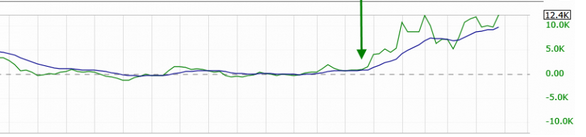

I believe I found the correct indicator for TSV on the Tradingview site. Here is some brief info:

If the histogram (TSV) is greater than zero and greater than the moving average, price should be moving long and there will be a green box below the chart.

If TSV falls below the moving average while still being greater than zero, the trend may be exhausting and has been coded to read Price Action Long - FAILURE with a black x below the chart.

If the histogram (TSV) is less than zero and less than the moving average, price should be moving short and there will be a red box below the chart.

If TSV rises above the moving average while still being less than zero, the trend may be exhausting and has been coded to read Price Action Short - FAILURE with a black x below the chart.

At times, the moving average may be above zero while TSV is below zero or vice versa. In these situations the chart will indicate long or short based on whether or not TSV is greater or less than zero. It is possible a new trend may be forming as the moving average obviously lags, but also possible price is consolidating with little

volume and causing TSV to oscillate close to zero.

Here is the code which they say is open source:

//@version=4

// Written by liw0 active on

https://www.tradingview.com/u/liw0

// corrected version by vitelot December 2018 -- no charity required

// Updated/Enhanced version by @eylwithsteph inspired by @storma

// CREDITS:

http://quant.stackexchange.com/questions/2816/how-to-calculate-time-segmented-volume

study("Enhanced Time Segmented Volume", shorttitle="TSV")

l = input(13, title="TSV Length")

l_ma = input(7, title="MA Length")

t = sum(close > close[1] ? volume * (close - close[1]) : close < close[1] ? volume * (close - close[1]) : 0, l)

m = sma(t, l_ma)

PAL = (t > m) and (t > 0)

PAL_fail = (t < m) and (t > 0)

PAS = (t < m) and (t < 0)

PAS_fail = (t > m) and (t < 0)

plot(t, color=color.red, style=plot.style_histogram, title="TSV")

plot(m, color=color.green, title="MA")

plotshape(PAL, title="Price Action Long", location=location.bottom, style=shape.square, size=size.auto, color=color.green, transp=80)

plotshape(PAS, title="Price Action Short", location=location.bottom, style=shape.square, size=size.auto, color=color.red, transp=80)

plotshape(PAL_fail, title="Price Action Long - FAILURE", location=location.bottom, style=shape.xcross, size=size.auto, color=color.black, transp=60)

plotshape(PAS_fail, title="Price Action Short - FAILURE", location=location.bottom, style=shape.xcross, size=size.auto, color=color.black, transp=60)