You should upgrade or use an alternative browser.

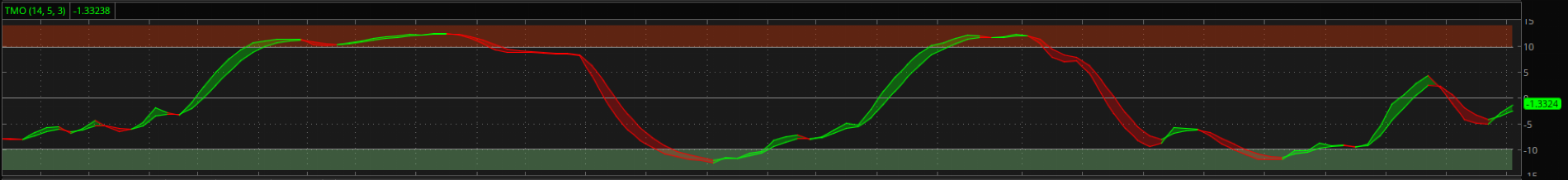

Archived: TMO True Momentum Oscillator

- Thread starter tenacity11

- Start date

-

- Tags

- oscillator

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Is there a way to setup a watchlist column to sort by the distance between the TMO Main line and TMO Signal line?

I have a watchlist that is my TMO scan results for Green TMO (Main line above Signal line) in the under -10 zone and I want to be able to sort that list by thickest to thinnest .

TMO

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/

Is there a way to make a watchlist column to show the distance between the Main and Signal Lines? So you can sort by closest to farthest apart?

@bobknob Test this and verify the results -

# Watchlist column using TMO ((T)rue (M)omentum (O)scilator) by Mobius, V01.05.2018

# column displays the difference between the main and signal lines when the main line is

# above the signal line and both are below the oversold line.

input length = 14;

input calcLength = 5;

input smoothLength = 3;

def o = open;

def c = close;

def data = fold i = 0 to length with s do s + (if c > getValue(o, i)

then 1 else if c < getValue(o, i) then - 1 else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

def os = -round(length * .7);

def total = Main > Signal and Signal < os;

plot between = if total then Main - Signal else 0;

between.assignvaluecolor(if total then color.green else color.black);You can add something like

AddLabel(1,round(Main - Signal,2),color.white) to your chart's lower True Momentum Oscillator code to have a label show the difference between the two lines.@bobknob Test this and verify the results -

Code:# Watchlist column using TMO ((T)rue (M)omentum (O)scilator) by Mobius, V01.05.2018 # column displays the difference between the main and signal lines when the main line is # above the signal line and both are below the oversold line. input length = 14; input calcLength = 5; input smoothLength = 3; def o = open; def c = close; def data = fold i = 0 to length with s do s + (if c > getValue(o, i) then 1 else if c < getValue(o, i) then - 1 else 0); def EMA5 = ExpAverage(data, calcLength); def Main = ExpAverage(EMA5, smoothLength); def Signal = ExpAverage(Main, smoothLength); def os = -round(length * .7); def total = Main > Signal and Signal < os; plot between = if total then Main - Signal else 0; between.assignvaluecolor(if total then color.green else color.black);

You can add something likeAddLabel(1,round(Main - Signal,2),color.white)to your chart's lower True Momentum Oscillator code to have a label show the difference between the two lines.

Okay I got this to work and to do what I wanted using the code blow (I'm sure there's a cleaner version of the "plot between" section but it works and gives me a positive value for green trends and a negative for red).

I also tried adding that bit of label code to the end of my TMO code but it crashed it out "invalid statement AddLabel"

# Watchlist column using TMO ((T)rue (M)omentum (O)scilator) by Mobius, V01.05.2018

# column displays the difference between the main and signal lines and cloud color.

input length = 14;

input calcLength = 5;

input smoothLength = 3;

def o = open;

def c = close;

def data = fold i = 0 to length with s do s + (if c > getValue(o, i)

then 1 else if c < getValue(o, i) then - 1 else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

def os = -round(length * .7);

def total = Main > Signal;

plot between = if total then Main - Signal else Main - Signal;

between.assignvaluecolor(if total then color.green else color.yellow);

AssignBackgroundColor(if Main > Signal then color.dark_GREEN else color.dark_RED);@bobknob Good job with the modifying the code! As you said, it can be "cleaned up", but it does'nt need much at all. Since you are'nt using the oversold level that line of code can be removed, and the plot can be made a bit more concise. As for the AddLabel error, all it needs is a semicolon at the end. Its free code, so . . . .Okay I got this to work and to do what I wanted using the code blow (I'm sure there's a cleaner version of the "plot between" section but it works and gives me a positive value for green trends and a negative for red).

I also tried adding that bit of label code to the end of my TMO code but it crashed it out "invalid statement AddLabel"

Code:# Watchlist column using TMO ((T)rue (M)omentum (O)scilator) by Mobius, V01.05.2018 # column displays the difference between the main and signal lines and cloud color. input length = 14; input calcLength = 5; input smoothLength = 3; def o = open; def c = close; def data = fold i = 0 to length with s do s + (if c > getValue(o, i) then 1 else if c < getValue(o, i) then - 1 else 0); def EMA5 = ExpAverage(data, calcLength); def Main = ExpAverage(EMA5, smoothLength); def Signal = ExpAverage(Main, smoothLength); def os = -round(length * .7); def total = Main > Signal; plot between = if total then Main - Signal else Main - Signal; between.assignvaluecolor(if total then color.green else color.yellow); AssignBackgroundColor(if Main > Signal then color.dark_GREEN else color.dark_RED);

# Watchlist column using TMO ((T)rue (M)omentum (O)scilator) by Mobius, V01.05.2018

# column displays the difference between the main and signal lines and cloud color.

input length = 14;

input calcLength = 5;

input smoothLength = 3;

def o = open;

def c = close;

def data = fold i = 0 to length with s do s + (if c > getValue(o, i)

then 1 else if c < getValue(o, i) then - 1 else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

def total = Main > Signal;

plot between = Main - Signal;

between.assignvaluecolor(if total then color.green else color.yellow);

AssignBackgroundColor(if total then color.dark_GREEN else color.dark_RED);Here's a new fancier Label to add to the TMO code. This one should work right out of the box.

AddLabel(1,"Difference = " + round(Main - Signal,2), if Main > Signal then color.dark_green else color.dark_red);avaughan323

New member

Has anyone converted the TMO oscillator into a scan? Here's the code I'm currently working with:

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/post-12675

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/post-12860

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/post-15052

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/post-19090

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/post-21691

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/post-43545

And this is only in the first 16 pages of the TMO thread. There's 8 or so more pages for you to search through yet.

jake438899

New member

@MerryDay How do I edit this scanner scan so that it can only scan for momentum that is above 0?@unkownriver

TMO ((T)rue (M)omentum (O)scilator) Scan Scanner

Mobius, with modifications by tomsk, 1.1.2020

Ruby:# TMO ((T)rue (M)omentum (O)scilator) Scan # Mobius, with modifications by tomsk, 1.1.2020 # V01.05.2018 #hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price. input length = 14; input calcLength = 5; input smoothLength = 3; input level = -15; ##Bullish Scan #input level = 10; ##Bearish Scan def o = open; def c = close; def data = fold i = 0 to length with s do s + (if c > getValue(o, i) then 1 else if c < getValue(o, i) then - 1 else 0); def EMA5 = ExpAverage(data, calcLength); plot Main = ExpAverage(EMA5, smoothLength); def Signal = ExpAverage(Main, smoothLength); addchartBubble(close,close,main); plot sell = main crosses below 10 ; #hint: Comment out using # below to scan for Bullish or Bearish. Please note that ## applies to conditional scan with parameters -10 (over sold condition) Bullish Scan) and 10 (over bought condition) Bearish Scan) Default is set to a Bullish TMO Scan without any conditions. ##***Bullish Scan*** plot scan = main crosses above level; #plot scan = main < level and signal < level and main > signal; #plot scan = main < main[1] and signal < signal[1]; ##***Bearish Scan*** ##plot scan = main > level and signal > level and main < signal; #plot scan = main > main[1] and signal > signal[1];

This scan returns a lot of results. Could you share how you will use this information?

jake438899

New member

Sure, I just used it as a confirmation of strength that it going fire in the direction that I want it.

https://prnt.sc/17l76la (Not really sure How to add Image since it a https)

But basically, I'm more a swing trader and my trading is influence a lot by John carter. Never toke his any of his class before just because I can't afford it.

I like to buy a Daily Squeeze (Red Dot) with the Weekly that is in a Squeeze. Once the Daily Fired, Combined with the Weekly, 70% of the time it an explosive move to the upside.. Sometime I would use a lower time frame to get into position early (Trying to find another Squeeze). Then, I have a Triple Squeeze Setup. Also, I like to have the VIX up, If it slowly going up then I avoid getting into long position.

Usually, I have a scan for these setup.

Hi, Merry, I came across a code where you added some labels... I made some slight changes to the labels, but wanted to know about how I could having TOS scan for such things as "Cover Shorts", "Trend Begins," and "Bearish" etc. Is there a way that you could help me so that the following labels can be scanned for in TOS? Here is the code:

input showlabels = yes ;

input paintcandles = no ;

input length = 14;

input calcLength = 5;

input smoothLength = 3;

input ob = 10;

input os = -10;

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

DefineGlobalColor("CoverShorts", CreateColor(50, 200, 255)) ;

DefineGlobalColor("TrendBEGIN", CreateColor(0, 0, 255)) ;

DefineGlobalColor("Rising", CreateColor(0, 165, 0)) ;

DefineGlobalColor("Overowned", CreateColor(255, 139 ,61)) ;

DefineGlobalColor("TrendEnd", CreateColor(255, 204, 0)) ;

DefineGlobalColor("Falling", CreateColor(225, 0, 0)) ;

DefineGlobalColor("Neutral", CreateColor(204, 204, 204)) ;

AddLabel(showlabels,

if main < os then "CoverShorts " +round(main,0) else

if main > ob then "Overowned " +round(main,0) else

if main crosses above os then "TREND BEGIN!" else

if main crosses below ob then "TREND END!" else

if main < signal then "BEARISH " +round(main,0) else

if main >= main[1] then "RISING " +round(main,0) else

if main < main[1] then "FALLING " +round(main,0) else

"NEUTRAL " +round(main,0),

if main < os then GlobalColor("CoverShorts") else

if main > ob then GlobalColor("Overowned") else

if main crosses above os then GlobalColor("TrendBEGIN") else

if main crosses below ob then GlobalColor("TrendEND") else

if main < signal then GlobalColor("falling") else

if main > main[1] then GlobalColor("rising") else GlobalColor("neutral")) ;

AssignPriceColor(

if !paintcandles then color.CURRENT else

if main < os then GlobalColor("CoverShorts") else

if main > ob then GlobalColor("OVEROWNED") else

if main crosses above os then GlobalColor("TrendBEGIN") else

if main crosses below ob then GlobalColor("TrendEND") else

if main < signal then GlobalColor("falling") else

if main > main[1] then GlobalColor("rising") else GlobalColor("neutral")) ;

# End Code TMOI created a TMO Scan Based On Label Conditions. Click on the below link:

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/page-24#post-68108

Save the below script as a study. In the TOS scan the parameters are as follows:

#

# TMO ((T)rue (M)omentum (O)scilator) Scan

# Mobius, with modifications by tomsk, 1.1.2020

# V01.05.2018

#hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

input length = 14;

input calcLength = 5;

input smoothLength = 3;

input ob = 10;

input os = -10;

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

#ScanTrigger

# for CoverShorts = ScanTrigger = 1

# for Overowned = ScanTrigger = 2

# for TREND BEGIN!= ScanTrigger = 3

# for TREND END! = ScanTrigger = 4

# for BEARISH = ScanTrigger = 5

# for RISING = ScanTrigger = 6

# for FALLING = ScanTrigger = 7

# for NEUTRAL = ScanTrigger = 0

Plot scanTrigger =

if main < os then 1 else

if main > ob then 2 else

if main crosses above os then 3 else

if main crosses below ob then 4 else

if main < signal then 5 else

if main >= main[1] then 6 else

if main < main[1] then 7 else 0 ;

# End Code TMOI added this script to a watchlist. Can anyone color the backgrounds based on the script? I tried myself but was unsuccessful. TIAHi, Merry, I came across a code where you added some labels... I made some slight changes to the labels, but wanted to know about how I could having TOS scan for such things as "Cover Shorts", "Trend Begins," and "Bearish" etc. Is there a way that you could help me so that the following labels can be scanned for in TOS? Here is the code:

input showlabels = yes ;

input paintcandles = no ;

input length = 14;

input calcLength = 5;

input smoothLength = 3;

input ob = 10;

input os = -10;

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

DefineGlobalColor("CoverShorts", CreateColor(50, 200, 255)) ;

