# https://www.tradingview.com/v/sfV6H5h5/

#//@KivancOzbilgic

#indicator('SuperTrended Moving Averages', 'ST MA', overlay=true,

#Converted by Sam4Cok@Samer800 - 11/2023

input maType = {SMA,default EMA, SMMA, WMA, VWMA,DEMA, TEMA, ZLSMA, ZLDEMA, ZLTEMA, McGinley, HMA};

input sourceType = {"High/Low",Default "Custom"};

input customSource = FundamentalType.HL2;

input maLength = 100; # " Length MA"

input changeATR = yes;

input atrLength = 10; # " Length Atr"

input atrMultiplier = 0.5; # "Band Mult"

input ShowCloud = yes;

input showsignals = yes;

def na = Double.NaN;

def avPlot = ohlc4;

def custom = sourceType==sourceType."Custom";

def src = Fundamental(FundamentalType = customSource);

#// ] -------------- FUNCTIONS : Moving Avg ------------------ [

#export zlSma(float src, simple int len) =>

script zlSma {

input src = close;

input len = 14;

def lsma = Inertia(src, len);

def lsma2 = Inertia(lsma, len);

def eq = lsma - lsma2;

def zlsma = lsma + eq;

plot return = zlsma;

}

#export zlDema(float src, simple int len) =>

script zlDema {

input src = close;

input len = 14;

def zdema1 = ExpAverage(src, len);

def zdema2 = ExpAverage(zdema1, len);

def dema1 = 2 * zdema1 - zdema2;

def zdema12 = ExpAverage(dema1, len);

def zdema22 = ExpAverage(zdema12, len);

def zldema = 2 * zdema12 - zdema22;

plot return = zldema;

}

#export zlTema(float src, simple int len) =>

script zlTema {

input src = close;

input len = 14;

def ema1 = ExpAverage(src, len);

def ema2 = ExpAverage(ema1, len);

def ema3 = ExpAverage(ema2, len);

def tema1 = 3 * (ema1 - ema2) + ema3;

def ema1a = ExpAverage(tema1, len);

def ema2a = ExpAverage(ema1a, len);

def ema3a = ExpAverage(ema2a, len);

def zltema = 3 * (ema1a - ema2a) + ema3a;

plot return = zltema;

}

#export mcginley(float src, simple int len)=>

script mcginley {

input src = close;

input len = 14;

def mg;

def t = ExpAverage(src, len);

mg = if IsNaN(mg[1]) then t else

CompoundValue(1 ,mg[1] + (src - mg[1]) / (len * Power(src / mg[1], 4)),src);

plot return = mg;

}

#vwma(source, length)

script VWMA {

input src = close;

input len = 15;

def v = volume;

def VWMA = SimpleMovingAvg(src * v, len) / SimpleMovingAvg(v, len);

plot result = VWMA;

}

#export multiMa(float source, simple int length, string type) =>

script multiMa {

input source = close;

input length = 14;

input type = "SMA";

def multiMa =

if type == "SMA" then SimpleMovingAvg(source, length) else

if type == "EMA" then ExpAverage(source, length) else

if type == "SMMA" then WildersAverage(source, length) else

if type == "WMA" then WMA(source, length) else

if type == "VWMA" then vwma(source, length) else

if type == "DEMA" then DEMA(source, length) else

if type == "TEMA" then TEMA(source, length) else

if type == "ZLSMA" then zlSma(source, length) else

if type == "ZLDEMA" then zlDema(source, length) else

if type == "ZLTEMA" then zlTema(source, length) else

if type == "McGinley" then mcginley(source, length) else

if type == "HMA" then HullMovingAvg(source, length ) else ExpAverage(source, length);

plot return = multiMa;

}

#Supertrend(lenAtr, lenMas, mult, highP, lowP, closeP) =>

Script Supertrend {

input maUp = high;

input maDn = low;

input atrLength = 14;

input mult = 2;

input changeATR = yes;

def tr = TrueRange(high, close, low);

def nATR = if changeATR then ATR(Length = atrLength) else SimpleMovingAvg(tr, atrLength);

def up = maDn - mult * nATR;

def dn = maUp + mult * nATR;

def lower;

def upper;

def up1 = if upper[1] then upper[1] else up;

def dn1 = if lower[1] then lower[1] else dn;

upper = if (close[1] > up1) then max(up, up1) else up;# else up1;

lower = if (close[1] < dn1) then min(dn, dn1) else dn;# else dn1;

def trend;# = na

if (!upper or !lower) {

trend = 1;

