Author Message:

Description:

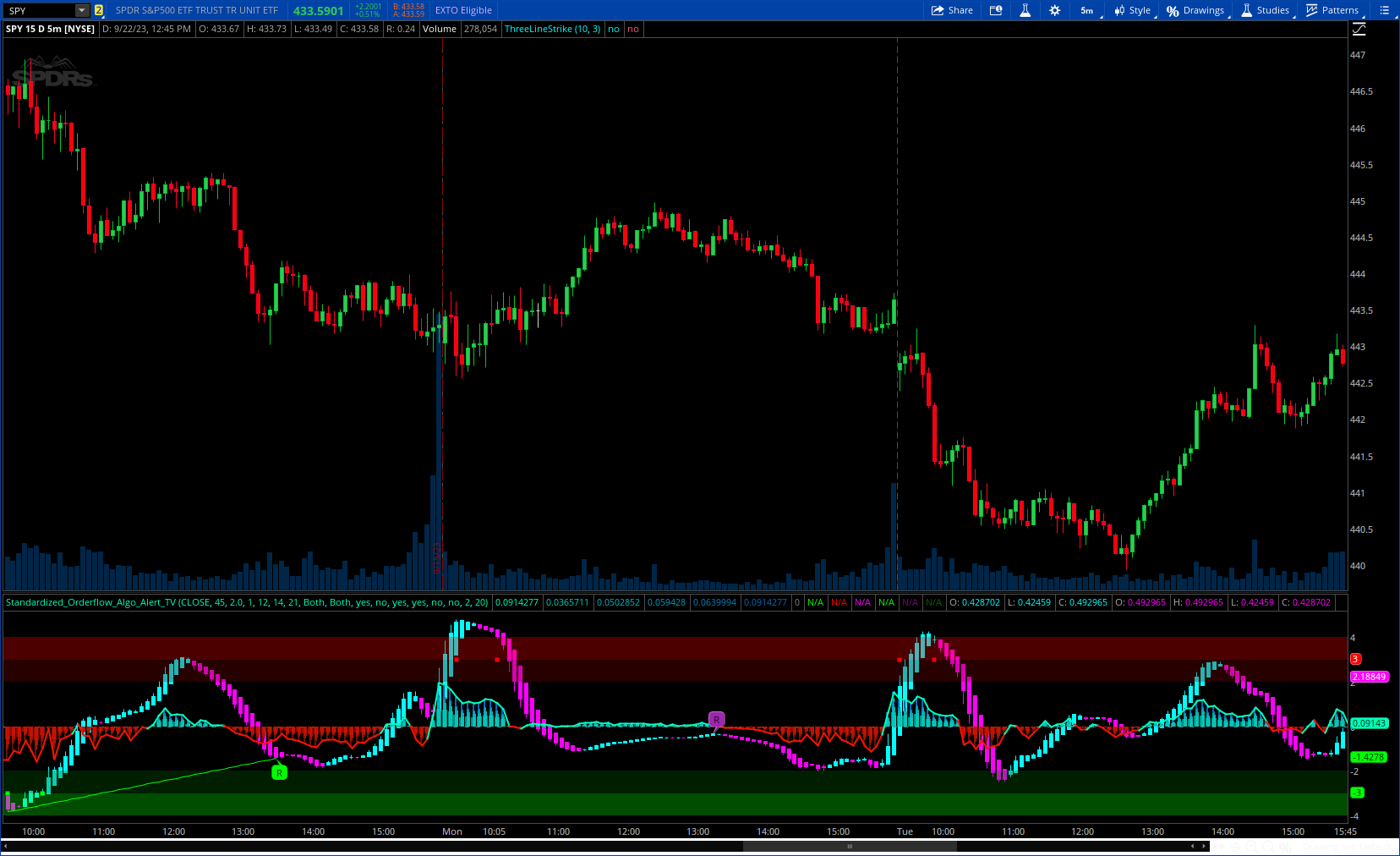

The "⨊ Standardized Orderflow" indicator is a powerful tool designed to enhance your technical analysis and trading strategies. This script brings together several unique features such as divergences, order flow, and volume-based sentiment analysis to provide traders with valuable insights into trend direction and reversal points.

More Details : https://www.tradingview.com/v/W8eyLpnK/

CODE:

CSS:

# https://www.tradingview.com/v/W8eyLpnK/

#// © Algo_Alert

#indicator(title='Standardized Orderflow [Algo Alert]', overlay=false)

# Converted by Sam4Cok@Samer800 - 09/2023

declare lower;

#// Input parameters

input source = close;

input standardDeviationPeriod = 45;

input standardDeviationMulti = 2.0;

input momentumLength = 1;

input orderFlowPeriod = 12; # 'Order Flow Period'

input VelocitySignalLength = 14; # "Velocity Signal Length"

input VelocityCalculationLength = 21; # "Velocity Calculation Length"

input DisplayMode = {default "Both", "Order Flow", "Order Velocity"}; # "Display Mode"

input ReversalType = {default "Both", "Order Flow", "Order Velocity"}; # "Reversal Type"

def na = Double.NaN;

def last = isNaN(close);

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

def emalen = VelocitySignalLength;

def emalen1 = VelocityCalculationLength;

def ofdispcon = DisplayMode != DisplayMode."Order Velocity";

def hadispcon = DisplayMode != DisplayMode."Order Flow";

def disOrderFlow = DisplayMode == DisplayMode."Order Flow";

def revOrderFlow = ReversalType == ReversalType."Order Flow";

def revOrderVelo = ReversalType == ReversalType."Order Velocity";

#--Color

DefineGlobalColor("green", CreateColor(0, 255, 187));

DefineGlobalColor("red", CreateColor(255, 17, 0));

DefineGlobalColor("green1", CreateColor(0, 255-150, 187));

DefineGlobalColor("red1", CreateColor(255-150, 17, 0));

DefineGlobalColor("green2", CreateColor(0, 255-125, 187));

DefineGlobalColor("red2", CreateColor(255-125, 17, 0));

DefineGlobalColor("green3", CreateColor(0, 255-100, 187));

DefineGlobalColor("red3", CreateColor(255-100, 17, 0));

DefineGlobalColor("green4", CreateColor(0, 255-75, 187));

DefineGlobalColor("red4", CreateColor(255-75, 17, 0));

DefineGlobalColor("green5", CreateColor(0, 255-50, 187));

DefineGlobalColor("red5", CreateColor(255-50, 17, 0));

#/Order Flow

def sumCond = if source > source[momentumLength] then volume else

(if source < source[momentumLength] then -volume else 0.00001);

def orderFlow_ = Sum(sumCond, orderFlowPeriod);

def orderFlow = orderFlow_ / 1000;

def stdev = StDev(orderFlow, standardDeviationPeriod);

def orderFlowX = orderFlow / (stdev * standardDeviationMulti);

def chg1 = orderFlowX * 0.70;

def chg2 = orderFlowX * 0.65;

def chg3 = orderFlowX * 0.55;

def chg4 = orderFlowX * 0.40;

def diff = ExpAverage((orderFlowX - ExpAverage(orderFlowX, emalen)) * 10, emalen1);

#//plot(orderFlowX)

plot ofxX = if ofdispcon then orderFlowX else na;

plot ofx4 = if ofdispcon then chg4 else na;

plot ofx3 = if ofdispcon then chg3 else na;

plot ofx2 = if ofdispcon then chg2 else na;

plot ofx1 = if ofdispcon then chg1 else na;

plot OFX = if ofdispcon then orderFlowX else na;

ofxX.SetLineWeight(2);

ofxX.AssignValueColor(if orderFlowX > 0 then GlobalColor("green") else GlobalColor("red"));

ofx.AssignValueColor(if orderFlowX > 0 then GlobalColor("green1") else GlobalColor("red1"));

ofx1.AssignValueColor(if orderFlowX > 0 then GlobalColor("green2") else GlobalColor("red2"));

ofx2.AssignValueColor(if orderFlowX > 0 then GlobalColor("green3") else GlobalColor("red3"));

ofx3.AssignValueColor(if orderFlowX > 0 then GlobalColor("green4") else GlobalColor("red4"));

ofx4.AssignValueColor(if orderFlowX > 0 then GlobalColor("green5") else GlobalColor("red5"));

OFX4.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

OFX3.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

OFX2.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

OFX1.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

OFX.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

#OFX4.SetLineWeight(1);

OFX3.SetLineWeight(4);

OFX2.SetLineWeight(3);

OFX1.SetLineWeight(2);

#OFX.SetLineWeight(1);

plot z = if last then na else 0;#, color = color.gray, style = plot.style_cross)

z.SetDefaultColor(Color.GRAY);

z.SetStyle(Curve.SHORT_DASH);

def post = if last then na else 3;

def negt = if last then na else -3;

def onepntf = if last then na else 2;#(1, color = red, display = display.none)

def negonepntf = if last then na else -2;#plot(-1, color = green, display = display.none)

AddCloud(4, post, Color.RED);

AddCloud(post, onepntf, Color.DARK_RED);

AddCloud(negt, -4, Color.GREEN);

AddCloud(negonepntf, negt, Color.DARK_GREEN);

def bullrevcon = if revOrderFlow then (orderFlowX Crosses Above -1.5) else

(if revOrderVelo then (diff Crosses Above -4) else

((diff Crosses Above -4) or (orderFlowX Crosses Above -1.5)));

def bearrevcon = if revOrderFlow then (orderFlowX Crosses Below 1.5) else

(if revOrderVelo then (diff Crosses Below 4) else

((diff Crosses Below 4) or (orderFlowX Crosses Below 1.5)));

plot BullSig = if bullrevcon then -3 else na;

plot BearSig = if bearrevcon then 3 else na;

BullSig.SetLineWeight(2);

BearSig.SetLineWeight(2);

BullSig.SetPaintingStrategy(PaintingStrategy.SQUARES);

BullSig.SetDefaultColor(Color.GREEN);

BearSig.SetPaintingStrategy(PaintingStrategy.SQUARES);

BearSig.SetDefaultColor(Color.RED);

def o = diff[1];

def h = max(diff, diff[1]);

def l = min(diff, diff[1]);

def c = diff;

def haClose = (o + h + l + c) / 4;

def haOpen_ = CompoundValue(1, (haOpen_[1] + haClose[1]) / 2, (o + c) / 2);

def haOpen = if isNaN(haOpen_) then (o + c) / 2 else haOpen_;

def haHigh = max(h, max(haOpen, haClose));

def haLow = min(l, min(haOpen, haClose));

def up = haClose > haOpen and hadispcon;

# Plot the new Chart

AddChart(high = if up then haHigh else na , low = haLow , open = haClose, close = haOpen,

type = ChartType.CANDLE, growcolor = Color.CYAN);

AddChart(high = if up or !hadispcon then na else haHigh , low = haLow , open = haOpen, close = haClose,

type = ChartType.CANDLE, growcolor = Color.MAGENTA);

#----Div-----------

input ShowLastDivLines = yes;

input ShowLastHiddenDivLines = no;

input DivBull = yes; # "Plot Bullish"

input DivBear = yes; # "Plot Bearish"

input DivHiddenBull = no; # "Plot Hidden Bullish"

input DivHiddenBear = no; # "Plot Hidden Bearish"

input LookBackRight = 2; # "Pivot Lookback Right"

input LookBackLeft = 20; # "Pivot Lookback Left"

def MaxLookback = 80; # "Max of Lookback Range"

def MinLookback = -80; # "Min of Lookback Range"

def divSrc = diff;

def divHi = high;

def divLo = low;

script FindPivots {

input dat = close; # default data or study being evaluated

input HL = 0; # default high or low pivot designation, -1 low, +1 high

input lbL = 5; # default Pivot Lookback Left

input lbR = 1; # default Pivot Lookback Right

##############

def _nan; # used for non-number returns

def _BN; # the current barnumber

def _VStop; # confirms that the lookforward period continues the pivot trend

def _V; # the Value at the actual pivot point

##############

_BN = BarNumber();

_nan = Double.NaN;

_VStop = if !isNaN(dat) and lbr > 0 and lbl > 0 then

fold a = 1 to lbR + 1 with b=1 while b do

if HL > 0 then dat > GetValue(dat,-a) else dat < GetValue(dat,-a) else _nan;

if (HL > 0) {

_V = if _BN > lbL + 1 and dat == Highest(dat, lbL + 1) and _VStop

then dat else _nan;

} else {

_V = if _BN > lbL + 1 and dat == Lowest(dat, lbL + 1) and _VStop

then dat else _nan;

}

plot result = if !IsNaN(_V) and _VStop then _V else _nan;

}

#_inRange(cond) =>

script _inRange {

input cond = yes;

input rangeUpper = 60;

input rangeLower = 5;

def bars = if cond then 0 else bars[1] + 1;

def inrange = (rangeLower <= bars) and (bars <= rangeUpper);

plot retrun = inRange;

}

def pl_ = if hadispcon then findpivots(divSrc,-1, LookBackLeft, LookBackRight) else na;

def ph_ = if hadispcon then findpivots(divSrc, 1, LookBackLeft, LookBackRight) else na;

def pl = !isNaN(pl_);

def ph = !isNaN(ph_);

def pll = lowest(divSrc,LookBackLeft);

def phh = highest(divSrc,LookBackLeft);

def sll = lowest(divLo, LookBackLeft);

def shh = highest(divHi, LookBackLeft);

#-- Pvt Low

def plStart = if pl then yes else plStart[1];

def plFound = if (plStart and pl) then 1 else 0;

def vlFound1 = if plFound then divSrc else vlFound1[1];

def vlFound_ = if vlFound1!=vlFound1[1] then vlFound1[1] else vlFound_[1];

def vlFound = if !vlFound_ then pll else vlFound_;

def plPrice1 = if plFound then divLo else plPrice1[1];

def plPrice_ = if plPrice1!=plPrice1[1] then plPrice1[1] else plPrice_[1];

def plPrice = if !plPrice_ then sll else plPrice_;

#-- Pvt High

def phStart = if ph then yes else phStart[1];

def phFound = if (phStart and ph) then 1 else 0;

def vhFound1 = if phFound then divSrc else vhFound1[1];

def vhFound_ = if vhFound1!=vhFound1[1] then vhFound1[1] else vhFound_[1];

def vhFound = if !vhFound_ then phh else vhFound_;

def phPrice1 = if phFound then divHi else phPrice1[1];

def phPrice_ = if phPrice1!=phPrice1[1] then phPrice1[1] else phPrice_[1];

def phPrice = if !phPrice_ then sll else phPrice_;

#// Regular Bullish

def inRangePl = _inRange(plFound[1],MaxLookback,MinLookback);

def oscHL = divSrc > vlFound and inRangePl;

def priceLL = divLo < plPrice;

def bullCond = plFound and oscHL and priceLL;

#// Hidden Bullish

def oscLL = divSrc < vlFound and inRangePl;

def priceHL = divLo > plPrice;

def hiddenBullCond = plFound and oscLL and priceHL;

#// Regular Bearish

def inRangePh = _inRange(phFound[1],MaxLookback,MinLookback);

def oscLH = divSrc < vhFound and inRangePh;

def priceHH = divHi > phPrice;

def bearCond = phFound and oscLH and priceHH;

#// Hidden Bearish

def oscHH = divSrc > vhFound and inRangePh;

def priceLH = divHi < phPrice;

def hiddenBearCond = phFound and oscHH and priceLH;

#------ Bubbles

def bullBub = DivBull and bullCond;

def HbullBub = DivHiddenBull and hiddenBullCond;

def bearBub = DivBear and bearCond;

def HbearBub = DivHiddenBear and hiddenBearCond;

addchartbubble(bullBub, divSrc, "R", color.GREEN, no);

addchartbubble(bearBub, divSrc, "R", CreateColor(156,39,176), yes);

addchartbubble(HbullBub, divSrc, "H", color.DARK_green, no);

addchartbubble(HbearBub, divSrc, "H", color.DARK_red, yes);

##### Lines

def bar = BarNumber();

#-- Bear Line

def lastPhBar = if ph then bar else lastPhBar[1];

def prePhBar = if lastPhBar!=lastPhBar[1] then lastPhBar[1] else prePhBar[1];

def priorPHBar = if bearCond then prePhBar else priorPHBar[1];

#-- Bull Line

def lastPlBar = if pl then bar else lastPlBar[1];

def prePlBar = if lastPlBar!=lastPlBar[1] then lastPlBar[1] else prePlBar[1];

def priorPLBar = if bullCond then prePlBar else priorPLBar[1];

def lastBullBar = if bullCond then bar else lastBullBar[1];

def lastBearBar = if bearCond then bar else lastBearBar[1];

def HighPivots = ph and bar >= HighestAll(priorPHBar) and bar <= HighestAll(lastBearBar);

def LowPivots = pl and bar >= HighestAll(priorPLBar) and bar <= HighestAll(lastBullBar);

def pivotHigh = if HighPivots then divSrc else na;

def pivotLow = if LowPivots then divSrc else na;

plot PlotHline = if ShowLastDivLines then pivotHigh else na;

PlotHline.EnableApproximation();

PlotHline.SetDefaultColor(Color.MAGENTA);

plot PlotLline = if ShowLastDivLines then pivotLow else na;

PlotLline.EnableApproximation();

PlotLline.SetDefaultColor(Color.GREEN);

#--- Hidden Lines

#-- Bear Line

def priorHPHBar = if hiddenBearCond then prePhBar else priorHPHBar[1];

#-- Bull Line

def priorHPLBar = if hiddenBullCond then prePlBar else priorHPLBar[1];

def lastHBullBar = if hiddenBullCond then bar else lastHBullBar[1];

def lastHBearBar = if hiddenBearCond then bar else lastHBearBar[1];

def HighHPivots = ph and bar >= HighestAll(priorHPHBar) and bar <= HighestAll(lastHBearBar);

def LowHPivots = pl and bar >= HighestAll(priorHPLBar) and bar <= HighestAll(lastHBullBar);

def pivotHidHigh = if HighHPivots then divSrc else na;

def pivotHidLow = if LowHPivots then divSrc else na;

plot PlotHBearline = if ShowLastHiddenDivLines then pivotHidHigh else na;

PlotHBearline.EnableApproximation();

PlotHBearline.SetDefaultColor(Color.PLUM);

plot PlotHBullline = if ShowLastHiddenDivLines then pivotHidLow else na;

PlotHBullline.EnableApproximation();

PlotHBullline.SetDefaultColor(Color.DARK_GREEN);

#-- END of CODE