#// Indicator forceIndex TOS

#// © QuantraAI

#indicator("Scalper's Volatility Filter", "SVF",

# Converted by Sam4Cok@Samer800 - 02/2024

# Updated by Sam4Cok@Samer800 - 07/2024 - Added MTF

declare lower;

input useChartTimeframe = {default "Yes", "No"};

input manualTimeframe = AggregationPeriod.FIFTEEN_MIN;

input displayType = {Default "Line", "Histogram", "Heikin-Ashi", "HA-Width"}; # "Display Type"

input Speed = 10; # "Speed"

input BaseAtrLength = 13; # "Base ATR Length"

input SecondAtrLength = 40; # "Second ATR Length"

input BaseStdDevLength = 20; # "Base StdDev"

input SecondStdDevLength = 100; # "Second StdDev"

input AdxSmoothingLength = 14; # "ADX Smoothing"

input adxThreshold = 25; # "ADX Baseline"

input diLength = 14; # "DI Length"

input RegressionLength = 20; # "Regression Length"

input RegressionSensitivity = 350; # "Regression Sensitivity"

input HistoricalVolatilityLookback = 50; # "Historical Volatility Lookback"

input colorBars = no; # "Bar Coloring"

input HollowCandles = yes; # "Hollow Candles"

input CompressedMode = no; # "Compressed Mode"

input showLabel = yes; # "Labels"

def na = Double.NaN;

def last = IsNaN(close);

#-- MTF

def cl; def hi; def lo;

Switch (useChartTimeframe) {

case "No" :

cl = close(Period=manualTimeframe);

hi = high(Period=manualTimeframe);

lo = low(Period=manualTimeframe);

Default :

cl = close;

hi = high;

lo = low;

}

#// Functions //

#// Modified Damiani Voltemter // Credit to @xinolia

script DV {

input src = close;

input vis_atr = 13;

input vis_std = 20;

input sed_atr = 40;

input sed_std = 100;

input h = high;

input c = close;

input l = low;

def tr = TrueRange(h, c, l);

def lag_s_K = 0.5;

def vol;

def visAtr = WildersAverage(tr, vis_atr);

def sedAtr = WildersAverage(tr, sed_atr);

def visStd = StDev(src, vis_std);

def sedStd = StDev(src, sed_std);

def anti_thres = visStd / sedStd;

def t1 = 1.4 - anti_thres;

def s1 = CompoundValue(1, vol[1], 0);

def s3 = CompoundValue(1, vol[3], 0);

vol = CompoundValue(1, visAtr / sedAtr + lag_s_K * (s1 - s3), t1);

def th = t1 - vol;

def DV = -th * 100;

plot out = if IsNaN(DV) then 0 else DV;

}

#// Average Directional Index

script nADX {

input dilen = 14;

input adxlen = 14;

input h = high;

input c = close;

input l = low;

def tr = TrueRange(h, c, l);

def hiDiff = h - h[1];

def loDiff = l[1] - l;

def plusDM = if hiDiff > loDiff and hiDiff > 0 then hiDiff else 0;

def minusDM = if loDiff > hiDiff and loDiff > 0 then loDiff else 0;

def ATR = WildersAverage(tr, dilen);

def "DI+" = 100 * WildersAverage(plusDM, dilen) / ATR;

def "DI-" = 100 * WildersAverage(minusDM, dilen) / ATR;

def DX = if ("DI+" + "DI-" > 0) then 100 * AbsValue("DI+" - "DI-") / ("DI+" + "DI-") else 0;

def nADX = WildersAverage(DX, adxlen);

plot out = nADX;

}

#// Linear Regression Dispersion

script dispersion {

input src = close;

input period = 20;

input TrSens = 350;

def linRegLine = Inertia(src, period);

def tes = StDev(src - linRegLine, period);

def median = Median(tes, TrSens);

def dispersion = (tes - median) / 2;

plot out = dispersion;

}

Script normalize {

input currentValue = close;

input targetMin = -100;

input targetMax = 100;

input window = 100;

def targetDiff = (targetMax - targetMin);

def dynCurrentVal = CompoundValue(1, currentValue, 0);

def minValue = lowest(dynCurrentVal, window);

def maxValue = highest(dynCurrentVal, window);

def minNew = min(dynCurrentVal, minValue);

def maxNew = max(dynCurrentVal, maxValue);

def newDiff = (maxNew - minNew);

def scale = targetMin + targetDiff * (dynCurrentVal - minNew) / newDiff;

def norm = if minValue!= maxValue then scale else dynCurrentVal;

plot out = if isNaN(norm) then 0 else norm;

}

#// ║ CALCULATE RAW VALUES ║ //

def dvmR = DV(cl , BaseAtrLength, BaseStdDevLength, SecondAtrLength, SecondStdDevLength, hi, cl, lo);

def sigR = (nADX(diLength, AdxSmoothingLength, hi, cl, lo) - adxThreshold) * 3;

def disR = dispersion(cl, RegressionLength, RegressionSensitivity);

#// ║ PREPROCESSING BY NORMALIZATION ║ //

def dvm = normalize(dvmR, -100, 100, Speed * 10);

def sig = normalize(sigR, -100, 100, Speed * 10);

def dis = normalize(disR, -100, 100, Speed * 10);

#// ║ CUSTOM 'MEAN' FUNCTION ║ //

def sumDVM = if !isNaN(dvm) then dvm else 0;

def sumSIG = if !isNaN(sig) then sig else 0;

def sumDIS = if !isNaN(dis) then dis else 0;

def cntDVM = if !isNaN(dvm) then 1 else 0;

def cntSIG = if !isNaN(sig) then 1 else 0;

def cntDIS = if !isNaN(dis) then 1 else 0;

def sum = sumDVM + sumSIG + sumDIS;

def cnt = cntDVM + cntSIG + cntDIS;

def av = if last then na else if cnt > 0 then sum / cnt else 0;

#// Function to calculate Heikin Ashi values

def o = if isNaN(av[1]) then av else av[1];

def h = Max(av, av[1]);

def l = Min(av, av[1]);

def c = av;

def xc = (o + h + l + c) / 4;

def xo = CompoundValue(1, if !xo[1] then (o + c) / 2 else (xo[1] + xc[1]) / 2, (o + c) / 2);

def xh = max(h, max(xo, xc));

def xl = min(l, min(xo, xc));

def hac = xc;

def hao = xo;

def hah = xh;

def hal = xl;

#// ║ HA WIDTH ║ //

def volatility = AbsValue(hac - hao);

def Hisotrical_Volatility = Average(volatility, HistoricalVolatilityLookback);

def col; def disp;

Switch (displayType) {

Case "Histogram" :

col = if av > 0 then if av > av[1] then 2 else 1 else

if av < 0 then if av < av[1] then -1 else -2 else 0;

disp = if last then na else 2;

Case "Heikin-Ashi" :

col = if hac > hao then 2 else 1;

disp = if last then na else 3;

Case "HA-Width" :

col = if volatility < Hisotrical_Volatility then -2 else

if hac > hao then 2 else 1;

disp = if last then na else 4;

Default :

col = if av > 0 then if av > av[1] then 2 else 1 else

if av < 0 then if av < av[1] then -1 else -2 else 0;

disp = if last then na else 1;

}

# Heikin Ashi Style

def up = !CompressedMode and disp==3 and col==2;

def dn = !CompressedMode and disp==3 and col==1;

def upO = if HollowCandles then hao else hac;

def upC = if HollowCandles then hac else hao;

def dnO = if HollowCandles then hac else hao;

def dnC = if HollowCandles then hao else hac;

# -- Display

plot CompressedLine = if CompressedMode and !last then 0 else na;

plot pavHist = if !CompressedMode and disp==2 then av else na; # "Average Volatility Hist"

plot pavLine = if !CompressedMode and disp==1 then av else na; # "Average Volatility Cross"

plot pavAvgHa = if !CompressedMode and disp==4 then Hisotrical_Volatility else na; # "Average HA Volatility

plot pavWidth = if !CompressedMode and disp==4 then volatility else na; # "HA Volatility Width"

plot zeroLine = if !CompressedMode and !last then 0 else na; # "Zero Line"

zeroLine.SetDefaultColor(Color.GRAY);

CompressedLine.SetLineWeight(5);

CompressedLine.SetPaintingStrategy(PaintingStrategy.SQUARES);

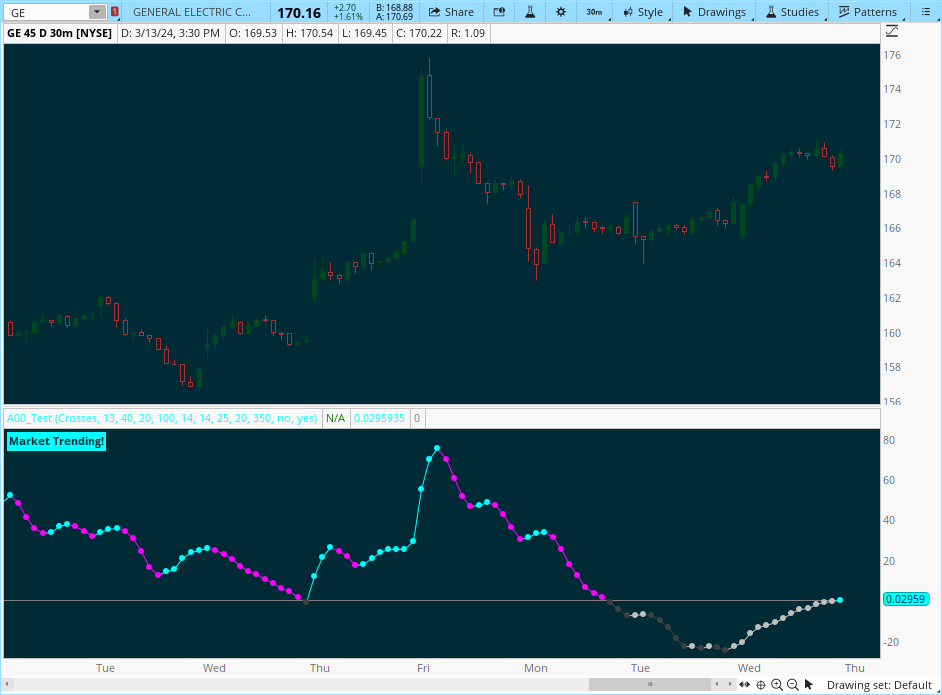

CompressedLine.AssignValueColor(if col== 2 then Color.CYAN else

if col== 1 then Color.MAGENTA else

if col==-2 then Color.DARK_GRAY else Color.LIGHT_GRAY);

pavHist.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

pavHist.AssignValueColor(if col== 2 then Color.CYAN else

if col== 1 then Color.MAGENTA else

if col==-2 then Color.DARK_GRAY else Color.LIGHT_GRAY);

pavLine.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

pavLine.AssignValueColor(if col== 2 then Color.CYAN else

if col== 1 then Color.MAGENTA else

if col==-2 then Color.DARK_GRAY else Color.LIGHT_GRAY);

pavWidth.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

pavWidth.AssignValueColor(if col== 2 then Color.CYAN else

if col== 1 then Color.MAGENTA else

if col==-2 then Color.DARK_GRAY else Color.LIGHT_GRAY);

pavAvgHa.SetDefaultColor(Color.ORANGE);

pavAvgHa.SetLineWeight(2);

# Heikin Ashi Candles

AddChart(open = if up then upO else na, high = if up then hah else na , low = hal , close = upC,

type = ChartType.CANDLE, growcolor = Color.CYAN);

AddChart(open = if dn then dnO else na, high = if dn then hah else na , low = hal , close = dnC,

type = ChartType.CANDLE, growcolor = Color.MAGENTA);

#-- bar color

AssignPriceColor(if !colorBars then Color.CURRENT else

if col== 2 then Color.CYAN else

if col== 1 then Color.MAGENTA else

if col==-2 then Color.DARK_GRAY else Color.LIGHT_GRAY);

#-- Label

#// Output Stream (For Quantra's Trading Station)

AddLabel(showLabel and col == 2, "Volatility Up!", Color.CYAN);

AddLabel(showLabel and col == 1, "Volatility Dn!", Color.MAGENTA);

AddLabel(showLabel and col <= 0, "No Volatility!", if col < 1 then Color.DARK_GRAY else Color.LIGHT_GRAY);

#-- END of CODE