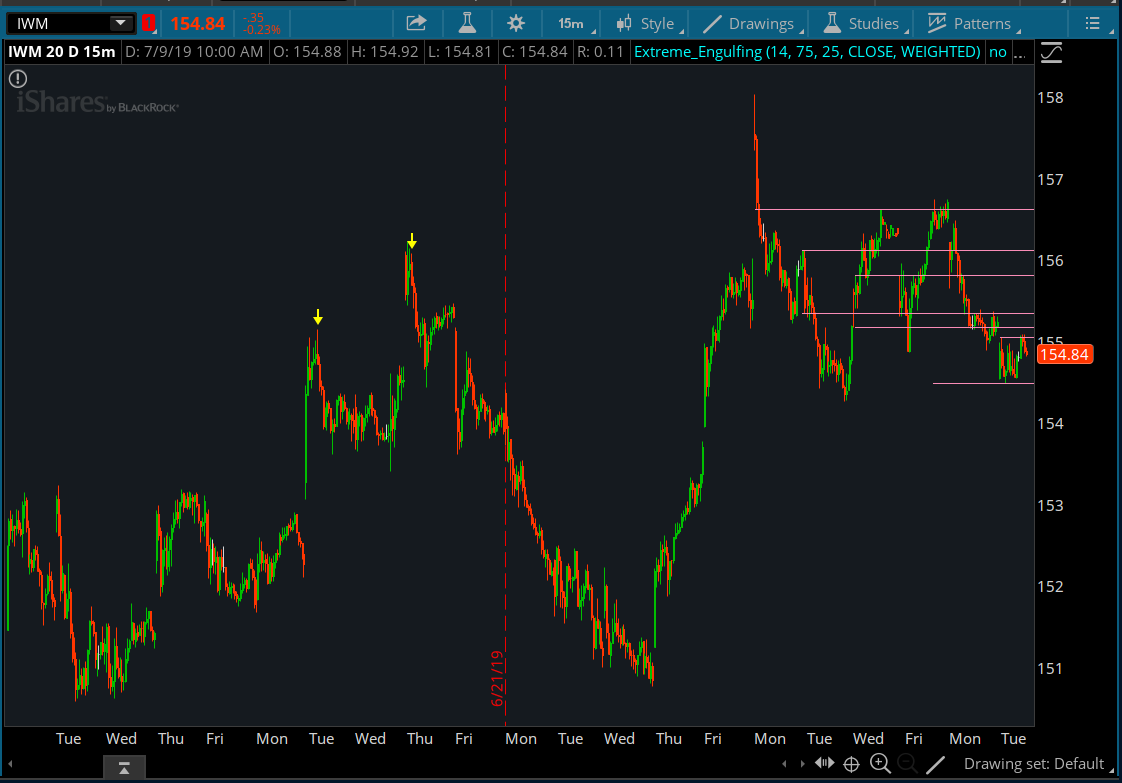

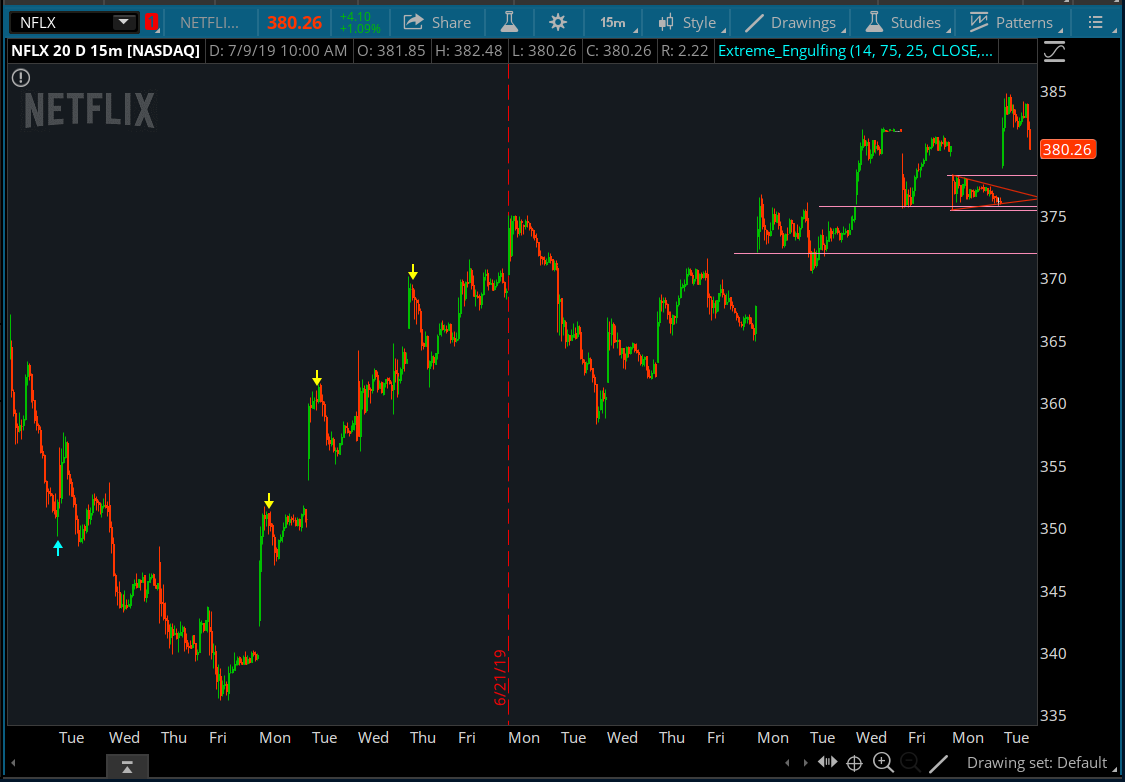

The Engulfing candlestick is considered to be a reliable pattern for reversal trading. This indicator will give you a buy and sell signal based on the Engulfing pattern combining with the RSI (Relative Strength Index) indicator.

When a bullish or bearish Engulfing candle is identified we also look at the Overbought and Oversold levels. If they match up then a signal is alerted.

When a bullish or bearish Engulfing candle is identified we also look at the Overbought and Oversold levels. If they match up then a signal is alerted.

- Buy signal: Bullish Engulfing Candlestick is detected while the RSI is below 25 (extremely oversold level) then we get a sense that a bullish reversal may happen here.

- Sell signal: The same goes for bearish Engulfing candles. It has to be detected while the RSI is in extreme overbought level (75 and over).

thinkScript Code

Code:

# Bullish/ Bearish Engulfing Alerts (Oversold/ Overbought)

# Use with caution and in context of market.

# Make sure to adjust settings that fits you best.

# By Confluence Capital Group @ConfluenceCptl - 2017-12-04

# Addendum & thanks from @M0101X

input length = 14;

input over_Bought = 75;

input over_Sold = 25;

input price = close;

input averageType = AverageType.WEIGHTED;

#defining engulfing bars

def BodyMax = Max(open, close);

def BodyMin = Min(open, close);

def IsEngulfing = BodyMax > BodyMax[1] and

BodyMin < BodyMin[1];

#defining the bullish / bearish signals

def bullish_signal = RSI(length = length, averageType = averageType) < over_Sold and Isengulfing and close > open;

def bearish_signal = RSI(length = length, averageType = averageType) > over_Bought and Isengulfing and close < open;

#plotting the bullish / bearish signals

plot bullish = bullish_signal;

bullish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

bullish.SetDefaultColor(Color.CYAN);

bullish.SetLineWeight(2);

plot bearish = bearish_signal;

bearish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

bearish.SetDefaultColor(Color.YELLOW);

bearish.SetLineWeight(2);