@a1cturner I have extended your idea to a scan in a very simple easy to follow steps. Can you take a look and make sure I haven't screwed it up

I was able to make a scan out of this strategy to scan for the "Get Ready" yellow/golden candles. You can follow steps below to create one. Use at your own risk/discretion.

1. Copy the code of the

Strategy and save as a

Study.

2.

Replace the following

#GET READY

def GetReadyBull = TradingDay and BothEMASBullish and PreMarketBull;

def GetReadyBear = TradingDay and BothEMASBearish and PreMarketBear;

WITH

#GET READY

plot GetReadyBull = TradingDay and BothEMASBullish and PreMarketBull;

GetReadyBull.Hide();

plot GetReadyBear = TradingDay and BothEMASBearish and PreMarketBear;

GetReadyBear.Hide();

plot GetReady = GetReadyBull or GetreadyBear;

GetReady.Hide();

3. Delete everything

starting from the following and below.

Doing this to keep the code small otherwise TOS starts complaining about complex scripts.....

##################################################################

# ADDED FAST EMA PCT HERE BASED OFF BUY SIGNAL #

##################################################################

4. Save the study.

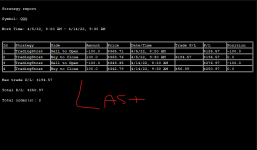

5. Create a scan using this updated study. You will be able to scan for Get Ready for Bullish action or Bearish action or general get ready and you can then look at the strategy chart to figure out if it is a bullish action or bearish....

Be forewarned, I am not a programmer and this study may not be usable by itself. I have set it up in the above manner so I can scan for the "Get Ready" signal. So, once again, this is what I did, use at your own discretion,

Hope this helps someone out there