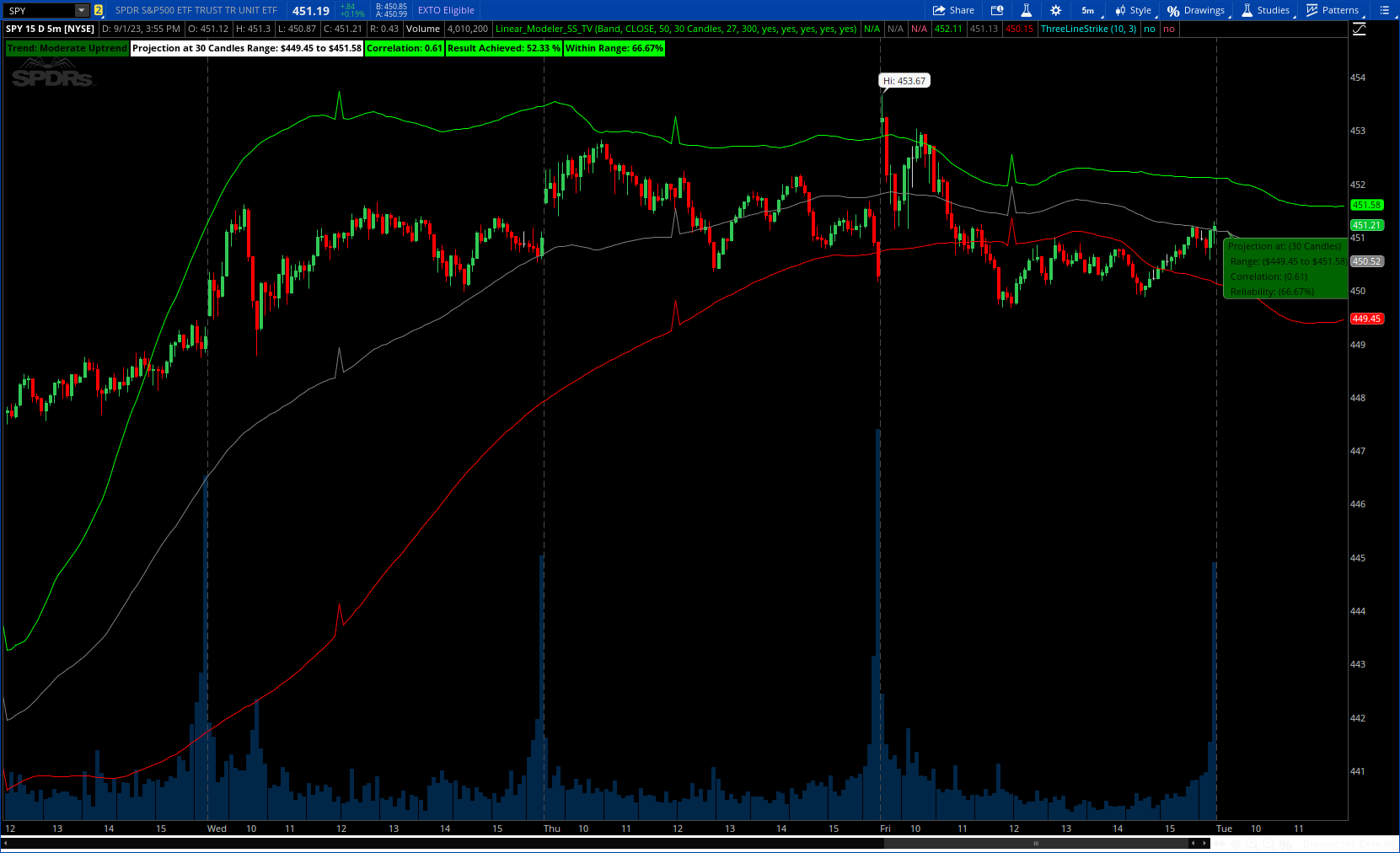

interesting indicator. I added option to plot line instead of band for better visualization.

Author Message:

This is the linear modeler indicator.

It is a statistical based indicator that provides a likely price target and range based on a linear regression time series analysis.

Read full details here : https://www.tradingview.com/v/fLeTgfxW/

CODE:

CSS:

# https://www.tradingview.com/v/fLeTgfxW/

#// © Steversteves

# indicator("[SS] Linear Modeler", overlay=true)

# Converted and mod by Sam4Cok@Samer800 - 09/2023

#// user inputs //

input plotStyle = {Default "Line", "Band", "Band & Line", "None"};

input Source = close; # "Source"

input AssessmentLength = 50; # "Assessment Length"

input prjplot = {"Manual", "10 Candles", "20 Candles",default "30 Candles", "40 Candles", "50 Candles", "60 Candles", "70 Candles", "80 Candles", "90 Candles", "100 Candles"}; # "Projection Plots"

input manualNoOfCandles = 27;

input lookback = 300; # "Backtest Range"

input onChartBubble = yes;

input projectionRangeLabel = yes; # "Display Chart"

input BacktestResultsLabel = yes; # "Display Backtest Results"

input CorrelationLabel = yes; # "Display Correlation"

input TrendLabel = yes; # "Display Trend Result"

def na = Double.NaN;

def last = isNaN(close);

def islast = !IsNaN(close[1]);

def len = AssessmentLength;

def band = plotStyle == plotStyle."Band" or plotStyle==plotStyle."Band & Line";

def line = plotStyle == plotStyle."Line" or plotStyle==plotStyle."Band & Line";

#// Pull Source Data //

def h = high;

def l = low;

def src_data = Source;

def time = GetTime();

def src_data_time = time;

def k;

Switch (prjplot) {

Case "Manual" : k = manualNoOfCandles;

Case "10 Candles" : k = 10;

Case "20 Candles" : k = 20;

Case "30 Candles" : k = 30;

Case "40 Candles" : k = 40;

Case "50 Candles" : k = 50;

Case "60 Candles" : k = 60;

Case "70 Candles" : k = 70;

Case "80 Candles" : k = 80;

Case "90 Candles" : k = 90;

Case "100 Candles" : k = 100;

}

#/ Fundamental Functions //

# f_regression(float independent, float dependent, int len, float variable) =>

script f_regression {

input ind = close;

input dep = close;

input len = 50;

input variable = 0;

def independent = ind;

def dependent = dep;

def y_array = fold i = 0 to len + 1 with p do

p + dependent[i];

def y_sq_array = fold i1 = 0 to len + 1 with p1 do

p1 + (dependent[i1] * dependent[i1]);

def x_array = fold i2 = 0 to len + 1 with p2 do

p2 + independent[i2];

def x_sq_array = fold i3 = 0 to len + 1 with p3 do

p3 + (independent[i3] * independent[i3]);

def xy_array = fold i4 = 0 to len + 1 with p4 do

p4 + (independent[i4] * dependent[i4]);

def y = y_array;

def y2 = y_sq_array;

def x = x_array;

def x2 = x_sq_array;

def xy = xy_array;

def b1 = xy - (x * y) / len;

def bbb2 = x2 - (Power(x, 2) / len);

def slope = (b1 / bbb2);

def abc = y - (slope * x);

def abc1 = abc / len;

def result = (variable * slope) + abc1;

plot out = result;

}

#f_standard_error(float result, float dependent, int len) =>

script f_standard_error {

input result = close;

input dependent = close;

input len = 50;

def se_residuals = fold i = 0 to len + 1 with p do

p + ((result[i] - dependent[i]) * (result[i] - dependent[i]));

def se_add = se_residuals;

def rk = se_add / (len - 1);

def se = Sqrt(rk);

plot out = se;

}

script f_perc {

input pass = 1;

input fail = 1;

def f_perc = pass / (pass + fail) * 100;

plot out = f_perc;

}

script f_trend {

input cor = 0;

def res =

if cor >= 0.5 and cor <= 0.7 then 1 else # "Moderate Uptrend"

if cor > 0.7 then 2 else # "Strong Uptrend"

if cor <= -0.5 and cor >= -0.7 then -1 else # "Moderate Downtrend"

if cor < -0.7 then -2 else 0;# res := "Strong Downtrend"

# res := "No Clear Trend"

plot out = res;

}

#/ Forecast Model //

def change = (src_data_time - src_data_time[1]);

def timeChange = (src_data_time + (change * k));

def q_10 = f_regression(src_data_time[k], src_data, len, timeChange);

def q10 = q_10;

#// Correlations //

def q10cor = Correlation(src_data, src_data_time, k);

def q10_cor = q10cor;

#// Range Determination //

def seq10 = f_standard_error(q10[k], src_data, len);

def se_q10 = seq10;

def q10_ucl = se_q10 + q10;

def q10_lcl = q10 - se_q10;

def q10rng_bt = src_data >= q10_lcl[k] and src_data <= q10_ucl[k];

def q10_rng_bt = q10rng_bt;

def q10pass = fold i = 0 to lookback with p do

if q10_rng_bt[i] and islast then p + 1 else p;

def q10fail = fold i0 = 0 to lookback with p0 do

if q10_rng_bt[i0] and islast then p0 else p0 + 1;

def q10_pass = q10pass;

def q10_fail = q10fail;

def q10pass_res = f_perc(q10_pass, q10_fail);

def q10_pass_res = q10pass_res;

