Picard

Member

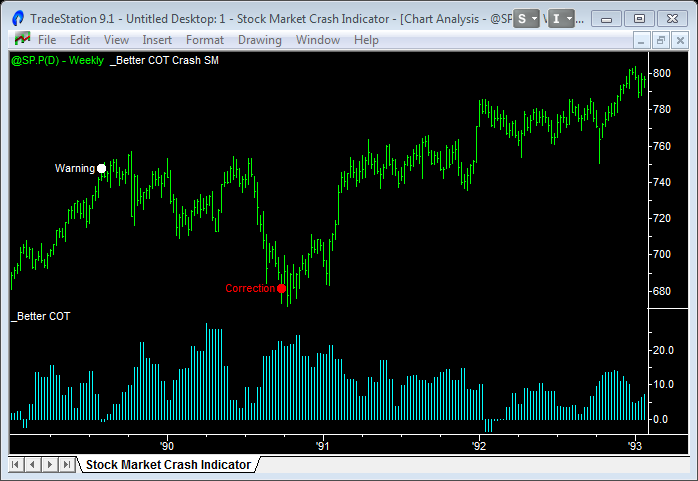

There's a The Stock Market Crash Indicator for TradeStation and I'm wondering if someone in this forum can translate this into ThinkScript? Watch This Video

Download

The Stock Market Crash Indicator

Code:

Inputs: WarningColor(White), CorrectionColor(Red), CrashColor(Red);

Variables: CommLong(0), CommShort(0), TotalOI(0), WarningSetUp(0), CorrectionSetUp(False), CrashSetUp(False), HighestHigh52(C);

CommLong = GetFundData("COTF-12",0);

CommShort = GetFundData("COTF-13",0);

TotalOI = GetFundData("COTF-8",0);

If TotalOI <> 0 then Value1 = (CommLong-CommShort)/TotalOI*100;

If H = Highest(H,52) and Value1 < 0 and WarningSetup = 0 then WarningSetup = 1;

If WarningSetup = 1 and Value1 > 0 then WarningSetup = 2;

If WarningSetup = 2 and Value1 < 0 then begin

WarningSetUp = 0;

Plot1(H,"Warning",WarningColor);

Value91 = Text_New(D,T,H,"Warning ");

Value92 = Text_SetColor(Value91,WarningColor);

Value93 = Text_SetStyle(Value91,1,2);

End;

If H = Highest(H,52) then begin

CorrectionSetUp = True;

CrashSetUp = True;

HighestHigh52 = H;

End;

If CorrectionSetUp and L <= HighestHigh52*0.9 then begin

WarningSetUp = 0;

CorrectionSetUp = False;

Plot2(HighestHigh52*0.9,"Correction",CorrectionColor);

Value91 = Text_New(D,T,HighestHigh52*0.9,"Correction ");

Value92 = Text_SetColor(Value91,CorrectionColor);

Value93 = Text_SetStyle(Value91,1,2);

End;

If CrashSetUp and L <= HighestHigh52*0.8 then begin

CrashSetUp = False;

Plot3(HighestHigh52*0.8,"Crash",CrashColor);

Value91 = Text_New(D,T,HighestHigh52*0.8,"Crash ");

Value92 = Text_SetColor(Value91,CrashColor);

Value93 = Text_SetStyle(Value91,1,2);

End;Download

The Stock Market Crash Indicator

Last edited: