Renko Bar Based Trading System

shared workspace link: https://tos.mx/DHOcwrT

V1.0 2020-07-26

System Components

Upper Chart Panel

Renko Bars

I use Renko Bars for scalping and day trading rather than being fixated and totally consumed by trade-by-trade candle price action. The Time interval settings I use are usually between 1 to 15 day. Price range is usually set to whatever works best for a particular instrument, but usually between 2 - 15 Ticks or ATR for Equities and from 1 - 5 Ticks or ATR for Options.

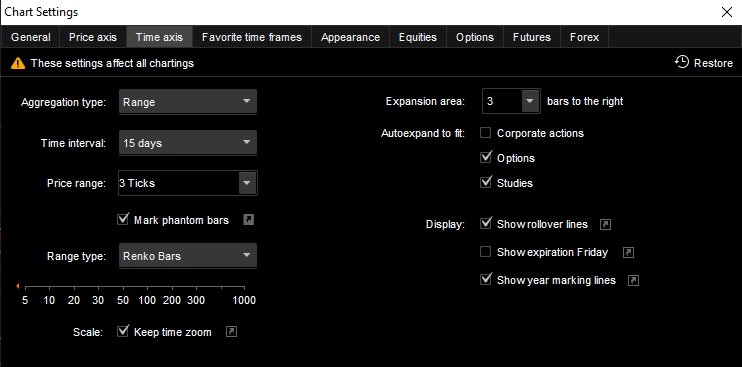

The figure below shows typical settings.

RSI(13, 70, 30, CLOSE, WILDERS, Yes) [RSI]: If you have never traded using the RSI as an Upper indicator, especially with Renko Bars, you owe it to yourself to try this method as it plays into the overall trade strategy quite well. I’m surprised I’ve seen so few traders using this setup as it adds a whole new dimension to the playing field.

Trend_Reversal_Indicator_with_Signals(No, Average, Pivot, No, 0.5) [TRI]: I’m sure I’ve made at least minor modifications to this Study script but none that drastically effect its functionality.

HullMovingAvg(OHLC4, 13, 0) (Optional) [HMA]: As you can see, I have opted to use OHLC4 for the Price setting because I have found that it performs better for my needs with this setting change.

Day_Highs_and_Lows (Optional) [DHL]: This is most likely default Study script code but it might be marginally modified.

Underlying_Equity_Price(Normal, Yes, Yes) (Optional) [UEP]: Custom AddLabel script to display Stock price as well as current Trend of the instrument being traded.

The following figure illustrates a typical Upper Chart panel for an Option:

Lower Chart Panel

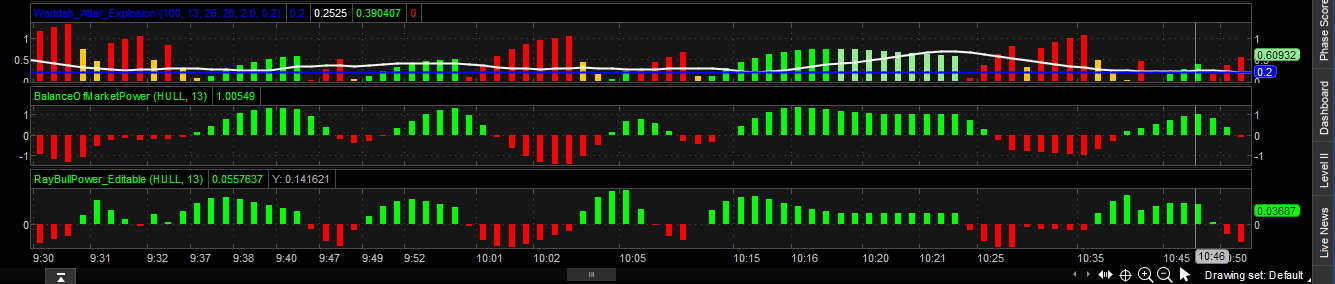

Waddah_Attar_Explosion(100, 13, 26, 20, 2.0, 0.2) [WAE] For best results, the “deadZone” xLine value needs to be adjusted so that it is functional for the instrument being charted. For most options that sweet spot is in the 0.2 range. You want your ex to drop below the xLine during periods of weak price movement when the bars are extremely short. This indicates a No-Trade “deadZone” area, meaning that you wouldn’t enter a trade when ex is below xLine. Note: I have moved the xLine and ex plots to the top of the plot code section so they paint on top of the Histogram instead of behind it. I have found that when the xLine is plotted first it becomes easier to determine when ex has dipped to or below xLine. Understanding plot hierarchy, and using it to your benefit, can be very helpful with decision making.

BalanceOfMarketPower(HULL, 13) [BOMP] I have not modified this Study script other than to adjust the AverageType to HULL and the length from 14 to 13.

RayBullPower(HULL, 13) [RBP] This Study script has been modified to allow bar color selection as well as AverageType selection.

The following figure illustrates a typical Lower Chart panel:

That’s pretty much it for Chart layout aside from the fact that I also enable the Charts Left Axis by checking the checkbox in one of my Study scripts, usually RSI.

Now let’s look at the entire Chart panel and go from there:

One thing I have just started utilizing is checking the Mark Phantom Bars option as indicated in the Chart Settings panel figure above. This causes the “phantom” bars, those that mark price movement without underlying volume, to display dimmer than true volume backed bars. All Phantom Bars have a Volume of zero and this is one of the quirks of using Renko Bars, albeit a minor one.

I won’t be covering the optional components as they are fairly self-explanatory and not part of the actual trading strategy. Sometimes I just turn them off to reduce screen clutter and to reduce processing overhead.

First, looking at the figure above, you will notice the RSI overlay working in conjunction with the Renko Bar movement. See what happens when the Renko Bars encroach on or surpass the Overbought RSI line? It indicates that it’s time to start paying closer attention to your trade and to anticipate taking profits before the RSI “breaks” and everyone is in a rush to exit, potentially leaving you in a Falling Knife situation. Yet you’ll also notice that when the RSI starts breaking back below Over-Bought but the Renko Bars are below Overbought it’s a good time to potentially ride out profit-takers creating a temporary price dip.

As I continue, please note that there will be some differences in how everything is interpreted depending on whether you are scalping or day trading. The main difference being how you plan your exit. As mentioned above, I utilize the TRI. This can serve multiple functions depending on your trading time-frame. When scalping you would use the Low Reversal as an entry point confirmation or you may choose to ignore it altogether and go by lower panel indicators. I find that, at the very least, it serves as an additional confirmation. When Day-Trading you can use both the Lower and Upper Reversal bubbles for entry and exit if that is your trading style. Just be aware of potential re-paints and watch those lower indicators for potential confirmations.

Now, let’s move on to how I use the Lower indicators. The main two being the WAE and RBP indicators. The BOMP indicator is primarily used to further confirm potential trade Entry and/or Exit as indicated by the WAE and RBP indicators. All three lower indicators have been set to a width of 1 for consistency as the default for RBP is 3 by default and that can cause synchronization alignment issues.

The WAE indicator provides a lot of information once you use it for a while. A Green bar indicates an upward trend in price movement. Dark Green indicates increasing strength and Light Green indicates decreasing strength. Yellow bars indicate decreasing strength and is also a good indication of upcoming Choppy Consolidation. More Yellow bars, typically tall ones, usually means a longer Consolidation period.

A typical entry signal would usually be a Green bar which has crossed above the ex line, with the ex line being your confirmation. This, of course, only holds true if it is your primary indicator and we’ll delve deeper into this as I describe the other two indicators. Now, remember those Yellow bars? Well, depending on various factors, a Yellow bar below the ex line that is below a Green Renko Bar can also be interpreted as an entry signal. Again, more on this later.

As far as exit signals are concerned, for Scalping, either a Light Green bar that closes below the ex line, ex being White on my charts, or any Red bar, would be an exit signal. For Day Trading we have several options for our exits. If the red bar is short, or a series of red bars are relatively short, in conjunction with the RSI crossing back below the Overbought line, you may choose to allow the trade to continue through what would usually be a Profit-Taking period. Your Renko Bars will also be Red during exit signals and Profit-Taking.

Next, let’s skip ahead to the RBP indicator as it can be used stand-alone or with the WAE indicator. The RBP indicator is fairly straight-forward, Green is your entry and the first Red is your exit - cut and dry. It just works! On long trade runs RBP will usually be your first to indicate an exit.

When used with WAE, the RBP indicator can be either the primary or secondary indicator. Essentially, you are looking for both indicators to display Green bars below a Green Renko Bar. Alternatively, a Yellow WAE bar and a Green RBP bar can also be used as a weaker yet valid entry signal. Also, when these two indicators are used you can optionally ignore the WAE Green bar having to cross above the ex line IF the RBP bar is also Green. Either indicator being Red can be used as your exit signal if nothing signals otherwise, such as RSI confirmed profit-taking dip.

And finally, the wildcard BOMP indicator. I say wildcard because that’s how I use it in decision making, and here is how it comes into play. Uncertain for an entry or an exit? Any switch to all three indicators painting Green bars can be interpreted as an entry signal and a switch to all three indicators painting Red bars can be interpreted as an exit signal if nothing signals otherwise, such as RSI confirmed profit-taking and short Red bars. If WAE is Yellow and RBP is Green then BOMP can optionally be the tie breaker with Green being an entry signal and Red indicating a pass. There may also be remote instances when it may be helpful in determining an early exit. Hence I tend to use the BOMP indicator as a catch-all, wildcard, tie-breaker for the most part. But important nonetheless.

There’s More

So, is that all there is? No! Pay close attention to the RSI as well as the Renko Bars relation to Overbought and Oversold. Sometimes the HMA can be useful in passing on a weak exit signal if the trend hasn’t turned. TRI is very useful in confirming entries and exits as long as you don’t use it as a primary signal or you’ll risk getting burned by repaints.

I no longer use a zeroLine on my Histograms, for good reason. If you’ve ever noticed what just looks like the zeroLine painting where there would normally be a bar you may be missing part of the story. By turning off the zeroLine you just see a gap between bars as though the bar never painted. Here is the trick! Hover your mouse pointer over any bars adjacent to the gap and your phantom bar or bars will magically appear. For example, I have seen a long gap of 15 bars or more that presented themselves as Red, Green, and Gray when revealed. I’ve seen every combination of phantom bar colors, Red to Green, Gray to Green, etcetera, that can be very helpful in making trade decisions that couldn’t have been made if the zeroLine was plotted. It is just about impossible to distinguish the phantom bar color by using the hovering trick with the zeroLine plotted so I simply turn them off and reap the benefits.

Identifying

The entire Chart Panel above includes a majority of what this strategy system encounters with the exception of RSI being in Oversold range, long Choppy DownTrend, or what a series of tall Yellow WAE bars foretells. I purposely selected this segment of chart for a GLD option because it has a very diverse amount of examples for such a short amount of chart. Some jump right out and others may take longer to find. A re-read of indicator use, and the twists and turns of interpreting them, should reveal most of them. I may eventually grab some snippets to help isolate some of the patterns.

If I follow my own rules this system can be very beneficial. I have actually spent a couple days ignoring the rules, intentionally, to prove that not following the rules is far less profitable than following them. And there were losses rather than gains. But it had to be done with real money because the real world is not as forgiving as back-testing. So, in the real world if I follow the rules rather than going rogue I have a far greater success rate. In 3 days of following the rules I had 12 wins and 2 losses. In 2 days of not following the rules and second guessing I had 4 wins, 1 break even, and 9 losses. And that was in an equal mix of market trends between Bullish and Bearish.

Summary

While I’m sure I haven’t covered every aspect of this trading system I feel that I’ve covered most of it, and, hopefully, adequately. I still find nuances as I use it more and more. After trying more than a few indicator suites I can honestly say that this one works the best for me. And I hope that it will for others as well. I will be sharing my setup, customized code and all, to provide a good starting point. If anyone finds a bug or makes improvements, please let me know.

THE END - rad14733

shared workspace link: https://tos.mx/DHOcwrT

V1.0 2020-07-26

System Components

Upper Chart Panel

Renko Bars

I use Renko Bars for scalping and day trading rather than being fixated and totally consumed by trade-by-trade candle price action. The Time interval settings I use are usually between 1 to 15 day. Price range is usually set to whatever works best for a particular instrument, but usually between 2 - 15 Ticks or ATR for Equities and from 1 - 5 Ticks or ATR for Options.

The figure below shows typical settings.

RSI(13, 70, 30, CLOSE, WILDERS, Yes) [RSI]: If you have never traded using the RSI as an Upper indicator, especially with Renko Bars, you owe it to yourself to try this method as it plays into the overall trade strategy quite well. I’m surprised I’ve seen so few traders using this setup as it adds a whole new dimension to the playing field.

Trend_Reversal_Indicator_with_Signals(No, Average, Pivot, No, 0.5) [TRI]: I’m sure I’ve made at least minor modifications to this Study script but none that drastically effect its functionality.

HullMovingAvg(OHLC4, 13, 0) (Optional) [HMA]: As you can see, I have opted to use OHLC4 for the Price setting because I have found that it performs better for my needs with this setting change.

Day_Highs_and_Lows (Optional) [DHL]: This is most likely default Study script code but it might be marginally modified.

Underlying_Equity_Price(Normal, Yes, Yes) (Optional) [UEP]: Custom AddLabel script to display Stock price as well as current Trend of the instrument being traded.

The following figure illustrates a typical Upper Chart panel for an Option:

Lower Chart Panel

Waddah_Attar_Explosion(100, 13, 26, 20, 2.0, 0.2) [WAE] For best results, the “deadZone” xLine value needs to be adjusted so that it is functional for the instrument being charted. For most options that sweet spot is in the 0.2 range. You want your ex to drop below the xLine during periods of weak price movement when the bars are extremely short. This indicates a No-Trade “deadZone” area, meaning that you wouldn’t enter a trade when ex is below xLine. Note: I have moved the xLine and ex plots to the top of the plot code section so they paint on top of the Histogram instead of behind it. I have found that when the xLine is plotted first it becomes easier to determine when ex has dipped to or below xLine. Understanding plot hierarchy, and using it to your benefit, can be very helpful with decision making.

BalanceOfMarketPower(HULL, 13) [BOMP] I have not modified this Study script other than to adjust the AverageType to HULL and the length from 14 to 13.

RayBullPower(HULL, 13) [RBP] This Study script has been modified to allow bar color selection as well as AverageType selection.

The following figure illustrates a typical Lower Chart panel:

That’s pretty much it for Chart layout aside from the fact that I also enable the Charts Left Axis by checking the checkbox in one of my Study scripts, usually RSI.

How To Use

Oh, where to begin? There is so much to cover that I hope I don’t leave anything out. I find new concepts all the time so I’m sure this section can be amended. As you may have noted, I prefer the HULL moving average and a bar length setting of 13. I have tried a plethora of different combinations of bar length settings and have found that 13 works best for my needs and synchronizes all of the indicators quite well. I also stick with standardized colors throughout for consistency.Now let’s look at the entire Chart panel and go from there:

One thing I have just started utilizing is checking the Mark Phantom Bars option as indicated in the Chart Settings panel figure above. This causes the “phantom” bars, those that mark price movement without underlying volume, to display dimmer than true volume backed bars. All Phantom Bars have a Volume of zero and this is one of the quirks of using Renko Bars, albeit a minor one.

I won’t be covering the optional components as they are fairly self-explanatory and not part of the actual trading strategy. Sometimes I just turn them off to reduce screen clutter and to reduce processing overhead.

First, looking at the figure above, you will notice the RSI overlay working in conjunction with the Renko Bar movement. See what happens when the Renko Bars encroach on or surpass the Overbought RSI line? It indicates that it’s time to start paying closer attention to your trade and to anticipate taking profits before the RSI “breaks” and everyone is in a rush to exit, potentially leaving you in a Falling Knife situation. Yet you’ll also notice that when the RSI starts breaking back below Over-Bought but the Renko Bars are below Overbought it’s a good time to potentially ride out profit-takers creating a temporary price dip.

As I continue, please note that there will be some differences in how everything is interpreted depending on whether you are scalping or day trading. The main difference being how you plan your exit. As mentioned above, I utilize the TRI. This can serve multiple functions depending on your trading time-frame. When scalping you would use the Low Reversal as an entry point confirmation or you may choose to ignore it altogether and go by lower panel indicators. I find that, at the very least, it serves as an additional confirmation. When Day-Trading you can use both the Lower and Upper Reversal bubbles for entry and exit if that is your trading style. Just be aware of potential re-paints and watch those lower indicators for potential confirmations.

Now, let’s move on to how I use the Lower indicators. The main two being the WAE and RBP indicators. The BOMP indicator is primarily used to further confirm potential trade Entry and/or Exit as indicated by the WAE and RBP indicators. All three lower indicators have been set to a width of 1 for consistency as the default for RBP is 3 by default and that can cause synchronization alignment issues.

The WAE indicator provides a lot of information once you use it for a while. A Green bar indicates an upward trend in price movement. Dark Green indicates increasing strength and Light Green indicates decreasing strength. Yellow bars indicate decreasing strength and is also a good indication of upcoming Choppy Consolidation. More Yellow bars, typically tall ones, usually means a longer Consolidation period.

A typical entry signal would usually be a Green bar which has crossed above the ex line, with the ex line being your confirmation. This, of course, only holds true if it is your primary indicator and we’ll delve deeper into this as I describe the other two indicators. Now, remember those Yellow bars? Well, depending on various factors, a Yellow bar below the ex line that is below a Green Renko Bar can also be interpreted as an entry signal. Again, more on this later.