#// Result Backtest //

def highest10 = Highest(h, k);

def lowest10 = Lowest(l, k);

def q10bt = q10[k] <= highest10 and q10[k] >= lowest10;

def q10_bt = q10bt;

def q10res_pass = fold j = 0 to lookback with q do

if q10_bt[j] and islast then q + 1 else q;

def q10res_fail = fold j0 = 0 to lookback with q0 do

if q10_bt[j0] and islast then q0 else q0 + 1;

def q10_res_pass = q10res_pass;

def q10_res_fail = q10res_fail;

def q10perc = f_perc(q10_res_pass, q10_res_fail);

def q10_perc = q10perc;

def s10 = f_trend(q10_cor);

def s_10 = if isNaN(s10) then 0 else s10;

def cor_Col = q10_cor >= 0.5 or q10_cor <= -0.5;

def corCol = cor_Col;

def plot_input = q10;

def plot_input_ucl = q10_ucl;

def plot_input_lcl = q10_lcl;

def roundlcl10 = round(q10_lcl,2);

def roundusl10 = round(q10_ucl,2);

def roundcor10 = round(q10_cor,2);

def roundrel10 = round(q10_pass_res,2);

def roundper10 = round(q10_perc, 2);

def middleBand = plot_input[k];

def lowerBand = plot_input_lcl[k];

def upperBand = plot_input_ucl[k];

def intInput = inertiaAll(plot_input, 2);

def intucl = inertiaAll(plot_input_ucl, 2);

def intlcl = inertiaAll(plot_input_lcl, 2);

def hiintInput = highestAll(intInput);

def hiuclInput = highestAll(intucl);

def hilclInput = highestAll(intlcl);

def middleLine_ = inertiaAll(hiintInput,lookback);

def upperLine_ = inertiaAll(hiuclInput,lookback) ;

def lowerLine_ = inertiaAll(hilclInput,lookback) ;

def middleLine = middleLine_;

def upperLine = upperLine_;

def lowerLine = lowerLine_;

#-- Plot

plot upLine = if line then upperLine else na;

plot midLine = if line then middleLine else na;

plot LoLine = if line then lowerLine else na;

plot UpBand = if band then upperBand else na;

plot midBand = if band then middleBand else na;

plot LoBand = if band then lowerBand else na;

midBand.SetDefaultColor(Color.GRAY);

UpBand.SetDefaultColor(Color.GREEN);

LoBand.SetDefaultColor(Color.RED);

midLine.SetDefaultColor(Color.GRAY);

UpLine.SetDefaultColor(Color.GREEN);

LoLine.SetDefaultColor(GetColor(2));

#-- Labels

AddLabel(TrendLabel, "Trend: " + if s_10==2 then "Strong Uptrend" else

if s_10==1 then "Moderate Uptrend" else

if s_10==-1 then "Moderate Downtrend" else

if s_10==-2 then "Strong Downtrend" else "No Clear Trend"

, if s_10==2 then Color.GREEN else

if s_10==1 then Color.DARK_GREEN else

if s_10==-1 then Color.DARK_RED else

if s_10==-2 then Color.RED else Color.GRAY);

AddLabel(projectionRangeLabel, "Projection at " + k + " Candles Range: $" +

roundlcl10 + " to $" + roundusl10, Color.WHITE);

AddLabel(CorrelationLabel, "Correlation: " + roundcor10 , if corCol then Color.GREEN else Color.RED);

AddLabel(BacktestResultsLabel, "Result Achieved: " + roundper10 + " %",

if roundper10 >=51 then Color.GREEN else Color.RED);

AddLabel(BacktestResultsLabel, "Within Range: " + roundrel10 + "%",

if roundrel10 >=51 then Color.GREEN else Color.RED);

#-- Bubble

def loc = onChartBubble and !last[1] and last;

AddChartBubble(loc[2], middleBand, "Projection at: (" + k + " Candles) \n Range: ($" + roundlcl10[3] + " to $" + roundusl10[3] + ")\n Correlation: (" + roundcor10[3] + ")\n Reliability: (" + roundrel10[3] + "%)"

, if s_10[3]==2 then Color.GREEN else

if s_10[3]==1 then Color.DARK_GREEN else

if s_10[3]==-1 then Color.DARK_RED else

if s_10[3]==-2 then Color.RED else Color.GRAY,

if source[3] < middleBand[3] then yes else no);

#- End of CODE