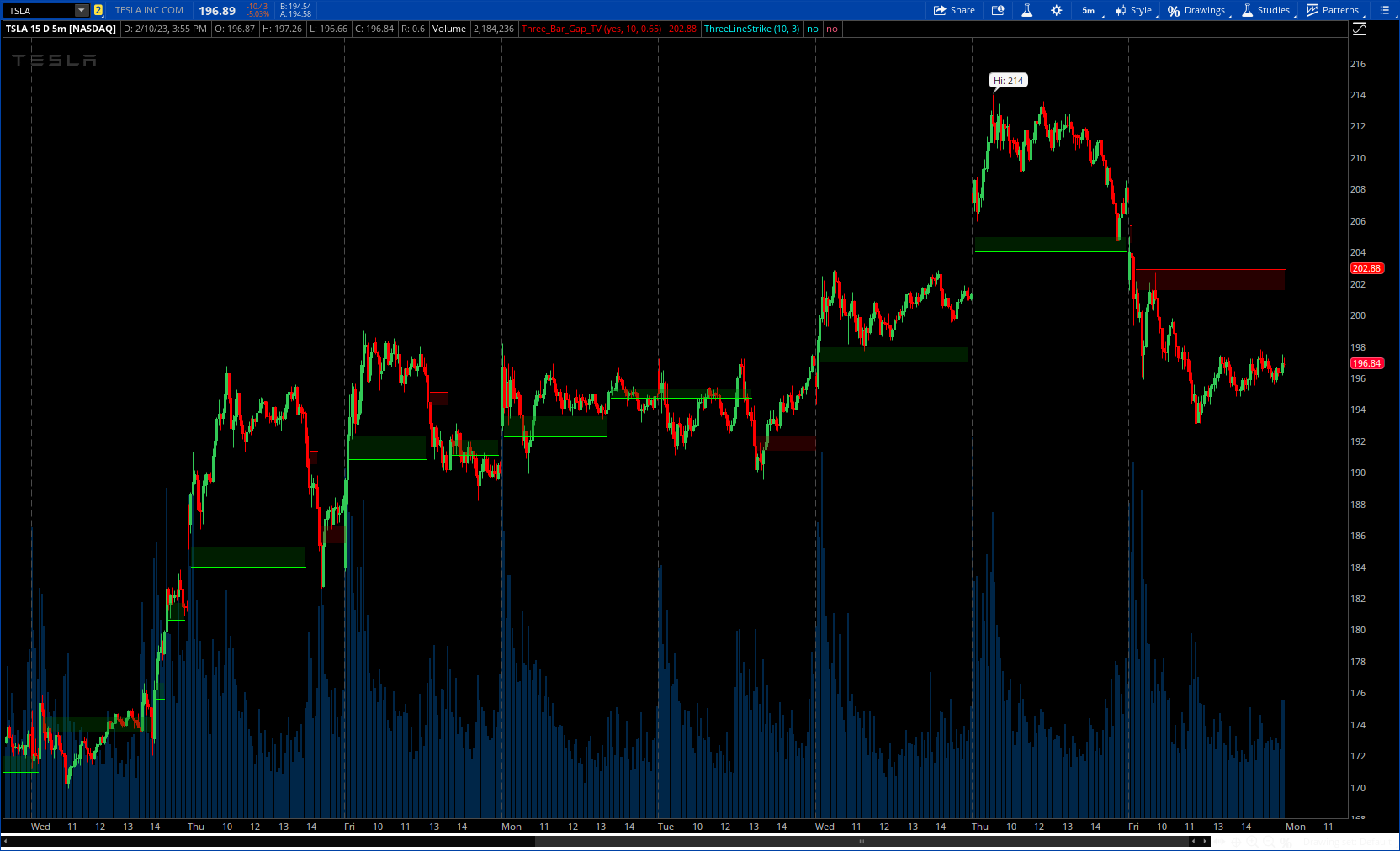

fair value gap / imbalance

Full information refer to below link - I add MTF option as well

https://www.tradingview.com/v/96ZstKf8/

Full information refer to below link - I add MTF option as well

https://www.tradingview.com/v/96ZstKf8/

CSS:

#/ © DojiEmoji

#// This script is tailored towards experienced traders who prefer to view raw price charts during live execution.

