TheRaptor22

New member

Looking for a scan for a three week tight scan , each weekly closing price within about 1% of prior weeks (3) close. Thanks in advance

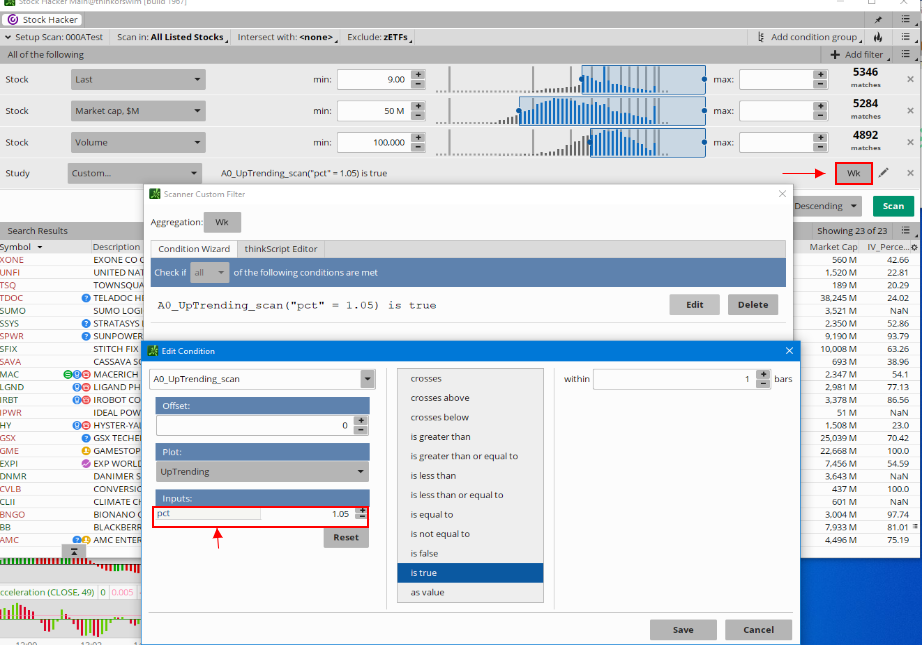

#UpTrending by @rll131

input PCT = 1.05 ;

plot UpTrending = low > hl2[1]*PCT and low[1] > hl2[2]*PCT and low[2] > hl2[3]*PCT;Join useThinkScript to post your question to a community of 21,000+ developers and traders.

wouldn't this just scan for a down trend? im looking for something that will scan for a very steady price for at least a month to up to a year so I can add a volume scan alert to it so I can hopefully catch stocks that are going to spike from there steady price. if im wrong just let me know Im sort of new to custom scans@rll131 I think this is what you want:

Ruby:#UpTrending by @rll131 input PCT = 1.05 ; plot UpTrending = low > hl2[1]*PCT and low[1] > hl2[2]*PCT and low[2] > hl2[3]*PCT;

On a Weekly scan this returns all stocks whose:

If you want a longer trend just replicate the above code and change the number in the brackets.

- current low is greater than one week ago multiplied by a percent AND

- one week ago is greater than two weeks ago multiplied by a percent AND

- two weeks ago is greater than three weeks ago multiplied by a percent...

close is less than (close * 1)thanks for that I just found it

@surfmang did you figure something out? I am trying to do the same but all these scanners here don't show me thatI've been scratching my head trying to create a scan that shows stocks over a 6 or even 10 or 15 day period that don't move much in price. Read an article recently that a 1.5% range is good to find before a big move up, and I've seen this time and time again.

The best bet is maybe to scan for flags on the weekly? I've tried using all the price tools built in to tos I can think of.

looking to build a scanner I could not find one here and can't figure it out on my own. I pretty much want to scan for stocks that have stayed for lets say 1-5% for the past 20-50 days. I can only find a scan that will find stocks greater then ect.. id like to put my own percent change. just want to look for a stock that has stayed steady for awhile and then add a volume change as well so I can find a steady priced stock that might be ready to rise due to volume change. appreciate any help and if there is already a post for this please post a link and sorry I couldn't find it.

#Price XYZ Bars ago has been within X% and Y% within last XYZ bars

#By XeoNoX Via usethinkscript.com

input barsago = 10;

#Percent as Decimal example .05 = 5%

input MAX_Percent = .05;

input Min_Percent = .01;

def priceback = close[barsago];

def MAXPercent = priceback * MAX_Percent;

def MinPercent = priceback * Min_Percent;

def scan1 = AbsValue(low - priceback) and AbsValue(high - priceback) is less than or equal to MAXPercent;

def scan2 = AbsValue(low - priceback) and AbsValue(high - priceback) is greater than or equal to MinPercent;

def var = scan1 and scan2;

def count = Sum(var, barsago);

Plot Finalscan = count >= 10;

#AddLabel (yes, "COUNT" + (count) );Make sure aggregation is set to weekly.Looking for a scan for a three week tight scan , each weekly closing price within about 1% of prior weeks (3) close. Thanks in advance

absValue(close[1]-close[2])/close[2] <= 0.01 AND absValue(close[2]-close[3])/close[3] <= 0.01| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| D | Crossover of three moving Averages | Questions | 5 | |

|

|

Find the last Three Lowest Lows and count the number of bars between them | Questions | 2 | |

|

|

How to Scan in Three Markets At Once? | Questions | 1 | |

| V | The 1-1-1 candle combination is a three-candle pattern | Questions | 2 | |

| T | Three period average seem wrong | Questions | 2 |

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.