lowest level would be perfectly timing the price movement at the lowest level, since that's not possible the best you can do is specify when the indicator has reached below XYZ number.@unkownriver Define "when the momentum is at lowest level"

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Archived: TMO True Momentum Oscillator

- Thread starter tenacity11

- Start date

-

- Tags

- oscillator

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

unknownriver

New member

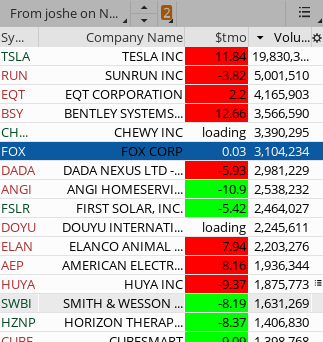

Hello MerryDay, What is $tmo in presented screen, can you pls point me to post which allows to get these numbers if they are TMO lower study numbers from post #1

all you had to do was search this thread or use the forum's search featureHello MerryDay, What is $tmo in presented screen, can you pls point me to post which allows to get these numbers if they are TMO lower study numbers from post #1

https://usethinkscript.com/threads/true-momentum-oscillator-for-thinkorswim.15/post-17336

T

Thomas

Guest

@MerryDay ,....you are terrific,...love the colors in the columns,......there happened to be a couple minor errors, here's my corrected code.

Code:

# TMO ((T)rue (M)omentum (O)scilator) Scan

# Mobius, with modifications by tomsk, 1.1.2020

# V01.05.2018

#hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, trend reversals and divergence than momentum oscillators using price.

input length = 14;

input calcLength = 5;

input smoothLength = 5;#3

input level = -5; ##Bullish Scan

#input level = 10; ##Bearish Scan

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

addchartBubble(close,close,main);

#plot sell = main crosses below 10 ;

#hint: Comment out using # below to scan for Bullish or Bearish. Please note that ## applies to conditional scan with parameters -10 (over sold condition) Bullish Scan) and 10 (over bought condition) Bearish Scan) Default is set to a Bullish TMO Scan without any conditions.

##[B][I]Bullish Scan[/I][/B]

#plot scan = main crosses above level;

plot scan = main < level and signal < level and main > signal;

#plot scan = main < main[1] and signal < signal[1];

##[B][I]Bearish Scan[/I][/B]

#plot scan = main > level and signal > level and main < signal;

#plot scan = main > main[1] and signal > signal[1];

Last edited by a moderator:

T

Thomas

Guest

Merry, this TMO is the first indicator I found, ever, that worked, meaning, tradeable information. How did you come about the input levels, I saw on another BTD/TMO level smaller input numbers, based on a daily chart,.... has someone posted optimal levels to adjust results. If TMO truly reacts from Delta/Options, then I will discard everything for only this to help assist in trading decisions, because this works.

SugarTrader

Member

Hello, I have been testing, using and trading with TMO. It is among one of my top indicators (I don't have many though).

As I am charting a lot with Tradingview, it's convenient to keep an eye on TMO directly on the same platform, I wonder if someone would be nice to convert TMO into Tradingview script.

Thank you

EDIT: I think I found what I need here. Sharing for other users.

https://www.tradingview.com/script/o9BQyaA4-True-Momentum-Oscillator/

As I am charting a lot with Tradingview, it's convenient to keep an eye on TMO directly on the same platform, I wonder if someone would be nice to convert TMO into Tradingview script.

Thank you

EDIT: I think I found what I need here. Sharing for other users.

https://www.tradingview.com/script/o9BQyaA4-True-Momentum-Oscillator/

Last edited:

@SugarTrader When you searched Tradingview for the TMO indicator, did you find that this one did not meet your needs?

https://www.tradingview.com/script/o9BQyaA4-True-Momentum-Oscillator/

https://www.tradingview.com/script/o9BQyaA4-True-Momentum-Oscillator/

@Iceburgh Sure thing. Here you go:

Code:

# TMO ((T)rue (M)omentum (O)scilator)

# Mobius

# V01.05.2018

# hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

# Modified by BenTen 03/24/2021: added arrows to upper chart

input length = 14;

input calcLength = 5;

input smoothLength = 3;

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

plot up = if Main crosses above Signal then low else double.nan;

plot down = if Main crosses below Signal then high else double.nan;

up.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

down.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);Added breakout signals

Code:

# TMO ((T)rue (M)omentum (O)scilator)

# Mobius

# V01.05.2018

# hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

declare Lower;

input length = 14;

input calcLength = 5;

input smoothLength = 3;

#input symbol = "SPX";

def o = open;#(symbol);

def c = close;#(symbol);

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

plot Main = ExpAverage(EMA5, smoothLength);

plot Signal = ExpAverage(Main, smoothLength);

Main.AssignValueColor(if Main > Signal

then color.green

else color.red);

Signal.AssignValueColor(if Main > Signal

then color.green

else color.red);

Signal.HideBubble();

Signal.HideTitle();

addCloud(Main, Signal, color.green, color.red);

plot zero = if isNaN(c) then double.nan else 0;

zero.SetDefaultColor(Color.gray);

zero.hideBubble();

zero.hideTitle();

plot ob = if isNaN(c) then double.nan else round(length * .7);

ob.SetDefaultColor(Color.gray);

ob.HideBubble();

ob.HideTitle();

plot os = if isNaN(c) then double.nan else -round(length * .7);

os.SetDefaultColor(Color.gray);

os.HideBubble();

os.HideTitle();

addCloud(ob, length, color.light_red, color.light_red, no);

addCloud(-length, os, color.light_green, color.light_green);

input showBreakoutSignals = no;

plot longsignal = if main crosses above signal then main else Double.NaN;

plot shortSignal = if main crosses below signal then signal else Double.NaN;

longSignal.SetHiding(!showBreakoutSignals);

shortSignal.SetHiding(!showBreakoutSignals);

longsignal.SetDefaultColor(Color.UPTICK);

longsignal.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

shortSignal.SetDefaultColor(Color.DOWNTICK);

shortSignal.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

# End Code TMO@Sagar Theoretically, the labels should work. Did you try to add them to the MTF TMO Indicator?

If not, give it a go. If you run into syntax errors, I will be glad to help you troubleshoot them.

I, myself, have no interest in putting the effort into such a project because I don't believe the information in the labels would necessarily be accurate. MTF indicators on a chart are great when used overall to analyze historical purposes, however, they are problematic when reading the current candle as explained in this link.

If not, give it a go. If you run into syntax errors, I will be glad to help you troubleshoot them.

I, myself, have no interest in putting the effort into such a project because I don't believe the information in the labels would necessarily be accurate. MTF indicators on a chart are great when used overall to analyze historical purposes, however, they are problematic when reading the current candle as explained in this link.

Last edited:

Hi @MerryDay I have a quick question. When I add the WL column do I select 5 min or a day? Thanks in advance@JE $$

You could make a watchlist

Shared Link: http://tos.mx/6HaRN1aRuby:# ######################################################## # TMO ((T)rue (M)omentum (O)scilator) WatchList Column Only # Mobius, with modifications by tomsk, 1.1.2020 #with WatchList added by @MerryDay 12/2020 #hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price. input showlabels = yes ; input length = 14; input calcLength = 5; input smoothLength = 3; input tmo_ob = 10; input tmo_os = -10; def data = fold i = 0 to length with s do s + (if close > getValue(open, i) then 1 else if close < getValue(open, i) then - 1 else 0); def EMA5 = ExpAverage(data, calcLength); def Main = ExpAverage(EMA5, smoothLength); def Signal = ExpAverage(Main, smoothLength); # ######################################################## #charting and formatting plot TMO = round(main,0); #DefineGlobalColor("pretrend", CreateColor(50, 200, 255)) ; #DefineGlobalColor("TrendBEGIN", CreateColor(0, 0, 255)) ; #DefineGlobalColor("rising", CreateColor(0, 165, 0)) ; #DefineGlobalColor("maxxed", CreateColor(255, 139 ,61)) ; #DefineGlobalColor("TrendEnd", CreateColor(255, 204, 0)) ; #DefineGlobalColor("falling", CreateColor(225, 0, 0)) ; #DefineGlobalColor("neutral", CreateColor(204, 204, 204)) ; AssignBackgroundColor( if main < tmo_os then CreateColor(50, 200, 255) else if main > tmo_ob then CreateColor(255, 139 ,61) else if main crosses above tmo_os then CreateColor(0, 0, 255) else if main crosses below tmo_ob then CreateColor(255, 204, 0) else if main < signal then CreateColor(225, 0, 0) else if main > main[1] then CreateColor(0, 165, 0) else CreateColor(204, 204, 204)) ;

