Focus

Member

It was @tradelex20I don't remember who created the hi_lo_hi column. I did not. Can someone help out with this?

It was @tradelex20I don't remember who created the hi_lo_hi column. I did not. Can someone help out with this?

I don't think I can post where I do things outside of the community or advertise that but I will say I'm not hard to find on Elon Musk's site. I have the same handle everywhere. I don't have a following or anything nor am I trying to build one. I make great trades and just try to help the community advance but you can find me there if you like. I don't post my trades too often but maybe I will if it helps others learn.Nice. I will have to play with it. Is there a way I can follow you and how you post your daily "trade" recaps? Is there a way to get labels on the scan to tell the counts and color for buy/sell? Also, @Trader Raider what you said about the 30m chart is golden. I'm finally getting it now and I hope I can learn more from you guys.

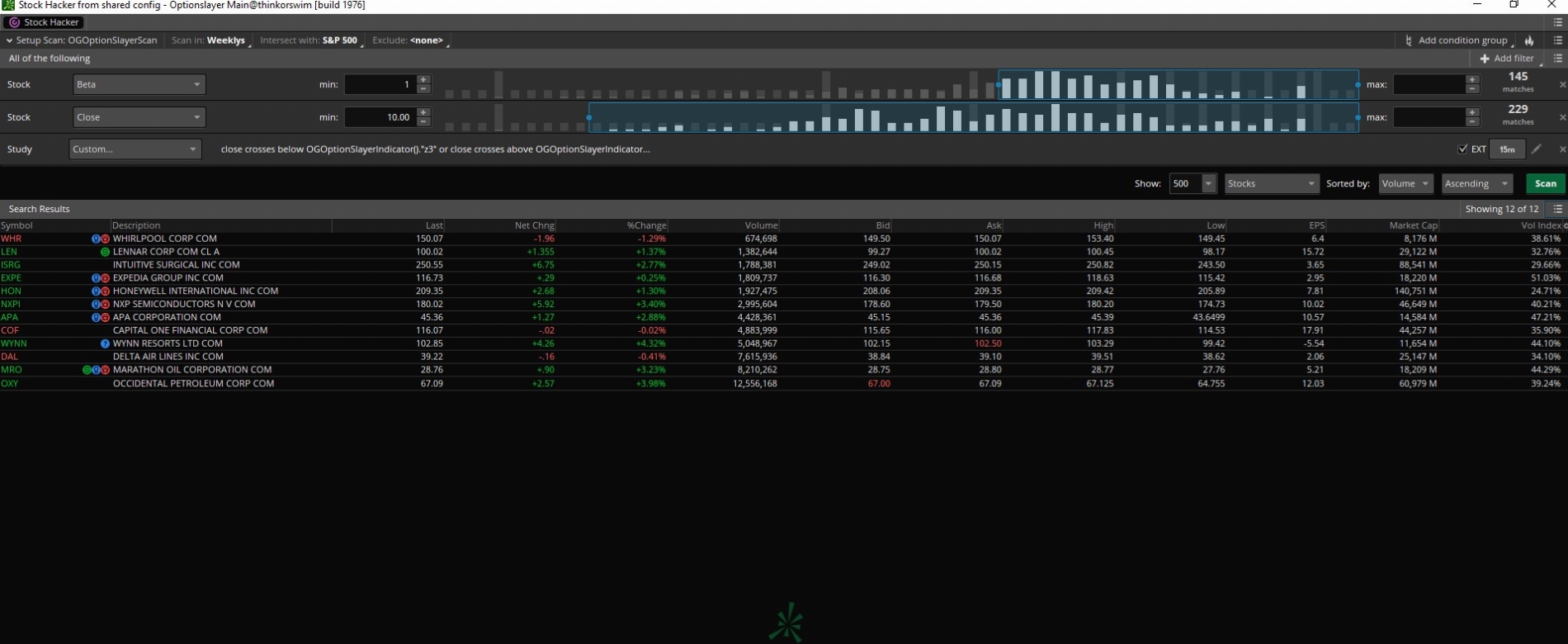

How many bars Do you set the candle counts to on the daily chart to swing trade?What instruments do you trade @Trader Raider? I trade $SPY, most tech stocks, and $SPX. On the 15m and 30m, I rarely get fakeouts and think it could work even without the other areas of confluence. I'm just curious about what instruments you trade on and don't see the results I do, however, I use a lot of confluence as mentioned in my strategy to ensure my entries are on point but still think the indicator works even without the confluence way more often than not.