As far as exit signals are concerned, for Scalping, either a Light Green bar that closes below the ex line, ex being White on my charts, or any Red bar, would be an exit signal. For Day Trading we have several options for our exits. If the red bar is short, or a series of red bars are relatively short, in conjunction with the RSI crossing back below the Overbought line, you may choose to allow the trade to continue through what would usually be a Profit-Taking period. Your Renko Bars will also be Red during exit signals and Profit-Taking.

Next, let’s skip ahead to the RBP indicator as it can be used stand-alone or with the WAE indicator. The RBP indicator is fairly straight-forward, Green is your entry and the first Red is your exit - cut and dry. It just works! On long trade runs RBP will usually be your first to indicate an exit.

When used with WAE, the RBP indicator can be either the primary or secondary indicator. Essentially, you are looking for both indicators to display Green bars below a Green Renko Bar. Alternatively, a Yellow WAE bar and a Green RBP bar can also be used as a weaker yet valid entry signal. Also, when these two indicators are used you can optionally ignore the WAE Green bar having to cross above the ex line IF the RBP bar is also Green. Either indicator being Red can be used as your exit signal if nothing signals otherwise, such as RSI confirmed profit-taking dip.

And finally, the wildcard BOMP indicator. I say wildcard because that’s how I use it in decision making, and here is how it comes into play. Uncertain for an entry or an exit? Any switch to all three indicators painting Green bars can be interpreted as an entry signal and a switch to all three indicators painting Red bars can be interpreted as an exit signal if nothing signals otherwise, such as RSI confirmed profit-taking and short Red bars. If WAE is Yellow and RBP is Green then BOMP can optionally be the tie breaker with Green being an entry signal and Red indicating a pass. There may also be remote instances when it may be helpful in determining an early exit. Hence I tend to use the BOMP indicator as a catch-all, wildcard, tie-breaker for the most part. But important nonetheless.

There’s More

So, is that all there is? No! Pay close attention to the RSI as well as the Renko Bars relation to Overbought and Oversold. Sometimes the HMA can be useful in passing on a weak exit signal if the trend hasn’t turned. TRI is very useful in confirming entries and exits as long as you don’t use it as a primary signal or you’ll risk getting burned by repaints.

I no longer use a zeroLine on my Histograms, for good reason. If you’ve ever noticed what just looks like the zeroLine painting where there would normally be a bar you may be missing part of the story. By turning off the zeroLine you just see a gap between bars as though the bar never painted. Here is the trick! Hover your mouse pointer over any bars adjacent to the gap and your phantom bar or bars will magically appear. For example, I have seen a long gap of 15 bars or more that presented themselves as Red, Green, and Gray when revealed. I’ve seen every combination of phantom bar colors, Red to Green, Gray to Green, etcetera, that can be very helpful in making trade decisions that couldn’t have been made if the zeroLine was plotted. It is just about impossible to distinguish the phantom bar color by using the hovering trick with the zeroLine plotted so I simply turn them off and reap the benefits.

Identifying

The entire Chart Panel above includes a majority of what this strategy system encounters with the exception of RSI being in Oversold range, long Choppy DownTrend, or what a series of tall Yellow WAE bars foretells. I purposely selected this segment of chart for a GLD option because it has a very diverse amount of examples for such a short amount of chart. Some jump right out and others may take longer to find. A re-read of indicator use, and the twists and turns of interpreting them, should reveal most of them. I may eventually grab some snippets to help isolate some of the patterns.

If I follow my own rules this system can be very beneficial. I have actually spent a couple days ignoring the rules, intentionally, to prove that not following the rules is far less profitable than following them. And there were losses rather than gains. But it had to be done with real money because the real world is not as forgiving as back-testing. So, in the real world if I follow the rules rather than going rogue I have a far greater success rate. In 3 days of following the rules I had 12 wins and 2 losses. In 2 days of not following the rules and second guessing I had 4 wins, 1 break even, and 9 losses. And that was in an equal mix of market trends between Bullish and Bearish.

Summary

While I’m sure I haven’t covered every aspect of this trading system I feel that I’ve covered most of it, and, hopefully, adequately. I still find nuances as I use it more and more. After trying more than a few indicator suites I can honestly say that this one works the best for me. And I hope that it will for others as well. I will be sharing my setup, customized code and all, to provide a good starting point. If anyone finds a bug or makes improvements, please let me know.

THE END - rad14733

Last edited by a moderator: