You should upgrade or use an alternative browser.

ThinkorSwim Earnings Date Indicator and Watchlist Column

- Thread starter BenTen

- Start date

-

- Tags

- earnings tracker

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

def LastEarningsBar = AbsValue(GetEventOffset(Events.Earnings, 0));

def NextEarnings = if isNaN(LastEarningsBar) then 0 else LastEarningsBar;

AddLabel(1, NextEarnings, if NextEarnings <= 4 then Color.Red else Color.Current);

@soary Did you ever get this fixed? If not, please post in the questions forum, hopefully you will get a bite.Hello all, I tried this indicator on the chart and still get the wrong date. I updated the expansion bars to 22 and have it on a daily chart like @tomsk instructed. For example, ticker D for Dominion TOS analyze thab-> earnings shows next earnings date as 2/10/2020 but pink label on the chart says 2/11/2020. I tried several tickers and they all have the wrong date. How do I fix it? Thanks

@ezrollin If you got this to work, would you share in a new thread? Thanks.Hey, just an observation. I was told we cant use labels on mobile. May have found a tricky workaround. You can set alerts and that will show our labels. Trying to do Market Sentiment/Adv Decliners. Very tricky though

jngy2k

Member

It returns a false value for # of days til earnings

when looking at other time frames.

def bn = BarNumber();

def na = Double.NaN;

def getNextEarnings = AbsValue(GetEventOffset(Events.EARNINGS, 0));

def findDay = GetDayOfMonth(GetYYYYMMDD());

def findMonth = GetMonth();

def findYear = GetYear();

def getNextEarningsBarNumber = if !isNaN(getNextEarnings) then bn + getNextEarnings else na;

def NextEarnings = bn == HighestAll(getNextEarningsBarNumber);

def getNextEarningsMonth = HighestAll(if NextEarnings then findMonth else na);

def getNextEarningsDay = HighestAll(if NextEarnings then findDay else na);

def getNextEarningsYear = HighestAll(if NextEarnings then findYear else na);

plot DaysToEarnings = getNextEarningsBarNumber;

DaysToEarnings.Hide();

AddLabel(getAggregationPeriod()==aggregationPeriod.DAY and getNextEarnings > 0, "Next Earnings: (" + getNextEarnings + (if getNextEarnings == 1 then " Day): " else " Days): ") + getNextEarningsMonth + "/" + getNextEarningsDay + "/" + AsPrice(getNextEarningsYear), Color.Pink);

AddLabel(getAggregationPeriod()==aggregationPeriod.DAY and getNextEarnings == 0, "EARNINGS TODAY", Color.Yellow);Additionally I do need help with something. @BenTen @markos @tomsk

First for a custom column the values are incorrect. Today is 10-4-2020 and earnings for ACCD is 10-14-2020.

That will be in 8 trading days or in TOS 8 Day Bars.

Is it possible to make a column OR scan because I think without the expansion (that is available on chart)

it cannot be done.

edit: nevermind i figured it out

i do still need help with the other post

about turning off the "earnings today" label when expansion is off

#column

def getNextEarnings = AbsValue(GetEventOffset(Events.EARNINGS, 0));

plot DaysToEarnings = getNextEarnings;

jngy2k

Member

there is a False-positive value when Expansion on the chart is not added.

I use a chart Volume Profile with expansion in order to see volume profile.

When that is turned off the Next Earnings indicator will produce a

False "earnings today" label.

In the example below and above, ACCD has earnings in 10-14-2020 with today 10-4-2020 which correctly gives 8 trading days (bars)

from today. Without expansion it is producing the false positive.

Is there a simple off function for the script when expansion is not detected???

Attachments

I do use one for my watchlists and it serves my purposes. See if this is of any use on a chart. btw, I haven't seen a work around for not having expansion room, but I haven't looked either. Markos

#For Watch List Column: This code originaly from Thinkscript Lounge at TOS circa 2017

#I use this one because it tells me xx.0= earns before market & xx.5 = earns after market close.

#Please notice that it counts down starting at 60 days and is adjustable via UI. Markos at usethinkscript.com

input length = 60;

def xx= -geteventOffset(events.EARNINGS);

def yy = sum(hasEarnings(type = earningTime.AFTER_MARKET),length)[-length +1] >0;

plot x=xx+yy*.5;

x.assignvaluecolor( if yy!=0 then color.LIGHT_RED else color.Yellow);Have you checked the OneNote Repository in Tutorials? Johnny Quotron has kept practically every days TSL chat in there since beginning of 2018.

The code above does work with enough days in Expansion. I used 50.

Other than that, I am able to help, unfortunately.

jngy2k

Member

Ok the best nextearnings indicator i can come up with.

still can't get it to work without expansion unfortuneately

#original nextearnings

declare lower;

def bn = BarNumber();

def na = Double.NaN;

def getNextEarnings = absvalue(GetEventOffset(Events.EARNINGS, 0));

def findDay = GetDayOfMonth(GetYYYYMMDD());

def findMonth = GetMonth();

def findYear = GetYear();

#getnextearningsbarnumber is confusing but for setting the mo/d/yr

def getNextEarningsBarNumber = if !isNaN(getNextEarnings) then bn + getNextEarnings else na;

def NextEarnings = bn == HighestAll(getNextEarningsBarNumber);

def getNextEarningsMonth = HighestAll(if NextEarnings then findMonth else na);

def getNextEarningsDay = HighestAll(if NextEarnings then findDay else na);

def getNextEarningsYear = HighestAll(if NextEarnings then findYear else na);

#different nextearnings with aftermarket is .5 and whole number is before or during market hours

input length = 63;

def xx= -geteventOffset(events.EARNINGS);

def yy = sum(hasEarnings(type = earningTime.AFTER_MARKET),length)[-length +1] >0;

plot DaysToEarnings = xx+yy*.5;

DaysToEarnings.assignvaluecolor( if yy!=0 then color.LIGHT_RED else color.Yellow);

#labels for original nextearnings with different nextearnings data

AddLabel(getAggregationPeriod()==aggregationPeriod.DAY and getNextEarnings > 0, "Earnings: (" + DaysToEarnings + (if getNextEarnings == 1 then " Day) " else " Days) ") + getNextEarningsMonth + "/" + getNextEarningsDay + "/" + AsPrice(getNextEarningsYear), Color.Pink);

#indicators for before or during or after earnings

plot isBefore = HasEarnings(EarningTime.BEFORE_MARKET);

plot isAfter = HasEarnings(EarningTime.AFTER_MARKET);

plot isDuringOrUnspecified = HasEarnings() and !isBefore and !isAfter;

isbefore.setDefaultColor(color.yellow);

isafter.setDefaultColor(color.red);

isduringorunspecified.setDefaultColor(color.orange);

isBefore.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

isAfter.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_up);

isDuringOrUnspecified.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);@jngy2k@markos

Ok the best nextearnings indicator i can come up with.

still can't get it to work without expansion unfortuneately

Code:#original nextearnings declare lower; def bn = BarNumber(); def na = Double.NaN; def getNextEarnings = absvalue(GetEventOffset(Events.EARNINGS, 0)); def findDay = GetDayOfMonth(GetYYYYMMDD()); def findMonth = GetMonth(); def findYear = GetYear(); #getnextearningsbarnumber is confusing but for setting the mo/d/yr def getNextEarningsBarNumber = if !isNaN(getNextEarnings) then bn + getNextEarnings else na; def NextEarnings = bn == HighestAll(getNextEarningsBarNumber); def getNextEarningsMonth = HighestAll(if NextEarnings then findMonth else na); def getNextEarningsDay = HighestAll(if NextEarnings then findDay else na); def getNextEarningsYear = HighestAll(if NextEarnings then findYear else na); #different nextearnings with aftermarket is .5 and whole number is before or during market hours input length = 63; def xx= -geteventOffset(events.EARNINGS); def yy = sum(hasEarnings(type = earningTime.AFTER_MARKET),length)[-length +1] >0; plot DaysToEarnings = xx+yy*.5; DaysToEarnings.assignvaluecolor( if yy!=0 then color.LIGHT_RED else color.Yellow); #labels for original nextearnings with different nextearnings data AddLabel(getAggregationPeriod()==aggregationPeriod.DAY and getNextEarnings > 0, "Earnings: (" + DaysToEarnings + (if getNextEarnings == 1 then " Day) " else " Days) ") + getNextEarningsMonth + "/" + getNextEarningsDay + "/" + AsPrice(getNextEarningsYear), Color.Pink); #indicators for before or during or after earnings plot isBefore = HasEarnings(EarningTime.BEFORE_MARKET); plot isAfter = HasEarnings(EarningTime.AFTER_MARKET); plot isDuringOrUnspecified = HasEarnings() and !isBefore and !isAfter; isbefore.setDefaultColor(color.yellow); isafter.setDefaultColor(color.red); isduringorunspecified.setDefaultColor(color.orange); isBefore.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN); isAfter.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_up); isDuringOrUnspecified.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

When TOS was created, the rumor was that the Russian programmers were told to only work with what's on the chart, hence the need for expansion. Oddly, this doesn't hold true with everything.

luketheduke

New member

The only place I can find the scheduled date of earnings is the earnings tab in analyze, but it's kind of inconvenient to have all the windows open if I could just have it in the scan.

Thanks for your help.

walksonair

New member

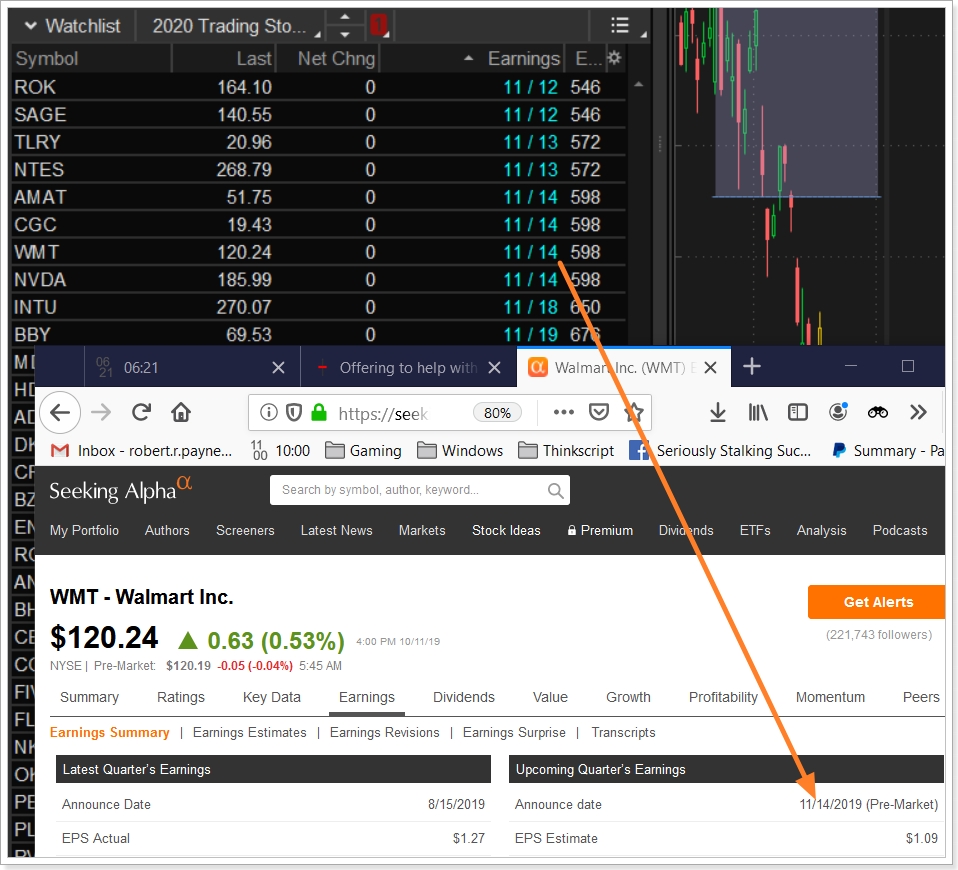

When I try to implement this in my scanned watchlist, I don't get a correct earnings date. What am I doing wrong? See image below please:@ansheth

Rather than adding a label to my charts, I created a simple watchlist column to show the next earnings release date. I have it setup so that if earnings were released within the last 5 days it will show the most recent release date; otherwise it shows next earnings release.

Ruby:# watchlist column for earnings release date # Robert Payne def PE = GetEventOffset(Events.EARNINGS, -1); def NE = GetEventOffset(Events.EARNINGS, 0); def z = if PE <= 5 then PE else NE; # get the earnings date def eDay = GetValue(GetDayOfMonth(GetYYYYMMDD()), z); def eMonth = GetValue(GetMonth(), z); AddLabel(yes, (if eMonth < 10 then "0" else "") + eMonth + " / " + (if eDay < 10 then "0" else "") + eDay, if z <= 0 then Color.CYAN else Color.CURRENT);

shgreenejr

New member

gravity2726

Member

Thanks Xeonox...scan for

Has earnings within past XYZ Days (bars) ago

Set to scan to day aggregation

Code:#Has earnings within XYZ Days ago # By XeoNoX Via usethinkscript.com def daysago = 1; def HasER_X_daysago = sum(hasearnings(),daysago) > 0; plot scan = HasER_X_daysago;

shgreenejr

New member

Thanks!!scan for

Has earnings within past XYZ Days (bars) ago

Set to scan to day aggregation

Code:#Has earnings within XYZ Days ago # By XeoNoX Via usethinkscript.com def daysago = 1; def HasER_X_daysago = sum(hasearnings(),daysago) > 0; plot scan = HasER_X_daysago;

gravity2726

Member

Hi Xeonox,scan for

Has earnings within past XYZ Days (bars) ago

Set to scan to day aggregation

Code:#Has earnings within XYZ Days ago # By XeoNoX Via usethinkscript.com def daysago = 1; def HasER_X_daysago = sum(hasearnings(),daysago) > 0; plot scan = HasER_X_daysago;

I am using this as a scan to backtest, It doesn't work on backtest. As it is taking current date in def daysago=15 ( I used last 15 days). Is there a way It to take the on demand date and calculate the last 15 days from on demand date ( or backtest date). Thank you

- Status

- Not open for further replies.

Similar threads

-

-

-

-

-

Market Maker Move Earnings Forecast Indicator for ThinkorSwim

- Started by BenTen

- Replies: 7

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

-

-

Market Maker Move Earnings Forecast Indicator for ThinkorSwim

- Started by BenTen

- Replies: 7

Similar threads

-

-

-

-

-

Market Maker Move Earnings Forecast Indicator for ThinkorSwim

- Started by BenTen

- Replies: 7

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/