#https://www.tradingview.com/v/6VgJlewW/

#// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla

#// © QuantraAI

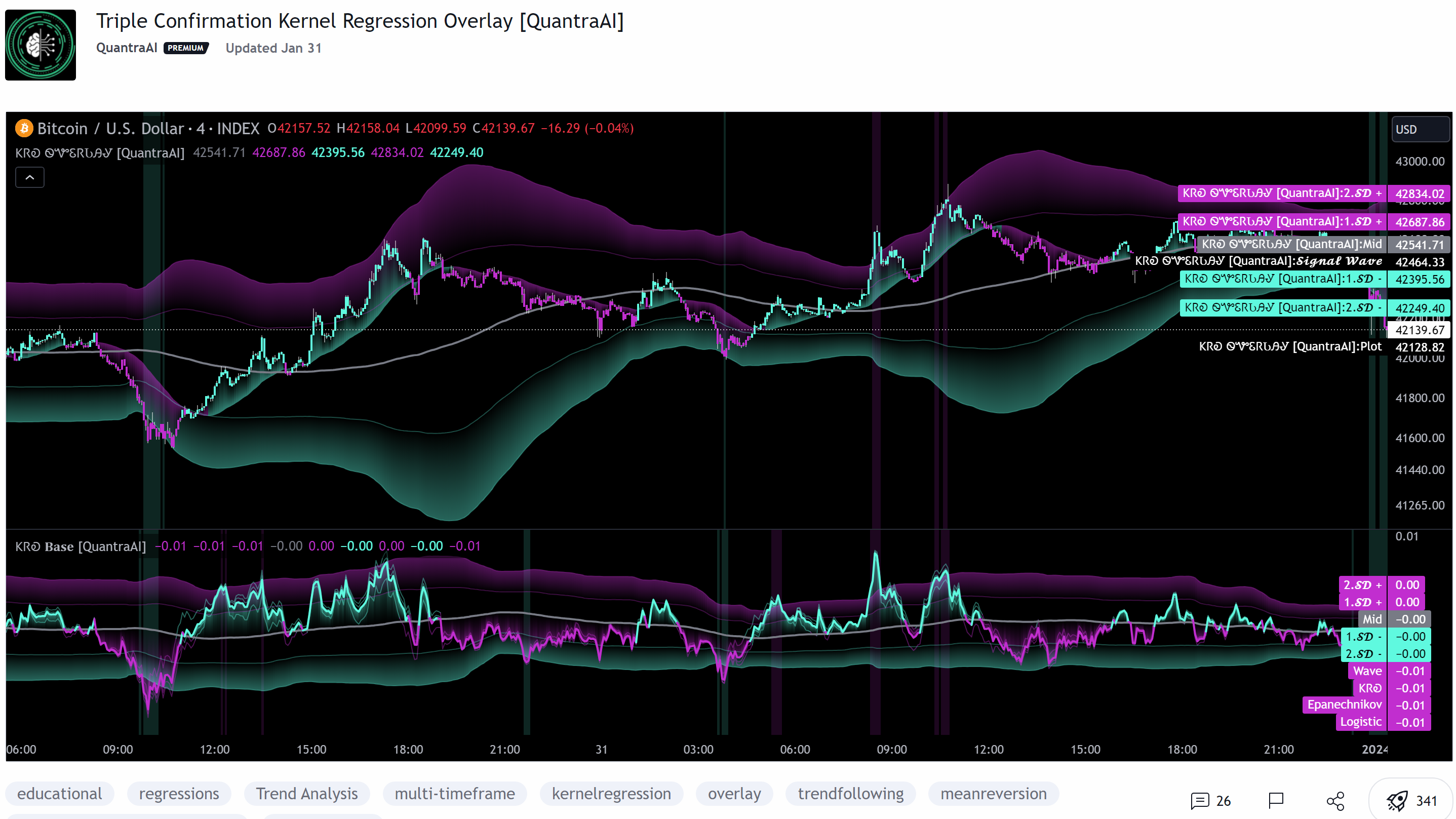

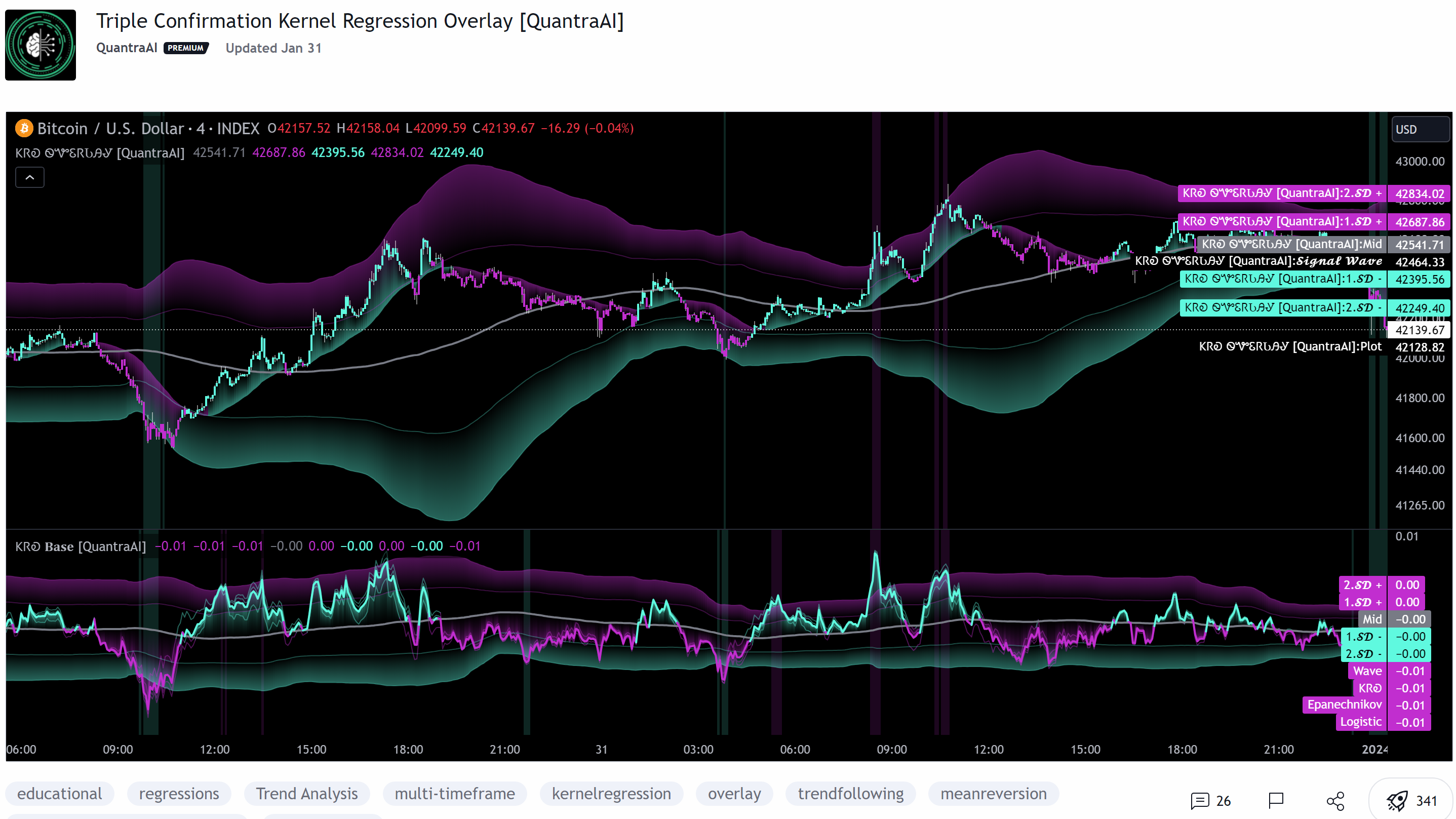

#indicator("Triple Confirmation Kernel Regression Oscillator [QuantraAI]", [QuantraAI]"

# Cconverted and mod to upper study by Sam4Cok@Samer800 - 12/2023

#// Kernel Regression Settings

input BarColoring = yes; # "Enable Bar Coloring"

input showSignals = yes; # "Enable Overbought/Oversold Shading"

input source = close; # "Source"

input bandwidth = 45; # "Bandwidth"

input RelativeWeighting = 2.0; # 'Relative weighting of time frames. Recommended range: 0.25-25'

input stdevLength = 150;

input sdevMulti = 3.0; # "Standard Deviation Extreme for OB/OS Border"

input stdevMultiplier = 2.0; #, "Standard Deviation Extreme for OB/OS Border",

def na = Double.NaN;

def last = isNaN(close);

DefineGlobalColor("up", CreateColor(95, 250, 224));

DefineGlobalColor("dn", CreateColor(194, 46, 208));

DefineGlobalColor("dup",CreateColor(3, 106, 89));

DefineGlobalColor("ddn", CreateColor(89, 21, 96));

#// Functions //

#epanechnikov(source, bandwidth) =>

Script epanechnikov {

input source = close;

input bandwidth = 45;

input width = 1;

def sum = fold i = 0 to bandwidth with p do

p + source[i] * (if AbsValue((Sqr(i) / Sqr(bandwidth))/width) <= 1 then

(3/4) * (1 - Sqr((Sqr(i) / Sqr(bandwidth))/width)) else 0);

def sumw = fold j = 0 to bandwidth with q do

q + (if AbsValue((Sqr(j) / Sqr(bandwidth))/width) <= 1 then

(3/4) * (1 - Sqr((Sqr(j) / Sqr(bandwidth))/width)) else 0);

def kernel_regression = (sum / sumw);

plot out = kernel_regression;

