Numajavier69

New member

Hi @a1cturner , could try TTM_SQUEEZE instead MACD ?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

On your shared file links, I could not get them to open ?Current Version 10.4 - 05/31/2022

Strategy Link: http://tos.mx/P3mxTl4 (Click Setup, Open Shared Item, Paste the Link)

Alternatively, to use the strategy code below (not the link above) click on the charts tab, studies button, edit studies, strategies tab, create, copy and paste the first code in and change the name at the top to your liking, click ok. Make sure to follow the rules on the first post regarding time frame, extended hours etc.

Watchlist Indicator: http://tos.mx/KDtke7m (Click Setup, Open Shared Item, Paste the Link)

For the watchlist custom indicator (again, the code is below not the link above) click the gear icon on your watchlist, customize, type in “custom”, click the small scroll looking icon to the left of an unused custom study, paste the second code in and change the name to your liking (something short), change the “D” to “5m” and check extended hours, click ok.

Flexible Grid Link: http://tos.mx/duZrCez

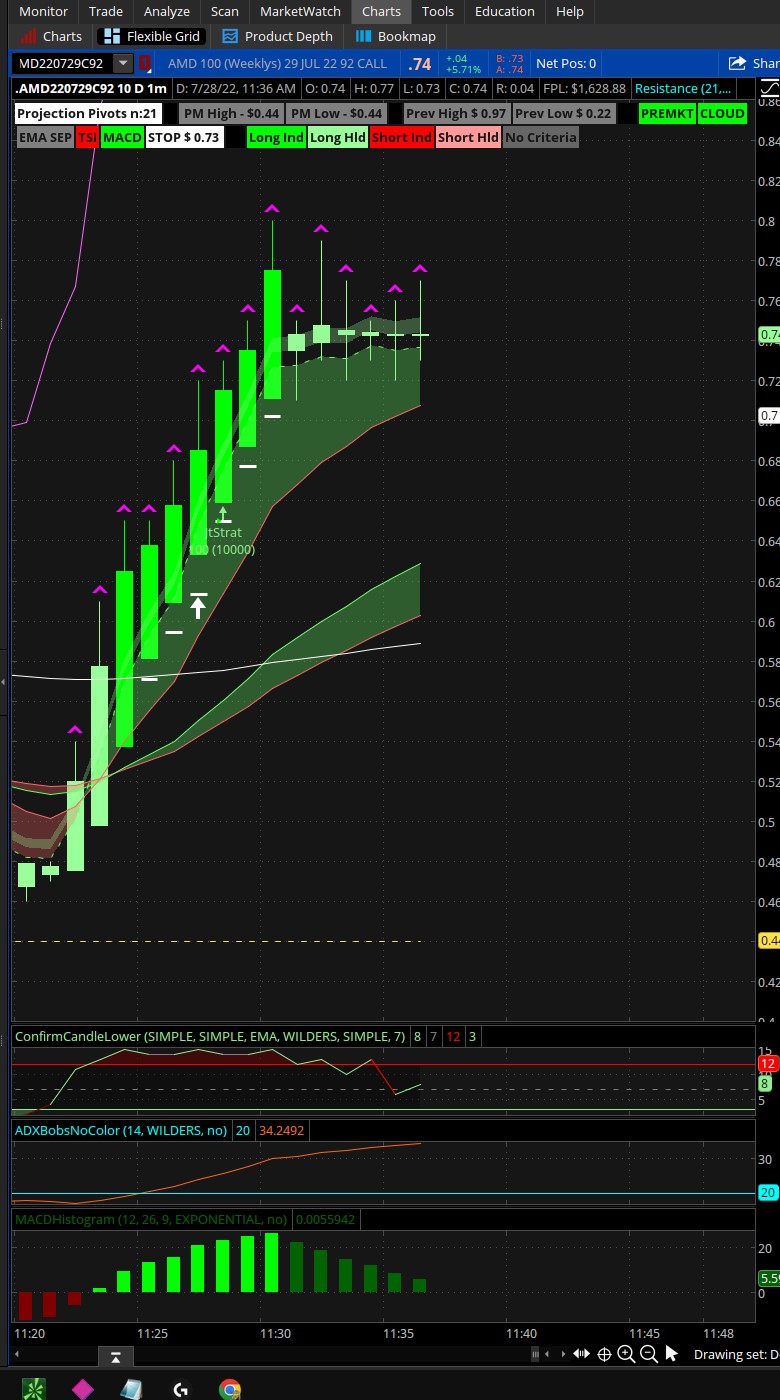

This is just the preview. More detailed instructions below.

I WILL ADD ALL UPDATES HERE! This strategy is changing and I don’t want to confuse anyone with comments from previous versions in the post below!!!

This is months of trial and error with different strategies and indicators. This is what I have found that works best as of today. I am continually updating this strategy to refine it and/or find better entries and exits. All updates will be posted here on Post #1.

This strategy USES two EMAs (5EMA, 12EMA), MACD, TSI, and Pre-Market High/Low. The EMAs are arranged in a cloud (5EMA / 12EMA). This strategy also INCLUDES but does not USE the 34EMA, 50EMA, and Yesterdays High/Low. These can be turned on and off to your liking.

The triggers I am using are:

Again, subject to change.

- Buy Signal only between 8:35 A.M. CST until 2:00 P.M. CST (This can be changed to fit your needs)

- EMAs Bullish (5EMA>12EMA) or EMAs Bearish (5EMA<12EMA)

- MACD Trending Up or MACD Trending Down

- TSI >10 and trending up or TSI <-10 and trending down

- Low > the Pre-Market High or High < the Pre-Market Low

Of note, I use this for options so the wording I use in the strategy is geared towards that.

Candle colors can be changed using the gear icon, scrolling to the very bottom and changing the "globals" settings.

- Gray Candles - Criteria Not Met

- Red Candle - Put Buy or Sell to Open (Short) (Entry is on the 5EMA or When you get the Buy Bubble)

- Light Red Candle - Put Hold or Short Hold

- Green Candle - Call Buy or Buy to Open (Long) (Entry is on 5EMA or when you get the Buy Bubble)

- Light Green Candle - Call Hold or Long Hold

Very basic instructions...

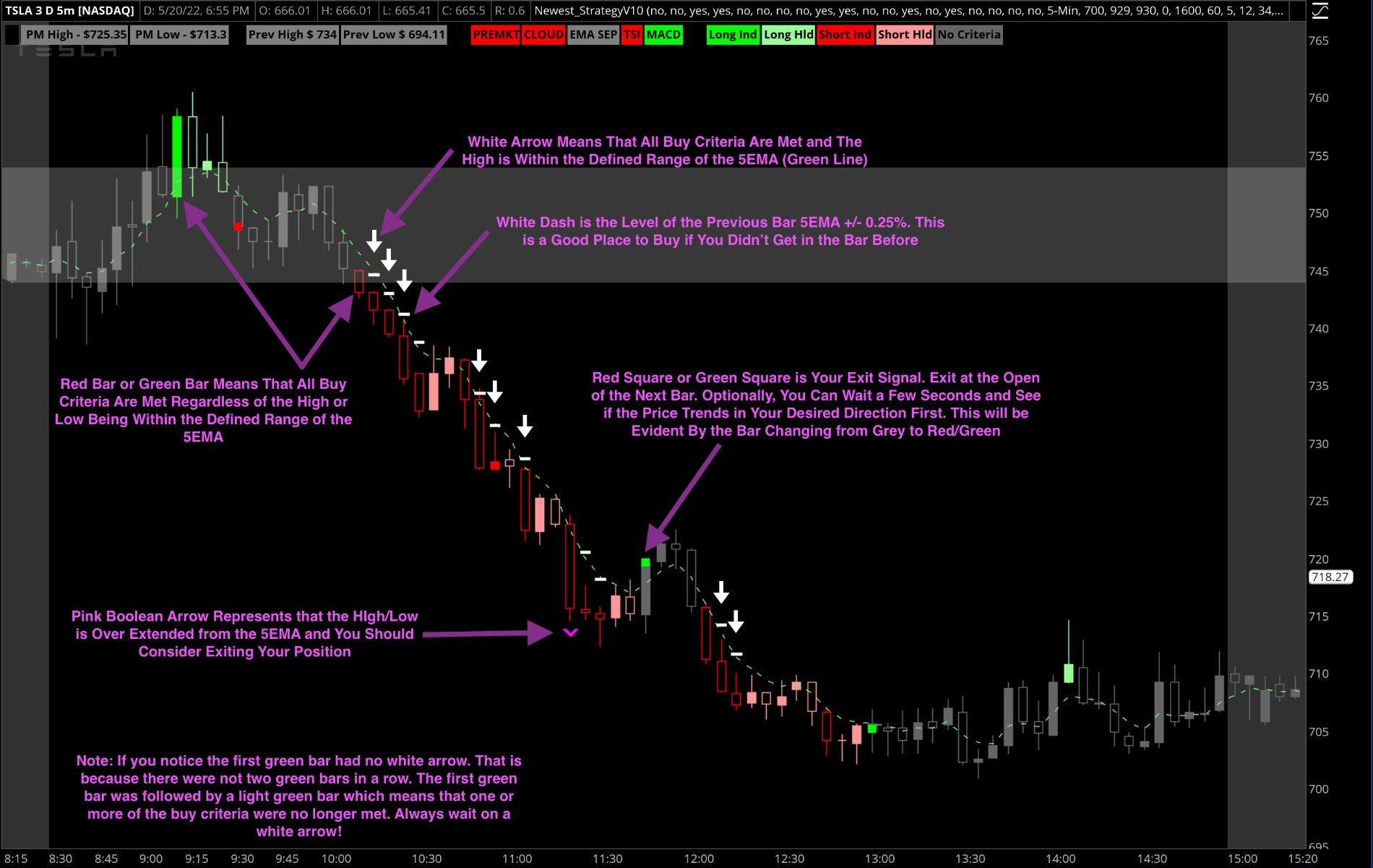

The difference in my trading waiting on that 5EMA entry was a game changer. In options, if I rushed into a trade that gave me a buy signal before it came back to the 5EMA I might be down 50% within seconds before maybe recovering. However, if I wait on that 5 EMA entry I may never be down or at worst 15%-20% before becoming profitable.

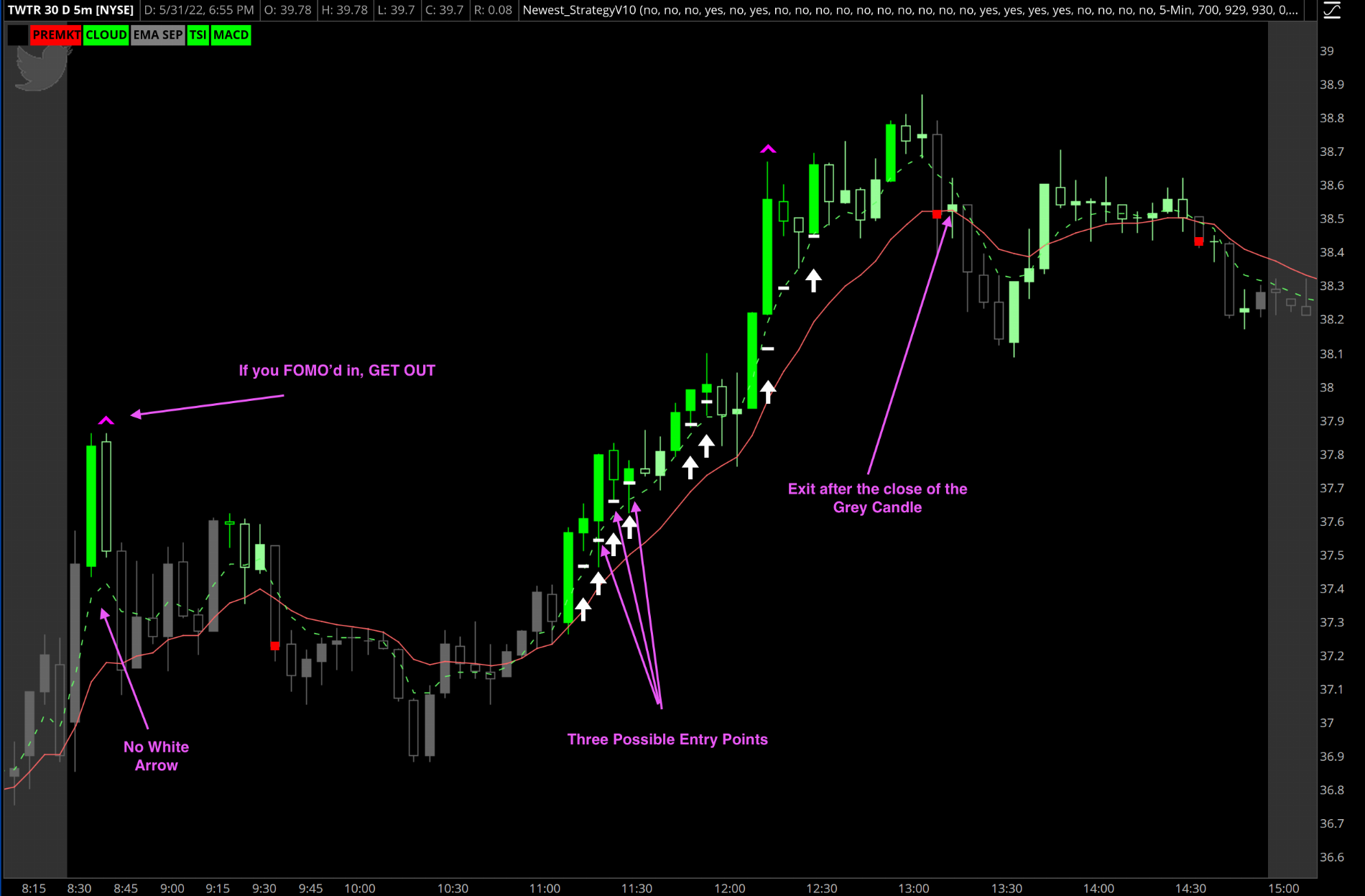

- If you FOMO in at the beginning of the day without a buy signal, which you shouldn't, and you get a Pink Boolean Arrow than GET OUT! The price is too extended from the EMA and you are just asked for a knife candle to kill your profits.

- If you were patient and waited on the Buy Signal (white arrow) then get in on that 5EMA (green dashed line) or better. Alternatively, if you missed your entry, then try to get in at least on the white dash or better. This was the entry point from the previous candle.

- You should not get a Buy Signal unless the price is already within the defined range of the 5EMA.

- If you are confident in your order placing abilities and the spread isn't too wide you can even set a trailing stop buy order to try to get the best price.

- If you get a Pink Boolean Arrow then again, really think about taking profits.

- This is a great spot for a trailing stop depending on the spread!

- If you get a Grey Candle than get ready to close your trade at the open of the next bar. Don't get in a hurry though because sometimes the candle will repaint and continue with your trend.

- Rinse and Repeat. Don't Get Fancy! Let It work or move on to a stock that is working!

I added labels to the top of the chart for each criteria this strategy is looking for. This will help you "get ready" to buy. If they are all red then get ready to go short or buy puts on that 5EMA. If they are all green than again, get ready to go long or buy calls on that 5EMA.

I THINK the labels should go green/blue from left to right if the stock cooperates. I have noticed that the biggest thing holding up the entry is MACD direction and price at the 5EMA at the same time but then again, that is what makes it mostly* dependable.

Once you are in the trade you can stop looking at the labels. At that point you are just waiting for the grey candle or pink boolean arrow for your exit.

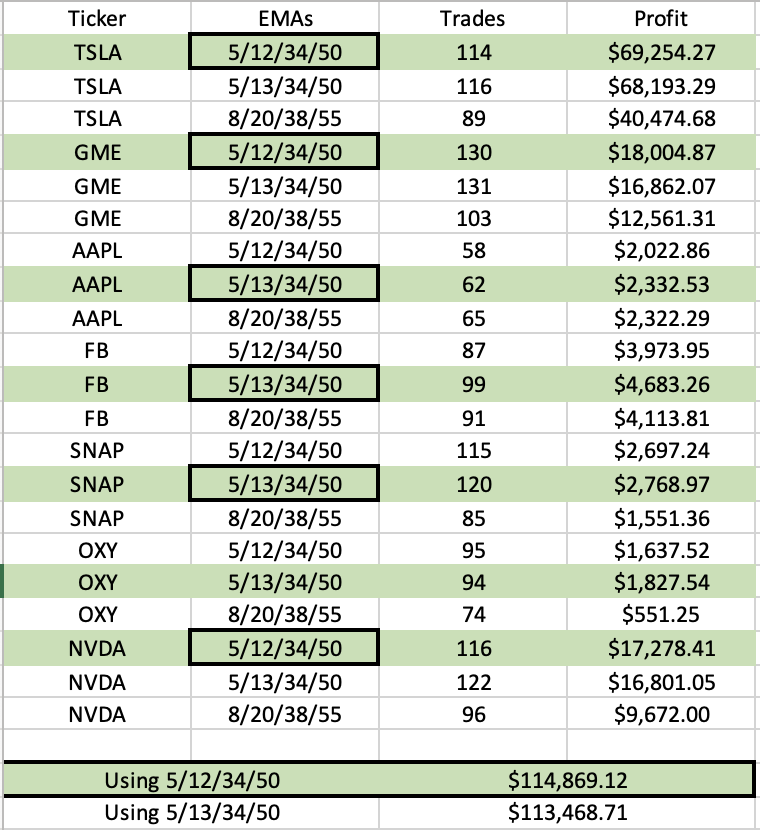

WIth that being said, be careful with options and this study! I chose my stocks based on my 2+ years of trading experience and look at support/resistance to chose the right strike. I am excited about this strategy because every single backtest I ran on every ticker on my watchlist was profitable over the past 10 days when trading 100 shares at a time.

Few Rules:

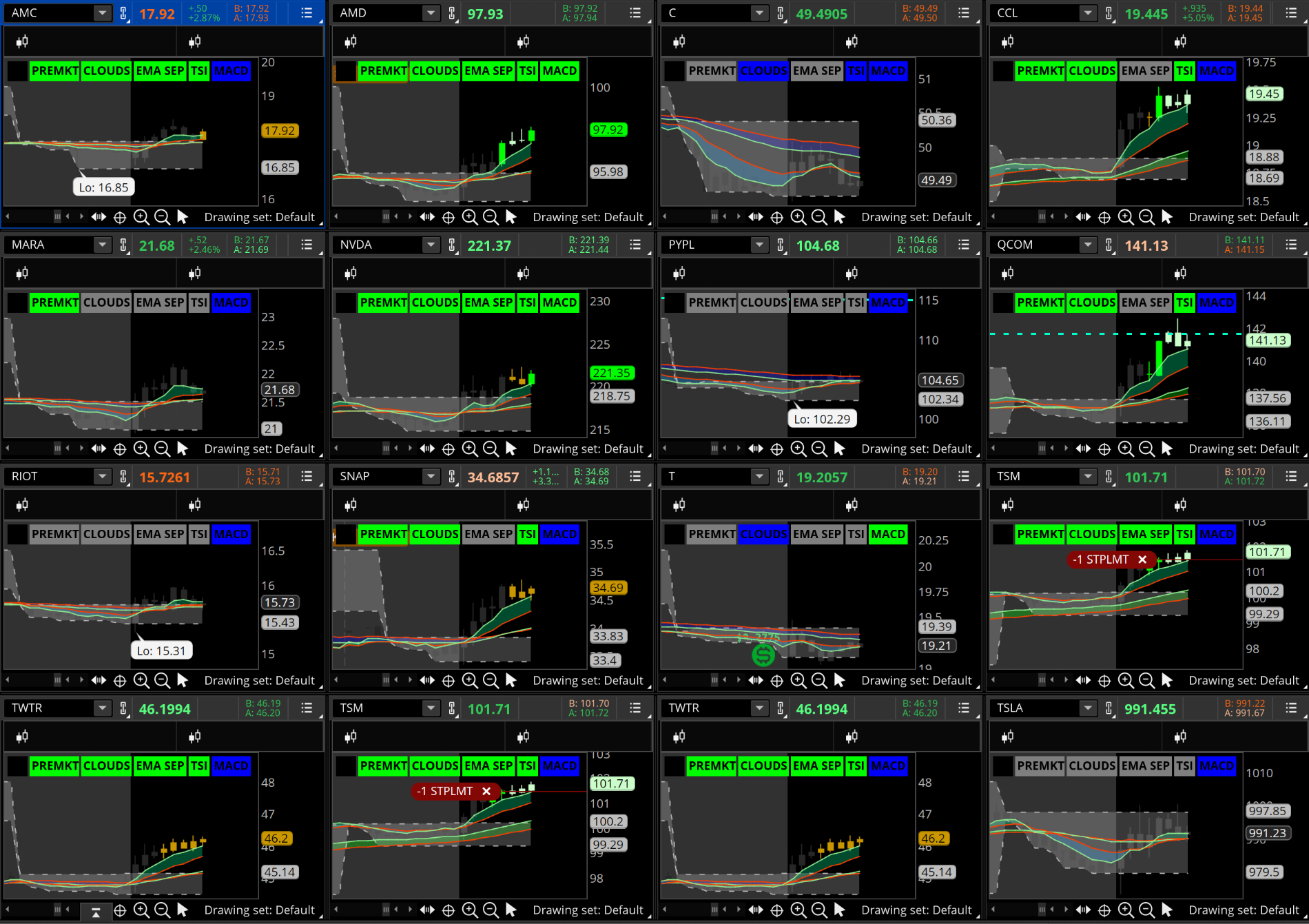

There is no scanner yet but some users are trying to create one that works (one or two are floating around the comments now). I use a flexible grid with 16 charts and load the tickers that I am looking at that particular day. This allows for the fastest response for me personally. Link at the top.

- To be used on 5 minute charts. That is all I have tested it on.

- Must have Extended Hours on and I prefer 3 Day / 5 Min zoomed in.

- Copy the code and paste it as a STRATEGY not study.

- If you so choose, turn on the "Over Ext Clouds". That is a take profit spot where you would get the pink boolean arrow.

