I am wondering if it's possible to create this particular scan.

Here is the setup for the criteria I am trying to scan. This is a SHORT I execute:

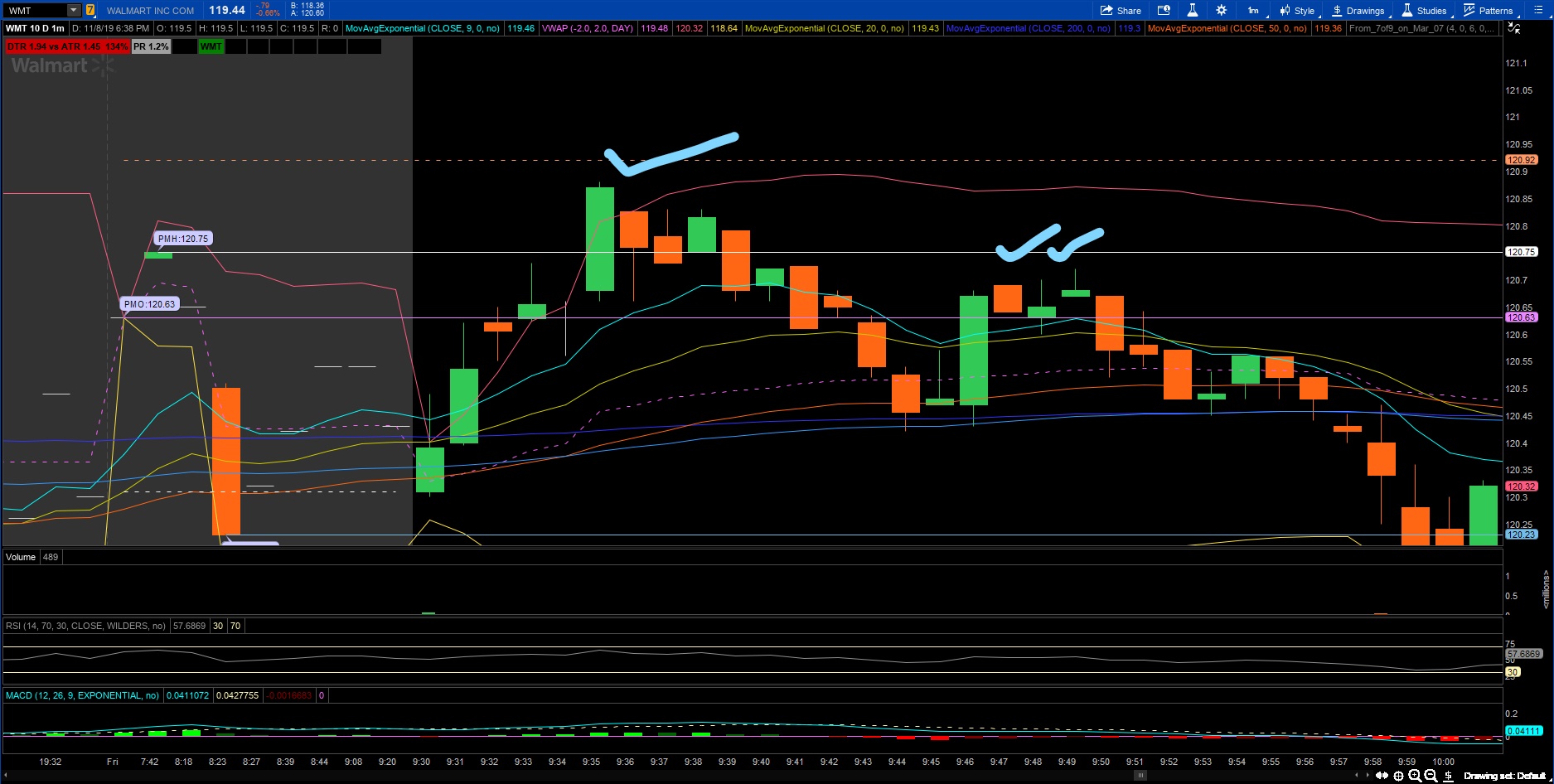

"A failed attempt to reach or break Previous Day High (1st check), followed by a failed attempt to reach or break Pre-Market High (2nd check)"

I already have those 2 levels coded into my platform. PDH and PMH

Is it within the realm of possibility to scan for something approximating this set up.. ie proximity to Pre Market High after the aforementioned Previous Day High failure?

Here is the setup for the criteria I am trying to scan. This is a SHORT I execute:

"A failed attempt to reach or break Previous Day High (1st check), followed by a failed attempt to reach or break Pre-Market High (2nd check)"

I already have those 2 levels coded into my platform. PDH and PMH

Is it within the realm of possibility to scan for something approximating this set up.. ie proximity to Pre Market High after the aforementioned Previous Day High failure?