mbarcala

Active member

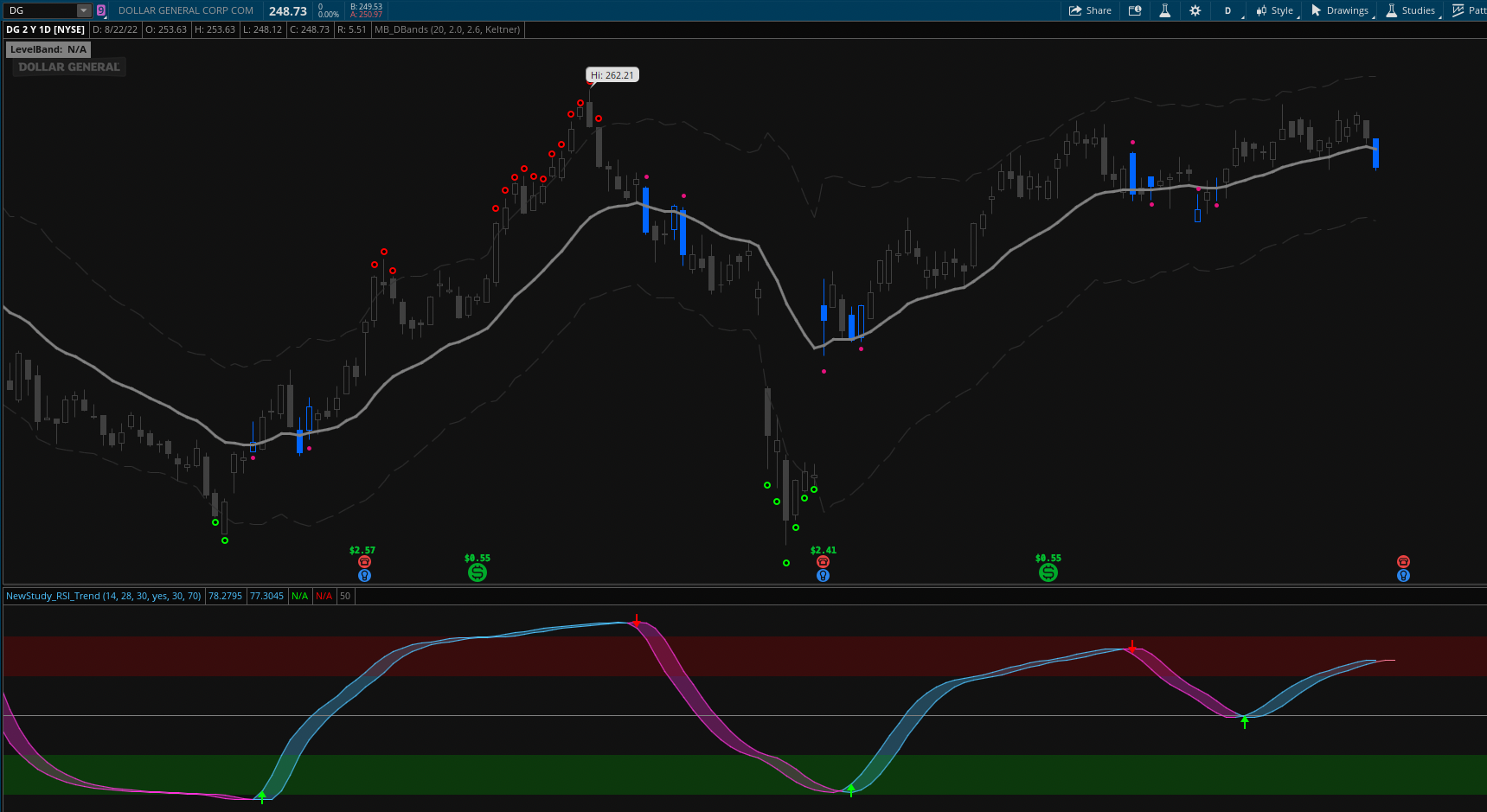

Here it's RSI Trend Indicator from Trading View converted to thinkscript. RSI Hull Trend is a hybrid indicator with RSI of HULL Signal. The Hull MA is combined with RSI to see if the Hull MA Buy/Sell Signal is in overbought or oversold condition. Buy Sell Signals are plotted based on settings of OB/OS or RSI. This indicator is very useful to see if the Trend is in Exhaustion or Beginning of a Trend.

Upper Indicator

https://usethinkscript.com/threads/break-keltner-bands-bkb-for-thinkorswim.11220/

photo

15580[/ATTACH]']

script

Upper Indicator

https://usethinkscript.com/threads/break-keltner-bands-bkb-for-thinkorswim.11220/

photo

15580[/ATTACH]']

script

Code:

# RSITrend by traderharikrishna converted by mbarcala for thinkorswim.com

# This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

# https://www.tradingview.com/script/LvEWCt8I-RSI-Trend/

declare lower;

input rsiLengthInput = 14;

input rsiLengthInput2 = 28;

input trendlen = 45;

input show_Baseline = yes;

input oversold = 30;

input overbought = 70;

def BBMC = HullMovingAvg(close, trendlen);

def MHULL = BBMC[0];

def SHULL = BBMC[2];

def frsi = HullMovingAvg(rsi(price = close, length = rsiLengthInput),10);

def srsi = HullMovingAvg(rsi(price = close, length = rsiLengthInput2),10);

def hullrsi1 = rsi(price = MHULL, length = rsiLengthInput);

def hullrsi2 = rsi(price = SHULL, length = rsiLengthInput);

DefineGlobalColor("Up",CreateColor(77,195,255));

DefineGlobalColor("Dn",CreateColor(255,51,221));

plot hu1 = if show_Baseline then hullrsi1 else frsi;

hu1.AssignValueColor(if MHULL > SHULL then GlobalColor("Up") else

if MHULL < SHULL then GlobalColor("Dn") else Color.CURRENT);

plot hu2 = if show_Baseline then hullrsi2 else srsi;

hu2.AssignValueColor(if MHULL > SHULL then GlobalColor("Up") else

if MHULL < SHULL then GlobalColor("Dn") else Color.CURRENT);

AddCloud(hu1, hu2, GlobalColor("Up"), GlobalColor("Dn"));

plot buysignal = if MHULL crosses above SHULL then hu1 else Double.NaN;

buysignal.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

buysignal.SetDefaultColor(Color.GREEN);

buysignal.SetLineWeight(2);

buysignal.HideBubble();

buysignal.HideTitle();

plot sellsignal = if MHULL crosses below SHULL then hu1 else Double.NaN;

sellsignal.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

sellsignal.SetDefaultColor(Color.RED);

sellsignal.SetLineWeight(2);

sellsignal.HideBubble();

sellsignal.HideTitle();

plot mline = 50;

mline.SetDefaultColor(Color.GRAY);

mline.HideBubble();

mline.HideTitle();

def rsiUpperBand = overbought;

def rsiUpperBand2 = 90;

AddCloud(rsiUpperBand2, rsiUpperBand, CreateColor(148,0,0));

def rsiLowerBand = oversold;

def rsiLowerBand2 = 10;

AddCloud(rsiLowerBand, rsiLowerBand2, CreateColor(0,148,0));Attachments

Last edited by a moderator: