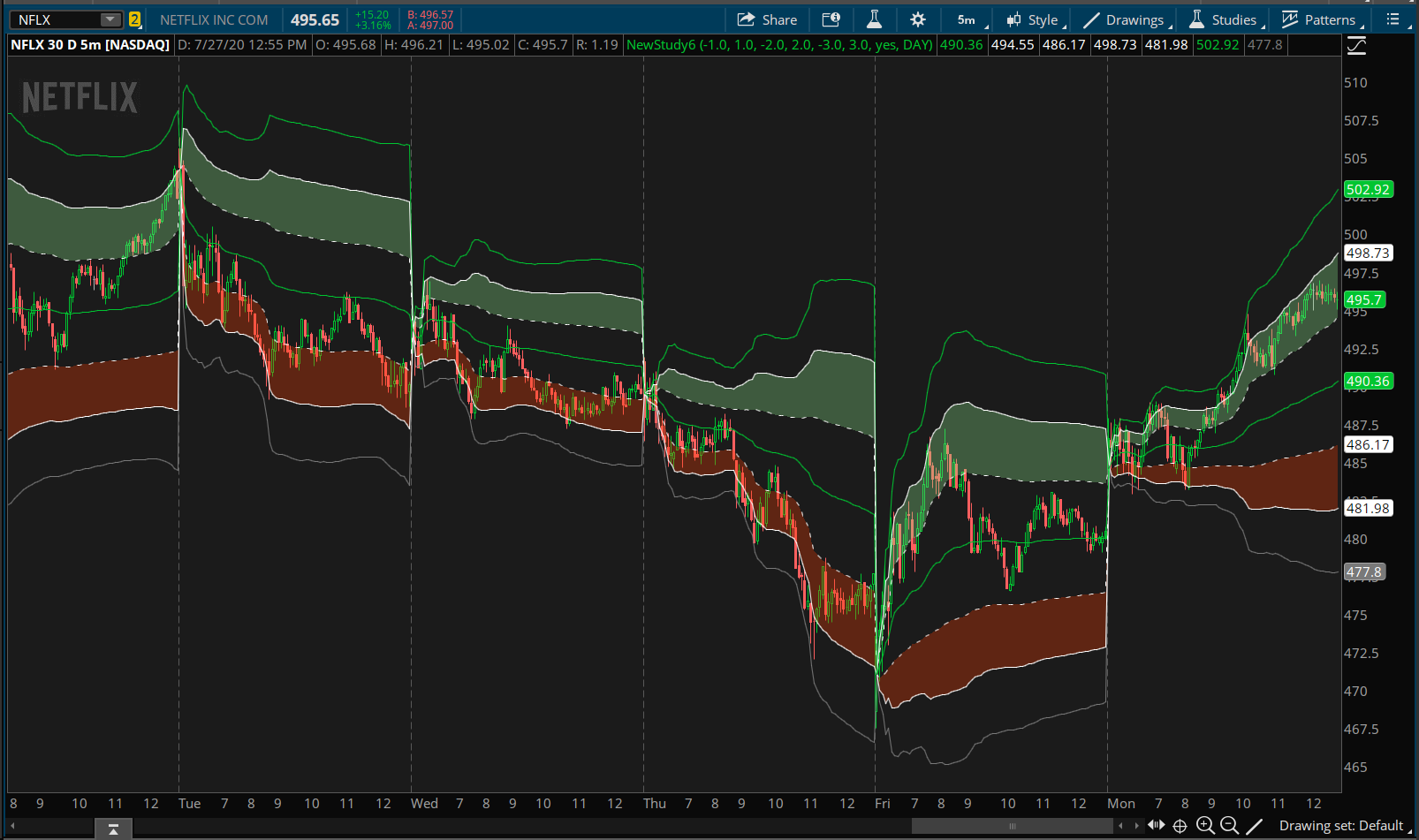

Regular VWAP indicator with additional standard deviations added. Now you can use the 1 and 3 Stdev Bands along with the default standard deviation bands (set to 2). Requested by a member on the forum.

There is also an advanced version called Ultimate VWAP by @Welkin. You should check it out here.

There is also an advanced version called Ultimate VWAP by @Welkin. You should check it out here.

thinkScript Code

Code:

# VWAP(3)

# Assembled by BenTen at UseThinkScript.com

input numDevDn1 = -1.0;

input numDevUp1 = 1.0;

input numDevDn2 = -2.0;

input numDevUp2 = 2.0;

input numDevDn3 = -3.0;

input numDevUp3 = 3.0;

input showCloud = yes;

input timeFrame = {default DAY, WEEK, MONTH};

def cap = getAggregationPeriod();

def errorInAggregation =

timeFrame == timeFrame.DAY and cap >= AggregationPeriod.WEEK or

timeFrame == timeFrame.WEEK and cap >= AggregationPeriod.MONTH;

assert(!errorInAggregation, "timeFrame should be not less than current chart aggregation period");

def yyyyMmDd = getYyyyMmDd();

def periodIndx;

switch (timeFrame) {

case DAY:

periodIndx = yyyyMmDd;

case WEEK:

periodIndx = Floor((daysFromDate(first(yyyyMmDd)) + getDayOfWeek(first(yyyyMmDd))) / 7);

case MONTH:

periodIndx = roundDown(yyyyMmDd / 100, 0);

}

def isPeriodRolled = compoundValue(1, periodIndx != periodIndx[1], yes);

def volumeSum;

def volumeVwapSum;

def volumeVwap2Sum;

if (isPeriodRolled) {

volumeSum = volume;

volumeVwapSum = volume * vwap;

volumeVwap2Sum = volume * Sqr(vwap);

} else {

volumeSum = compoundValue(1, volumeSum[1] + volume, volume);

volumeVwapSum = compoundValue(1, volumeVwapSum[1] + volume * vwap, volume * vwap);

volumeVwap2Sum = compoundValue(1, volumeVwap2Sum[1] + volume * Sqr(vwap), volume * Sqr(vwap));

}

def price = volumeVwapSum / volumeSum;

def deviation = Sqrt(Max(volumeVwap2Sum / volumeSum - Sqr(price), 0));

plot VWAP = price;

plot UpperBand1 = price + numDevUp1 * deviation;

plot LowerBand1 = price + numDevDn1 * deviation;

plot UpperBand2 = price + numDevUp2 * deviation;

plot LowerBand2 = price + numDevDn2 * deviation;

plot Upperband3 = price + numDevUp3 * deviation;

plot LowerBand3 = price + numDevDn3 * deviation;

VWAP.setDefaultColor(getColor(6));

UpperBand1.setDefaultColor(getColor(9));

UpperBand1.setStyle(Curve.SHORT_DASH);

LowerBand1.setDefaultColor(getColor(9));

LowerBand1.setStyle(Curve.SHORT_DASH);

UpperBand2.setDefaultColor(getColor(9));

LowerBand2.setDefaultColor(getColor(9));

AddCloud(if showCloud then UpperBand2 else Double.NaN, Upperband3, color.light_green, color.light_green);

AddCloud(if showCloud then LowerBand2 else Double.NaN, LowerBand3, color.light_red, color.light_red);

Last edited: