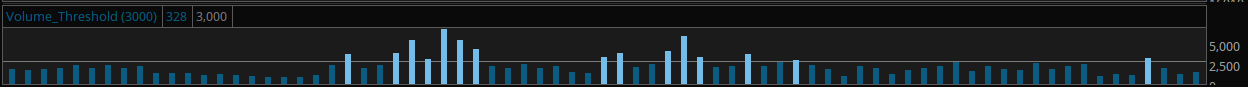

Input a volume threshold number of your choice and volume bars will paint in a different color + alert. From my observations markets tend to reverse (intraday) at or after a high volume spike / period this script allows me to quickly glance at the lower volume section of the chart and I identify just that. It's nothing fancy but I thought I would contribute and maybe somebody will find it useful in their trading.

Code:

#Custom Volume Threshold

declare lower;

declare zerobase;

input Threshold = 3000;

plot Vol = volume;

plot ThresholdLine = Threshold;

ThresholdLine.setPaintingStrategy(paintingStrategy.line);

ThresholdLine.setDefaultColor(color.gray);

ThresholdLine.SetLineWeight(1);

Vol.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

Vol.SetLineWeight(1);

Vol.DefineColor("Threshold", CreateColor(116,189,232));

Vol.DefineColor("Normal", CreateColor(10,93,128));

Vol.AssignValueColor(if vol > ThresholdLine then Vol.Color("Threshold") else if vol < ThresholdLine then Vol.Color("Normal") else GetColor(1));

Alert(vol > ThresholdLine, "HighVolume" , Alert.Bar, Sound.Bell);