s1111 If you are using the TMO indicator to trigger or confirm signal then set the timeframe as the same as the chart you are trading on.

If you are using it to confirm trend, then set it to 3 or 4 times higher aggregation than the chart you trade on.

The TMO is compatible with all timeframes. Feel free to set up more than one column testing different time frames and see what works best for you. HTH

If you are using it to confirm trend, then set it to 3 or 4 times higher aggregation than the chart you trade on.

The TMO is compatible with all timeframes. Feel free to set up more than one column testing different time frames and see what works best for you. HTH

rlohmeyer

Active member

Needed TMO normalized code to run with RSI scale to run scan with if needed. Normalizing code can be very useful for scans and utilizing the same lower study to pile on a few indicators.

Image below, code below image.

Image below, code below image.

Code:

# TMO ((T)rue (M)omentum (O)scilator)

# Mobius

# V01.05.2018

# hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

#4/13/21 @rlohmeyer modified raw code and normalized for RSI scale

declare Lower;

input data_length = 14;

input EMA_Length = 5;

def o = open;

def c = close;

def data = fold i = 0 to data_length with s do s + (if c > getValue(o, i) then 1 else if c < getValue(o, i) then - 1 else 0);

def Main = ExpAverage(data, EMA_Length);

#Scale Normalization Code

def hh = Round(highestAll(main),2);

def ll = Round(lowestall(main),2);

plot TMO = ((main-ll)/(hh-ll))*100;

TMO.setdefaultColor (color.yellow);Sorry I should have specified, I was referring to the original code that started this thread. Does anyone know how to paint the candle sticks the same color as the oscillator? (If oscillator is showing green, the candle sticks would be painted the same color?)

@rlohmeyer Thanks anyway though!

Ruby:

# TMO ((T)rue (M)omentum (O)scilator)

# Mobius

# V01.05.2018

# hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

declare Lower;

input length = 14;

input calcLength = 5;

input smoothLength = 3;

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

plot Main = ExpAverage(EMA5, smoothLength);

plot Signal = ExpAverage(Main, smoothLength);

Main.AssignValueColor(if Main > Signal

then color.green

else color.red);

Signal.AssignValueColor(if Main > Signal

then color.green

else color.red);

Signal.HideBubble();

Signal.HideTitle();

addCloud(Main, Signal, color.green, color.red);

plot zero = if isNaN(c) then double.nan else 0;

zero.SetDefaultColor(Color.gray);

zero.hideBubble();

zero.hideTitle();

plot ob = if isNaN(c) then double.nan else round(length * .7);

ob.SetDefaultColor(Color.gray);

ob.HideBubble();

ob.HideTitle();

plot os = if isNaN(c) then double.nan else -round(length * .7);

os.SetDefaultColor(Color.gray);

os.HideBubble();

os.HideTitle();

addCloud(ob, length, color.light_red, color.light_red, no);

addCloud(-length, os, color.light_green, color.light_green);

# End Code TMO@rlohmeyer Thanks anyway though!

Last edited by a moderator:

@Britt95

TMO Candle Painting #1

TMO Candle Painting #2

While neither do exactly what you are asking for. These give you the basic setup and even if you are not a scripter, play with the code, it won't break, and you should be able to adapt it to your needs.

HTH

TMO Candle Painting #1

TMO Candle Painting #2

While neither do exactly what you are asking for. These give you the basic setup and even if you are not a scripter, play with the code, it won't break, and you should be able to adapt it to your needs.

HTH

Last edited:

rlohmeyer

Active member

For those interested I include how I am using TMO combined with 2 RSI indicators on a normalized scale for swing trading on day charts. Below is a graphic and below that the code. TMO in yellow. The RSI's in Cyan and Magenta.

Code:

# TMO ((T)rue (M)omentum (O)scilator)

# Mobius

# V01.05.2018

# hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

#@rlohmeyer: RSI,TMO on normalized scale

declare lower;

#Scale Normaliztion Script

script normalizePlot {

input normalize_data = close;

input MinRng = -1;

input MaxRng = 1;

def HH = HighestAll( normalize_data );

def LL = LowestAll( normalize_data );

plot NR = ((( MaxRng - MinRng ) * ( normalize_data - LL )) / ( HH - LL )) + MinRng;

}

#TMO

input Tmo_Price = close;

input Tmo_data_length = 5;

input Tmo_Ema_Length = 5;

def o = open;

def TMOdata = fold i = 0 to TMO_data_length with s do s + (if TMO_price > getValue(o, i) then 1 else if TMO_price < getValue(o, i) then - 1 else 0);

def TMOavg = ExpAverage(TMOdata, TMO_EMA_Length);

#RSI

input RSI_price = close;

def RSI_Average = AverageType.WILDERS;

input RSI_Avg_Length = 2;

def NetChgAvg = MovingAverage(RSI_Average, RSI_price - RSI_price[1], RSI_Avg_Length);

def TotChgAvg = MovingAverage(RSI_Average, AbsValue(RSI_price - RSI_price[1]), RSI_Avg_Length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RS = 50 * (ChgRatio + 1);

input Rsi_Ema_Length = 2;

def RSIavg = ExpAverage(RS, RSI_EMA_Length);

#RSI2

input RsiTwoPrice = close;

def RsiTwoAverage = AverageType.WILDERS;

input RsiTwoAvgLength = 2;

def NetChgAvg2 = MovingAverage(RsiTwoAverage, RsiTwoPrice - RsiTwoPrice[1], RsiTwoAvgLength);

def TotChgAvg2 = MovingAverage(RsiTwoAverage, AbsValue(RsiTwoPrice - RsiTwoPrice[1]), RsiTwoAvgLength);

def ChgRatio2 = if TotChgAvg2 != 0 then NetChgAvg2 / TotChgAvg2 else 0;

def RS2 = 50 * (ChgRatio2 + 1);

input RsiTwoEmaLength = 2;

def RSIavg2 = ExpAverage(RS2, RsiTwoEmaLength);

#Scale parameters

input MaxRng = 100;#Max range value

input MinRng = 0;#Min range value

input OBH = 95;

input OBL = 90;

Addcloud(OBH,OBL,color.green);

input OSH = 10;

input OSL = 5;

Addcloud(OSH,OSL,color.red);

#Scale normalization based on parameters

def newTMO = normalizePlot(TMOavg, MinRng, MaxRng );

def newRSI = normalizePlot(RSIavg, MinRng, MaxRng );

def newRSI2 = normalizePlot(RSIavg2, MinRng, MaxRng );

#Plots

plot TMO = newTMO;

TMO.setdefaultColor(color.yellow);

TMO.Hidebubble();

TMO.hidetitle();

plot RSI = newRSI;

RSI.setdefaultColor(color.cyan);

RSI.hidebubble();

RSI.hidetitle();

plot RSI2 = newRSI2;

RSI2.setdefaultColor(color.magenta);

RSI2.hidebubble();

RSI2.hidetitle();

plot Mid = (MaxRng + MinRng)/2;

Mid.setdefaultColor(color.light_gray);

Mid.hidebubble();

Mid.hidetitle();- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Archived: RSI Divergence Indicator | Indicators | 131 | |

|

|

Archived: Opening Range Breakout | Indicators | 340 | |

|

|

Archived: Supertrend Indicator by Mobius for ThinkorSwim | Indicators | 312 | |

|

|

Repaints TMO with Higher Agg_Mobius @ TSL | Indicators | 207 | |

|

|

TMO True Momentum Oscillator For ThinkOrSwim | Indicators | 143 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1335

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.