Author Message:

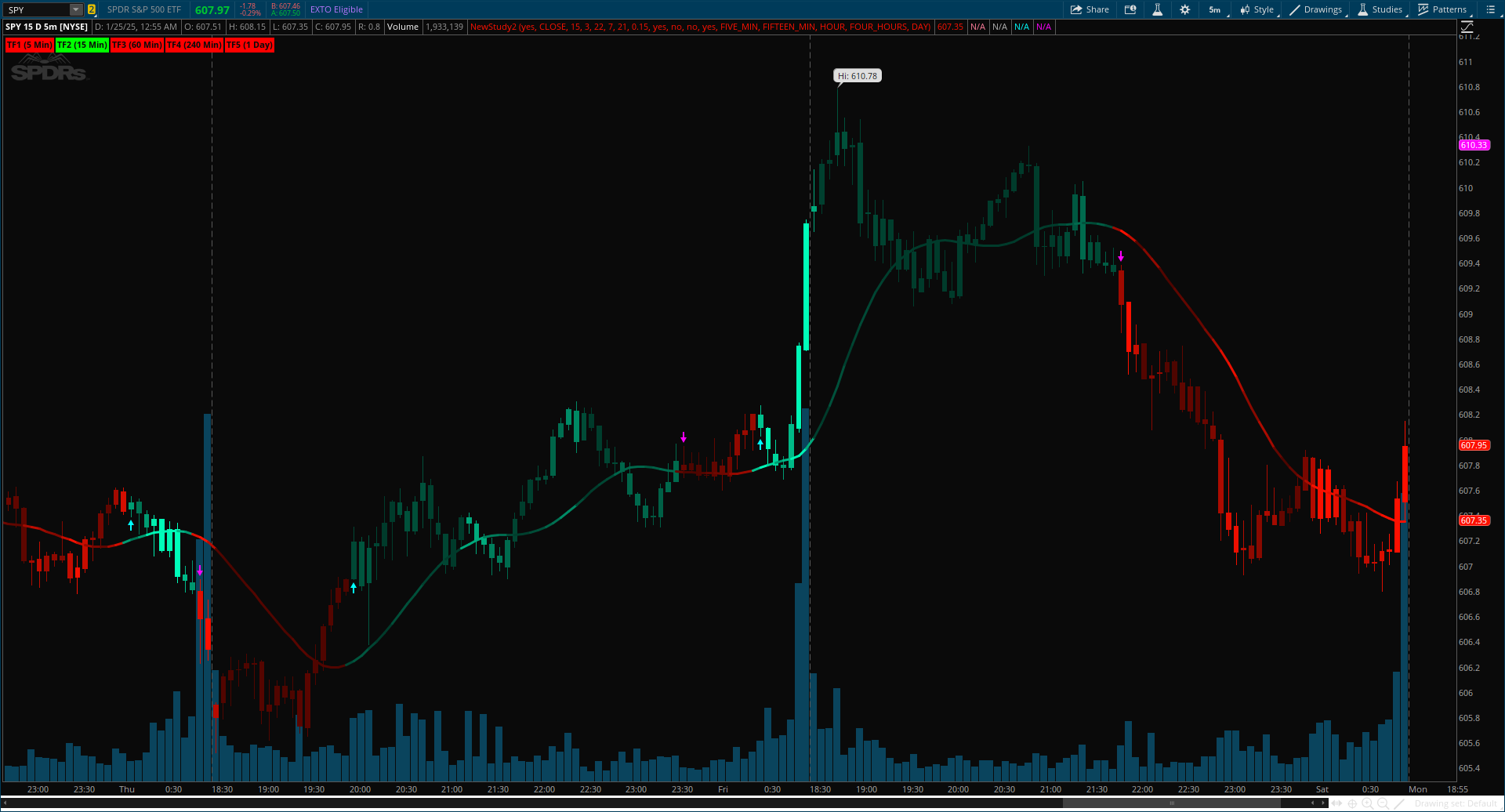

Experience seamless trend detection and market analysis with the Smoothed Gaussian Trend Filter by AlgoAlpha! This cutting-edge indicator combines advanced Gaussian filtering with linear regression smoothing to identify and enhance market trends, making it an essential tool for traders seeking precise and actionable signals.

More Details: https://www.tradingview.com/v/mCGycOyz/

CODE:

CSS:

#// Indicator for TOS

#//@AlgoAlpha

#indicator("Smoothed Gaussian Trend Filter [AlgoAlpha]", "AlgoAlpha - Smoothed Gaussian Trend"

#Hint showTabel: Enables/Disables the table.

#Hint GaussianLength: Period used to calculate the Gaussian alpha.

#Hint Poles: Order of the Gaussian filter, affects smoothness.

#Hint LinearRegLength: Length for linear regression smoothing applied on the gaussian line.

#Hint LinearRegOffset: Offset for flattening the output, making it less wavey.

#Hint volumeIntensity: Highlight based on volume intensity.

#Hint MidTrendSignals: Enable additional buy/sell signals during trends.

#Hint TrailingBands: Enables/Disables Trend Bands.

# Converted by Sam4Cok@Samer800 - 01/2025

input colorBars = yes; # "Bar Color"

input GaussianSource = FundamentalType.CLOSE;

input GaussianLength = 15; # "Gaussian Length"

input Poles = 3; # "Poles"

input LinearRegLength = 22; # "Smoothing Length"

input LinearRegOffset = 7; # "Flatten Multiplier"

input supertrendLength = 21;

input supertrendFactor = 0.15;

input volumeIntensity = yes; # "Appearance"

input MidTrendSignals = no; # "Mid-Trend Signals"

input TrailingBands = no; # "Trailing Bands"

input showTabel = yes; # "Enable Table"

input timeframe1 = AggregationPeriod.FIVE_MIN; # "Time frame 1"

input timeframe2 = AggregationPeriod.FIFTEEN_MIN; # "Time frame 2"

input timeframe3 = AggregationPeriod.HOUR; # "Time frame 3"

input timeframe4 = AggregationPeriod.FOUR_HOURS; # "Time frame 4"

input timeframe5 = AggregationPeriod.DAY; # "Time frame 5"

def na = Double.NaN;

def last = IsNaN(close);

def src = Fundamental(FundamentalType = GaussianSource);

script linReg {

input y = close;

input len = 20;

input offset = 5;

def x = x[1] + 1;

def sumXY = Sum(x * y, len);

def sumX = Sum(x, len);

def sumY = Sum(y, len);

def sumSrX = Sum(Sqr(x), len);

def a = (len * sumXY - sumX * sumY) / (len * sumSrX - Sqr(sumX));

def b = (sumSrX * sumY - sumX * sumXY) / (len * sumSrX - Sqr(sumX));

def linreg = a * (x - offset) + b;

plot out = linreg;

}

Script supertrend {

input src = hl2;

input factor = 3;

input atrPeriod = 10;

def tr = if isNaN(high[1]) then (high - low) else

if !high[1] then (high - low) else TrueRange(high, close, low);

def atr = WildersAverage(tr, atrPeriod);

def upBand = src + factor * atr;

def loBand = src - factor * atr;

def lowerBand; def upperBand;

def prevLowerBand = if isNaN(lowerBand[1]) then loBand else

if !lowerBand[1] then loBand else lowerBand[1];

def prevUpperBand = if isNaN(upperBand[1]) then upBand else

if !upperBand[1] then upBand else upperBand[1];

lowerBand = if loBand > prevLowerBand or src[1] < prevLowerBand then loBand else prevLowerBand;

upperBand = if upBand < prevUpperBand or src[1] > prevUpperBand then upBand else prevUpperBand;

def _direction;

def superTrend;

def prevSuperTrend = superTrend[1];

if isNaN(atr[1]) {

_direction = 1;

} else if !atr[1] {

_direction = 1;

} else if prevSuperTrend == prevUpperBand {

_direction = if src > upperBand then -1 else 1;

} else {

_direction = if src < lowerBand then 1 else -1;

}

superTrend = if _direction == -1 then lowerBand else upperBand;

plot st = superTrend;

}

Script supertrendMTF {

input src = hl2;

input factor = 3;

input atrPeriod = 10;

input tf = 300000;

def tr = if isNaN(high(Period = tf)[1]) then (high(Period = tf) - low(Period = tf)) else

if !high(Period = tf)[1] then (high(Period = tf) - low(Period = tf)) else

TrueRange(high(Period = tf), close(Period = tf), low(Period = tf));

def atr = WildersAverage(tr, atrPeriod);

def upBand = src + factor * atr;

def loBand = src - factor * atr;

def lowerBand; def upperBand;

def prevLowerBand = if isNaN(lowerBand[1]) then loBand else

if !lowerBand[1] then loBand else lowerBand[1];

def prevUpperBand = if isNaN(upperBand[1]) then upBand else

if !upperBand[1] then upBand else upperBand[1];

lowerBand = if loBand > prevLowerBand or src[1] < prevLowerBand then loBand else prevLowerBand;

upperBand = if upBand < prevUpperBand or src[1] > prevUpperBand then upBand else prevUpperBand;

def _direction;

def superTrend;

def prevSuperTrend = superTrend[1];

if isNaN(atr[1]) {

_direction = 1;

} else if !atr[1] {

_direction = 1;

} else if prevSuperTrend == prevUpperBand {

_direction = if src > upperBand then -1 else 1;

} else {

_direction = if src < lowerBand then 1 else -1;

}

superTrend = if _direction == -1 then lowerBand else upperBand;

plot st = superTrend;

}

script calcGaussianAlpha {

input _length = 15;

input _poles = 3;

def pi = Double.Pi;

def _order = Min(Max(_poles, 1), 4);

def freq = (2.0 * pi) / _length;

def factorB = (1.0 - Cos(freq)) / (Power(1.414, (2.0 / _order)) - 1.0);

def alphaVal = -factorB + Sqrt(factorB * factorB + 2.0 * factorB);

plot out = alphaVal;

}

script gaussianSmooth {

input dataIn = close;

input poles = 3;

input alphaCoeff = 1;

def filterLevel = Min(Max(poles, 1), 4);

def oneMinusAlpha = 1.0 - alphaCoeff;

def alphaSquared = alphaCoeff * alphaCoeff;

def alphaCubed = alphaCoeff * alphaCoeff * alphaCoeff;

def alpha4 = alphaCoeff * alphaCoeff * alphaCoeff * alphaCoeff;

def omaSquared = oneMinusAlpha * oneMinusAlpha;

def omaCubed = omaSquared * oneMinusAlpha;

def oma4 = omaCubed * oneMinusAlpha;

def runningFilterValue;

if filterLevel == 1 {

runningFilterValue = alphaCoeff * dataIn +

oneMinusAlpha * runningFilterValue[1];

} else if filterLevel == 2 {

runningFilterValue = alphaSquared * dataIn

+ 2.0 * oneMinusAlpha * runningFilterValue[1]

- omaSquared * runningFilterValue[2];

} else if filterLevel == 3 {

runningFilterValue = alphaCubed * dataIn

+ 3.0 * oneMinusAlpha * runningFilterValue[1]

- 3.0 * omaSquared * runningFilterValue[2]

+ omaCubed * runningFilterValue[3];

} else if filterLevel == 4 {

runningFilterValue = alpha4 * dataIn

+ 4.0 * oneMinusAlpha * runningFilterValue[1]

- 6.0 * omaSquared * runningFilterValue[2]

+ 4.0 * omaCubed * runningFilterValue[3]

- oma4 * runningFilterValue[4];

} else {

runningFilterValue = runningFilterValue[1];

}

plot out = runningFilterValue;

}

##// ~~ Gradient Coloring {

Script gradient_color {

input src = close;

input minVal = 10;

input maxVal = 400;

input loR = 173;

input loG = 216;

input loB = 230;

input hiR = 41;

input hiG = 98;

input hiB = 255;

def value = if isNaN(src) then 0 else src;

def clamped_value = max(min(value, maxVal), minVal);

def normalized_value = (clamped_value - minVal) / (maxVal - minVal);

def re = floor(loR + (hiR - loR) * normalized_value);

def gr = floor(loG + (hiG - loG) * normalized_value);

def bl = floor(loB + (hiB - loB) * normalized_value);

plot r = re;

plot g = gr;

plot b = bl;

}

def alphaValue = calcGaussianAlpha(GaussianLength, Poles);

def gmaOutput = gaussianSmooth(src, Poles, alphaValue);

def final = linReg(gmaOutput, LinearRegLength, LinearRegOffset);

def ST = supertrend(final, supertrendFactor, supertrendLength);

def linTrend = if final > final[1] then 1 else -1;

def stTrend = if final > ST then 1 else -1;

def ranging = MidTrendSignals and ((linTrend * stTrend) < 0);

def vol_filt = 99;

def z = 33;

def hhVol = highest(volume, z);

def llVol = lowest(volume, z);

def s_vol = HullMovingAvg((volume - llVol) / (hhVol - llVol), 4);

def transparency = vol_filt - Max(min(100 - s_vol * 100, vol_filt), 1);

def dist = Average(AbsValue(close - open), 100);

def rUp = gradient_color(transparency, 1, vol_filt, 0, 59, 43, 0, 255, 187).r;

def gUp = gradient_color(transparency, 1, vol_filt, 0, 59, 43, 0, 255, 187).g;

def bUp = gradient_color(transparency, 1, vol_filt, 0, 59, 43, 0, 255, 187).b;

def rDn = gradient_color(transparency, 1, vol_filt, 78, 5, 0, 255, 17, 0).r;

def gDn = gradient_color(transparency, 1, vol_filt, 78, 5, 0, 255, 17, 0).g;

def bDn = gradient_color(transparency, 1, vol_filt, 78, 5, 0, 255, 17, 0).b;

# plot

plot main = if !last and final then final else na;

main.SetLineWeight(3);

main.AssignValueColor(if ranging then Color.GRAY else

if stTrend > 0 then if volumeIntensity then CreateColor(rUp, gUp, bUp) else Color.GREEN else

if volumeIntensity then CreateColor(rDn, gDn, bDn) else Color.RED);

plot bull = if !last and TrailingBands and stTrend > 0 then final - dist * 2 else na;

plot bear = if !last and TrailingBands and stTrend < 0 then final + dist * 2 else na;

bull.AssignValueColor(if ranging then Color.GRAY else

if stTrend > 0 then if volumeIntensity then CreateColor(rUp, gUp, bUp) else Color.GREEN else

if volumeIntensity then CreateColor(rDn, gDn, bDn) else Color.RED);

bear.AssignValueColor(if ranging then Color.GRAY else

if stTrend > 0 then if volumeIntensity then CreateColor(rUp, gUp, bUp) else Color.GREEN else

if volumeIntensity then CreateColor(rDn, gDn, bDn) else Color.RED);

#-- Cloud

def up1 = !ranging and stTrend > 0;

def up2 = !ranging and stTrend > 0 and transparency > 45;

def up3 = !ranging and stTrend > 0 and transparency > 70;

def dn1 = !ranging and stTrend <= 0;

def dn2 = !ranging and stTrend <= 0 and transparency > 45;

def dn3 = !ranging and stTrend <= 0 and transparency > 70;

AddCloud(if (ranging or ranging[-1]) then main else na, bull, Color.GRAY);

AddCloud(if (ranging or ranging[-1]) then bear else na, main, Color.GRAY);

AddCloud(if up1 then main else na, bull, CreateColor(0, 59, 43));

AddCloud(if up2 then main else na, bull, Color.DARK_GREEN);

AddCloud(if up3 then main else na, bull, CreateColor(0, 255, 187));

AddCloud(if dn1 then bear else na, main, CreateColor(78, 5, 0));

AddCloud(if dn2 then bear else na, main, Color.DARK_RED);

AddCloud(if dn3 then bear else na, main, CreateColor(255, 17, 0));

#-- Signals

def h = max(Max(highest(high, 14), highest(final, 14)), final + dist * 2);

def l = min(Min(lowest(low, 14), lowest(final, 14)), final - dist * 2);

plot SigUp = if stTrend > 0 and (if MidTrendSignals then !ranging and ranging[1] else stTrend[1] < 0) then l else na; # "Bullish Signal"

plot SigDn = if stTrend < 0 and (if MidTrendSignals then !ranging and ranging[1] else stTrend[1] > 0) then h else na; # "Bearish Signal"

SigUp.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

SigDn.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

SigUp.SetDefaultColor(Color.CYAN);

SigDn.SetDefaultColor(Color.MAGENTA);

AddChartBubble(SigUp, bull, "", Color.GREEN, no);

AddChartBubble(SigDn, bear, "", Color.RED);

#-- BAr Color

AssignPriceColor(if !colorBars then Color.CURRENT else

if ranging then Color.GRAY else

if stTrend > 0 then if volumeIntensity then CreateColor(rUp, gUp, bUp) else Color.GREEN else

if volumeIntensity then CreateColor(rDn, gDn, bDn) else Color.RED);

#-- HTF Cals

def cap = GetAggregationPeriod();

def t1 = Max(cap, timeframe1);

def t2 = Max(cap, timeframe2);

def t3 = Max(cap, timeframe3);

def t4 = Max(cap, timeframe4);

def t5 = Max(cap, timeframe5);

def src1 = Fundamental(FundamentalType = GaussianSource, Period = t1);

def src2 = Fundamental(FundamentalType = GaussianSource, Period = t2);

def src3 = Fundamental(FundamentalType = GaussianSource, Period = t3);

def src4 = Fundamental(FundamentalType = GaussianSource, Period = t4);

def src5 = Fundamental(FundamentalType = GaussianSource, Period = t5);

def gmaOutput1 = gaussianSmooth(src1, Poles, alphaValue);

def gmaOutput2 = gaussianSmooth(src2, Poles, alphaValue);

def gmaOutput3 = gaussianSmooth(src3, Poles, alphaValue);

def gmaOutput4 = gaussianSmooth(src4, Poles, alphaValue);

def gmaOutput5 = gaussianSmooth(src5, Poles, alphaValue);

def final1 = linReg(gmaOutput1, LinearRegLength, LinearRegOffset);

def final2 = linReg(gmaOutput2, LinearRegLength, LinearRegOffset);

def final3 = linReg(gmaOutput3, LinearRegLength, LinearRegOffset);

def final4 = linReg(gmaOutput4, LinearRegLength, LinearRegOffset);

def final5 = linReg(gmaOutput5, LinearRegLength, LinearRegOffset);

def ST1 = supertrendMTF(final1, supertrendFactor, supertrendLength, t1);

def ST2 = supertrendMTF(final2, supertrendFactor, supertrendLength, t2);

def ST3 = supertrendMTF(final3, supertrendFactor, supertrendLength, t3);

def ST4 = supertrendMTF(final4, supertrendFactor, supertrendLength, t4);

def ST5 = supertrendMTF(final5, supertrendFactor, supertrendLength, t5);

def linTrend1 = if final1 > final1[1] then 1 else -1;

def linTrend2 = if final2 > final2[1] then 1 else -1;

def linTrend3 = if final3 > final3[1] then 1 else -1;

def linTrend4 = if final4 > final4[1] then 1 else -1;

def linTrend5 = if final5 > final5[1] then 1 else -1;

def stTrend1 = if final1 > ST1 then 1 else -1;

def stTrend2 = if final2 > ST2 then 1 else -1;

def stTrend3 = if final3 > ST3 then 1 else -1;

def stTrend4 = if final4 > ST4 then 1 else -1;

def stTrend5 = if final5 > ST5 then 1 else -1;

def ranging1 = MidTrendSignals and ((linTrend1 * stTrend1) < 0);

def ranging2 = MidTrendSignals and ((linTrend2 * stTrend2) < 0);

def ranging3 = MidTrendSignals and ((linTrend3 * stTrend3) < 0);

def ranging4 = MidTrendSignals and ((linTrend4 * stTrend4) < 0);

def ranging5 = MidTrendSignals and ((linTrend5 * stTrend5) < 0);

def s1 = if ranging1 then 0 else if stTrend1 > 0 then 1 else -1;

def s2 = if ranging2 then 0 else if stTrend2 > 0 then 1 else -1;

def s3 = if ranging3 then 0 else if stTrend3 > 0 then 1 else -1;

def s4 = if ranging4 then 0 else if stTrend4 > 0 then 1 else -1;

def s5 = if ranging5 then 0 else if stTrend5 > 0 then 1 else -1;

def m1 = t1 < AggregationPeriod.DAY;

def m2 = t2 < AggregationPeriod.DAY;

def m3 = t3 < AggregationPeriod.DAY;

def m4 = t4 < AggregationPeriod.DAY;

def m5 = t5 < AggregationPeriod.DAY;

def tf1 = if m1 then AggregationPeriod.MIN else AggregationPeriod.DAY;

def tf2 = if m2 then AggregationPeriod.MIN else AggregationPeriod.DAY;

def tf3 = if m3 then AggregationPeriod.MIN else AggregationPeriod.DAY;

def tf4 = if m4 then AggregationPeriod.MIN else AggregationPeriod.DAY;

def tf5 = if m5 then AggregationPeriod.MIN else AggregationPeriod.DAY;

AddLabel(showTabel,"TF1 (" + t1/tf1 + (if m1 then " Min)" else " Day)"),

if s1>0 then Color.GREEN else if s1<0 then Color.RED else Color.GRAY);

AddLabel(showTabel,"TF2 (" + t2/tf2 + (if m2 then " Min)" else " Day)"),

if s2>0 then Color.GREEN else if s2<0 then Color.RED else Color.GRAY);

AddLabel(showTabel,"TF3 (" + t3/tf3 + (if m3 then " Min)" else " Day)"),

if s3>0 then Color.GREEN else if s3<0 then Color.RED else Color.GRAY);

AddLabel(showTabel,"TF4 (" + t4/tf4 + (if m4 then " Min)" else " Day)"),

if s4>0 then Color.GREEN else if s4<0 then Color.RED else Color.GRAY);

AddLabel(showTabel,"TF5 (" + t5/tf5 + (if m5 then " Min)" else " Day)"),

if s5>0 then Color.GREEN else if s5<0 then Color.RED else Color.GRAY);

#-- END of CODE