Code:#JT Newest Strategy Based on EMAs, TSI, Premarket Highs/Lows, and MACD #VERSION 10.4 - 05/31/2022 #Notes Declare Upper; ################################################################## # OPTIONS # ################################################################## input ShowTestBubbles = no; input ShowFlexGridBackgroundColor = no; input ShowColorDefLabels = yes; input AlertOn = yes; input Show200EMA = no; input ShowFastEMALines = no; input ShowFastEMACloud = no; input ShowSlowEMALines = no; input ShowSlowEMACloud = no; input ShowPreMarketLines = no; input ShowPreMarketCloud = no; input ShowPreMarketLabel = yes; input ShowPrevDayLines = no; input ShowPrevDayCloud = no; input ShowPrevHighLowLabel = no; input ShowBuySellBubbles = no; input ShowArrows = yes; input ShowSquares = yes; input ShowDashes = yes; input ShowBooleanArrows = yes; input ShowOverExtCloud = no; input ShowTkPftBubble = no; input ShowOrders = no; input ShowTkPftOrders = no; ################################################################## # COLORS # ################################################################## DefineGlobalColor("200EMA", createcolor (255, 255, 255)); DefineGlobalColor("CloudUp", createcolor (102, 255, 102)); DefineGlobalColor("CloudDown", createcolor (255, 102, 102)); DefineGlobalColor("OpenLongPosition", createcolor (0, 255, 0)); DefineGlobalColor("OpenShortPosition", createcolor (255, 0, 0)); DefineGlobalColor("HoldLongPosition", createcolor (153, 255, 153)); DefineGlobalColor("HoldShortPosition", createcolor (255, 153, 153)); DefineGlobalColor("SellPosition", createcolor (255, 0, 0)); DefineGlobalColor("TakeProfit", createcolor (255, 0, 255)); DefineGlobalColor("CriteriaNotMet", createcolor (102, 102, 102)); #(255, 255, 0) ################################################################## # TIMES # ################################################################## #START AND END TIMES input TimeFrame = {default "5-Min", "1-Min", "10-Min", "15-Min", "30-Min", "1-Hour"}; input PreMarketStart = 0700; #EST input PreMarketEnd = 0929; #EST input StartTime = 0930; #EST input BuySignalDelay = 0; input EndTime = 1600; #EST input BuySignalStop = 60; #Minutes Before End of Day def LastCandleStop; #Last Candle is Sell Candle switch (TimeFrame) { case "1-min": LastCandleStop = 1; case "10-Min": LastCandleStop = 10; case "15-Min": LastCandleStop = 15; case "30-Min": LastCandleStop = 30; case "1-Hour": LastCandleStop = 60; default: LastCandleStop = 5; } def TradingDayStart= SecondsFromTime(StartTime); def BuySignalDelaySeconds = BuySignalDelay * 60; def SignalStart = TradingDayStart > BuySignalDelaySeconds; def TradingDayEnd = SecondsTillTime(EndTime); def EndSignalDelaySeconds = BuySignalStop * 60; def SignalEnd = TradingDayEnd > EndSignalDelaySeconds; def TradingDay = SignalStart and SignalEnd; #10:00EST - 1500EST def LastStopDelaySeconds = LastCandleStop * 60; def EndDay = TradingDayEnd == LastStopDelaySeconds; #1550EST def TradingDayExt = TradingDayEnd > LastStopDelaySeconds; ################################################################## # INDICATORS # ################################################################## #200 EMA plot EMA200 = ExpAverage(HL2, 200); EMA200.SetDefaultColor(globalcolor("200EMA")); EMA200.HideBubble(); EMA200.sethiding(!Show200EMA); #EMAS input Ema1Length = 5; input Ema2Length = 12; input Ema3Length = 34; input Ema4Length = 50; plot EMA1 = ExpAverage(close, Ema1Length); EMA1.SetStyle(Curve.Short_Dash); EMA1.SetDefaultColor(globalcolor("CloudUp")); EMA1.HideBubble(); #EMA1.sethiding(!ShowFastEMALines); plot EMA2 = ExpAverage(close, Ema2Length); EMA2.SetDefaultColor(globalcolor("CloudDown")); EMA2.HideBubble(); EMA2.sethiding(!ShowFastEMALines); AddCloud(if ShowFastEMACloud then EMA1 else double.nan, if ShowFastEMACloud then EMA2 else double.nan, globalcolor("CloudUp"), globalcolor("CloudDown")); plot EMA3 = ExpAverage(close, Ema3Length); EMA3.SetDefaultColor(globalcolor("CloudUp")); EMA3.HideBubble(); EMA3.sethiding(!ShowSlowEMALines); plot EMA4 = ExpAverage(close, Ema4Length); EMA4.SetDefaultColor(globalcolor("CloudDown")); EMA4.HideBubble(); EMA4.sethiding(!ShowSlowEMALines); AddCloud(if ShowSlowEMACloud then EMA3 else double.nan, if ShowSlowEMACloud then EMA4 else double.nan, globalcolor("CloudUp"), globalcolor("CloudDown")); #EMAS BULLISH OR BEARISH def EMABullish = EMA1 > EMA2; def EMABearish = EMA1 < EMA2; #EMA PERCENT SEPERATION def EMAPctBull = ((EMA1 / EMA2) * 100) - 100; #Distance Between EMA1 and EMA2 def EMAPctBullRound = Round(EMAPctBull, 2); def EMAPctBear = ((EMA2 / EMA1) * 100) - 100; #Distance Between EMA2 and EMA1 def EMAPctBearRound = Round(EMAPctBear, 2); #FAST EMA PERCENT SEPERATION BUY SIGNAL def EMASepThrHld; switch (TimeFrame) { case "1-min": EMASepThrHld = 0.1; case "10-Min": EMASepThrHld = 0.25; case "15-Min": EMASepThrHld = 0.25; case "30-Min": EMASepThrHld = 0.3; case "1-Hour": EMASepThrHld = 0.3; default: EMASepThrHld = 0.2; } def EMAPctBullish = EMAPctBullRound > EMASepThrHld and EMAPctBullRound >= EMAPctBullRound[1]; def EMAPctBearish = EMAPctBearRound > EMASepThrHld and EMAPctBearRound >= EMAPctBearRound[1]; #TESTING addchartbubble(ShowTestBubbles and EMAPctBullish, High * 1.005, EMAPctBullRound, color.dark_green, yes); addchartbubble(ShowTestBubbles and EMAPctBearish, Low * 0.995, EMAPctBearRound, color.dark_red, no); #EMA SELL SIGNALS def EMACrossDown = EMA1 crosses below EMA2; def EMACrossUp = EMA1 crosses above EMA2; #TSI input TSILongLength = 25; input TSIShortLength = 13; input TSISignalLength = 8; def TSIDiff = close - close[1]; def DoubleSmoothedAbsDiff = ExpAverage(ExpAverage(AbsValue(TSIDiff), TSILongLength), TSIShortLength); def TSIRound = Round((100 * (ExpAverage(ExpAverage(TSIDiff, TSILongLength), TSIShortLength)) / DoubleSmoothedAbsDiff), 2); #TSI BUY SIGNAL def TSIBull = (TSIRound > TSIRound[2]); #(TSIRound > 10) def TSIBear = (TSIRound < TSIRound[2]); #(TSIRound < -10) #TSI SELL SIGNAL def TSICrossDown = TSIRound < (TSIRound[1] * 0.91); def TSICrossUp = TSIRound > (TSIRound[1] * 0.91); #MACD input MACDFast = 10; input MACDSlow = 22; input MACDLength = 8; def MACDValue = ExpAverage(close, MACDFast) - ExpAverage(close, MACDSlow); def MACDAverage = ExpAverage(MACDValue, MACDLength); def MACDDiff = MACDValue - MACDAverage; def ZeroLine = 0; #MACD BUY SIGNAL def MACDBull = TSIRound > MACDAverage; #(MACDAverage > MACDAverage[1]) within 3 bars; def MACDBear = TSIRound < MACDAverage; #(MACDAverage < MACDAverage[1]) within 3 bars; #TSI AND MACD SELL SIGNAL def TSIMACDLongSell = TSIRound crosses below MACDAverage; def TSIMACDShortSell = TSIRound crosses above MACDAverage; ################################################################## # PREMARKET # ################################################################## #PREMARKET HIGHS AND LOWS def PreMarketTimeRange = secondsFromTime(PreMarketStart) >= 0 and secondsTillTime(PreMarketEnd) >= 0; def PreMarket = PreMarketTimeRange and !PremarketTimeRange[1]; def Pre_Market_High = compoundValue(1, if((high > Pre_Market_High[1] and PremarketTimeRange) or PreMarket, high, Pre_Market_High[1]), high); def Pre_Market_Low = compoundValue(1, if((low < Pre_Market_Low[1] and PremarketTImeRange) or PreMarket, low, Pre_Market_Low[1]), low); plot PreMarketHigh = Pre_Market_High; PreMarketHigh.SetStyle(curve.short_dash); PreMarketHigh.SetDefaultColor(color.light_gray); PreMarketHigh.Sethiding(!ShowPreMarketLines); plot PreMarketLow = Pre_Market_Low; PreMarketLow.SetStyle(curve.short_dash); PreMarketLow.SetDefaultColor(color.light_gray); PreMarketLow.Sethiding(!ShowPreMarketLines); AddCloud(if ShowPreMarketCloud then PreMarketHigh else double.nan, if ShowPreMarketCloud then PreMarketLow else double.nan, color.light_gray, color.light_gray); AddLabel(if ShowPreMarketLabel then yes else no, " ", color.black); AddLabel(if ShowPreMarketLabel then yes else no, " PM High - $" + PreMarketHigh + " ", color.gray); AddLabel(if ShowPreMArketLabel then yes else no, " PM Low - $" + PreMarketLow + " ", color.gray); #PREMARKET HIGH/LOW BUY SIGNAL def PreMarketBull = close > Pre_Market_High; def PreMarketBear = close < Pre_Market_Low; #PREMARKET HIGH/LOW SELL SIGNAL def PreMarketBullSell = PreMarketBull[1] and low < Pre_Market_High; def PreMarketBearSell = PreMarketBear[1] and high > Pre_Market_Low; ################################################################## # YESTERDAY HIGH/LOW # ################################################################## plot PrevHigh = high(period = "day")[1]; PrevHigh.SetStyle(curve.medium_dash); PrevHigh.SetDefaultColor(Color.GREEN); PrevHigh.Sethiding(!ShowPrevDayLines); plot PrevLow = low(period = "day")[1]; PrevLow.SetStyle(curve.medium_dash); PrevLow.SetDefaultColor(Color.GREEN); PrevLow.Sethiding(!ShowPrevDayLines); AddCloud(if ShowPrevDayCloud then PrevHigh else double.nan, if ShowPrevDayCloud then PrevLow else double.nan, color.light_gray, color.light_gray); AddLabel(if ShowPrevHighLowLabel then 1 else 0, " ", color.black); AddLabel(if ShowPrevHighLowLabel then 1 else 0, "Prev High " + "$ " + PrevHigh + " ", color.gray); AddLabel(if ShowPrevHighLowLabel then 1 else 0, "Prev Low " + "$ " + PrevLow + " ", color.gray); ################################################################## # SIGNALS # ################################################################## #INDICATOR BUY SIGNALS def LongBuyInd = TradingDay and EMABullish and EMAPctBullish and MACDBull and TSIBull and PreMarketBull; def ShortBuyInd = TradingDay and EMABearish and EMAPctBearish and MACDBear and TSIBear and PreMarketBear; plot LongEntryLine = if (LongBuyInd[1] or LongBuyInd[2]) and ShowDashes and LongBuyInd then EMA1[1] * 1.0025 else double.nan; LongEntryLine.SetPaintingStrategy(PaintingStrategy.Dashes); LongEntryLine.SetDefaultColor(color.white); LongEntryLine.SetLineWeight(3); plot ShortEntryLine = if (ShortBuyInd[1] or ShortBuyInd[2]) and ShowDashes and ShortBuyInd then EMA1[1] * 0.9975 else double.nan; ShortEntryLine.SetPaintingStrategy(PaintingStrategy.Dashes); ShortEntryLine.SetDefaultColor(color.white); ShortEntryLine.SetLineWeight(3); #INDICATOR ENTRY SIGNALS def LongEntryInd = (LongBuyInd[1] or LongBuyInd[2]) and LongBuyInd and low <= (EMA1 * 1.0025); def ShortEntryInd = (ShortBuyInd[1] or ShortBuyInd[2]) and ShortBuyInd and high >= (EMA1 * 0.9975); #INDICATOR HOLD SIGNALS def LongHoldInd = TradingDayExt and PreMarketBull and (LongBuyInd[1] or LongHoldInd[1]); def ShortHoldInd = TradingDayExt and PreMarketBear and (ShortBuyInd[1] or ShortHoldInd[1]); ################################################################## # ADDED FAST EMA PCT HERE BASED OFF BUY SIGNAL # ################################################################## def EMAPctAtLongBuy = if LongEntryInd then EMAPctBullRound else EMAPctAtLongBuy[1]; def EMAPctAtShortBuy = if ShortEntryInd then EMAPctBearRound else EMAPctAtShortBuy[1]; #FAST EMA CLOUD SELL TRIGGER BASED OFF BUY INDICATOR input EMAPctDecFromBuy = 0.6; def LongEMAPctSell = EMAPctBullRound < (EMAPctAtLongBuy * EMAPctDecFromBuy); def ShortEMAPctSell = EMAPctBearRound < (EMAPctAtShortBuy * EMAPctDecFromBuy); ################################################################## # SIGNALS CONT. # ################################################################## #SELL SIGNALS def LongPriceActSell = low < low[4]; def ShortPriceActSell = high > high[4]; def LongSellInd = TradingDayExt and (close < open) and close < EMA1 and LongPriceActSell and close < EMA2 and (EMACrossDown or TSICrossDown or LongEMAPctSell or TSIMACDLongSell); def ShortSellInd = TradingDayExt and (close > open) and close > EMA1 and ShortPriceActSell and close > EMA2 and (EMACrossUp or TSICrossUp or ShortEMAPctSell or TSIMACDShortSell); #TESTING addchartbubble(ShowTestBubbles and TSICrossDown, High * 1.005, "T-Dn", color.dark_green, yes); addchartbubble(ShowTestBubbles and TSICrossUp, Low * 0.995, "T-Up", color.dark_red, no); addchartbubble(ShowTestBubbles and EMACrossDown, High * 1.005, "E-X-Dn", color.dark_green, yes); addchartbubble(ShowTestBubbles and EMACrossUp, Low * 0.995, "E-X-Up", color.dark_red, no); addchartbubble(ShowTestBubbles and LongEMAPctSell, High * 1.005, "E-Pct-Dn", color.dark_green, yes); addchartbubble(ShowTestBubbles and SHortEMAPctSell, Low * 0.995, "E-Pct-Up", color.dark_red, no); #HOLD SIGNALS def LongHoldInd2 = LongHoldInd and !LongSellInd; def ShortHoldInd2 = ShortHoldInd and !ShortSellInd; ################################################################## # BARS # ################################################################## AssignPriceColor(if LongBuyInd then GlobalColor("OpenLongPosition") else if ShortBuyInd then GlobalColor("OpenShortPosition") else if LongHoldInd2 then GlobalColor("HoldLongPosition") else if ShortHoldInd2 then GlobalColor("HoldShortPosition") else GlobalColor("CriteriaNotMet")); ################################################################## # EMA TAKE PROFIT CLOUD (IDENTIFY IF PRICE IS EXTENDED FROM EMAS)# ################################################################## def OvrExtUp1 = if ShowOverExtCloud and SignalStart and TradingDayExt and (LongEntryInd or LongHoldInd2) then EMA1 * 1.01 else Double.NaN; def OvrExtUp2 = if ShowOverExtCloud and SignalStart and TradingDayExt and (LongEntryInd or LongHoldInd2) then EMA1 * 1.02 else Double.NaN; AddCloud(OvrExtUp1, OvrExtUp2, color.light_green, color.light_green); def OvrExtDn1 = if ShowOverExtCloud and SignalStart and TradingDayExt and (ShortEntryInd or ShortHoldInd2) then EMA1 * 0.99 else Double.NaN; def OvrExtDn2 = if ShowOverExtCloud and SignalStart and TradingDayExt and (ShortEntryInd or ShortHoldInd2) then EMA1 * 0.98 else Double.NaN; AddCloud(OvrExtDn1, OvrExtDn2, color.light_green, color.light_green); ################################################################## # LABELS # ################################################################## #LABELS AddLabel(yes, " ", color.black); AddLabel(yes, "PREMKT", if PreMarketBull then GlobalColor("OpenLongPosition") else if PreMarketBear then GlobalColor("OpenShortPosition") else color.gray); AddLabel(yes, "CLOUD", if EMABullish then GlobalColor("OpenLongPosition") else if EMABearish then GlobalColor("OpenShortPosition") else color.gray); AddLabel(yes, "EMA SEP", if EMAPctBullish then GlobalColor("OpenLongPosition") else if EMAPctBearish then GlobalColor("OpenShortPosition") else color.gray); AddLabel(yes, "TSI", if TSIBull then GlobalColor("OpenLongPosition") else if TSIBear then GlobalColor("OpenShortPosition") else color.gray); AddLabel(yes, "MACD", if MACDBull then GlobalColor("OpenLongPosition") else if MACDBear then GlobalColor("OpenShortPosition") else color.gray); ################################################################## # CHART BUBBLES/POINTS FOR BUY/SELL # ################################################################## #BUY def LongBuyBub = LongEntryInd; addchartbubble(ShowBuySellBubbles and LongBuyBub, High * 1.005, "Long", color.green, yes); def ShortBuyBub = ShortEntryInd; addchartbubble(ShowBuySellBubbles and ShortBuyBub, Low * 0.995, "Short", color.red, no); plot LongBuyPoint = if ShowArrows and LongBuyBub then EMA1[1] else double.nan; LongBuyPoint.SetDefaultColor(color.white); LongBuyPoint.SetPaintingStrategy(PaintingStrategy.Arrow_Up); LongBuyPoint.SetLineWeight(5); LongBuyPoint.HideBubble(); plot ShortBuyPoint = if ShowArrows and ShortBuyBub then EMA1[1] else double.nan; ShortBuyPoint.SetDefaultColor(color.white); ShortBuyPoint.SetPaintingStrategy(PaintingStrategy.Arrow_Down); ShortBuyPoint.SetLineWeight(5); ShortBuyPoint.HideBubble(); #SELL def LongSellBub = (LongEntryInd[1] or LongHoldInd2[1]) and (LongEntryInd[2] or LongHoldInd2[2]) and LongSellInd; addchartbubble(ShowBuySellBubbles and LongSellBub, High * 1.005, "Sell", color.red, yes); def ShortSellBub = (ShortEntryInd[1] or ShortHoldINd2[1]) and (ShortEntryInd[2] or ShortHoldINd2[2]) and ShortSellInd; addchartbubble(ShowBuySellBubbles and ShortSellBub, Low * 0.995, "Sell", color.green, no); plot LongSellPoint = if ShowSquares and LongSellBub then Close else double.nan; LongSellPoint.SetDefaultColor(color.red); LongSellPoint.SetPaintingStrategy(PaintingStrategy.Squares); LongSellPoint.SetLineWeight(5); LongSellPoint.HideBubble(); plot ShortSellPoint = if ShowSquares and ShortSellBub then Close else double.nan; ShortSellPoint.SetDefaultColor(color.green); ShortSellPoint.SetPaintingStrategy(PaintingStrategy.Squares); ShortSellPoint.SetLineWeight(5); ShortSellPoint.HideBubble(); #TAKE PROFIT def LongTkPftBub = TradingDayExt and (LongEntryInd or LongHoldInd2) and high > EMA1 * 1.01; addchartbubble(ShowTkPftBubble and LongTkPftBub, high * 1.001, "Tk Pft", GlobalColor("TakeProfit"), yes); def ShortTkPftBub = TradingDayExt and (ShortEntryInd or ShortHoldInd2) and low < EMA1 * 0.99; addchartbubble(ShowTkPftBubble and ShortTkPftBub, low * 0.999, "Tk Pft", GlobalColor("TakeProfit"), no); plot LongTkPftPoint = if ShowBooleanArrows and LongTkPftBub then High else double.nan; LongTkPftPoint.SetDefaultColor(GlobalColor("TakeProfit")); LongTkPftPoint.SetPaintingStrategy(PaintingStrategy.Boolean_Wedge_Up); LongTkPftPoint.SetLineWeight(5); LongTkPftPoint.HideBubble(); plot ShortTkPftPoint = if ShowBooleanArrows and ShortTkPftBub then Low else double.nan; ShortTkPftPoint.SetDefaultColor(GlobalColor("TakeProfit")); ShortTkPftPoint.SetPaintingStrategy(PaintingStrategy.Boolean_Wedge_Down); ShortTkPftPoint.SetLineWeight(5); ShortTkPftPoint.HideBubble(); ################################################################## # STOP LOSS # ################################################################## def longstop = if (open < close) then open else close; def shortstop = if (open > close) then open else close; addlabel(if (LongBuyInd or LongHoldInd2) then yes else no, "STOP $ " + longstop[4] + " ", color.white); addlabel(if (ShortBuyInd or ShortHoldInd2) then yes else no, "STOP $ " + shortstop[4] + " ", color.white); ################################################################## # ORDERS # ################################################################## def orderQuantity = Round(10000 / open, 0); #BUY ORDERS AddOrder(OrderType.BUY_TO_OPEN, ShowOrders and LongEntryInd, EMA1 * 1.0025, 100, Color.GREEN, Color.LIGHT_GREEN); AddOrder(OrderType.SELL_TO_OPEN, ShowOrders and ShortEntryInd, EMA1 * 0.9975, 100, Color.GREEN, Color.LIGHT_GREEN); #SELL ORDERS AddOrder(OrderType.SELL_TO_CLOSE, ShowOrders and ShowTkPftOrders and LongTkPftBub, high * 0.999, 100, Color.RED, Color.LIGHT_RED); AddOrder(OrderType.SELL_TO_CLOSE, ShowOrders and (LongSellInd or EndDay[-1]), open[-1], 100, Color.RED, Color.LIGHT_RED); AddOrder(OrderType.BUY_TO_CLOSE, ShowOrders and ShowTkPftOrders and ShortTkPftBub, low * 1.001, 100, Color.RED, Color.LIGHT_RED); AddOrder(OrderType.BUY_TO_CLOSE, ShowOrders and (ShortSellInd or EndDay[-1]), open[-1], 100, Color.RED, Color.LIGHT_RED); ################################################################## # ALERTS # ################################################################## Alert(AlertOn and (LongSellBub or ShortSellBub or LongTkPftBub or ShortTkPftBub), "SELL" + GetSymbol(), Alert.BAR, Sound.Bell); Alert(AlertOn and (LongBuyInd or ShortBuyInd), "BUY" + GetSymbol(), Alert.BAR, Sound.Chimes); ################################################################## # CANDLE COLOR LABEL # ################################################################## AddLabel(if ShowColorDefLabels == 1 then yes else no, " ", color.black); AddLabel(if ShowColorDefLabels == 1 then yes else no, "Long Ind", GlobalColor("OpenLongPosition")); AddLabel(if ShowColorDefLabels == 1 then yes else no, "Long Hld", GlobalColor("HoldLongPosition")); AddLabel(if ShowColorDefLabels == 1 then yes else no, "Short Ind", GlobalColor("OpenShortPosition")); AddLabel(if ShowColorDefLabels == 1 then yes else no, "Short Hld", GlobalColor("HoldShortPosition")); AddLabel(if ShowColorDefLabels == 1 then yes else no, "No Criteria", GlobalColor("CriteriaNotMet")); ################################################################## # BACKGROUND COLOR FOR FLEX GRID # ################################################################## AssignBackgroundColor(if ShowFlexGridBackgroundColor and LongBuyInd then GlobalColor("OpenLongPosition") else if ShowFlexGridBackgroundColor and ShortBuyInd then GlobalColor("OpenShortPosition") else if ShowFlexGridBackgroundColor and (LongTkPftBub or ShortTkPftBub) then GlobalColor("TakeProfit") else color.current);

And last but not least, my watchlist indicator. I only use this to visually tell me when to take a closer look at a stock. I have whittled down my watchlist to ones that I know move and have plenty of options flow. Make sure your watchlist study is set to 5 Min and Extended Hours are turned On.

The numbers mean nothing. It is just my way of sorting. You can change the labels to whatever you want in the bottom of the code under “Label”

You will only get a signal on the chart and the watchlist between 8:35 A.M. CST and 2:55 P.M. CST.

Code:#JT Newest Strategy Based on EMAs, TSI, Premarket Highs/Lows, and MACD #VERSION 10.3 - 05/26/2022 #Notes ################################################################## # TIMES # ################################################################## #START AND END TIMES def PreMarketStart = 0700; #EST def PreMarketEnd = 0929; #EST def StartTime = 0930; #EST def BuySignalDelay = 0; def EndTime = 1600; #EST def BuySignalStop = 60; #Minutes Before End of Day def LastCandleStop = 5; #Last Candle is Sell Candle def TradingDayStart= SecondsFromTime(StartTime); def BuySignalDelaySeconds = BuySignalDelay * 60; def SignalStart = TradingDayStart > BuySignalDelaySeconds; def TradingDayEnd = SecondsTillTime(EndTime); def EndSignalDelaySeconds = BuySignalStop * 60; def SignalEnd = TradingDayEnd > EndSignalDelaySeconds; def TradingDay = SignalStart and SignalEnd; #10:00EST - 1500EST def LastStopDelaySeconds = LastCandleStop * 60; def EndDay = TradingDayEnd == LastStopDelaySeconds; #1550EST def TradingDayExt = TradingDayEnd > LastStopDelaySeconds; ################################################################## # INDICATORS # ################################################################## #200 EMA def EMA200 = ExpAverage(HL2, 200); #EMAS def Ema1Length = 5; def Ema2Length = 12; def EMA1 = ExpAverage(close, Ema1Length); def EMA2 = ExpAverage(close, Ema2Length); #EMAS BULLISH OR BEARISH def EMABullish = EMA1 > EMA2; def EMABearish = EMA1 < EMA2; #EMA PERCENT SEPERATION def EMAPctBull = ((EMA1 / EMA2) * 100) - 100; #Distance Between EMA1 and EMA2 def EMAPctBullRound = Round(EMAPctBull, 2); def EMAPctBear = ((EMA2 / EMA1) * 100) - 100; #Distance Between EMA2 and EMA1 def EMAPctBearRound = Round(EMAPctBear, 2); def EMAPctBullish = EMAPctBullRound > 0.2 and EMAPctBullRound >= EMAPctBullRound[1]; def EMAPctBearish = EMAPctBearRound > 0.2 and EMAPctBearRound >= EMAPctBearRound[1]; #EMA SELL SIGNALS def EMACrossDown = EMA1 crosses below EMA2; def EMACrossUp = EMA1 crosses above EMA2; #TSI def TSILongLength = 25; def TSIShortLength = 13; def TSISignalLength = 8; def TSIDiff = close - close[1]; def DoubleSmoothedAbsDiff = ExpAverage(ExpAverage(AbsValue(TSIDiff), TSILongLength), TSIShortLength); def TSIRound = Round((100 * (ExpAverage(ExpAverage(TSIDiff, TSILongLength), TSIShortLength)) / DoubleSmoothedAbsDiff), 2); #TSI BUY SIGNAL def TSIBull = (TSIRound > TSIRound[2]); #(TSIRound > 10) def TSIBear = (TSIRound < TSIRound[2]); #(TSIRound < -10) #TSI SELL SIGNAL def TSICrossDown = TSIRound < (TSIRound[1] * 0.91); def TSICrossUp = TSIRound > (TSIRound[1] * 0.91); #MACD def MACDFast = 10; def MACDSlow = 22; def MACDLength = 8; def MACDValue = ExpAverage(close, MACDFast) - ExpAverage(close, MACDSlow); def MACDAverage = ExpAverage(MACDValue, MACDLength); def MACDDiff = MACDValue - MACDAverage; def ZeroLine = 0; #MACD BUY SIGNAL def MACDBull = TSIRound > MACDAverage; #(MACDAverage > MACDAverage[1]) within 3 bars; def MACDBear = TSIRound < MACDAverage; #(MACDAverage < MACDAverage[1]) within 3 bars; #TSI AND MACD SELL SIGNAL def TSIMACDLongSell = TSIRound crosses below MACDAverage; def TSIMACDShortSell = TSIRound crosses above MACDAverage; ################################################################## # PREMARKET # ################################################################## #PREMARKET HIGHS AND LOWS def PreMarketTimeRange = secondsFromTime(PreMarketStart) >= 0 and secondsTillTime(PreMarketEnd) >= 0; def PreMarket = PreMarketTimeRange and !PremarketTimeRange[1]; def Pre_Market_High = compoundValue(1, if((high > Pre_Market_High[1] and PremarketTimeRange) or PreMarket, high, Pre_Market_High[1]), high); def Pre_Market_Low = compoundValue(1, if((low < Pre_Market_Low[1] and PremarketTImeRange) or PreMarket, low, Pre_Market_Low[1]), low); def PreMarketHigh = Pre_Market_High; def PreMarketLow = Pre_Market_Low; #PREMARKET HIGH/LOW BUY SIGNAL def PreMarketBull = close > Pre_Market_High; def PreMarketBear = close < Pre_Market_Low; #PREMARKET HIGH/LOW SELL SIGNAL def PreMarketBullSell = PreMarketBull[1] and low < Pre_Market_High; def PreMarketBearSell = PreMarketBear[1] and high > Pre_Market_Low; ################################################################## # SIGNALS # ################################################################## #INDICATOR BUY SIGNALS def LongBuyInd = TradingDay and EMABullish and EMAPctBullish and MACDBull and TSIBull and PreMarketBull; def ShortBuyInd = TradingDay and EMABearish and EMAPctBearish and MACDBear and TSIBear and PreMarketBear; #INDICATOR ENTRY SIGNALS def LongEntryInd = (LongBuyInd[1] or LongBuyInd[2]) and LongBuyInd and low <= (EMA1 * 1.0025); def ShortEntryInd = (ShortBuyInd[1] or ShortBuyInd[2]) and ShortBuyInd and high >= (EMA1 * 0.9975); #INDICATOR HOLD SIGNALS def LongHoldInd = TradingDayExt and PreMarketBull and (LongBuyInd[1] or LongHoldInd[1]); def ShortHoldInd = TradingDayExt and PreMarketBear and (ShortBuyInd[1] or ShortHoldInd[1]); ################################################################## # ADDED FAST EMA PCT HERE BASED OFF BUY SIGNAL # ################################################################## def EMAPctAtLongBuy = if LongEntryInd then EMAPctBullRound else EMAPctAtLongBuy[1]; def EMAPctAtShortBuy = if ShortEntryInd then EMAPctBearRound else EMAPctAtShortBuy[1]; #FAST EMA CLOUD SELL TRIGGER BASED OFF BUY INDICATOR def LongEMAPctSell = EMAPctBullRound < (EMAPctAtLongBuy * 0.6); def ShortEMAPctSell = EMAPctBearRound < (EMAPctAtShortBuy * 0.6); ################################################################## # SIGNALS CONT. # ################################################################## #SELL SIGNALS def LongPriceActSell = low < low[4]; def ShortPriceActSell = high > high[4]; def LongSellInd = TradingDayExt and (close < open) and (EMACrossDown or TSICrossDown or LongEMAPctSell or LongPriceActSell or TSIMACDLongSell); def ShortSellInd = TradingDayExt and (close > open) and (EMACrossUp or TSICrossUp or ShortEMAPctSell or ShortPriceActSell or TSIMACDShortSell); #HOLD SIGNALS def LongHoldInd2 = LongHoldInd and !LongSellInd; def ShortHoldInd2 = ShortHoldInd and !ShortSellInd; ################################################################## # CHART BUBBLES/POINTS FOR BUY/SELL # ################################################################## #TAKE PROFIT def LongTkPftBub = TradingDayExt and (LongEntryInd or LongHoldInd2) and high > EMA1 * 1.01; def ShortTkPftBub = TradingDayExt and (ShortEntryInd or ShortHoldInd2) and low < EMA1 * 0.99; ################################################################## # WATCHLIST INDICATOR # ################################################################## #LABEL AddLabel(yes, if LongBuyInd then "1. LONG" else if LongHoldInd2 then "4. LONG HOLD" else if ShortBuyInd then "2. SHORT" else if ShortHoldInd2 then "5. SHORT HOLD" else if LongTkPftBub or ShortTkPftBub then "3. TAKE PROFIT" else "6. NO GO"); #BACKGROUND AssignBackgroundColor(if LongBuyInd then createcolor (0, 255, 0) else if LongHoldInd2 then createcolor (153, 255, 153) else if ShortBuyInd then createcolor (255, 0, 0) else if ShortHoldInd2 then createcolor (255, 153, 153) else if LongTkPftBub or ShortTkPftBub then createcolor (255, 0, 255) else createcolor (102, 102, 102));

What can go wrong....?

See the chart below. You will notice green candles which means all criteria to buy are met EXCEPT the price being within the defined range of the 5EMA. Because the price is extended, you didn't get a white arrow. If you FOMO'd in, get out on the pink boolean arrow. You will notice after 5 minutes the price sharply reverses down and below the 5EMA. The price eventually normalizes and starts a gradual uptrend. You would do your best to enter on the candle with the white arrow, as close as possible to the 5EMA and definitely below the white dash. You would then wait for a grey candle to completely close and then exit at the open of the following candle.

I didn't just pull that over extended cloud out of nowhere. That was me looking at multiple charts and coming up with the best number (probably has something to do with other algos).

To the right is what it's supposed to look like.

Some light backtesting here. This is over 90 days and BEFORE I backtested with the pink boolean arrows.

If you happen to have something of value to add please don't hesitate to post that here. This is however about 6 months of trial and error in the making.

###################################################################################

This is how I trade personally. Do whatever you want with this information.

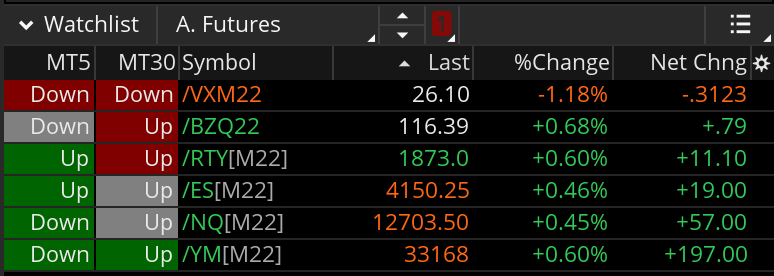

Step 1. Before pre-market opens if I am awake. I look at the futures to get an idea of the direction of the market and VIX futures. So I am following the rules of the site. Here are the links to the two watchlist columns below. Not pertinent at this point. MT5 - http://tos.mx/4hzwiEn MT30 - http://tos.mx/45R1EOH

Step 2. Look at my watchlist throughout the premarket to get an idea on what is running or what sectors may be in play. This comes with experience. I am strictly looking at percent gain or percent loss.

Step 3. Pick a few stocks that I think I want to trade. That may be based on news, pre-market action, recent earnings, some Elon Must Twitter post etc. I want something that is going to move! I would highly prefer that it move with the sector and with the futures and/or index it's trading in.

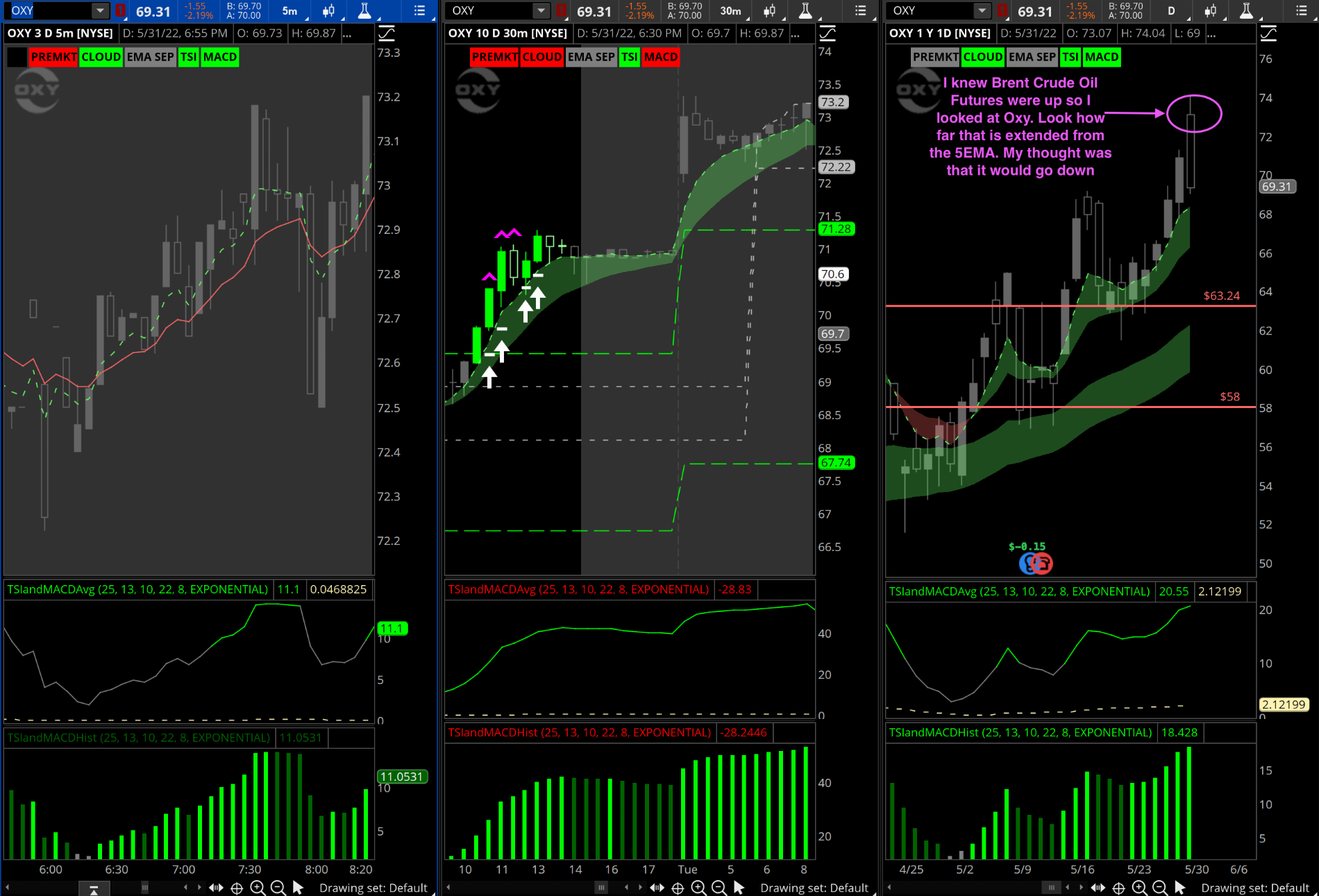

Step 4. Look at the daily charts of the tickers that you like. This is my main screen and what I traded today 5/31/22. My thought was that OXY would go down because the price was so extended from the 5EMA on the daily chart. (I scrolled to the premarket to show what I saw. Obviously can't do that with the daily candle.) More to come on those histograms on the bottom. TSI and MACD Line - http://tos.mx/91sbV6M and TSI and MACD Histogram - http://tos.mx/5fBU0TW

Step 5. Wait for your bias to play out or admit that you're wrong and look for another opportunity.

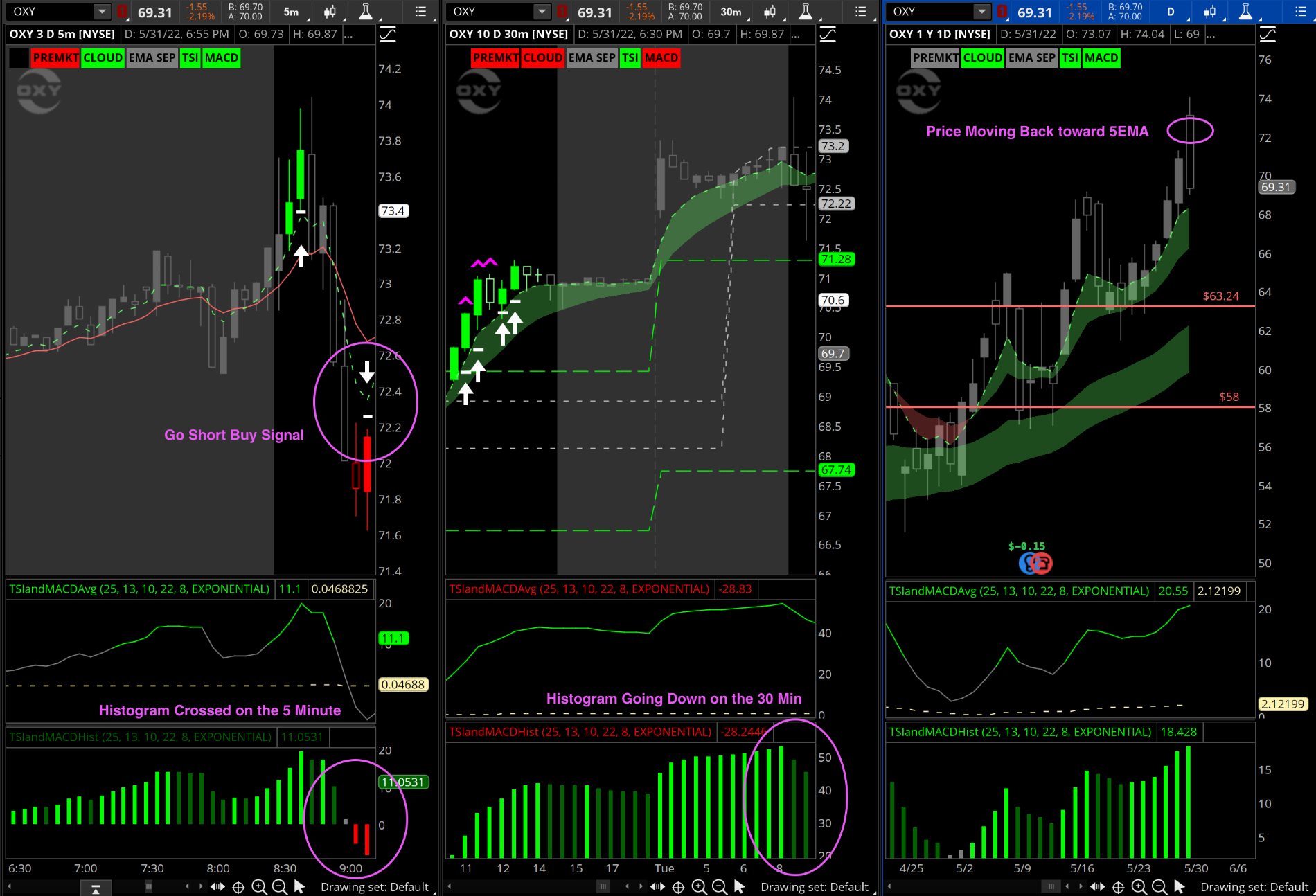

Step 6. Review the Chart Below for what I saw around 0910 CST. My direction is correct but I don't quite like that the 30 minute is not there yet. Lets wait a bit... In the mean time lets get a price target. $68 Put looks good because that is where the 5EMA is at. Be patient.

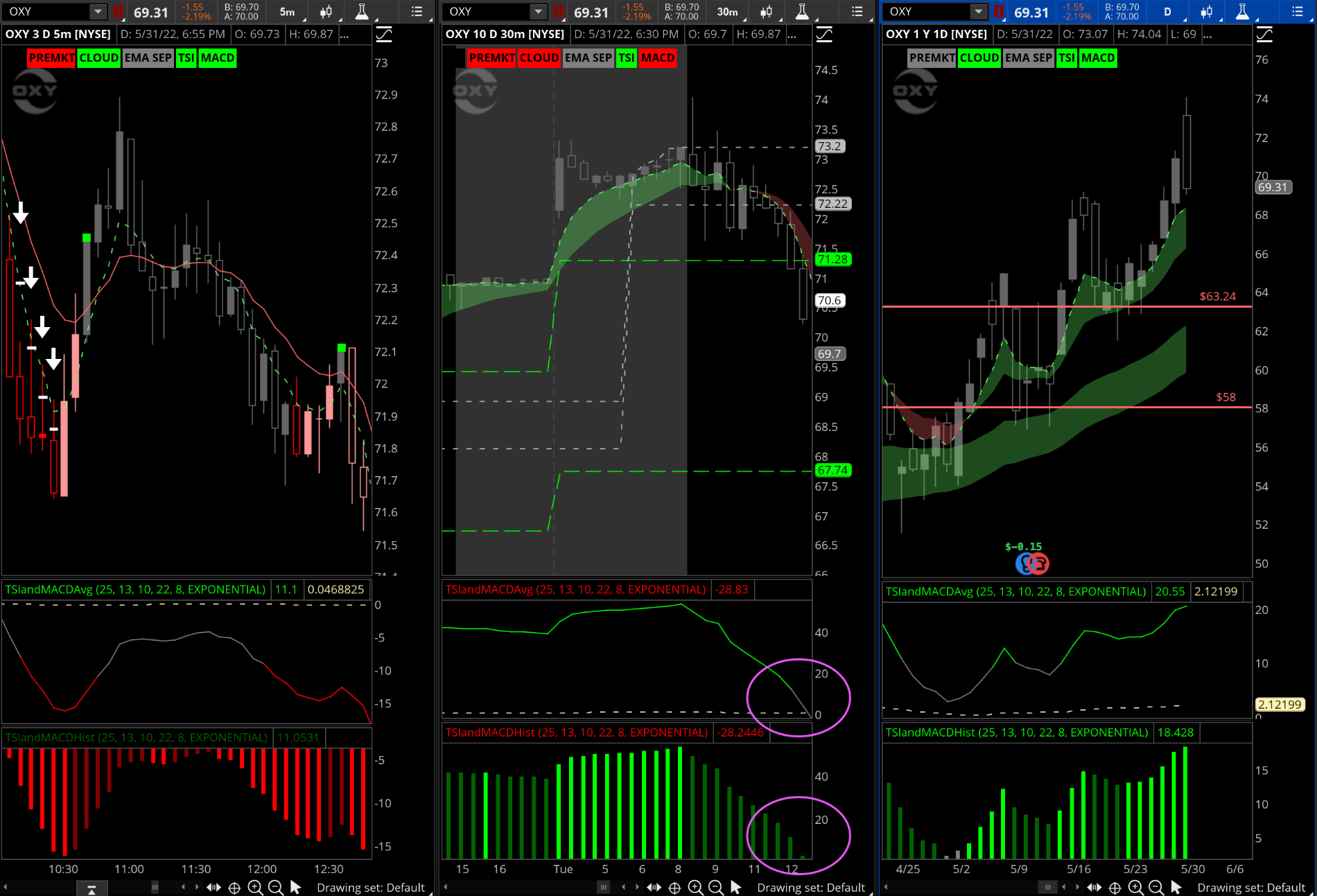

Step 7. 30 Minute Histogram is nearing 0 and still declining. I'm about ready to enter but I have to wait on the white arrow to appear and buy as close to the 5EMA as possible.

