Author Message:

Core Aspects:

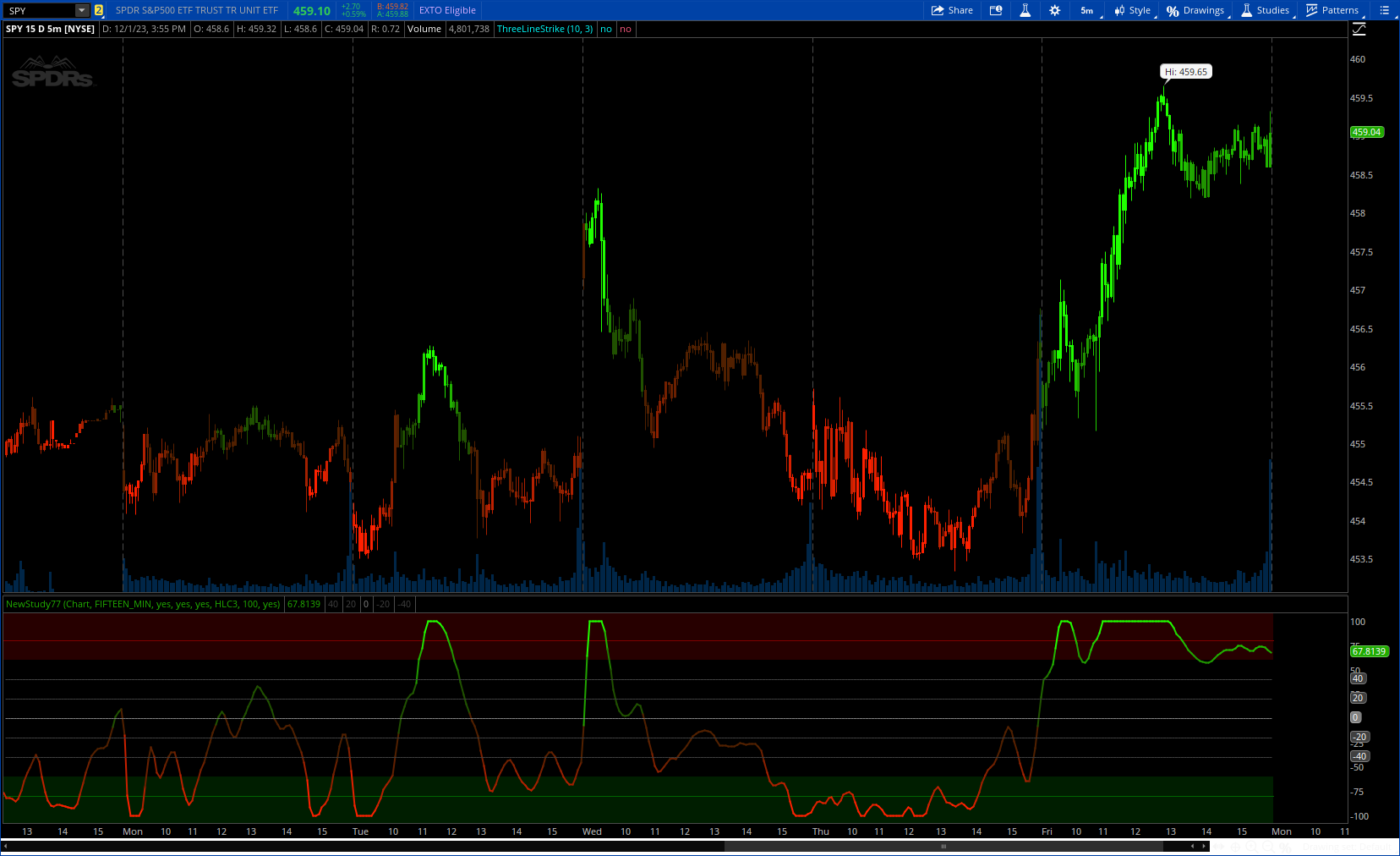

- The script calculates the VWAP by considering both volume and price data, offering a comprehensive view of market activity.

- Uses an adaptive normalization function to balance the data, ensuring that the VWAP reflects current market conditions accurately.

- The oscillator includes customizable settings such as VWAP source, lookback period, and buffer percentage.

- Provides a clear visual representation of market trends.

CSS:

#// https://www.tradingview.com/v/vKpmM4Sk/

#// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0

#// © godzcopilot

#// Thanks to LazyBear for WaveTrend Oscillator https://www.tradingview.com/script/2KE8wTuF-Indicator-

#indicator("VWAP Oscillator" (Normalised), shorttitle="VWAP-O",

# Converted and mod by Sam4Cok@Samer800 - 12/2023

Declare Lower;

#// Inputs

input timeframe = {Default "Chart", "Custom"};

input customTimeframe = AggregationPeriod.FIFTEEN_MIN;

input colorBars = yes;

input showGrid = yes; # "Show Grid Levels"

input showVWAP = yes; # "Show VWAP"

input vwapSrc = FundamentalType.HLC3; # 'VWAP Source'

input NormalisedPeriod = 100; # "VWAP Lookback Period"

input smoothedVwap = yes;

def na = Double.NaN;

def last = !isNaN(close);

#--- MTF

def tfS = Fundamental(FundamentalType = vwapSrc);

def tfV = Volume;

def tfC = close;

def mtfS = Fundamental(FundamentalType = vwapSrc, Period = customTimeframe);

def mtfV = Volume(Period = customTimeframe);

def mtfC = close(Period = customTimeframe);

def src; def v; def c;

Switch (timeframe) {

Case "Custom" :

src = mtfS;

v = mtfV;

c = mtfC;

Default :

src = tfS;

v = tfV;

c = tfC;

}

#// Function Definitions

#// VWAP Calculation Function

Script computeVWAP {

input src = hlc3;

input Vol = Volume;

def SrcVol = src * Vol;

def sumSrcVol = if isNaN(sumSrcVol[1]) then srcVol else

CompoundValue(1, srcVol + sumSrcVol[1], SrcVol);

def sumVol = if isNaN(sumVol[1]) then vol else

CompoundValue(1, vol + sumVol[1], Vol);

def _vwap = sumSrcVol / sumVol;

plot out = _vwap;

}

#// Adaptive Normalization Function without Buffer

Script adaptiveNormalize {

input data = hlc3;

input period = 100;

def minValue = lowest(data, period);

def maxValue = highest(data, period);

def normalized = (200 * (data - minValue) / (maxValue - minValue)) - 100;

plot out = normalized;

}

#// Function to Linearly Extend Extremes

Script linearExtendExtremes {

input normalizedData = hlc3;

input rawValue = close;

input rateOfChangePeriod = 5;

input extremeThreshold = 100;

def adjustedValue; def direction; def avgRateOfChange;def excess;#= normalizedData

if AbsValue(normalizedData) >= extremeThreshold {

direction = sign(normalizedData);

avgRateOfChange = AbsValue(Average(rawValue-rawValue[1], rateOfChangePeriod));

excess = AbsValue(normalizedData) - extremeThreshold;

adjustedValue = direction * (extremeThreshold + excess + avgRateOfChange);

} else {

direction = 0;#direction[1];

avgRateOfChange = 0;#avgRateOfChange[1];

excess = 0;#excess[1];

adjustedValue = normalizedData;

}

plot out = adjustedValue;

}

#/ Calculations

#// Define the threshold for extreme values and period for rate of change calculation

def extremeThreshold = 100;#

def rateOfChangePeriod = 5;# // Adjust this period based on your data characteristics

#// VWAP Calculations

def vwapValue = computeVWAP(src, v);

def difference = (c / vwapValue - 1) * 100;

def smooth = EhlersSuperSmootherFilter(difference, 10);

def diff = if smoothedVwap then smooth else difference;

#// Apply Normalization and Linear Extension to Extremes

def normalizedVWAP = adaptiveNormalize(diff, NormalisedPeriod);

def adjustedVWAP = linearExtendExtremes(normalizedVWAP, diff, rateOfChangePeriod, extremeThreshold);

#/ Plotting

def AbsVwap = AbsValue(adjustedVWAP);

def col = if AbsVwap > 90 then 100 else

if AbsVwap > 50 then AbsVwap else

if AbsVwap < 30 then 32 else AbsVwap;# else 0;

def rbg = col * 2.55;

#// Normalized VWAP Oscillator Plot

plot p_VWAP = if showVWAP then adjustedVWAP else na; # 'Normalized VWAP Oscillator'

p_VWAP.SetLineWeight(2);

p_VWAP.AssignValueColor(if adjustedVWAP > 0 then CreateColor(32, rbg, 0) else

if adjustedVWAP < 0 then CreateColor(rbg, 32, 0) else Color.GRAY);

#// Horizontal Lines

#// Upper and Lower Threshold Lines

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

#def uline100 = if last[1] and showGrid then 100 else na;

def uline80 = if last[1] then 80 else na;

def uline60 = if last[1] then 60 else na;

plot uline40 = if last and showGrid then 40 else na;

plot uline20 = if last and showGrid then 20 else na;

plot midline0 = if last and showGrid then 0 else na;

plot dline20 = if last and showGrid then -20 else na;

plot dline40 = if last and showGrid then -40 else na;

def dline60 = if last[1] then -60 else na;

def dline80 = if last[1] then -80 else na;

#def dline100 = if last[1] and showGrid then -100 else na;

AddCloud(pos, uline80, Color.DARK_RED, Color.DARK_RED, showGrid);

AddCloud(uline80, uline60, Color.DARK_RED);

AddCloud(dline60, dline80, Color.DARK_GREEN);

AddCloud(dline80, neg, Color.DARK_GREEN, Color.DARK_GREEN, showGrid);

uline40.SetDefaultColor(Color.DARK_GRAY);

uline20.SetDefaultColor(Color.DARK_GRAY);

midline0.SetDefaultColor(Color.GRAY);

dline20.SetDefaultColor(Color.DARK_GRAY);

dline40.SetDefaultColor(Color.DARK_GRAY);

uline40.SetPaintingStrategy(PaintingStrategy.DASHES);

uline20.SetPaintingStrategy(PaintingStrategy.DASHES);

midline0.SetPaintingStrategy(PaintingStrategy.DASHES);

dline20.SetPaintingStrategy(PaintingStrategy.DASHES);

dline40.SetPaintingStrategy(PaintingStrategy.DASHES);

#-- Bar Color

AssignPriceColor(if !colorBars then Color.CURRENT else

if adjustedVWAP > 0 then CreateColor(32, rbg, 0) else

if adjustedVWAP < 0 then CreateColor(rbg, 32, 0) else Color.GRAY);

#-- END of CODE