You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Smoothed Heikin-Ashi for ThinkorSwim

- Thread starter mc01439

- Start date

JP782

Active member

Does anyone have the script for this Smooth HA study watchlist column?Hi, I'm new here.

I really wanted to try out a Smoothed Heiken-Ashi study for TOS, since it is not available in the default program I looked for a script online, which brought me here. I edited the study from page 1.

I don't do much scripting but I thought others might find it useful.

Code:# Heikin Ashi Smoothed # HoboTheClown / blt # 9.15.2016 # HoboTheClown: I recently found a code for smoothed heiken ashi bars, # however for some reason all the bars are displayed as one color (going up or down). # # blt: Modified the code and replaced the addchart code at the bottom, # you should now see proper coloring. This is how that was coded to plot # as an overlay to the chart candlesticks. That is two sets of candles, # with different coloring for each. If you have the heikin ashi candle # coloring code on your chart, then they will likely appear the same color. #Update that "fixes" the green candles. #JTP #02/7/2021 input period = 20; input hideCandles = Yes; #Now functional - JTP input candleSmoothing = {default Valcu, Vervoort}; DefineGlobalColor("RisingMA", color.green); DefineGlobalColor("FallingMA", color.red); input movingAverageType = {Simple, default Exponential, Weighted, Hull, Variable, TEMA}; def openMA; def closeMA; def highMA; def lowMA; switch (movingAverageType) { case Simple: openMA = compoundValue(1, Average(open, period), open); closeMA = compoundValue(1, Average(close, period), close); highMA = compoundValue(1, Average(high, period), high); lowMA = compoundValue(1, Average(low, period), low); case Exponential: openMA = compoundValue(1, ExpAverage(open, period), open); closeMA = compoundValue(1, ExpAverage(close, period), close); highMA = compoundValue(1, ExpAverage(high, period), high); lowMA = compoundValue(1, ExpAverage(low, period), low); case Weighted: openMA = compoundValue(1, WMA(open, period), open); closeMA = compoundValue(1, WMA(close, period), close); highMA = compoundValue(1, WMA(high, period), high); lowMA = compoundValue(1, WMA(low, period), low); Case Hull: openMA = compoundValue(1, HullMovingAvg(open, period), open); closeMA = compoundValue(1, HullMovingAvg(close, period), close); highMA = compoundValue(1, HullMovingAvg(high, period), high); lowMA = compoundValue(1, HullMovingAvg(low, period), low); case variable: openMA = compoundValue(1, VariableMA(open, period), open); closeMA = compoundValue(1, VariableMA(close, period), close); highMA = compoundValue(1, VariableMA(high, period), high); lowMA = compoundValue(1, VariableMA(low, period), low); case TEMA: openMA = compoundValue(1, TEMA(open, period), open); closeMA = compoundValue(1, TEMA(close, period), close); highMA = compoundValue(1, TEMA(high, period), high); lowMA = compoundValue(1, TEMA(low, period), low); } hidePricePlot(hideCandles); def haOpen; def haClose; switch(candleSmoothing) { case Valcu: haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) /4.0)/2.0), open); haClose = ((OpenMA + HighMA + LowMA + CloseMA)/4.0) ; case Vervoort: haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) /4.0)/2.0), open); haClose = ((((OpenMA + HighMA + LowMA + CloseMA)/4.0) + haOpen + Max(HighMA, haOpen) + Min(LowMA, haOpen))/4.0); } plot o = haOpen + 0; o.hide(); ### Wicks and Shadows def haLow = min(lowMA, haOpen); def haHigh = max(highMA,haOpen); ### NO LONGER SUPPORTED BY TOS ### ### AddChart(high = haHigh, low = haLow, open = o, close = haclose, type = ChartType.CANDLE, growColor = GlobalColor("RisingMA"), fallColor = GlobalColor("FallingMA"), neutralColor = color.gray); #Red Candlesticks -----------------------------------------------------------------| input charttype = ChartType.CANDLE; def haOpen_fall = if haOpen>haClose then haOpen else double.nan; def haHigh_fall = if haOpen>=haClose then haHigh else double.nan; def haLow_fall = if haOpen>=haClose then haLow else double.nan; def haClose_fall = if haOpen>=haClose then haClose else double.nan; AddChart(growColor = Color.red, fallColor = Color.green, neutralColor = Color.current, high = haHigh_fall, low = haLow_fall, open = haOpen_fall, close = haClose_fall , type = ChartType.CANDLE); #Green Candlesticks -----------------------------------------------------------------| #Removed and/or replaced - JTP #def HAclose1 = if haOpen<=haClose # then hahigh # else double.nan; #def HAclose1 = ohlc4 -1; #def HAopen1 = if haopen<=haclose # then haclose # then CompoundValue(1, (HAopen[1] + HAclose[1]) /2, (open[1] + close[1]) / 2) # else double.nan; def haOpen_rise = if haOpen<haClose then haClose else double.nan; def haHigh_rise = if haOpen<=haClose then haHigh else double.nan; def haLow_rise = if haOpen<=haClose then haLow else double.nan; def haClose_rise = if haOpen<=haClose then haOpen else double.nan; AddChart(growColor = Color.green, fallColor = Color.red, neutralColor = Color.current, high = haHigh_rise, low = haLow_rise, open = haOpen_rise, close = HAclose_rise, type = ChartType.CANDLE); # End Study ##############################################################################

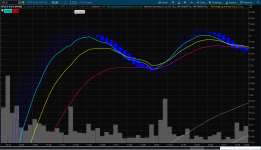

View attachment 9397

OutsideTrades

New member

I was wondering if any one knows how to add an alert to this Heikin Ashi Smoothed code below to signal when the trend has change and closed in a new direction. I have added a screen shot of when I am looking for it to alert, the purple vertical line is where the signal should trigger. I pulled the alert code from another one of my scripts but for some reason I havent been able to figure out what part of the Heikin code will actually make this one trigger on the switch.

Thanks a bunch in advance!!!

https://usethinkscript.com/threads/smoothed-heikin-ashi-for-thinkorswim.216/

Code Below

Thanks a bunch in advance!!!

https://usethinkscript.com/threads/smoothed-heikin-ashi-for-thinkorswim.216/

Code Below

Code:

Code Below

# Heikin Ashi Smoothed

# HoboTheClown / blt

# 9.15.2016

input period = 6;

input hideCandles = no;

input candleSmoothing = {default Valcu, Vervoort};

DefineGlobalColor("RisingMA", color.green);

DefineGlobalColor("FallingMA", color.red);

input movingAverageType = {Simple, default Weighted};

def openMA;

def closeMA;

def highMA;

def lowMA;

switch (movingAverageType) {

case Simple:

openMA = compoundValue(1, Average(open, period), open);

closeMA = compoundValue(1, Average(close, period), close);

highMA = compoundValue(1, Average(high, period), high);

lowMA = compoundValue(1, Average(low, period), low);

case Weighted:

openMA = compoundValue(1, WMA(open, period), open);

closeMA = compoundValue(1, WMA(close, period), close);

highMA = compoundValue(1, WMA(high, period), high);

lowMA = compoundValue(1, WMA(low, period), low);

}

#hidePricePlot(hideCandles);

def haOpen;

def haClose;

switch(candleSmoothing) {

case Valcu:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) /4.0)/2.0), open);

haClose = ((OpenMA + HighMA + LowMA + CloseMA)/4.0) ;

case Vervoort:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) /4.0)/2.0), open);

haClose = ((((OpenMA + HighMA + LowMA + CloseMA)/4.0) + haOpen + Max(HighMA, haOpen) + Min(LowMA, haOpen))/4.0);

}

plot o = haopen;

o.hide();

def haLow = min(lowMA, haOpen);

def haHigh = max(highMA,haOpen);

### NO LONGER SUPPORTED BY TOS

###

### AddChart(high = haHigh, low = haLow, open = o, close = haclose, type = ChartType.CANDLE, growColor = GlobalColor("RisingMA"), fallColor = GlobalColor("FallingMA"), neutralColor = color.gray);

####THIS IS FOR THE RED CANDLES OF THE HA

input charttype = ChartType.CANDLE;

def haopen_ = if haopen>haclose

then HAopen + 0

else double.nan;

def HAhi = if haopen>=haclose

then hahigh

else double.nan;

def HAlo = if haopen>=haclose

then halow

else double.nan;

AddChart(growColor = color.red, fallColor = Color.green, neutralColor = Color.current, high = HAhi, low = HAlow, open = haopen_, close = HAclose, type = ChartType.CANDLE);

####THIS IS FOR THE GREEN CANDLES OF THE HA

def HAclose1 = ohlc4;

def HAopen1 = if haopen<=haclose

then CompoundValue(1, (HAopen[1] + HAclose[1]) / 2, (open[1] + close[1]) / 2)

else double.nan;

def haopen_1 = if haopen<=haclose

then HAopen1 + 0

else double.nan;

def HAhigh1 = hahigh;

def HAlow1 = halow;

AddChart(growColor = Color.green, fallColor = Color.red, neutralColor = Color.current, high = HAhigh1, low = HAlow1, open = haopen_1, close = HAclose1, type = ChartType.CANDLE);

####This is the alert code, the next 2 lines are incorrect and need fixing, the last 2 ALERT codes work as they should.

#def SELL = hahigh1[1] > hahigh1 ;

#def BUY = halow1[1] < halow1 ;

#alert(SELL, "SELL", Alert.BAR, Sound.Ding);

#alert(BUY, "BUY", Alert.BAR, Sound.Ring);Attachments

Last edited by a moderator:

I was wondering if any one knows how to add an alert to this Heikin Ashi Smoothed code below to signal when the trend has change and closed in a new direction. I have added a screen shot of when I am looking for it to alert, the purple vertical line is where the signal should trigger. I pulled the alert code from another one of my scripts but for some reason I havent been able to figure out what part of the Heikin code will actually make this one trigger on the switch.

Thanks a bunch in advance!!!

https://usethinkscript.com/threads/smoothed-heikin-ashi-for-thinkorswim.216/

Code Below

# Heikin Ashi Smoothed

# HoboTheClown / blt

# 9.15.2016

input period = 6;

input hideCandles = no;

input candleSmoothing = {default Valcu, Vervoort};

DefineGlobalColor("RisingMA", color.green);

DefineGlobalColor("FallingMA", color.red);

input movingAverageType = {Simple, default Weighted};

def openMA;

def closeMA;

def highMA;

def lowMA;

switch (movingAverageType) {

case Simple:

openMA = compoundValue(1, Average(open, period), open);

closeMA = compoundValue(1, Average(close, period), close);

highMA = compoundValue(1, Average(high, period), high);

lowMA = compoundValue(1, Average(low, period), low);

case Weighted:

openMA = compoundValue(1, WMA(open, period), open);

closeMA = compoundValue(1, WMA(close, period), close);

highMA = compoundValue(1, WMA(high, period), high);

lowMA = compoundValue(1, WMA(low, period), low);

}

#hidePricePlot(hideCandles);

def haOpen;

def haClose;

switch(candleSmoothing) {

case Valcu:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) /4.0)/2.0), open);

haClose = ((OpenMA + HighMA + LowMA + CloseMA)/4.0) ;

case Vervoort:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) /4.0)/2.0), open);

haClose = ((((OpenMA + HighMA + LowMA + CloseMA)/4.0) + haOpen + Max(HighMA, haOpen) + Min(LowMA, haOpen))/4.0);

}

plot o = haopen;

o.hide();

def haLow = min(lowMA, haOpen);

def haHigh = max(highMA,haOpen);

### NO LONGER SUPPORTED BY TOS

###

### AddChart(high = haHigh, low = haLow, open = o, close = haclose, type = ChartType.CANDLE, growColor = GlobalColor("RisingMA"), fallColor = GlobalColor("FallingMA"), neutralColor = color.gray);

####THIS IS FOR THE RED CANDLES OF THE HA

input charttype = ChartType.CANDLE;

def haopen_ = if haopen>haclose

then HAopen + 0

else double.nan;

def HAhi = if haopen>=haclose

then hahigh

else double.nan;

def HAlo = if haopen>=haclose

then halow

else double.nan;

AddChart(growColor = color.red, fallColor = Color.green, neutralColor = Color.current, high = HAhi, low = HAlow, open = haopen_, close = HAclose, type = ChartType.CANDLE);

####THIS IS FOR THE GREEN CANDLES OF THE HA

def HAclose1 = ohlc4;

def HAopen1 = if haopen<=haclose

then CompoundValue(1, (HAopen[1] + HAclose[1]) / 2, (open[1] + close[1]) / 2)

else double.nan;

def haopen_1 = if haopen<=haclose

then HAopen1 + 0

else double.nan;

def HAhigh1 = hahigh;

def HAlow1 = halow;

AddChart(growColor = Color.green, fallColor = Color.red, neutralColor = Color.current, high = HAhigh1, low = HAlow1, open = haopen_1, close = HAclose1, type = ChartType.CANDLE);

####This is the alert code, the next 2 lines are incorrect and need fixing, the last 2 ALERT codes work as they should.

#def SELL = hahigh1[1] > hahigh1 ;

#def BUY = halow1[1] < halow1 ;

#alert(SELL, "SELL", Alert.BAR, Sound.Ding);

#alert(BUY, "BUY", Alert.BAR, Sound.Ring);

looks like you want lines from the peaks and valleys

take a look at this post

https://usethinkscript.com/threads/...y-demand-zones-for-thinkorswim.172/#post-7048

frankthefrogking

New member

Can't remember where I had found this, but I seem to get only the risingMA color. The fallingMA(red) color is risingMA(blue). So it's all the same color.

Code:

input period = 6;

input hideCandles = YES;

input candleSmoothing = {default Valcu, Vervoort};

DefineGlobalColor("RisingMA", color.blue);

DefineGlobalColor("FallingMA", color.red);

input movingAverageType = {default Simple, Exponential, Weighted, Hull, Variable, TEMA};

def openMA;

def closeMA;

def highMA;

def lowMA;

switch (movingAverageType) {

case Simple:

openMA = compoundValue(1, Average(open, period), open);

closeMA = compoundValue(1, Average(close, period), close);

highMA = compoundValue(1, Average(high, period), high);

lowMA = compoundValue(1, Average(low, period), low);

case Exponential:

openMA = compoundValue(1, ExpAverage(open, period), open);

closeMA = compoundValue(1, ExpAverage(close, period), close);

highMA = compoundValue(1, ExpAverage(high, period), high);

lowMA = compoundValue(1, ExpAverage(low, period), low);

case Weighted:

openMA = compoundValue(1, WMA(open, period), open);

closeMA = compoundValue(1, WMA(close, period), close);

highMA = compoundValue(1, WMA(high, period), high);

lowMA = compoundValue(1, WMA(low, period), low);

Case Hull:

openMA = compoundValue(1, HullMovingAvg(open, period), open);

closeMA = compoundValue(1, HullMovingAvg(close, period), close);

highMA = compoundValue(1, HullMovingAvg(high, period), high);

lowMA = compoundValue(1, HullMovingAvg(low, period), low);

case variable:

openMA = compoundValue(1, VariableMA(open, period), open);

closeMA = compoundValue(1, VariableMA(close, period), close);

highMA = compoundValue(1, VariableMA(high, period), high);

lowMA = compoundValue(1, VariableMA(low, period), low);

case TEMA:

openMA = compoundValue(1, TEMA(open, period), open);

closeMA = compoundValue(1, TEMA(close, period), close);

highMA = compoundValue(1, TEMA(high, period), high);

lowMA = compoundValue(1, TEMA(low, period), low);

}

hidePricePlot(hideCandles);

def haOpen;

def haClose;

switch(candleSmoothing) {

case Valcu:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) /4.0)/2.0), open);

haClose = ((OpenMA + HighMA + LowMA + CloseMA)/4.0) ;

case Vervoort:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) /4.0)/2.0), open);

haClose = ((((OpenMA + HighMA + LowMA + CloseMA)/4.0) + haOpen + Max(HighMA, haOpen) + Min(LowMA, haOpen))/4.0);

}

plot o = haopen;

o.hide();

def haLow = min(lowMA, haOpen);

def haHigh = max(highMA,haOpen);

AddChart(high = haHigh, low = haLow, open = o, close = haclose, type = ChartType.CANDLE, growColor = GlobalColor("RisingMA"), fallColor = GlobalColor("FallingMA"), neutralColor = color.gray);Can't remember where I had found this, but I seem to get only the risingMA color. The fallingMA(red) color is risingMA(blue). So it's all the same color.

It would appear that the candles are hard-coded to green and red and not using your global option of blue

Are you looking for all bullish candles to be blue and bearish red?

Or are you looking for something else.

If something else, be very clear as to what you are asking.

An annotated image also helps.

frankthefrogking

New member

thanks for the response, yes id like them to show bullish blue and bearish red. They're all blue right not.It would appear that the candles are hard-coded to green and red and not using your global option of blue

Are you looking for all bullish candles to be blue and bearish red?

Or are you looking for something else.

If something else, be very clear as to what you are asking.

An annotated image also helps.

Attachments

Last edited:

thanks for the response, yes id like them to show bullish blue and bearish red. They're all blue right not.

Can't remember where I had found this, but I seem to get only the risingMA color. The fallingMA(red) color is risingMA(blue). So it's all the same color.

Code:input period = 6; input hideCandles = YES; input candleSmoothing = {default Valcu, Vervoort}; DefineGlobalColor("RisingMA", color.blue); DefineGlobalColor("FallingMA", color.red); input movingAverageType = {default Simple, Exponential, Weighted, Hull, Variable, TEMA}; def openMA; def closeMA; def highMA; def lowMA; switch (movingAverageType) { case Simple: openMA = compoundValue(1, Average(open, period), open); closeMA = compoundValue(1, Average(close, period), close); highMA = compoundValue(1, Average(high, period), high); lowMA = compoundValue(1, Average(low, period), low); case Exponential: openMA = compoundValue(1, ExpAverage(open, period), open); closeMA = compoundValue(1, ExpAverage(close, period), close); highMA = compoundValue(1, ExpAverage(high, period), high); lowMA = compoundValue(1, ExpAverage(low, period), low); case Weighted: openMA = compoundValue(1, WMA(open, period), open); closeMA = compoundValue(1, WMA(close, period), close); highMA = compoundValue(1, WMA(high, period), high); lowMA = compoundValue(1, WMA(low, period), low); Case Hull: openMA = compoundValue(1, HullMovingAvg(open, period), open); closeMA = compoundValue(1, HullMovingAvg(close, period), close); highMA = compoundValue(1, HullMovingAvg(high, period), high); lowMA = compoundValue(1, HullMovingAvg(low, period), low); case variable: openMA = compoundValue(1, VariableMA(open, period), open); closeMA = compoundValue(1, VariableMA(close, period), close); highMA = compoundValue(1, VariableMA(high, period), high); lowMA = compoundValue(1, VariableMA(low, period), low); case TEMA: openMA = compoundValue(1, TEMA(open, period), open); closeMA = compoundValue(1, TEMA(close, period), close); highMA = compoundValue(1, TEMA(high, period), high); lowMA = compoundValue(1, TEMA(low, period), low); } hidePricePlot(hideCandles); def haOpen; def haClose; switch(candleSmoothing) { case Valcu: haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) /4.0)/2.0), open); haClose = ((OpenMA + HighMA + LowMA + CloseMA)/4.0) ; case Vervoort: haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) /4.0)/2.0), open); haClose = ((((OpenMA + HighMA + LowMA + CloseMA)/4.0) + haOpen + Max(HighMA, haOpen) + Min(LowMA, haOpen))/4.0); } plot o = haopen; o.hide(); def haLow = min(lowMA, haOpen); def haHigh = max(highMA,haOpen); AddChart(high = haHigh, low = haLow, open = o, close = haclose, type = ChartType.CANDLE, growColor = GlobalColor("RisingMA"), fallColor = GlobalColor("FallingMA"), neutralColor = color.gray);