DefineGlobalColor("TrendBEGIN", CreateColor(0, 0, 255)) ;

DefineGlobalColor("Rising", CreateColor(0, 165, 0)) ;

DefineGlobalColor("Overowned", CreateColor(255, 139 ,61)) ;

DefineGlobalColor("TrendEnd", CreateColor(255, 204, 0)) ;

DefineGlobalColor("Falling", CreateColor(225, 0, 0)) ;

DefineGlobalColor("Neutral", CreateColor(204, 204, 204)) ;

AddLabel(showlabels,

if main < os then "CoverShorts " +round(main,0) else

if main > ob then "Overowned " +round(main,0) else

if main crosses above os then "TREND BEGIN!" else

if main crosses below ob then "TREND END!" else

if main < signal then "BEARISH " +round(main,0) else

if main >= main[1] then "RISING " +round(main,0) else

if main < main[1] then "FALLING " +round(main,0) else

"NEUTRAL " +round(main,0),

if main < os then GlobalColor("CoverShorts") else

if main > ob then GlobalColor("Overowned") else

if main crosses above os then GlobalColor("TrendBEGIN") else

if main crosses below ob then GlobalColor("TrendEND") else

if main < signal then GlobalColor("falling") else

if main > main[1] then GlobalColor("rising") else GlobalColor("neutral")) ;

AssignPriceColor(

if !paintcandles then color.CURRENT else

if main < os then GlobalColor("CoverShorts") else

if main > ob then GlobalColor("OVEROWNED") else

if main crosses above os then GlobalColor("TrendBEGIN") else

if main crosses below ob then GlobalColor("TrendEND") else

if main < signal then GlobalColor("falling") else

if main > main[1] then GlobalColor("rising") else GlobalColor("neutral")) ;

# End Code TMO

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/page-15#post-41224

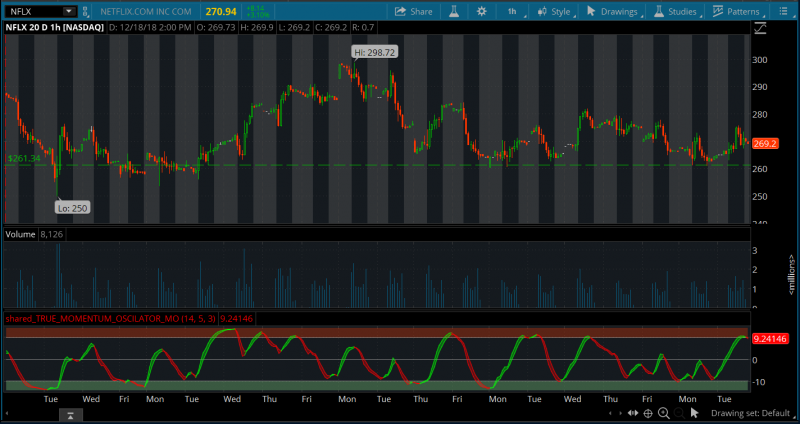

The following thinkScript of the true momentum oscillator was created by Mobius.

thinkScript Code

Rich (BB code):# TMO ((T)rue (M)omentum (O)scilator) # Mobius # V01.05.2018 # hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price. declare Lower; input length = 14; input calcLength = 5; input smoothLength = 3; def o = open; def c = close; def data = fold i = 0 to length with s do s + (if c > getValue(o, i) then 1 else if c < getValue(o, i) then - 1 else 0); def EMA5 = ExpAverage(data, calcLength); plot Main = ExpAverage(EMA5, smoothLength); plot Signal = ExpAverage(Main, smoothLength); Main.AssignValueColor(if Main > Signal then color.green else color.red); Signal.AssignValueColor(if Main > Signal then color.green else color.red); Signal.HideBubble(); Signal.HideTitle(); addCloud(Main, Signal, color.green, color.red); plot zero = if isNaN(c) then double.nan else 0; zero.SetDefaultColor(Color.gray); zero.hideBubble(); zero.hideTitle(); plot ob = if isNaN(c) then double.nan else round(length * .7); ob.SetDefaultColor(Color.gray); ob.HideBubble(); ob.HideTitle(); plot os = if isNaN(c) then double.nan else -round(length * .7); os.SetDefaultColor(Color.gray); os.HideBubble(); os.HideTitle(); addCloud(ob, length, color.light_red, color.light_red, no); addCloud(-length, os, color.light_green, color.light_green); # End Code TMO

