I want an indicator that accurately forces a relationship between a lower study indicator and price. I can watch both and see what is happening and make a successful trade (say on a divergence for example), but I want a single indicator that tells the whole story with precision. So here's what I'm thinking:

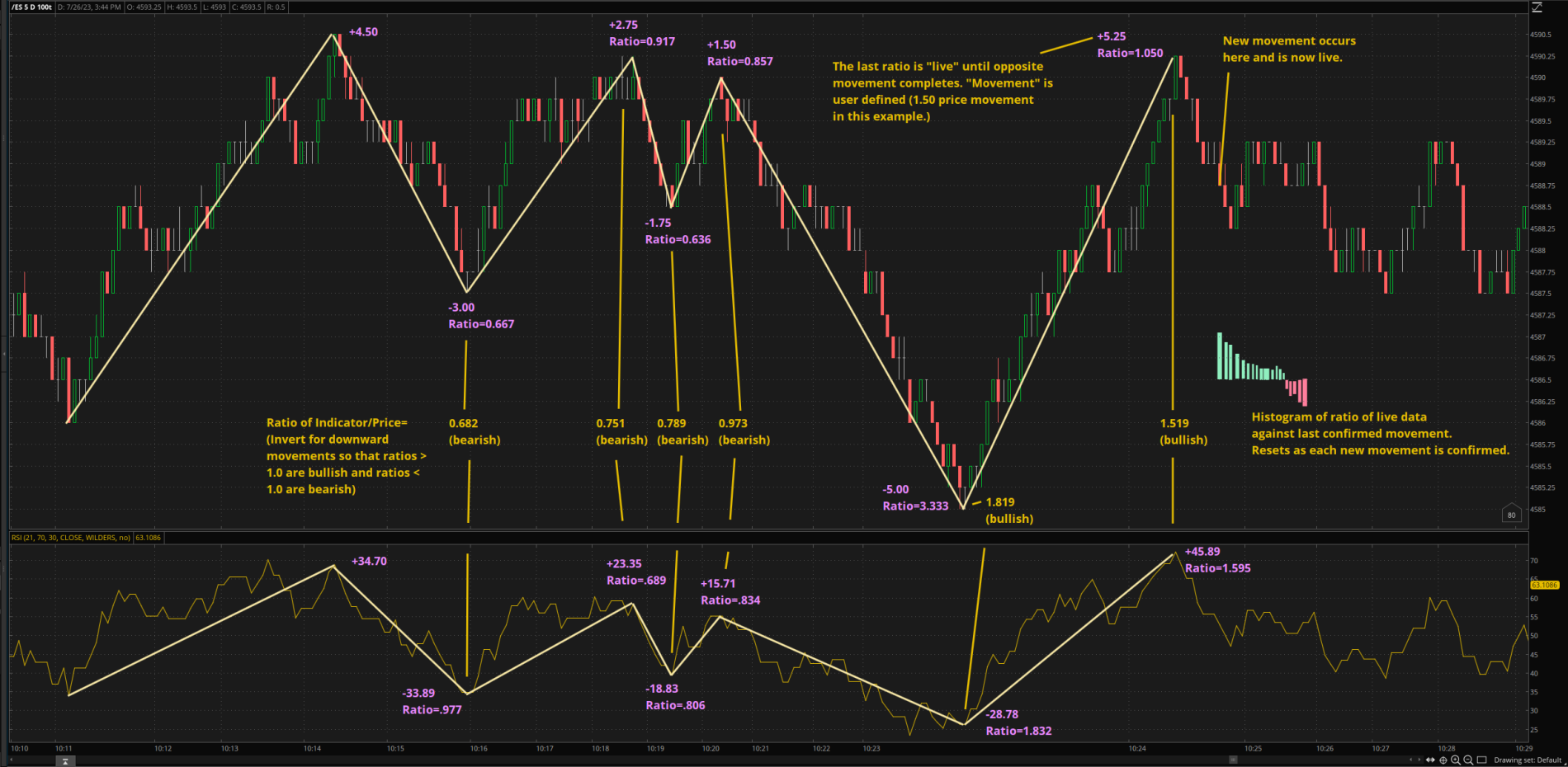

1) Break down the price action into peaks and valleys determined by user-defined parameters. Between each peak and valley I call a "movement", and for this example a movement is 1.50 of price on /ES futures. So once the price moves 1.50, a new movement has been established and continues until the price reverses by at least 1.50.

2) The corresponding values of the lower study are being tracked and form their own peaks and valleys aligned with the peaks and valleys of the price (even if the lower study peaks or valleys on a different bar).

3) Once a movement has been established the indicator is tracking the next movement, and a histogram can express a ratio of the current values of each bar against the previous movement. Once that movement finishes, the histogram resets and starts tracking ratios against the most recently completed movement. And so on.

4) You can see how the ratios are calculated in the screen capture below. I used RSI as the lower study but ideally one could apply this to any lower study. For the sake of this example, the lower study is assumed to be a leading indicator and so the ratios give you bearish/bullish indication against the price action.

Does this make sense and is this doable? Any help greatly appreciated!

1) Break down the price action into peaks and valleys determined by user-defined parameters. Between each peak and valley I call a "movement", and for this example a movement is 1.50 of price on /ES futures. So once the price moves 1.50, a new movement has been established and continues until the price reverses by at least 1.50.

2) The corresponding values of the lower study are being tracked and form their own peaks and valleys aligned with the peaks and valleys of the price (even if the lower study peaks or valleys on a different bar).

3) Once a movement has been established the indicator is tracking the next movement, and a histogram can express a ratio of the current values of each bar against the previous movement. Once that movement finishes, the histogram resets and starts tracking ratios against the most recently completed movement. And so on.

4) You can see how the ratios are calculated in the screen capture below. I used RSI as the lower study but ideally one could apply this to any lower study. For the sake of this example, the lower study is assumed to be a leading indicator and so the ratios give you bearish/bullish indication against the price action.

Does this make sense and is this doable? Any help greatly appreciated!

Last edited: