You should upgrade or use an alternative browser.

Supertrend CCI ATR in 1 Plot For Mobile For ThinkOrSwim

- Thread starter leakywaders

- Start date

-

- Tags

- trend

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

hguru

ST_SuperTrend_CCI_ATR_Combo https://tos.mx/RKdoB7q

Thanks

Hguru

I have it set up on a 5 min with a 15 min and 30 min single chart but it can be set up for any combo Daily Weekly Monthly or 10,20,30 or 15 30,1 hour for example just set the agg in the study. the settings are the same in all which I like but if you find better ones that work for you please share .

The only thing missing that might help is a label for the spread of each ST CCI range area moving in real time to see if range area is spreading or coming together till it flips. if anyone has code for this please pass it along, thanks

Remember these study's and settings for a MTF must be on the same or higher time frame to show up

To show a 5 min 15 min and 30 min

Use one study of this...on the 5 min chart

SuperTrend_CCI_ATR_Base https://tos.mx/PvHT4Ag

Use two studies of this and change the aggs one for 15 min and one for 30 min or whatever you want,

SuperTrend_CCI_ATR_HigherAgg https://tos.mx/Ec6NYXN

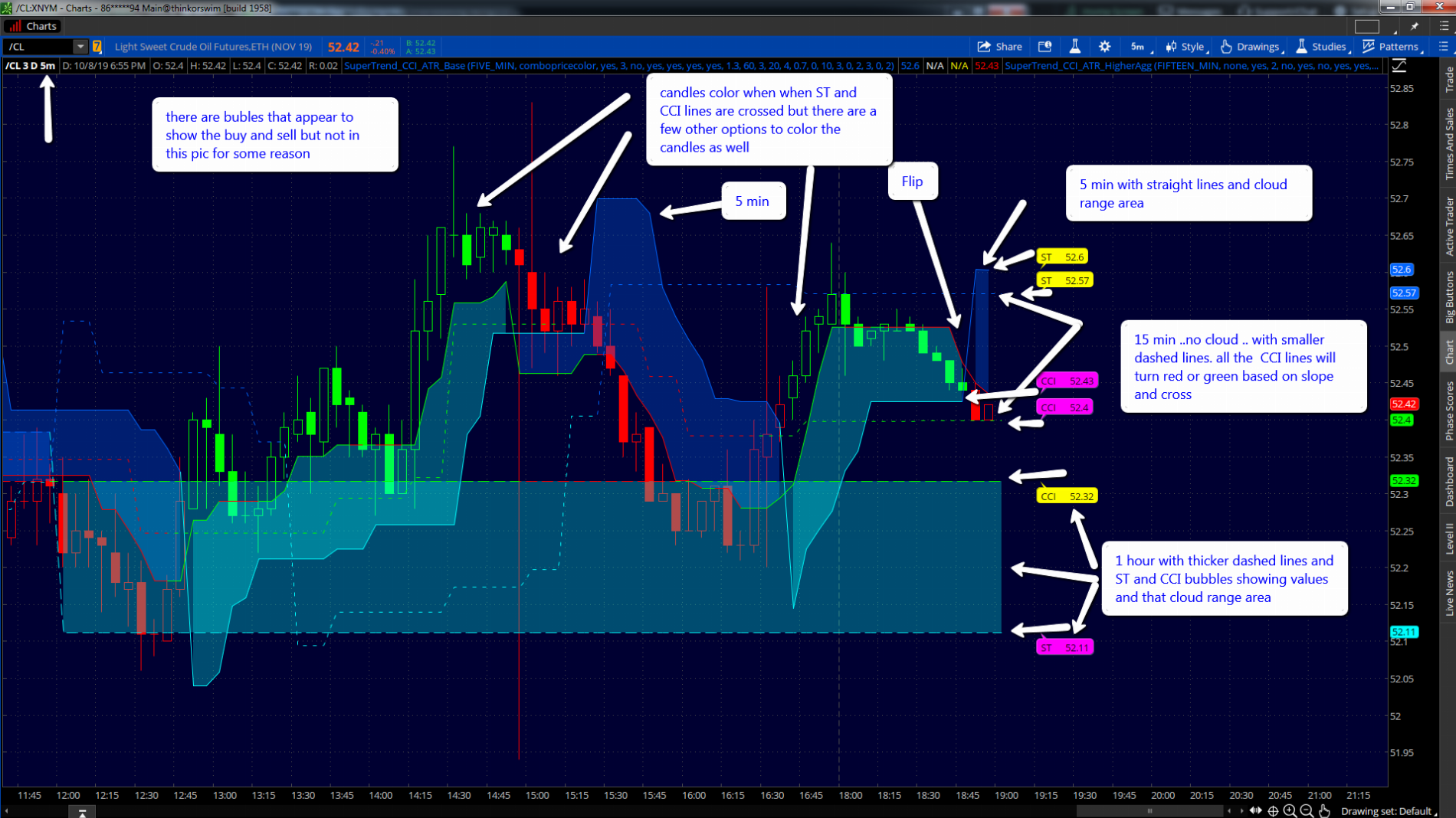

Leakywaders... Great minds must think alike as I created a ST_SuperTrend_CCI_ATR_Combo as well with the help of a friend (the ST in the name) using Mobius's SuperTrend and CCI ATR as well and I shared it in the TSL room in Feb because I used Mobius's studies to create them and wanted to show him. Your code does look different and the study looks different so I am going to share my study here for you and all others to check out. Mine creates a cloud range area and has a bunch of other labels ,bubbles, color candle options and other bells and whistles with on off toggles to make it look any way others want to see it and use it. The settings are a little different too so check it out and tell me what you all think.

ST_SuperTrend_CCI_ATR_Combo https://tos.mx/RKdoB7q

Thanks

Hguru

thanks for sharing! - pretty nice Hguru

Here is the MTF version put together by LB/ZZZ/BLT .....It take 2 versions and 3 studies to create the MTF. there is a difference with the CCI value in the bubbles in these studies vs the stand alone version above that I shared first as he changed something but I do not know what. Read the info in the Base header for info and instructions

I have it set up on a 5 min with a 15 min and 30 min single chart but it can be set up for any combo Daily Weekly Monthly or 10,20,30 or 15 30,1 hour for example just set the agg in the study. the settings are the same in all which I like but if you find better ones that work for you please share .

The only thing missing that might help is a label for the spread of each ST CCI range area moving in real time to see if range area is spreading or coming together till it flips. if anyone has code for this please pass it along, thanks

Remember these study's and settings for a MTF must be on the same or higher time frame to show up

To show a 5 min 15 min and 30 min

Use one study of this...on the 5 min chart

SuperTrend_CCI_ATR_Base https://tos.mx/PvHT4Ag

Use two studies of this and change the aggs one for 15 min and one for 30 min or whatever you want,

SuperTrend_CCI_ATR_HigherAgg https://tos.mx/Ec6NYXN

this is great Hguru, perhaps you should do a video or a tutorial showing on how you trade this strategy. super nice work!

"Ok try this one based on CCI and ATR. Do not understand TradingView code so just kind of speculating if it is doing exactly the same thing.

Watch out for aggregation period, it must be higher than chart period or it will not plot. You can change other settings to your liking. Initially set to CCI length of 50. https://tos.mx/WzND7F "

Amazing work. Thank you for sharing!this is the CL 5 min chart with the 15 min and 1 hour SuperTrend CCI ATR MTF set up read the notations in the study

Here is the MTF version put together by LB/ZZZ/BLT .....It take 2 versions and 3 studies to create the MTF. there is a difference with the CCI value in the bubbles in these studies vs the stand alone version above that I shared first as he changed something but I do not know what. Read the info in the Base header for info and instructions

I have it set up on a 5 min with a 15 min and 30 min single chart but it can be set up for any combo Daily Weekly Monthly or 10,20,30 or 15 30,1 hour for example just set the agg in the study. the settings are the same in all which I like but if you find better ones that work for you please share .

The only thing missing that might help is a label for the spread of each ST CCI range area moving in real time to see if range area is spreading or coming together till it flips. if anyone has code for this please pass it along, thanks

Remember these study's and settings for a MTF must be on the same or higher time frame to show up

To show a 5 min 15 min and 30 min

Use one study of this...on the 5 min chart

SuperTrend_CCI_ATR_Base https://tos.mx/PvHT4Ag

Use two studies of this and change the aggs one for 15 min and one for 30 min or whatever you want,

SuperTrend_CCI_ATR_HigherAgg https://tos.mx/Ec6NYXN

@Hguru - These seem to re-paint from my observations of /CL, /ES, /NG and a few other futures today using combo price color. Have not looked at the other bar settings. Not that re-painting is good or bad but should be aware of the potential.

@Hguru - These seem to re-paint from my observations of /CL, /ES, /NG and a few other futures today using combo price color. Have not looked at the other bar settings. Not that re-painting is good or bad but should be aware of the potential.

Yeah it repaints and reason is because it uses higher aggregation and puts arrow on lower aggregation. So if the setup on higher aggregation disappear - arrow will disappear.

Its reason things like entryshort=high(agg=higher) looks so good in the past (perfect entries and exits). You totally right - not a bad thing in itself but must be aware. This thing got me more than a few times .

The key thing is to watch the S/R areas of the CCI and ST and the lines, I find them to be very helpful as where price might go and hold and bounce to show support, The CCI line is a strong line and even though price might go into the cloud until both the cci and st lines cross you pretty much have to follow the direction but like every study you have to get a feel for it and use others indicators you trust to make your trading decisions.Yeah it repaints and reason is because it uses higher aggregation and puts arrow on lower aggregation. So if the setup on higher aggregation disappear - arrow will disappear.

Its reason things like entryshort=high(agg=higher) looks so good in the past (perfect entries and exits). You totally right - not a bad thing in itself but must be aware. This thing got me more than a few times .

I am a Multiple Signal Approach with a Multiple Time Frame type of guy,

Thank You @Hguru and @skynetgen for the reply. I understand - just wanted others to understand that there was re-paint possibility.The key thing is to watch the S/R areas of the CCI and ST and the lines, I find them to be very helpful as where price might go and hold and bounce to show support, The CCI line is a strong line and even though price might go into the cloud until both the cci and st lines cross you pretty much have to follow the direction but like every study you have to get a feel for it and use others indicators you trust to make your trading decisions.

I am a Multiple Signal Approach with a Multiple Time Frame type of guy,

I am beginning to really enjoy using this indicator and with it Im using TMO, VOL, and MACD. I’m better able to catch the highs and lows.Nicely done!

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| T | SuperTrend CCI ATR Trend for ThinkorSwim | Indicators | 63 | |

|

|

Q-Trend, QQE, SuperTrend strategy for ThinkOrSwim | Indicators | 24 | |

|

|

Smart Supertrend For ThinkOrSwim | Indicators | 13 | |

| M | SuperTrend Oscillator [LUX] For ThinkOrSwim | Indicators | 6 | |

| B | SuperTrend TradingView Look-A-Like For ThinkOrSwim | Indicators | 69 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

Similar threads

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/