Shareable Link

https://tos.mx/yXqNwi

Nice indicator. It would be fun to have a chart where the candlestick colors mimic the color of this True Momentum Oscillator. What would the code be for that?The following thinkScript of the true momentum oscillator was created by Mobius.

thinkScript Code

Rich (BB code):# TMO ((T)rue (M)omentum (O)scilator) # Mobius # V01.05.2018 # hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price. declare Lower; input length = 14; input calcLength = 5; input smoothLength = 3; def o = open; def c = close; def data = fold i = 0 to length with s do s + (if c > getValue(o, i) then 1 else if c < getValue(o, i) then - 1 else 0); def EMA5 = ExpAverage(data, calcLength); plot Main = ExpAverage(EMA5, smoothLength); plot Signal = ExpAverage(Main, smoothLength); Main.AssignValueColor(if Main > Signal then color.green else color.red); Signal.AssignValueColor(if Main > Signal then color.green else color.red); Signal.HideBubble(); Signal.HideTitle(); addCloud(Main, Signal, color.green, color.red); plot zero = if isNaN(c) then double.nan else 0; zero.SetDefaultColor(Color.gray); zero.hideBubble(); zero.hideTitle(); plot ob = if isNaN(c) then double.nan else round(length * .7); ob.SetDefaultColor(Color.gray); ob.HideBubble(); ob.HideTitle(); plot os = if isNaN(c) then double.nan else -round(length * .7); os.SetDefaultColor(Color.gray); os.HideBubble(); os.HideTitle(); addCloud(ob, length, color.light_red, color.light_red, no); addCloud(-length, os, color.light_green, color.light_green); # End Code TMO

Shareable Link

https://tos.mx/yXqNwi

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/page-18#post-45217

# TMO ((T)rue (M)omentum (O)scilator)

# Mobius

# V01.05.2018

# hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

declare Lower;

input length = 14;

input calcLength = 5;

input smoothLength = 3;

input AlertDisplace = 0;

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

plot Main = ExpAverage(EMA5, smoothLength);

plot Signal = ExpAverage(Main, smoothLength);

Main.AssignValueColor(if Main > Signal

then color.green

else color.light_red);

Signal.AssignValueColor(if Main > Signal

then color.green

else color.light_red);

Signal.HideBubble();

Signal.HideTitle();

addCloud(Main, Signal, color.green, color.light_red);

plot zero = if isNaN(c) then double.nan else 0;

zero.SetDefaultColor(Color.gray);

zero.hideBubble();

zero.hideTitle();

plot ob = if isNaN(c) then double.nan else round(length * .7);

ob.SetDefaultColor(Color.gray);

ob.HideBubble();

ob.HideTitle();

plot os = if isNaN(c) then double.nan else -round(length * .7);

os.SetDefaultColor(Color.gray);

os.HideBubble();

os.HideTitle();

addCloud(ob, length, color.light_red, color.light_red, no);

addCloud(-length, os, color.light_green, color.light_green);

def BUYsignal =Main < OS and Main crosses above Signal and Main < os;

def SELLsignal = Main > OB and Main crosses below Signal and Main > ob;

# Alerts

Alert(SellSignal[AlertDisplace], " ", Alert.Bar, Sound.ring);Copy the code below and paste it directly into the scanner. Hope this helps!

# TMO ((T)rue (M)omentum (O)scilator) ************** scanner only ****************

# Mobius

# V01.05.2018

# hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

input length = 14;

input calcLength = 5;

input smoothLength = 3;

input AlertDisplace = 0;

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

def zero = if isNaN(c) then double.nan else 0;

def ob = if isNaN(c) then double.nan else round(length * .7);

def os = if isNaN(c) then double.nan else -round(length * .7);

plot BUYsignal =Main < OS and Main crosses above Signal and Main < os;

#plot SELLsignal = Main > OB and Main crosses below Signal and Main > ob;- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Archived: RSI Divergence Indicator | Indicators | 131 | |

|

|

Archived: Opening Range Breakout | Indicators | 340 | |

|

|

Archived: Supertrend Indicator by Mobius for ThinkorSwim | Indicators | 312 | |

|

|

Repaints TMO with Higher Agg_Mobius @ TSL | Indicators | 207 | |

|

|

TMO True Momentum Oscillator For ThinkOrSwim | Indicators | 143 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

Similar threads

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/