sorry, i'm a little confused by your post.

i looked at QQQ on a chart and didn't see those price levels in the last 30 days.

calling a middle price value a pivot is an opinion and confusing.

not sure what you mean by , day high at 8:30?

don't know what you want to use input for?

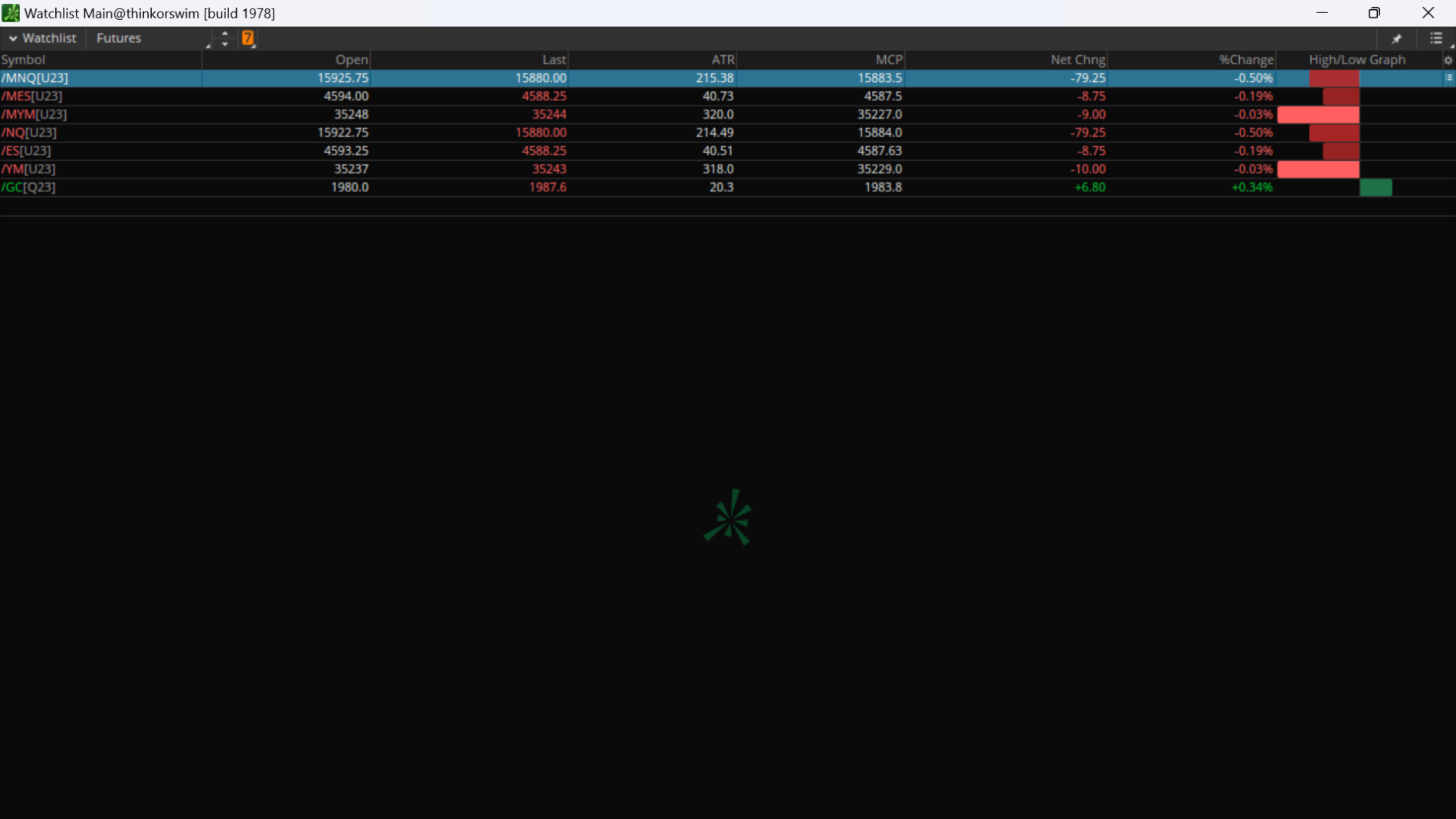

not sure what we are supposed to look at in that image? the right column of horizontal bars?

you can use input in a column study to set a value. there just isn't anywhere for the user to change a value, like on a chart. the code has to be changed.

just tell us where you want to see something, ( a column study ?)

and what you want to see. ??

My apology for the confusion.

I want to see the calculation on both my chart and column study.

Currently, I pull my numbers from the website "barchart."

For example, NVDA, from the "Price Overview" tab I would pull the "Day Low" and the "Day High" between 8:30 and 9:00 a.m. Add those two figures together and divide by two and come up with a price. I would plot that price on my TOS chart.

I'm trying to automate this in TOS.

I was able to calculate the figure. However the figure changes throughout the day. I want to lock the figure for the entire day. It would only change at 6:00 p.m. the start of the Asian session and run through the NY session. Then start all over again.

Please see attachment (I used /MNQ ).

The red vertical lines (left = p.m. EST; right vertical line = 9:00 a.m. EST).

I want to trap price between 6 p.m. (previous day) and 9:00 a.m. EST. What is/was the HOD and LOD. I want to lock in this price so it doesn't change throughout the day as the price moves.

Looking at the chart price reached it's "overall" HOD at 12:45 p.m. EST

And reached it's overall LOD at 3:50 p.m. EST. Not interested in those figures.

I drew horizonal lines on the chart for the high (15561, 1:50 a.m. candle) and low (15401.5, 8:35 candle) achieved prior to 9:00 a.m. EST. Add those 2 figures and divide by 2 you get 15481.25.

I would love to show the figure in the "column", plot it on the chart and display it as a label.

I hope this clears it up.

A big thank you for your help.