Sorry for my late reply. Its a busy and extraordinary time at the moment.

Let me come back with a feedback from my side.

Using a 1m timeframe is far too fast for me personally and using only a EMA20 crossover to buy and sell is far too inconsistant for me.

But the idea to develop clear setup, that is easy to use, is great.

So I tried some things out and came over the "floating levels" from the member "Mladen

https://usethinkscript.com/threads/averages-with-floating-levels-for-thinkorswim.3526/

Its a great tool and I think its worth to dig deeper into it, although I use it in a slightly different way.

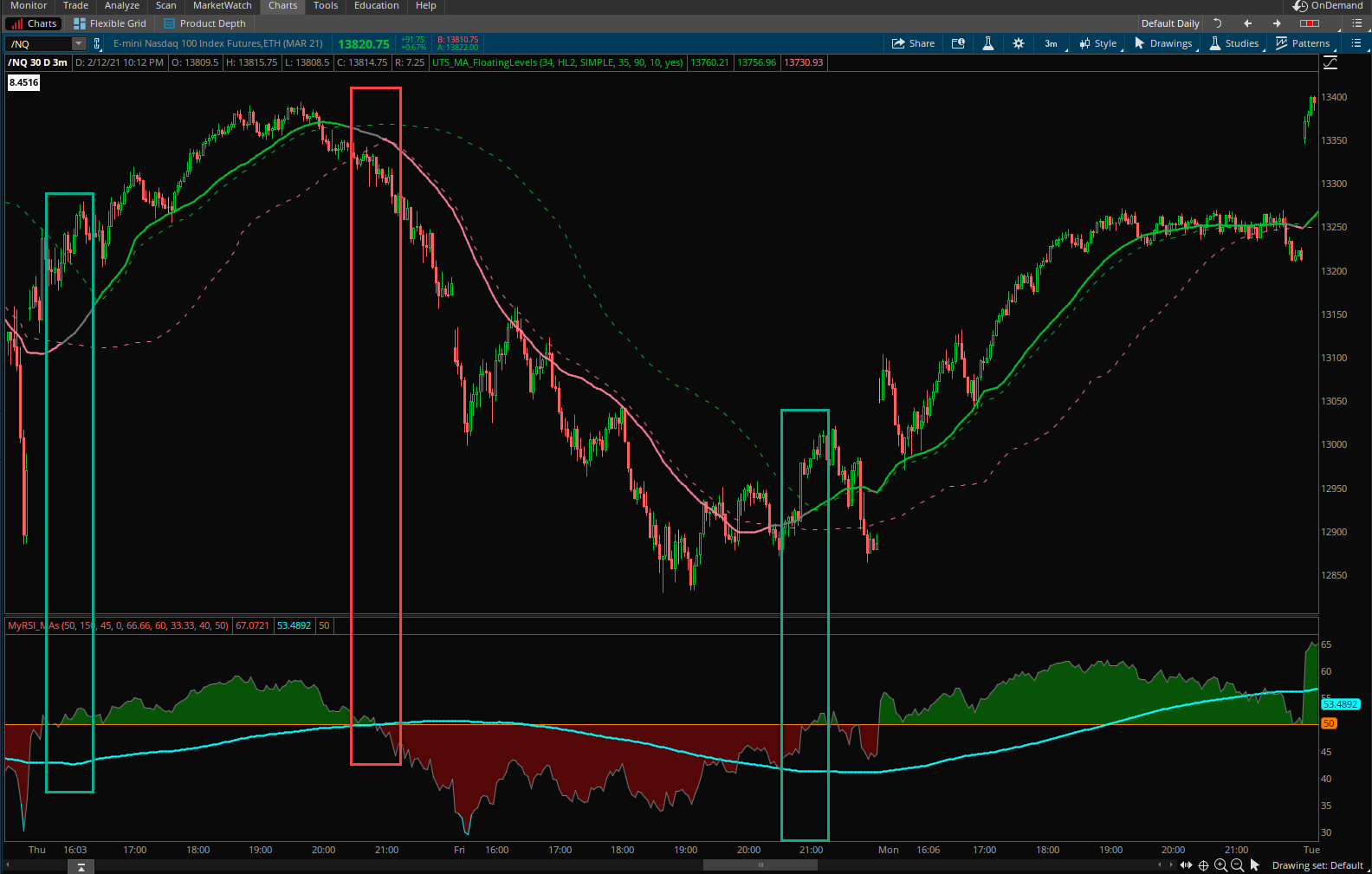

My settings:

NQ 3m chart (1m is too fast)

Floating Levels indicator, lenght 34, HL2

RSI50 with EMA200 (based on the RSI, not price)

Go Long:

Price crosses above the upper green line AND RSI is above its EMA

Go Short:

Price crosses below the lower red loine AND RSI is below its EMA

Contract size:

Enter with 2 Lots (thats crucial)

Exit 1 Lot with 10 points profit (and move SL for the 2. Lot to breakeven)

Most of the time 10 points are hit even in choppy markets.

Let the 2. Lot move in your direction with a 20 points trailing stop

Stoploss:

hard stop at the opposite line

Maybe the commuinity can improve the SL and profit levels

I attached 2 charts.

The first is a choppy chart.

Red rectangles are the short trades

Green rectangles are the long trades.

White rectangle: look how the RSI _MA protects from long trades.

The second is a trending chart.

1. chart:

2. chart:

There are also nice trending times.

Would be great to get a feedback.

Thanks.

Let me come back with a feedback from my side.

Using a 1m timeframe is far too fast for me personally and using only a EMA20 crossover to buy and sell is far too inconsistant for me.

But the idea to develop clear setup, that is easy to use, is great.

So I tried some things out and came over the "floating levels" from the member "Mladen

https://usethinkscript.com/threads/averages-with-floating-levels-for-thinkorswim.3526/

Its a great tool and I think its worth to dig deeper into it, although I use it in a slightly different way.

My settings:

NQ 3m chart (1m is too fast)

Floating Levels indicator, lenght 34, HL2

RSI50 with EMA200 (based on the RSI, not price)

Go Long:

Price crosses above the upper green line AND RSI is above its EMA

Go Short:

Price crosses below the lower red loine AND RSI is below its EMA

Contract size:

Enter with 2 Lots (thats crucial)

Exit 1 Lot with 10 points profit (and move SL for the 2. Lot to breakeven)

Most of the time 10 points are hit even in choppy markets.

Let the 2. Lot move in your direction with a 20 points trailing stop

Stoploss:

hard stop at the opposite line

Maybe the commuinity can improve the SL and profit levels

I attached 2 charts.

The first is a choppy chart.

Red rectangles are the short trades

Green rectangles are the long trades.

White rectangle: look how the RSI _MA protects from long trades.

The second is a trending chart.

1. chart:

2. chart:

There are also nice trending times.

Would be great to get a feedback.

Thanks.