Step 8. Now I switch to my flex grid where I have the 5 minute, 30 minute, 5 minute option that I want to buy, and active trader up. That way I am ready to pounce when the signal hits.

Step 9. Buy. Don't hesitate. You did the work, now follow through! I entered at $0.45 per contract.

Step 10. Wait for your Exit. You could have exited on the pink boolean candle on the 30 minute chart. I did not. Profits would have been about the same.

Step 11. Take your 150% profit and enjoy your day!

@a1cturner I am getting the pink sell carot above every bar. I am trading using the 1 Min. Is this typical? Just curious if I need to adjust a setting.edited:

Watchlist indicator updated. I have updated the buy/sell/hold criteria to match the updated strategy and deleted as many notes, clouds, etc as possible to hopefully fix the loading problem.

The words don't really matter if you know the colors. That is what I am paying attention to.

Again make sure the watchlist is set to 10 Min and Extended Hours are On.

EDIT: As of 4/11/2022 at 10:40 I still have a bunch of symbols loading. This time on my desktop. If anyone wants to look at my watchlist indicator code and think they can streamline it or otherwise help the loading problem it would be appreciated.

EDIT 2. Once I deleted a few other custom watchlist indicators a lot more of this specific indicator loaded. I knew this was an issue with ToS but thought I was under the magic number. I still did have 2 with issues loading but they didn't meet criteria anyways.

On options that is common just because the price moves so much. You could probably change the longtkpftbub and shorttkpftbub around line 385 and see what works for you. you will need to change the part that says ema1 * 1.01 or ema1 * 0.99 to something a little "wider"@a1cturner I am getting the pink sell carot above every bar. I am trading using the 1 Min. Is this typical? Just curious if I need to adjust a setting.

Okay Thanks. Do you use with options on chart or on separate chart?On options that is common just because the price moves so much. You could probably change the longtkpftbub and shorttkpftbub around line 385 and see what works for you. you will need to change the part that says ema1 * 1.01 or ema1 * 0.99 to something a little "wider"

I keep my options chain on a separate chart for the strike that I’m watchingOkay Thanks. Do you use with options on chart or on separate chart?

@a1cturner Sorry to bug you. I just noticed that when I use this Strat on the 1 min timeframe, the bars stay gray. I changed the setting to 1 min in the strat settings. Is there something I need to do to get the color to work on 1 min? BTW, I change the same chart to 5 min and the bars were colored. Any thoughts?On options that is common just because the price moves so much. You could probably change the longtkpftbub and shorttkpftbub around line 385 and see what works for you. you will need to change the part that says ema1 * 1.01 or ema1 * 0.99 to something a little "wider"

It just varies by chart. The stock has to move with a certain momentum for it to trigger the color change and buy signal.@a1cturner Sorry to bug you. I just noticed that when I use this Strat on the 1 min timeframe, the bars stay gray. I changed the setting to 1 min in the strat settings. Is there something I need to do to get the color to work on 1 min? BTW, I change the same chart to 5 min and the bars were colored. Any thoughts?

Gotcha. Was just wandering if I needed to change anything. The coloring works for the 5 min but not the 1 min at the same time of day. Using two charts. Maybe a coder/programmer can help with this one. Thanks again for all of you hard work/effort!It just varies by chart. The stock has to move with a certain momentum for it to trigger the color change and buy signal.

I’m no expert programmer or trader. This was my first attempt at an in depth strategy. Still learning.

I’m confused. It gave a signal first thing in the morning before a gigantic move. It stayed green most of the day until the reversal. It wouldn’t give a short signal because of the state of the slower EMA cloud.I didn't trade BBBY at all, but I was just looking at the chart to gauge how this strategy works with trending & higher-volatility/volume stocks.

I am surprised to see pretty minimal activity on the strategy today, despite several decently large moves. What the easiest way to increase the sensitivity of this a bit, without throwing the whole system out of whack?

I’ll have to look at this when I have more time. Send me a reminder if I don’t get back to you in a few days.@a1cturner Sorry to bug you. I am a novice trader who knows coding. I was trying to understand the study and wrote this cheat-sheet for my reference. If you have the time (I know the list below is quite long), would you please review it and let me know if my understanding is correct? Thank you so much in advance!!

White Arrows:

- UP arrow means that all criteria are met and that we should GO LONG (Buy stock / call, or Sell puts)

- DOWN arrow means all criteria are met and that we should GO SHORT (Short or Sell stock, Sell calls, or Buy puts)

- White arrows are our ENTRY SIGNAL into a long or short position.

- White Dash is the level of the previous bar 5EMA +/- 0.25%. This is a good place to ENTER if we didn't get the bar before.

Squares:

- Red or Green squares are our EXIT SIGNAL. Exit at the open of the next bar. We can wait a few seconds and see if the price trends in our desired direction first. This will be evident by the bar changing from Grey to Red/Green.

- Red square means we should exit our long positions

- Green square means we should exit our short positions

Boolean:

- PINK boolean arrow represents that the High/Low is over extended from the 5EMA and we should consider EXITING our position

- UP arrow means we should exit our short positions, while DOWN arrow means we should exit our long positions

- We can also turn on the "Over Ext Clouds" feature. That is a take profit spot where we would get the pink boolean arrow.

Bars / Candles:

- Bars/Candles when combined with Arrows, Squares and Booleans show us our ENTRY and EXIT SIGNALS.

- Red Candle - Buy Puts, Short Shares, or Sell Calls (Entry is on 5EMA or when we get the Buy Bubble)

- Light Red Candle - Hold Puts, Hold your shorted shares or Hold we sold calls

- Green Candle - Buy Calls or Shares, or Sell Puts (Entry is on 5EMA or when we get the Buy Bubble)

- Light Green Candle - Hold Calls or Shares or Hold we sold puts

- Grey bar means “Criteria not met” and that no action should be taken

Default values used:

- EMA (5 and 12)

- TSI (Long Length = 25; Short Length = 13; Signal Length = 8)

- MACD (Fast Length = 10; Slow Length = 22; Signal Length = 8)

Timeframe and Chart Setup:

- Use the 3-Day 5-min timeframe zoomed in, with extended hours visible on chart

- This study will show BUY/SELL indicators only between 6:35a.m. and 1p.m. PST

- Use a flexible grid with multiple charts and load the tickers that you are looking at that particular day.

What does this TOS Strategy check for, that is, how are signals generated?

- For bullish signals, this strategy checks for

- 5EMA>12EMA,

- MACD trending up,

- if TSI > 10, trending up and if the LOW is greater than the pre-market HIGH.

- For bearish signals, this study checks for

- 5EMA<12EMA,

- MACD trending down,

- if TSI < -10, trending down and if the HIGH is lower than the pre-market LOW.

Labels:

- PM High = Pre-Market High

- PM Low = Pre-Market Low

- Prev High = Previous Day’s High

- Prev Low = Previous Day’s Low

- PREMKT

- Green = close price of last bar in selected timeframe (5 min) chart > pre-market high

- Red = close price of last bar in selected timeframe (5 min) chart < pre-market low

- Grey = if above criteria are not met, color is grey

- CLOUD

- Green = 5EMA > 12EMA

- Red = 5EMA < 12EMA

- Grey = if above criteria are not met, color is grey

- EMA SEP

- We first calculate the EMA Separation percent to determine if we get a bullish or bearish value. For the 5-minute timeframe, the EMA Sep Threshold is 0.2.

- Green = The Bullish percent separation from the average EMA which is {(EMA1/EMA2 x100) -100} is calculated and compared to the EMA Sep threshold. If the Bullish EMA Separation > .02 and also > previous EMA-Sep, then the label is green

- Red = The Bearish percent separation from the average EMA which is {(EMA2/EMA1 x100) -100} is calculated and compared to the EMA SEP threshold. If the Bearish EMA Separation > .02 and also > previous EMA-Sep, then the label is red.

- Grey = if above criteria are not met, color is grey

- TSI

- Green = the current TSI is higher than the second last TSI

- Red = the current TSI is lower than the second last TSI

- MACD

- Green = MACD Average is less than TSI

- Red = MACD Average is greater than TSI

- Static labels (for informational purposes only). If the bar / candle is:

- Green = That is a "Long Indicator" and tells us to Go Long (i.e., buy stock or calls, or sell puts)

- Light Green = That is a "Long Hold". That is, if you are currently in a long position, Hold your position

- Red = This is a "Short Indicator" and tells us to Go Short (i.e., short stock, sell stock or calls you own, or buy puts)

- Light Red = That is a "Short Hold". That is, if you are currently in a short position, Hold your position

- Grey = "No Criteria". Criteria are not met

Sorry, that was a bad screenshot—I was talking about the day after. There were hardly any signals at all. Let me ask you this: do you leave extended hours view on or off? Definitely changes the signals quite a bit.I’m confused. It gave a signal first thing in the morning before a gigantic move. It stayed green most of the day until the reversal. It wouldn’t give a short signal because of the state of the slower EMA cloud.

I leave it on. It changes the premarket signals I believe if you turn it off.Sorry, that was a bad screenshot—I was talking about the day after. There were hardly any signals at all. Let me ask you this: do you leave extended hours view on or off? Definitely changes the signals quite a bit.

Thanks for you hard work on this, love the strategy!

Hi @a1cturner thanks for all of your hard work. I just got done reading all 16 pages and I am sort of a novice. I understand this is for options (which I am learing about) but can we also use this for stocks and not use for trading options? Thank you.I leave it on. It changes the premarket signals I believe if you turn it off.

Absolutely. It’s probably safer to use it for stocks vs options.Hi @a1cturner thanks for all of your hard work. I just got done reading all 16 pages and I am sort of a novice. I understand this is for options (which I am learing about) but can we also use this for stocks and not use for trading options? Thank you.

Thanks again.Absolutely. It’s probably safer to use it for stocks vs options.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.