Thank you, I can see now exactly what you're talking about on Daily Market Tide. It looks like that section of the Unusual Whales platform doesn't use filters. The section that uses filters is the one I screenshotted, and I understand you're saying that you also watch that (in addition to Daily Market Tide) with the filters set so that you can see the particular, individual directional bets that are taking place.

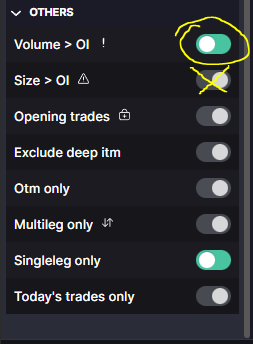

The ones with the exclamation points (for "Volume>Open Interest") were hidden because I had the filter condition for "Size>Open Interest" and it seems that I need to switch it to "Volume>Open Interest" instead for these to show up:

It seems that having both of these switched on, instead of only the circled one, likewise causes the rows with exclamation points to not show up as results.