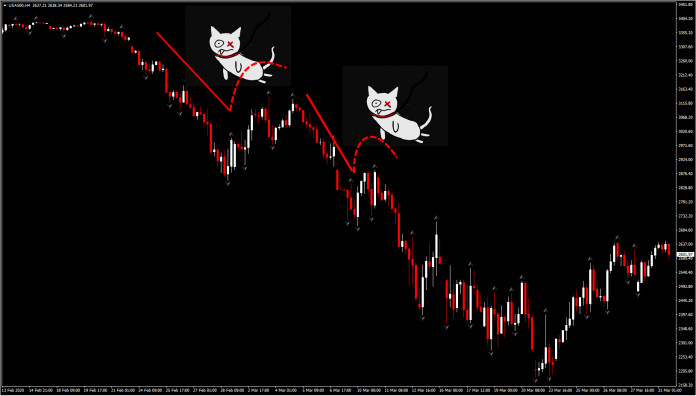

Is it possible to create a scan for dead cat bounces or how some traders call it as the "h pattern"?

This is an example of a Futures contract /HG on 1/11/2021 between the hours of 6PM EST and 9PM EST - Please know this works on regular stocks as well.

The Yellow line is the VWAP.

Here is another example

This is how the Dead Cat bounce is defined: https://www.investopedia.com/terms/d/deadcatbounce.asp

I've been dabbling with some code but have not had much success.

Here I am defining what may be what's marked as B in the image above. What I am having difficulty coding is the condition between B and C.

There may be a better way of accomplishing this. Any help will be greatly appreciated.

This is an example of a Futures contract /HG on 1/11/2021 between the hours of 6PM EST and 9PM EST - Please know this works on regular stocks as well.

The Yellow line is the VWAP.

Here is another example

This is how the Dead Cat bounce is defined: https://www.investopedia.com/terms/d/deadcatbounce.asp

I've been dabbling with some code but have not had much success.

Code:

declare lower;

input length = 5;

def IsLongBlack = IsLongBlack(length);

def myVWAP = reference VWAP()."VWAP";

def underVWAP = high < myVWAP;

def redCandles = sum(close < open, 2) >=2;

def lowerLows = sum(high < high[1] && low < low[1] ,2) >= 2;

plot scan = underVWAP and (redCandles or redCandles[1]) and

(lowerLows or lowerLows[1]) and IsLongBlack;Here I am defining what may be what's marked as B in the image above. What I am having difficulty coding is the condition between B and C.

There may be a better way of accomplishing this. Any help will be greatly appreciated.