}

#logistic(source, bandwidth) =>

Script logistic {

input source = close;

input bandwidth = 45;

input width = 1;

def sum = fold i = 0 to bandwidth with p do

p + source[i] * (1 / (Exp((Sqr(i) / Sqr(bandwidth)) / width) + 2

+ Exp(-(Sqr(i) / Sqr(bandwidth)) / width)));

def sumw = fold j = 0 to bandwidth with q do

q + (1 / (Exp((Sqr(j) / Sqr(bandwidth)) / width) + 2

+ Exp(-(Sqr(j) / Sqr(bandwidth)) / width)));

def kernel_regression = (sum / sumw);

plot out = kernel_regression;

}

#wave(source, bandwidth) =>

Script wave {

input source = close;

input bandwidth = 45;

input width = 1;

def pi = Double.Pi;

def sum = fold i = 0 to bandwidth with p do

p + source[i] * (if (AbsValue((Sqr(i) / Sqr(bandwidth))/width) <= 1) then

(1 - AbsValue((Sqr(i) / Sqr(bandwidth))/width)) * Cos(pi * (Sqr(i) / Sqr(bandwidth)) / width) else 0);

def sumw = fold j = 0 to bandwidth with q do

q + (if (AbsValue((Sqr(j) / Sqr(bandwidth))/width) <= 1) then

(1 - AbsValue((Sqr(j) / Sqr(bandwidth))/width)) * Cos(pi * (Sqr(j) / Sqr(bandwidth)) / width) else 0);

def kernel_regression = (sum / sumw);

plot out = kernel_regression;

}

Script waveCalculation {

input source = close;

input bandwidth = 45;

input width = 2;

def pi = Double.Pi;

def sum = fold i = 0 to bandwidth with p do

p + source[i] * (if ((i * i) / (bandwidth * bandwidth) / width) <= 1 then

(1 - ((i * i) / (bandwidth * bandwidth) / width)) * cos(pi * ((i * i) / (bandwidth * bandwidth) / width)) else 0.0);

def sumw = fold j = 0 to bandwidth with q do

q + (if ((j * j) / (bandwidth * bandwidth) / width) <= 1 then

(1 - ((j * j) / (bandwidth * bandwidth) / width)) * cos(pi * ((j * j) / (bandwidth * bandwidth) / width)) else 0.0);

def kernel_regression = sum / sumw;

plot out = kernel_regression;

}

#// Triple Confirmations

def Wav = waveCalculation(source, bandwidth, RelativeWeighting);

def Ep = epanechnikov(source, bandwidth, RelativeWeighting);

def Lo = logistic(source, bandwidth, RelativeWeighting);

def Wa = wave(source, bandwidth, RelativeWeighting);

def up = Wav>Wav[1]; # 'Wave'

def dn = wav<wav[1];

#// Average

def AV = Average((Ep + Lo + Wa) / 3, 1);

def Mid = Average(AV, stdevLength);

#// Base Plots

plot pAV = Wav;

def Epanechnikov = Ep; # 'Epanechnikov'

def Logistic = Lo; # 'Logistic'

pAV.SetLineWeight(2);

pAV.AssignValueColor(if up then GlobalColor("up") else if dn then GlobalColor("dn") else Color.GRAY);

#// Calculate Dynamic OB/OS Zones

def basis = Average(AV, stdevLength);

def dev = stdev(AV, stdevLength);

def u1 = basis + sdevMulti/2 * dev;

def l1 = basis - sdevMulti/2 * dev;

def u2 = basis + sdevMulti * dev;

def l2 = basis - sdevMulti * dev;

##// Final Plots + Fill

plot avg = basis;

plot pu1 = u1;

plot pl1 = l1;

def pu2 = u2;

def pl2 = l2;

avg.SetDefaultColor(Color.GRAY);

pu1.SetDefaultColor(GlobalColor("dn"));

pl1.SetDefaultColor(GlobalColor("up"));

AssignPriceColor(if !BarColoring then Color.CURRENT else

if up and wav > av then Color.GREEN else #GlobalColor("up") else

if up then Color.DARK_GREEN else

if dn and wav < av then GlobalColor("dn") else

if dn then Color.PLUM else Color.GRAY);

AddCloud(if source > pAV then pAV - (pAV - source)/2 else na,pAV , GlobalColor("dup"));

AddCloud(if source > pAV then na else pAV, pAV + (source - pAV)/2, GlobalColor("ddn"));

AddCloud(pu2, pu1, GlobalColor("ddn"));

AddCloud(pl1, pl2, GlobalColor("dup"));

def sigUp = av > (l1 - (l1-l2)/2);# and av > av[1];

def sigDn = av < (u1 + (u2-u1)/2);# and av < av[1];

def sig = if showSignals then (if sigUp and !sigUp[1] then 1 else

if sigDn and !sigDn[1] then -1 else 0) else na;

# and sig[1]<0;

#def arrUp = Wac > Wac[1];# and !(Wac[1] > Wac[2]);

#def arrDn = Wac < Wac[1];# and !(Wac[1] < Wac[2]);

AddChartBubble(sig>0, low, "B", Color.GREEN, no);

AddChartBubble(sig<0, high, "S", Color.RED);

#-- END of CODE