I've even started to use longer timeframes and have been swinging trades quite successfully using the indicator. For example, I swung $SPX calls yesterday and they literally went to the moon never even getting close to hitting my stop loss.

I use the hourly and I only want to capture the last part of the day. I typically only do this on $SPX as it doesn't trade in extended hours. I'm still testing this strategy and it is very new to me so be cautious. I use this indicator for price action because it's not lagging and I tend to use it only for intraday.How many bars Do you set the candle counts to on the daily chart to swing trade?

I'm focusing on how to use the Price-Action-Momentum at the moment and I want to know how to use it well.I use the hourly and I only want to capture the last part of the day. I typically only do this on $SPX as it doesn't trade in extended hours. I'm still testing this strategy and it is very new to me so be cautious. I use this indicator for price action because it's not lagging and I tend to use it only for intraday.

I'm looking for higher areas of confluence like Squeeze Pro, ema cross over with rejection/support retests prior to getting in a swing. I am also looking at more ema's to ensure that the trend is long-term and confirming on the daily charts that the direction I'm selecting makes sense to swing that way. I don't do swings on most news cycles but I thought PMI would come in good today and luckily I was right and the market reacted positively.

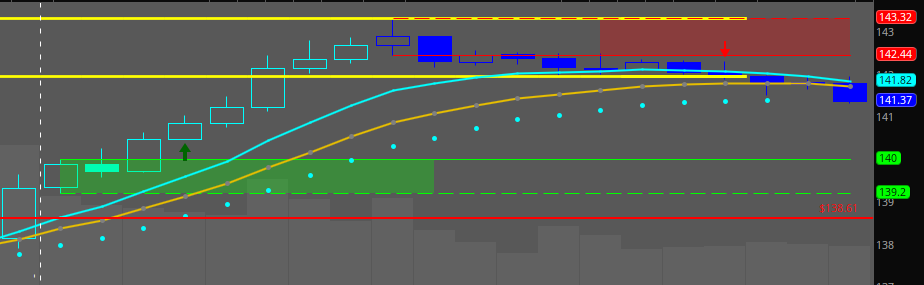

@OGOptionSlayer , do you think more steps are needed on Post51 of this thread?I would say that you missed the area of confluence. You had your ema cross prior to the signal because the bar was so long. You entered a bear market at that time and probably should have gotten in the trade. You don't always get the ema cross prior to the signal firing but you have to consider other areas of confluence when deciding to take the trade. An ema cross as significant as the one that occurred on your chart, then a retest of the ema with subsequent rejection should have been your entry signal and the way I would have traded it.

The strategy is about using confluence. Also, you may be staying in trades too long but everyone's risk management strategy is different.

That cross with what may be your 48 ema rejection first then later the 13 ema rejection second would have been my entry on this trade. I wouldn't have waited for the indicator to give you the signal on this one, however, I would have used the indicator to get out of the trade instead.

That's my two cents and everyone's strategy is different so don't take it as a criticism of yours but this trade is one where I would have been in earlier just due to the high areas of confluence occurring before that signal was generated.

Also, when you have these huge large candle extensions, it's best to avoid the trade if it's the only area of confluence you have. While bears took the market for a brief bit, they had to use a lot of their energy to steal it from the bulls which led to an easy takeback from the bulls, which you reference with the reversal.

Last thing, I trade two different sessions per day and I break during 12 to 1 pm EST. Crazy things can happen during these times. This morning was a strong bear market and the afternoon was an even stronger bull market. Try to take that mentality and understand the market can shift after everyone comes back from lunch so I treat them as two different sessions.

Nope. Seems solid to me. It's that simple. Really it is that simple. I, like @Trader Raider, use the indicator along with other areas of confluence depending on the market I'm in. I have enjoyed using the 13 and 48.5 ema's lately. I also religiously reference Squeeze Pro to stay in trades and understand what the BB's and KC's are doing.@OGOptionSlayer , do you think more steps are needed on Post51 of this thread?

Could you please share ToS link for this chart?This indicator is killer on 15m and 30m timeframes. If you are wondering about what moving averages I'm currently using, I have found the most confluence with 13 ema and 48.5 ema. Also, when combined with a reversal candle and I see movement in relative volume, especially if we are in the 2.0 and higher range, I'm always in that move.

Colombia University tested the best moving averages and found the 13 and 48.5 to be the most accurate when predicting price movement, especially with reversals. I have been using these instead of my 10SMA and 50SMA lately and I'm loving it.

This is the 15m chart that caught a 4 pt move on AAPL. The 30m caught a 5.76 move.

17305[/ATTACH]']

I wouldn't mind making an attempt at a non-repainting version, though it would probably take me a little bit given that I'm not as proficient as halcyonguy and have been rather busy as of late. But yeah I definitely see the appeal of making a version that can actually be backtested as a strategy.I wonder if @Chemmy could design a version that paints a new signal but leaves the old signals in place. That would allow the ability to backtest.

It's really more of what risk am I willing to accept. With 70 deltas, you leave yourself in a much better position than you would with even a 0DTE contract. I have started to play 0dte's more often but with 70 deltas because you aren't getting priced out by premiums. I look at the flow using Unusual Whales and Tradytics. I find both give me a better view than using just one. Unusual Whales has great flow information while Tradytics I use more for analytical information like GEX and Darkpool levels.

So if I'm in a market that has 0dte, I always look at the flow for 0dte because that's where I'm going to see those >$50k OTM contracts being taken that tell me there is a good chance we are going there before the market closes that day. Doesn't always happen but no trade strategy ever produces 100% returns but using flow for directional bias is key.

The reason I say 70 deltas is because you aren't just paying for premium and the contract won't lose value, plus you have a 70% chance of finishing in the money which means you won't lose your entire amount on that play. It's kind of like a built-stop loss where you usually at least prevent yourself from losing the entire amount.

I trade SPX and SPY a ton so I typically am only taking plays 1 or 2 days out. If I swing, I try to swing on Monday's and let it play through until Friday. I don't like holding over the weekend. I use that time for futures.

I think it's key to really prove the efficacy of the actual indicator. When the bar closes and you get the arrow, that's a trade taken.I wouldn't mind making an attempt at a non-repainting version, though it would probably take me a little bit given that I'm not as proficient as halcyonguy and have been rather busy as of late. But yeah I definitely see the appeal of making a version that can actually be backtested as a strategy.

So my filter is 0dte, I hide Equity Type ETF's/ETN's, Premium is set to $50k and above. I also filter Size > OI, Single Leg Only. The reason why is I want pure directional bias. Spreads are saying chop. But if I have a whale that puts in $50k on a directional put or call, and the size of that trade is more than the OI that the trade currently has, then that's strong directional bias in my experience.Hello, you've inspired me to try an Unusual Whales subscription. Thank you for explaining this part of your process. Would you mind elaborating about how you use the platform to filter and interpret flow based on unusual options transaction history? Do you just set up a filter to view OTM contracts with more than $50k sized block purchases or is it more complicated than that?

Also, for this particular use case trading SPY or ES, which pricing plan are you using? I imagine that you need the Tier 3 ("Super Live Buffet") plan since it's the lowest tier that has realtime options flow data available.

Yes, I'm working on it. I have downloaded Loom and recorded a few videos but they weren't related to using the tool as I was just getting comfortable hearing my voice on video. It's more intimidating than I thought lol.I’ve been reading through the thread and I must say I’m very intrigued! Will there be a video walkthrough soon?

Sure here it the indicator link: http://tos.mx/ZMo0dIvCould you please share ToS link for this chart?

Please use the one that I shared here. It's the most latest update and the original code had some bugs that will cause some false signals or missing paints. You can use whatever you like but I always encourage you to use the latest version of the indicator.I’ve copied code from the 2nd or 3rd page of this thread. Is it recommended to use the newest code? Or does an original one still work just as good. They’re both good but I prefer the older one because it look more simple.

@Chemmy is going to work on a solution soon but currently it does not exist. The best way to test this now is to just do some type of market replay and manual backtest it like @Trader Raider did. I would try paper trading with the indicator until you find your areas of confluence you want to use. It's a solid indicator and is not a lagging indicator so that's the reasoning for not keeping old signals.Using V 5.2 I hate to beat a dead horse but is there a way of showing the FIRST time Buy Puts or Calls alerts before painting changes the signals?

Just toying around with strategy and being a visual person not a coder I'm trying to develop an edge and I'm impressed with your layout as part of

that possible edge

Thus far it works well with@Chemmy is going to work on a solution soon but currently it does not exist. The best way to test this now is to just do some type of market replay and manual backtest it like @Trader Raider did. I would try paper trading with the indicator until you find your areas of confluence you want to use. It's a solid indicator and is not a lagging indicator so that's the reasoning for not keeping old signals.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.