#// It searches for a three-bar pattern of what is colloquially called "fair value gap", or "imbalance" and uses

#// a single line to plot the results. The goal is to display price in a way that is as simple as possible so that

#// chart readers who don't prefer to add indicators on their screen will still find this indicator as an

#// acceptable option to consider for.

#indicator("3 Bar Gap [DojiEmoji]", overlay=true)

# Converted and mod by Sam4Cok@Samer800 - 02/2023

input ShowCloud = yes;

input UseChartTimeFrame = yes;

input ManualTimeFrame = AggregationPeriod.HOUR;

input atr_Length = 20; # "ATR Length"

input atr_multi = 0.65; # "Multi"

def na = Double.NaN;

def last = isNaN(Close);

def hTF; def cTF; def lTF;

if UseChartTimeFrame {

htf = high;

ctf = close;

ltf = low;

} else {

htf = high(Period=ManualTimeFrame);

ctf = close(Period=ManualTimeFrame);

ltf = low(Period=ManualTimeFrame);

}

#

script insert_gap {

input price_t_minustwo = high;

input price_t_zero = low;

def pivot_upper = max(price_t_minustwo, price_t_zero);

def pivot_lower = min(price_t_minustwo, price_t_zero);

def pivot_mid = (pivot_upper+ pivot_lower)/2;

def linecolor = if price_t_minustwo < price_t_zero then 1 else

if price_t_minustwo > price_t_zero then -1 else 0;

plot mid = pivot_mid;

plot Color = linecolor;

}

def tr = TrueRange(htf, ctf, ltf);

def nATR = WildersAverage(tr, atr_Length);

def threshold = nATR * atr_multi;

def PivotUpMain = insert_gap(htf[2], ltf[0]).mid;

def PivotUpColo = insert_gap(htf[2], ltf[0]).Color;

def PivotUpThre = PivotUpMain + threshold;

def PivotDnMain = insert_gap(ltf[2], htf[0]).mid;

def PivotDnColo = insert_gap(ltf[2], htf[0]).Color;

def PivotDnThre = PivotDnMain - threshold;

def main_pivot;def linecolor; def PivUp; def PivDn;

def displacement_up = ltf[0] - htf[2];

def displacement_dn = htf[0] - ltf[2];

if AbsValue(displacement_up) > threshold and displacement_up > 0 {

main_pivot = PivotUpMain;

linecolor = PivotUpColo;

PivUp = PivotUpThre;#main_pivot + threshold;

PivDn = PivDn[1];

} else

if AbsValue(displacement_dn) > threshold and displacement_dn < 0 {

main_pivot = PivotDnMain;

linecolor = PivotDnColo;

PivUp = PivUp[1];

PivDn = PivotDnThre;#main_pivot - threshold;

} else {

main_pivot = main_pivot[1];

linecolor = linecolor[1];

PivUp = PivUp[1];

PivDn = PivDn[1];

}

def Pivot = if linecolor==0 or main_pivot!=main_pivot[1] or last then na else main_pivot;

def PivotUp = if linecolor<=0 or main_pivot!=main_pivot[1] or last then na else PivUp;

def PivotDn = if linecolor>=0 or main_pivot!=main_pivot[1] or last then na else PivDn;

plot PivotMid = Pivot[-1];

PivotMid.AssignValueColor(if linecolor>0 then Color.Green else Color.RED);

AddCloud(if ShowCloud then PivotUp[-1] else na, Pivot[-1], Color.DARK_GREEN, Color.DARK_RED);

AddCloud(if ShowCloud then PivotDn[-1] else na, Pivot[-1], Color.DARK_GREEN, Color.DARK_RED);

#---END CODE

Last edited by a moderator: