You need to change the "strategy hold trend" to NO.Thank you @HODL-Lay-HE-hoo! I will copy your watchlist column. I have another question about Big 4, every time I log in on Tos the colored candles is not working correctly on some charts, I don't know if the indicator can only be open once or not I'm going to share a screen of spy and qqq with Big 4, so you can see the issue with Big 4 (QQQ is not changing the color of the candles). @HODL-Lay-HE-hoo! I'm going to add @TradingNumbers on my post maybe he knows what I need to change on my setup to eliminate the issue with Big 4.

thanks again.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Big Four Chart SetUp For ThinkOrSwim

- Thread starter TradingNumbers

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Good work on those scans 'illbedam'. Was uploading them and noticed that the 1 Hr Dn scan is the same as the 1 Hr Up Scan. Was hoping you could send us the 1 Hr Dn Scan w/n 1 bar.I have 2 main watchlists...one is called "Default" and it probably has about 500+ stocks. Then I have a "Favorites" which has probably half of the stocks from Default. These are filtered out based on volume, open interest, bid/ask spreads, and backtesting to see if the signals would have worked previously. But mostly option spreads...I don't want to trade options that have wide bid/ask and low volume & open interest.

I have created a scan for up/dn signals on the 1 HR pulling from my "favorites." I have also added scans for 1 HR within 6 bars (1day) and 12 bars (2 days). This allows me to go back and see which stocks have confirmed long or short without having to keep up with them every hour. Sometimes you'll get a signal early in the hour but the stock may not confirm if the price doesn't close above Ehlers Distant Coeffeint. So having the scans within 6 & 12 bars will only grab those that have confirmed.

Here are the scans. I'm not sure if these will work. This scan looks for the TMO less than Zero for Up signals and TMO greater than zero for Dn Scans.

You can also change the timeframe to whatever time you want...I also have saved scans for Daily w/n 1 bar, 5 bars (week) and 10 bars (2 weeks). As well as Weekly timeframe.

http://tos.mx/1Tj1J6C - Scan for Big Four Up 1 Hr w/n 1 bar

http://tos.mx/oS8p3Yy - Scan for Big Four Up 1 Hr w/n 6 bars

http://tos.mx/NfMMobv - Scan for Big Four Up 1 Hr w/n 12 bars

http://tos.mx/1Tj1J6C - Scan for Big Four Dn 1 Hr w/n 1 bar

http://tos.mx/i2fL63S - Scan for Big Four Dn 1 Hr w/n 6 bars

http://tos.mx/8rNAA54 - Scan for Big Four Dn 1 Hr w/n 12 bars

http://tos.mx/6XQSLFG - My Favorites Watchlist

I hope this helps.

Thanks

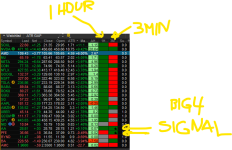

Thanks @illbdam69, I have the big 4 already setup as you mentioned on your past posts (Hold trend NO). I would like to thank you for your scanners, but I'm unable to see them I'm still learning how to active the scanners. I'm testing @HODL-Lay-HE-hoo! watchlist column scan in 1 hour and 3 minutes timeframes without extended hours, so far the color of the cells match what big 4 is showing on the charts (candles color) with theYou need to change the "strategy hold trend" to NO.

Attachments

Last edited:

Also, just to clarify the big seven does not change the strategy of the big four it only changes the way the candles paint however, I did add the extra conditions at one point, but was not necessarily useful so as of now, the big seven only changes the candle color. on top of that the only other difference is I added a second direction statement that is a duplicate of the first one. However, its only purpose was to allow the arrows to be filtered by TMO while the candle painting is not filtered by TMO… which I could’ve accomplished a more efficient way I’m sure. Anyway, all that to say the watchlist column in question I believe may have an indication along with the thumbs up or thumbs down that says alert for which is the Vicks reversal other than that it should be as stated above.Thanks @illbdam69, I have the big 4 already setup as you mentioned on your past posts (Hold trend NO). I would like to thank you for your scanners, but I'm unable to see them I'm still learning how to active the scanners. I'm testing @HODL-Lay-HE-hoo! watchlist column scan in 1 hour and 3 minutes timeframes without extended hours, so far the color of the cells match what big 4 is showing on the charts (candles color) with theshowing the direction of the arrows. I'm going to attach my watchlist with the watchlist column scan.

illbedam69, thanks for your recommendation to use the Mobius SuperTrend along with TheBigFour. I started using that today and it made a big difference in the way I entered trades. I have a couple of questions for you if you have time:I have been using the Big Four with Mobius Supertrend. I have absolutely been killing it the last 4 weeks. I use it on the 1 Hour time frame. I look for Up or Dn signals to confirm on the 1 Hour and then look at the Daily to see if it conforms with the direction...then narrow down to 10, 3, 1 min charts for entries. It has absolutely changed my trading! I don't use any of the stuff from Hodl-Lay only because I don't understand what is going with his charts. But the Original Big Four is simple and it works GREAT! I can also use with ease on the TOS Mobile app. Big Four works on Mobile. So I can make money while at work. I almost always buy the next weeks expiration to give it time to work out. IF the stock has been in a downtrend and you get an UP signal will usually work and vice versa. However, if the stock has been in a range I avoid those. TMO needs to be below zero for calls and above zero for puts. I have had several multi-baggers of 100, 200, 300, 400 & 500%. I have left lots of money on the table also....as I was getting use to the strength of this indicator. I love using it for SPX trades on 3Min and I also put the option strike price in a separate chart and use the big four for the signal on an option about 10-20 strikes away from the price and this has worked tremedously as well. Can usually scalp -$100-$300/day with just a a couple trades per day.

Hope this helps you...I know it has changed my trading life!

Account is up 440% since I began using this indicator on the 1 Hour signals over the last 3-4 weeks.

1) How do you make the decision as to when to exit a trade. I find myself giving way too much money back. Im pretty sure it is because of my greed. If I had a rules based system as to when to exit Im pretty sure I would be m ore profitable.

2) Can you explain a little further how you use the 1 Hr chart for your signals?

Again, thanks very much for your willingness to share with us.

Sounds like he is looking for an arrow on the one hour and making sure the direction of the daily agrees…. then moves to the 3min or 10min to enter / exit the trade only in the direction confirmed by the higher timeframes.illbedam69, thanks for your recommendation to use the Mobius SuperTrend along with TheBigFour. I started using that today and it made a big difference in the way I entered trades. I have a couple of questions for you if you have time:

1) How do you make the decision as to when to exit a trade. I find myself giving way too much money back. Im pretty sure it is because of my greed. If I had a rules based system as to when to exit Im pretty sure I would be m ore profitable.

2) Can you explain a little further how you use the 1 Hr chart for your signals?

Again, thanks very much for your willingness to share with us.

Hey if you are using “the big 7” the light green candles are from triple exhaustion (when exhaustion ends expect a pullback or reversal) the other green colored candles are the normal big 4 conditionsThank you @HODL-Lay-HE-hoo! I will copy your watchlist column. I have another question about Big 4, every time I log in on Tos the colored candles is not working correctly on some charts, I don't know if the indicator can only be open once or not I'm going to share a screen of spy and qqq with Big 4, so you can see the issue with Big 4 (QQQ is not changing the color of the candles). @HODL-Lay-HE-hoo! I'm going to add @TradingNumbers on my post maybe he knows what I need to change on my setup to eliminate the issue with Big 4.

thanks again.

I'm happy the Mobius SuperTrend has helped you. I wish I was the best person for an exit strategy. I am terrible at following exit rules! However with that being said. How far out are your expiration dates? If you are buying 14-28 days out you should have less drawdown. But if I were a strict rule follower I would/should use a 1H candle close of one or two of the following...illbedam69, thanks for your recommendation to use the Mobius SuperTrend along with TheBigFour. I started using that today and it made a big difference in the way I entered trades. I have a couple of questions for you if you have time:

1) How do you make the decision as to when to exit a trade. I find myself giving way too much money back. Im pretty sure it is because of my greed. If I had a rules based system as to when to exit Im pretty sure I would be m ore profitable.

2) Can you explain a little further how you use the 1 Hr chart for your signals?

Again, thanks very much for your willingness to share with us.

1) 1H close below the the SuperTrend

2) 1H close below the Ehler's DCF (34)

3) My proprietary (lol) MACD....ready for it...settings are 21,55,13 (exponential). You'll recognize these are Fib numbers. I started playing around with how to smooth out the MACD several years ago and found these settings work great on all timeframes.

So if you're in a trade and it's working for you....you should be able to hold the trade until MACD (21,55,13) crosses bearish (exit long) bullish (exit short). If you add this MACD and back test I think you'll agree that on trades that lasted several days to several weeks....this was an early indication for closing the trade.

I don't like to enter trades when I get a Big 4 signal if the stock has been range bound. I only like to enter trades on Big 4 signals if the stock has been in downtrend for several days for bullish signals and in an uptrend for bearish signals. I would also check the Daily/Weekly. Then look at a smaller time frame for a more perfect entry.

Another trick I like to use is to copy/paste the options strike price into a separate chart with the same chart setup as the equity. If the options are liquid enough (high volume) it will look just like the equity. I would enter using the same criteria....but use a lower time frame such as 3,5, or 10 Min.

Last edited:

Doesn't the TMO have to be above zero for calls and below for puts?I have been using the Big Four with Mobius Supertrend. I have absolutely been killing it the last 4 weeks. I use it on the 1 Hour time frame. I look for Up or Dn signals to confirm on the 1 Hour and then look at the Daily to see if it conforms with the direction...then narrow down to 10, 3, 1 min charts for entries. It has absolutely changed my trading! I don't use any of the stuff from Hodl-Lay only because I don't understand what is going with his charts. But the Original Big Four is simple and it works GREAT! I can also use with ease on the TOS Mobile app. Big Four works on Mobile. So I can make money while at work. I almost always buy the next weeks expiration to give it time to work out. IF the stock has been in a downtrend and you get an UP signal will usually work and vice versa. However, if the stock has been in a range I avoid those. TMO needs to be below zero for calls and above zero for puts. I have had several multi-baggers of 100, 200, 300, 400 & 500%. I have left lots of money on the table also....as I was getting use to the strength of this indicator. I love using it for SPX trades on 3Min and I also put the option strike price in a separate chart and use the big four for the signal on an option about 10-20 strikes away from the price and this has worked tremedously as well. Can usually scalp -$100-$300/day with just a a couple trades per day.

Hope this helps you...I know it has changed my trading life!

Account is up 440% since I began using this indicator on the 1 Hour signals over the last 3-4 weeks.

Thanks illbedam69!!!I'm happy the Mobius SuperTrend has helped you. I wish I was the best person for an exit strategy. I am terrible at following exit rules! However with that being said. How far out are your expiration dates? If you are buying 14-28 days out you should have less drawdown. But if I were a strict rule follower I would/should use a 1H candle close of one or two of the following...

1) 1H close below the the SuperTrend

2) 1H close below the Ehler's DCF (34)

3) My proprietary (lol) MACD....ready for it...settings are 21,55,13 (exponential). You'll recognize these are Fib numbers. I started playing around with how to smooth out the MACD several years ago and found these settings work great on all timeframes.

So if you're in a trade and it's working for you....you should be able to hold the trade until MACD (21,55,13) crosses bearish (exit long) bullish (exit short). If you add this MACD and back test I think you'll agree that on trades that lasted several days to several weeks....this was an early indication for closing the trade.

I don't like to enter trades when I get a Big 4 signal if the stock has been range bound. I only like to enter trades on Big 4 signals if the stock has been in downtrend for several days for bullish signals and in an uptrend for bearish signals. I would also check the Daily/Weekly. Then look at a smaller time frame for a more perfect entry.

Another trick I like to use is to copy/paste the options strike price into a separate chart with the same chart setup as the equity. If the options are liquid enough (high volume) it will look just like the equity. I would enter using the same criteria....but use a lower time frame such as 3,5, or 10 Min.

Arun85, I believe if you go back and read the rules it is just the opposite regarding TMO. Above zero for Puts and below zero for calls.Doesn't the TMO have to be above zero for calls and below for puts?

Good job on the chart Casey. Do you mind sharing the chart setup? ThanksView attachment 19312

Here is my Chart setup

2 TMO(30,6,6) 1min/3min

50 channel ema (High, Low, Close)

Working on Scalping /ES /MES

Fairly new to trading but this seems to be making sense. Levels predetermined by myself. Scalp when you get a signal and both TMOs are green/red. Hold until level. Entry is on cross of 50ema.

No. Just the opposite. TMO needs to be below zero for calls and above zero for puts.Doesn't the TMO have to be above zero for calls and below for puts?

I still don't get it sir, maybe im missing something. For instance, if u look at NVDAs chart today, 8/28... hourly charts been bearish and TMO was well under 0 since it opened this AM and so was 30 minutes chart. If big4 says bearish, then y would someone buy calls? However, big4 on 10 mins chart was bullish and TMO bounced from green zone at around 454 area and broke above 0 and hit 20 area mark, making it go up to 469, where i think buying calls at around 454 area makes sense. How would u have traded NVDA today based on 1 hr chart....both ways?No. Just the opposite. TMO needs to be below zero for calls and above zero for puts.

I assume this is the latest code for Big4. I tried it today on SPX on 3 min. I bought and exited on marking. End up in small loss. Wondering if I am missing any settings. Market is choppy that can be another reason. Technically at point of exit expected the trend to downward on calendars. Thanks for the indicators there are too many versions and discussions on want to check this is latest and greatestNewest Version v1.5

Here is the latest update. Also added labels.

View attachment 17857

Code:# The Big Four Indicator # https://usethinkscript.com/threads/the-big-four-chart-setup.14711/ # v1.0 - GiantBull and TradingNumbers # v1.1 - TradingNumbers - hiding vertical lines by ddefault and added arrows # v1.2 - TradingNumbers - added TMO # v1.3 - TradingNumbers - hold trend input added # v1.4 - TradingNumbers - simplified options, added filter with TMO, and set conditions per GianBull parameters # v1.5 - TradingNumbers - removed TMO color filter percentChg GiantBull, added labels # Info Labels input showLabels = yes; AddLabel(showLabels, " The Big Four v1.5 ", Color.WHITE); # AK Trend def aktrend_input1 = 3; def aktrend_input2 = 8; def aktrend_price = close; def aktrend_fastmaa = MovAvgExponential(aktrend_price, aktrend_input1); def aktrend_fastmab = MovAvgExponential(aktrend_price, aktrend_input2); def aktrend_bspread = (aktrend_fastmaa - aktrend_fastmab) * 1.001; def cond1_UP = if aktrend_bspread > 0 then 1 else 0; def cond1_DN = if aktrend_bspread <= 0 then -1 else 0; # ZSCORE def zscore_price = close; def zscore_length = 20; def zscore_ZavgLength = 20; def zscore_oneSD = StDev(zscore_price, zscore_length); def zscore_avgClose = SimpleMovingAvg(zscore_price, zscore_length); def zscore_ofoneSD = zscore_oneSD * zscore_price[1]; def zscore_Zscorevalue = ((zscore_price - zscore_avgClose) / zscore_oneSD); def zscore_avgZv = Average(zscore_Zscorevalue, 20); def zscore_Zscore = ((zscore_price - zscore_avgClose) / zscore_oneSD); def zscore_avgZscore = Average(zscore_Zscorevalue, zscore_ZavgLength); def cond2_UP = if zscore_Zscore > 0 then 1 else 0; def cond2_DN = if zscore_Zscore <= 0 then -1 else 0; # Ehlers def ehlers_length = 34; def ehlers_price = (high + low) / 2; def ehlers_coeff = ehlers_length * ehlers_price * ehlers_price - 2 * ehlers_price * Sum(ehlers_price, ehlers_length)[1] + Sum(ehlers_price * ehlers_price, ehlers_length)[1]; def ehlers_Ehlers = Sum(ehlers_coeff * ehlers_price, ehlers_length) / Sum(ehlers_coeff, ehlers_length); def cond3_UP = if close > ehlers_Ehlers then 1 else 0; def cond3_DN = if close <= ehlers_Ehlers then -1 else 0; # Anchored Momentum def amom_src = close; def amom_MomentumPeriod = 10; def amom_SignalPeriod = 8; def amom_SmoothMomentum = no; def amom_SmoothingPeriod = 7; def amom_p = 2 * amom_MomentumPeriod + 1; def amom_t_amom = if amom_SmoothMomentum == yes then ExpAverage(amom_src, amom_SmoothingPeriod) else amom_src; def amom_amom = 100 * ( (amom_t_amom / ( Average(amom_src, amom_p)) - 1)); def amom_amoms = Average(amom_amom, amom_SignalPeriod); def cond4_UP = if amom_amom > 0 then 1 else 0; def cond4_DN = if amom_amom <= 0 then -1 else 0; # TMO def tmo_length = 30; #def 14 def tmo_calcLength = 6; #def 5 def tmo_smoothLength = 6; #def 3 def tmo_data = fold i = 0 to tmo_length with s do s + (if close > GetValue(open, i) then 1 else if close < GetValue(open, i) then - 1 else 0); def tmo_EMA5 = ExpAverage(tmo_data, tmo_calcLength); def tmo_Main = ExpAverage(tmo_EMA5, tmo_smoothLength); def tmo_Signal = ExpAverage(tmo_Main, tmo_smoothLength); def tmo_color = if tmo_Main > tmo_Signal then 1 else -1; def cond5_UP = if tmo_Main <= 0 then 1 else 0; def cond5_DN = if tmo_Main >= 0 then -1 else 0; # Strategy input Strategy_Confirmation_Factor = 4; input Strategy_FilterWithTMO = no; input Strategy_ColoredCandlesOn = yes; input Strategy_VerticalLinesOn = no; input Strategy_HoldTrend = yes; def cond_UP = cond1_UP + cond2_UP + cond3_UP + cond4_UP; def cond_DN = cond1_DN + cond2_DN + cond3_DN + cond4_DN; def direction = if cond_UP >= Strategy_Confirmation_Factor and (!Strategy_FilterWithTMO or cond5_UP) then 1 else if cond_DN <= -Strategy_Confirmation_Factor and (!Strategy_FilterWithTMO or cond5_DN) then -1 else if !Strategy_HoldTrend and direction[1] == 1 and cond_UP < Strategy_Confirmation_Factor and cond_DN > -Strategy_Confirmation_Factor then 0 else if !Strategy_HoldTrend and direction[1] == -1 and cond_DN > -Strategy_Confirmation_Factor and cond_UP < Strategy_Confirmation_Factor then 0 else direction[1]; plot signal_up = direction == 1 and direction[1] < 1; signal_up.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); signal_up.SetDefaultColor(Color.WHITE); signal_up.Hide(); signal_up.HideBubble(); signal_up.HideTitle(); plot signal_dn = direction == -1 and direction[1] > -1; signal_dn.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); signal_dn.SetDefaultColor(Color.WHITE); signal_dn.Hide(); signal_dn.HideBubble(); signal_dn.HideTitle(); AssignPriceColor(if Strategy_ColoredCandlesOn then if direction == 1 then Color.LIGHT_GREEN else if direction == -1 then Color.RED else Color.GRAY else Color.CURRENT); AddLabel(showLabels, if Strategy_ColoredCandlesOn then if direction == 1 then " Bullish " else if direction == -1 then " Bearish " else " Neutral " else " N/A ", if Strategy_ColoredCandlesOn then if direction == 1 then Color.LIGHT_GREEN else if direction == -1 then Color.RED else Color.GRAY else Color.BLACK); AddVerticalLine(Strategy_VerticalLinesOn and signal_up, "Buy", Color.LIGHT_GREEN); AddVerticalLine(Strategy_VerticalLinesOn and signal_dn, "Sell", Color.RED); Alert(signal_up[1], "Buy", Alert.BAR, Sound.DING); Alert(signal_dn[1], "Sell", Alert.BAR, Sound.DING);

Attachments

rmyree2020

New member

Hello @AspaTrader. Is the channel on the left chart a premium indicator?AXP is something I am eyeing with the strategy! I was waiting for the breakout on 1HR and the resistance break on 30 minutes.

View attachment 19356

Hey @HODL-Lay-HE-hoo! Is there Info on how to trade Bull_Bear_Last_Stand chart?@jrock8903 - I added Vix Alert 4 to the Big four the study with the levels (C3_Max_Spark) contains the Triple_Exhaustion indication (dots) and can be turned off. Also included a less involved version with the Bull Bear Last Stand levels study. (no repaint)

Style with studies (with C3_Max_Spark): http://tos.mx/oCvX58m

/ES

View attachment 18261

SPY (AH off)

View attachment 18262

Style with studies (with Bull_Bear_Last_Stand): http://tos.mx/UvSjhZX

Last Stand Levels

View attachment 18263

Last edited by a moderator:

NVDA confirmed long on the 1H on 8/29 on the 9:30-10:30 candle having extended hours session OFF. It confirmed bullish on 8/28 on 1:00-2:00 candle with extended hours ON. Both of these signals TMO was below zero. Of course in hindsight the extended hours ON worked great as you would have bought the options with the stock at 465. With Ext hrs OFF around 481. Both entries would have worked as the stock is at 493. And went as high as 498.I still don't get it sir, maybe im missing something. For instance, if u look at NVDAs chart today, 8/28... hourly charts been bearish and TMO was well under 0 since it opened this AM and so was 30 minutes chart. If big4 says bearish, then y would someone buy calls? However, big4 on 10 mins chart was bullish and TMO bounced from green zone at around 454 area and broke above 0 and hit 20 area mark, making it go up to 469, where i think buying calls at around 454 area makes sense. How would u have traded NVDA today based on 1 hr chart....both ways?

I personally leave extended hours OFF on my 1H charts.

Attachments

danjoh

Member

Thank you all for these contributions. However, after spending a considerable amount of time reading through this, I have no idea where to find the final product of this beautiful collaboration. Who hid the script? There are several in process and I am most likely a blind man. Help!

here you go: https://usethinkscript.com/threads/day-trading-with-pivots-for-thinkorswim.7943/post-75972Hello @AspaTrader. Is the channel on the left chart a premium indicator?

Hey @HODL-Lay-HE-hoo! Is there Info on how to trade Bull_Bear_Last_Stand chart?

- Status

- Not open for further replies.

Similar threads

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 141

-

Repaints AGAIG Visual Options Trading Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 63

-

Repaints AGAIG High Profit Options Trading Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 37

-

Repaints AGAIG Stars Aligned Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 23

-

Repaints AGAIG The Trading Edge Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 9

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

999

Online

Similar threads

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 141

-

Repaints AGAIG Visual Options Trading Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 63

-

Repaints AGAIG High Profit Options Trading Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 37

-

Repaints AGAIG Stars Aligned Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 23

-

Repaints AGAIG The Trading Edge Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 9

Similar threads

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 141

-

Repaints AGAIG Visual Options Trading Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 63

-

Repaints AGAIG High Profit Options Trading Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 37

-

Repaints AGAIG Stars Aligned Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 23

-

Repaints AGAIG The Trading Edge Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 9

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.