} else

if trend[1] == -1 and close > dn1 {

trend = 1;

} else if trend[1] == 1 and close < up1 {

trend = -1;

} else {

trend = if trend[1] then trend[1] else 1;

}

def superTrend = if trend == -1 then lower else upper;

plot ST = superTrend;

plot dir = trend;

}

def maUp = multiMa(if custom then src else high, maLength, maType);

def maDn = multiMa(if custom then src else low, maLength, maType);

def ST = Supertrend(maUp, maDn, atrLength, atrMultiplier,changeATR).ST;

def Trend = Supertrend(maUp, maDn, atrLength, atrMultiplier,changeATR).DIR;

def buySignal = trend == 1 and trend[1] == -1;

def sellSignal = trend == -1 and trend[1] == 1;

#-- plts

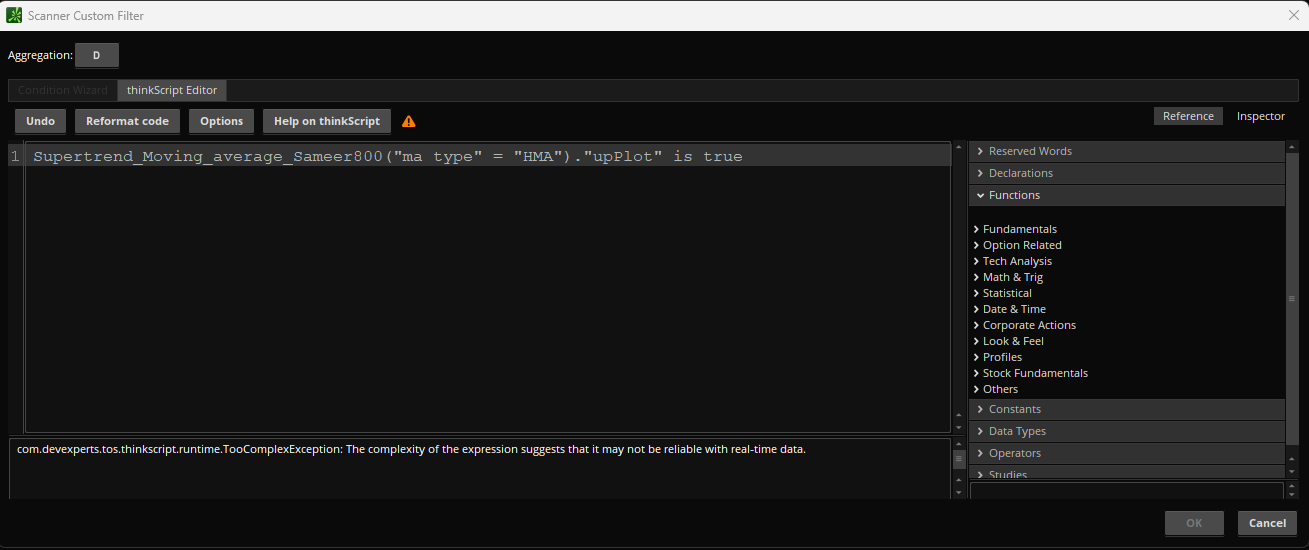

plot upPlot = if Trend > 0 then ST else na; # 'Up Band'

upPlot.SetDefaultColor(CreateColor(76,175,80));

plot loPlot = if Trend > 0 then na else ST; # 'Low Band'

loPlot.SetDefaultColor(CreateColor(255,82,82));

#-- Signals and Cloud

AddChartBubble(showsignals and buySignal, ST, "B", Color.GREEN, no);

AddChartBubble(showsignals and sellSignal, ST, "S", Color.RED);

AddCloud(if ShowCloud then avPlot else na, upPlot, CreateColor(0,35,0)); # 'Upper Area'

AddCloud(if ShowCloud then loPlot else na, avPlot, CreateColor(55,0,0)); # 'Lower Area'

#--- END CODE