a visual display of what the range has been for the past x days; which is long enough to filter out noise and give a clear analysis of what this stock's activity has been compared to where it is currently.

Generally the default lookback is not changed on range indicators regardless of timeframe.

On shorter-term charts, you want to see the dynamic range over a few days.

On your longer-term charts, such as daily; you want to see the dynamic range over the past year.

(FYI, read more about why you do your analysis of three timeframes:

https://usethinkscript.com/threads/best-time-frame-for-trading-for-thinkorswim.12209/)

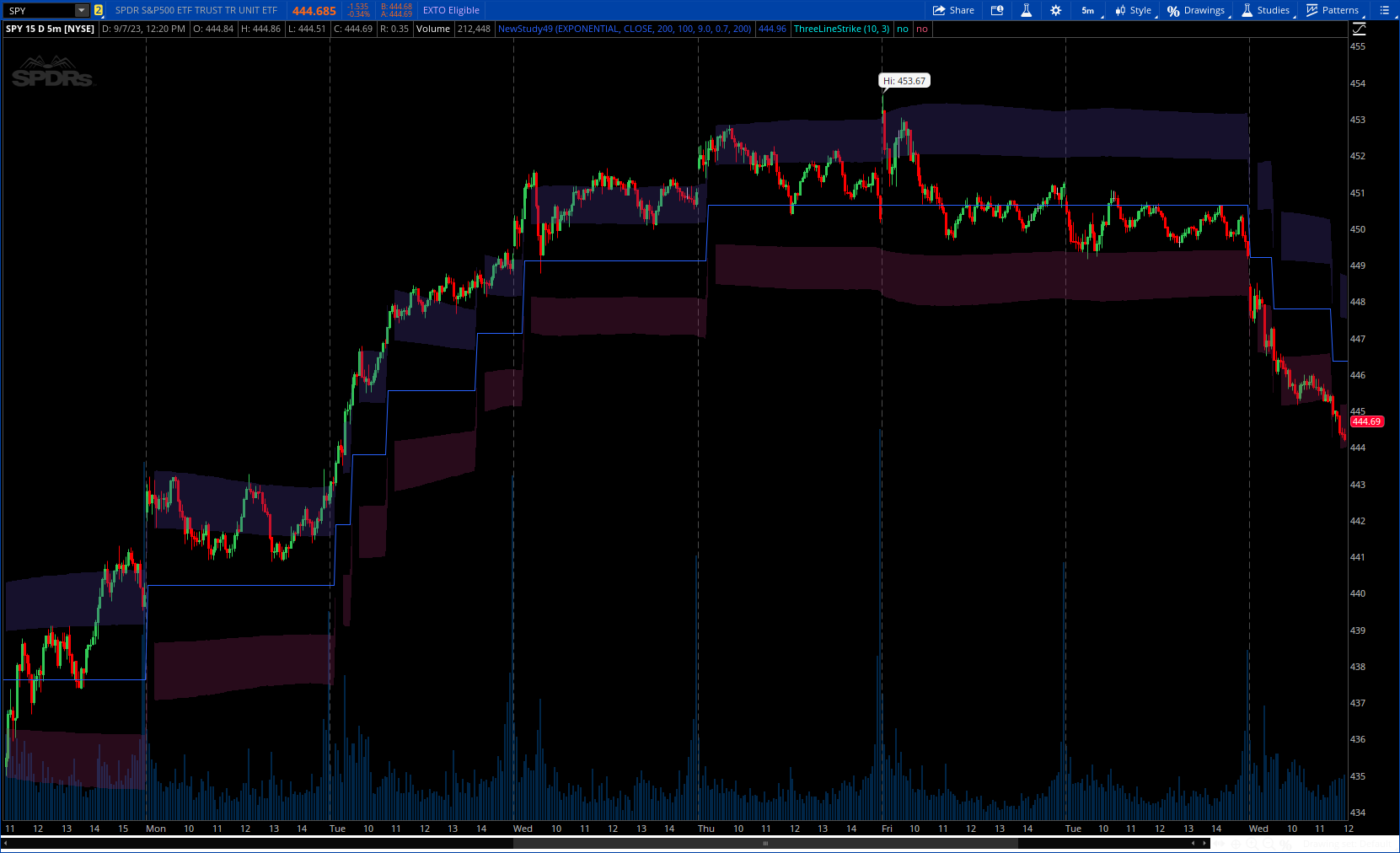

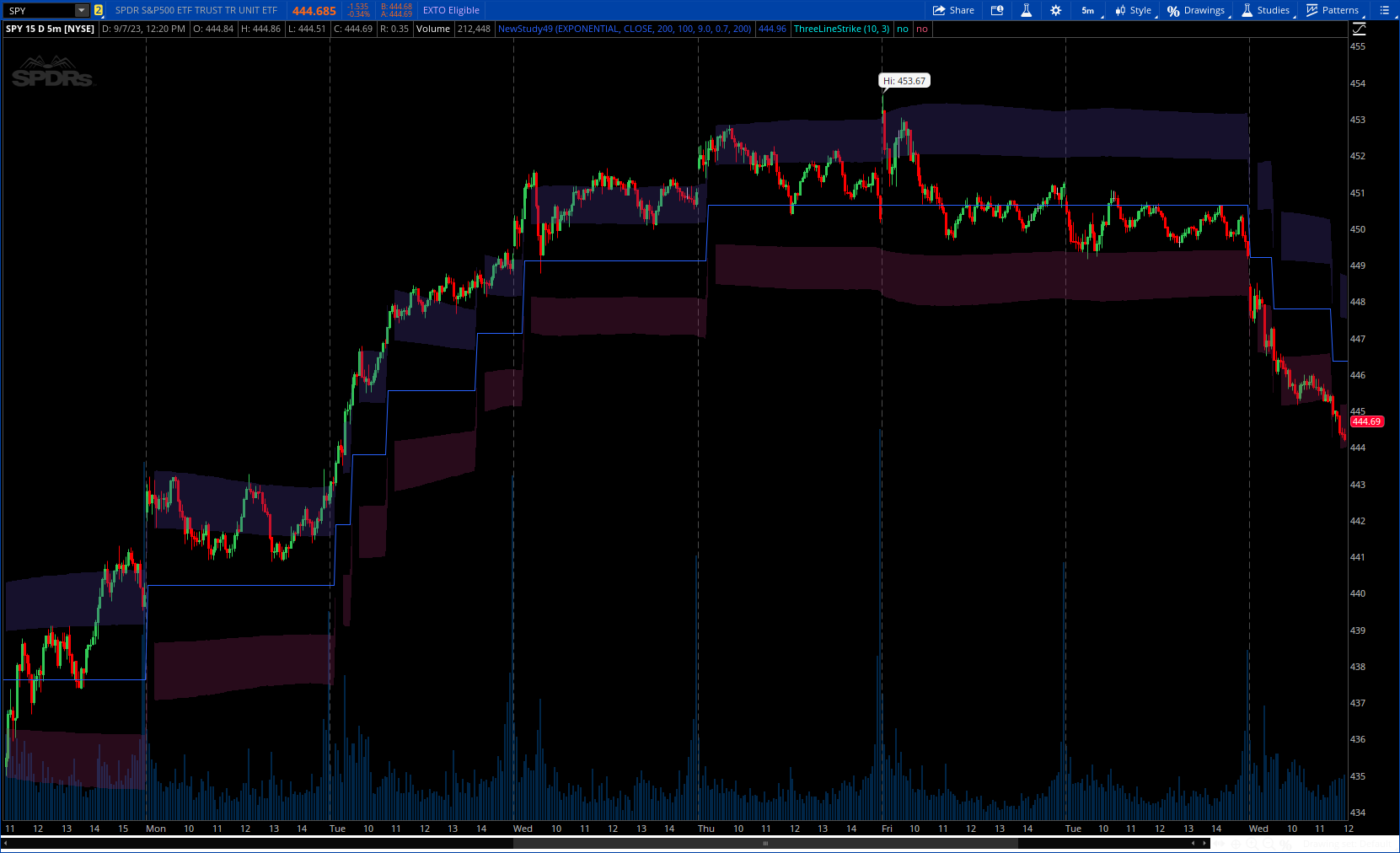

However, this has been a very volatile past 12 months.

Started with a deep bear market. Had an AWESOME January, April, and July, and now we are in the throes of the Aug-Sep correction. On my daily charts, I want to see where the instrument is now compared to the previous bullish periods, so I shorten up my long-term charts lookback to about April or so.

In summary, channel indicators are the opposite of trend indicators.

If considering changing the channel lookback, optimal is LONGER on Lower timeframes;

perhaps sometimes SHORTER on Higher timeframes.