Remove the addchart() code:

Code:AddChart(high = haHigh, low = haLow, open = o, close = haclose, type = ChartType.CANDLE, growColor = GlobalColor("RisingMA"), fallColor = GlobalColor("FallingMA"), neutralColor = color.gray);[

Replace it with:

Code:

def bull = haOpen < haClose;

def na = Double.NaN;

AddChart(if bull then haHigh else na, low = haLow, open = o, close = haClose, type = ChartType.CANDLE, growColor = GlobalColor("RisingMA"), fallColor = GlobalColor("FallingMA"), neutralColor = Color.GRAY);

AddChart(if !bull then haHigh else na, low = haLow, open = o, close = haClose, type = ChartType.CANDLE, growColor = GlobalColor("fallingMA"), fallColor = GlobalColor("FallingMA"), neutralColor = Color.GRAY);frankthefrogking

New member

Remove the addchart() code:

Replace it with:

Code:def bull = haOpen < haClose; def na = Double.NaN; AddChart(if bull then haHigh else na, low = haLow, open = o, close = haClose, type = ChartType.CANDLE, growColor = GlobalColor("RisingMA"), fallColor = GlobalColor("FallingMA"), neutralColor = Color.GRAY); AddChart(if !bull then haHigh else na, low = haLow, open = o, close = haClose, type = ChartType.CANDLE, growColor = GlobalColor("fallingMA"), fallColor = GlobalColor("FallingMA"), neutralColor = Color.GRAY);

Worked perfectly!

Last edited by a moderator:

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| P | Smoothed Moving Average For ThinkOrSwim | Indicators | 5 | |

| P | Heikin-Ashi Candles Lower Chart For ThinkorSwim (assorted versions) | Indicators | 28 | |

| V | Heikin Ashi For ThinkOrSwim | Indicators | 23 | |

|

|

RSI-Heiken Ashi For ThinkOrSwim | Indicators | 29 | |

|

|

MA Colored Heiken Ashi Trend with PaintBars for ThinkorSwim | Indicators | 17 |

Similar threads

-

-

Heikin-Ashi Candles Lower Chart For ThinkorSwim (assorted versions)

- Started by petergluis

- Replies: 28

-

-

-

MA Colored Heiken Ashi Trend with PaintBars for ThinkorSwim

- Started by Welkin

- Replies: 17

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1023

Online

Similar threads

-

-

Heikin-Ashi Candles Lower Chart For ThinkorSwim (assorted versions)

- Started by petergluis

- Replies: 28

-

-

-

MA Colored Heiken Ashi Trend with PaintBars for ThinkorSwim

- Started by Welkin

- Replies: 17

Similar threads

-

-

Heikin-Ashi Candles Lower Chart For ThinkorSwim (assorted versions)

- Started by petergluis

- Replies: 28

-

-

-

MA Colored Heiken Ashi Trend with PaintBars for ThinkorSwim

- Started by Welkin

- Replies: 17

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.