Author Message:

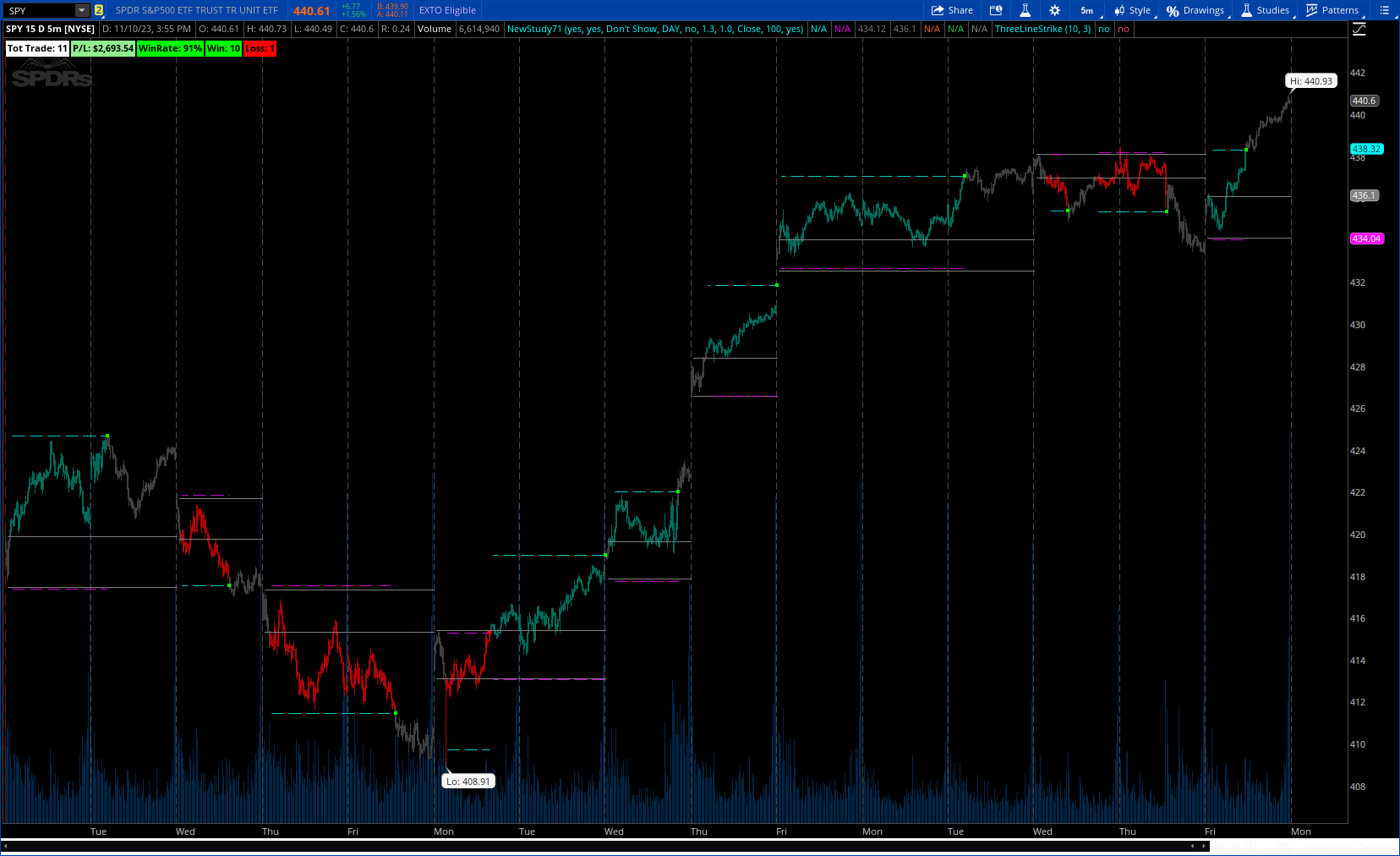

The Ranges With Targets indicator is a tool designed to assist traders in identifying potential trading opportunities on a chart derived from breakout trading. It dynamically outlines ranges with boxes in real-time, providing a visual representation of price movements. When a breakout occurs from a range, the indicator will begin coloring the candles. A green candle signals a long breakout, suggesting a potential upward movement, while a red candle indicates a short breakout, suggesting a potential downward movement. Grey candles indicate periods with no active trade. Ranges are derived from daily changes in price action.

CODE:

CSS:

# https://www.tradingview.com/v/3swrxpw6/

#// This source code is subject to the terms of the Mozilla Public License 2.0

#// © ChartPrime

#indicator("Ranges with Targets [ChartPrime]",overlay = true,max_lines_count = 500,max_labels_count = 500)

# converted by Sam4Cok@Samer800 - 11/2023

input colorBars = yes;

input showInfoLabel = yes;

input signalType = {default "Bubbles", "Arrows", "Don't Show"};

input rangeTimeFrame = {default DAY, WEEK, MONTH};

input atrBodyFilter = no; # "ATR Body Filter"

input profitMulti = 1.3; # "Target Multiplyer"

input stoplossMulti = 1.0; # "stop Multiplyer"

input stoplossType = {default "Close", "High/Low"}; # 'SL Type'

input lotSizeinUsd = 100;#,"Risk Per Trade (USD)",group=CORE)

input showTargetLines = yes;

def na = Double.NaN;

def bar_index = AbsValue(BarNumber());

def sigBubble = signalType == signalType."Bubbles";

def sigArrows = signalType == signalType."Arrows";

def slClose = stoplossType == stoplossType."Close";

DefineGlobalColor("Line", Color.GRAY);#CreateColor(245,127,23));#CreateColor(92, 67, 154));

DefineGlobalColor("RED", CreateColor(172, 5, 5));

DefineGlobalColor("GREEN", CreateColor(2, 106, 89));

DefineGlobalColor("OFF", Color.DARK_GRAY);#CreateColor(52, 52, 54));

def minVol = Min(ATR(Length = 30) * 0.3, close * (0.3 / 100));

def volAdj = minVol[20] / 2;

def BodyRange = AbsValue(close - open);

def BodyCon = bar_index > 0;

def BodyCon1 = (if atrBodyFilter then BodyRange < ATR(Length = 5) else yes);

script VolCal {

input Index = 100;

def var = AbsValue(Index);

def Bar = Max(Min(var, 500), 1);

def Bars = if IsNaN(Bar) then 1 else Bar;

def Green = fold i = 0 to Bars with p do

if GetValue(close, i) > GetValue(open, i) then p + GetValue(volume, i) else p;

def Red = fold j = 0 to Bars with q do

if GetValue(close, j) < GetValue(open, j) then q + GetValue(volume, j) else q;

def Total = fold v = 0 to Bars with l do

l + GetValue(volume, v);

def GreenRatio = Green / Total * 100;

def RedRatio = Red / Total * 100;

def VolCal = if GreenRatio > 55 then 1 else

if RedRatio > 55 then -1 else 0;

plot Out = VolCal;

}

def nATR;

def SCR;

def TradeOn;

def Res;

def TradeisON;

def yyyyMmDd = GetYYYYMMDD();

def periodIndx;

switch (rangeTimeFrame) {

case DAY:

periodIndx = yyyyMmDd;

case WEEK:

periodIndx = Floor((DaysFromDate(First(yyyyMmDd)) + GetDayOfWeek(First(yyyyMmDd))) / 7);

case MONTH:

periodIndx = RoundDown(yyyyMmDd / 100, 0);

}

def isPeriodRolled = CompoundValue(1, periodIndx != periodIndx[1], yes);

if isPeriodRolled[1] and !TradeisON[1] {

nATR = volAdj;

SCR = hl2 - (nATR * 15);

Res = SCR + (nATR * 25);

TradeOn = yes;

} else {

nATR = 0;

SCR = SCR[1];

Res = Res[1];

TradeOn = no;

}

def crossOver = Crosses(close, Res, CrossingDirection.ABOVE);

def crossUnder = Crosses(close, SCR, CrossingDirection.BELOW);

def BUY = crossOver[1] and BodyCon and BodyCon1;

def SELL = crossUnder[1] and BodyCon and BodyCon1;

#//----- { SL Calculation

def LongTrade;

def ShortTrade;

def longDiffSL2 = AbsValue(close - Res);

def longDiffSL = AbsValue(close - SCR);

def Long = BUY and !TradeisON[1];

def Short = SELL and !TradeisON[1];

def TradeFire = Long or Short;

if Long and !TradeisON[1] {

LongTrade = yes;

ShortTrade = no;

} else

if Short and !TradeisON[1] {

LongTrade = no;

ShortTrade = yes;

} else {

LongTrade = LongTrade[1];

ShortTrade = ShortTrade[1];

}

def win;

def los;

def entry;

def profit;

def losses;

def TP;

def SL;

if TradeFire and !TradeisON[1] {

entry = ohlc4[-1];

TP = if Long then entry + (profitMulti * longDiffSL) else

if Short then entry - (profitMulti * longDiffSL2) else na;

SL = if Long then entry - (stoplossMulti * longDiffSL) else

if Short then entry + (stoplossMulti * longDiffSL2) else na;

win = if !bar_index then 0 else win[1];

los = if !bar_index then 0 else los[1];

profit = profit[1];

losses = losses[1];

TradeisON = yes;

} else

if LongTrade and TradeisON[1] {

entry = entry[1];

TP = TP[1];

SL = SL[1];

win = if high >= TP then win[1] + 1 else win[1];

los = if close <= SL then los[1] + 1 else los[1];

profit = if (high crosses above TP) then profit[1] + AbsValue(close - entry) * lotSizeinUsd else profit[1];

losses = if (close crosses below SL) then losses[1] + AbsValue(entry - close) * lotSizeinUsd else losses[1];

TradeisON = if high >= TP then no else

if (if slClose then close else low) <= SL then no else TradeisON[1];

} else

if ShortTrade and TradeisON[1] {

entry = entry[1];

TP = TP[1];

SL = SL[1];

win = if low <= TP then win[1] + 1 else win[1];

los = if close >= SL then los[1] + 1 else los[1];

profit = if (low crosses below TP) then profit[1] + AbsValue(entry - close) * lotSizeinUsd else profit[1];

losses = if (close crosses above SL) then losses[1] + AbsValue(close - entry) * lotSizeinUsd else losses[1];

TradeisON = if low <= TP then no else

if (if slClose then close else high) >= SL then no else TradeisON[1];

} else {

entry = na;

win = if !bar_index then 0 else win[1];

los = if !bar_index then 0 else los[1];

profit = profit[1];

losses = losses[1];

TradeisON = TradeisON[1];

TP = if TradeisON then TP[1] else na;

SL = if TradeisON then SL[1] else na;

}

def lineUp = !showTargetLines or TP != TP[1];

def lineDn = !showTargetLines or SL != SL[1];

plot TakeProfit = if lineUp then na else TP;

plot stopLoss = if lineDn then na else SL;

TakeProfit.SetStyle(Curve.MEDIUM_DASH);

stopLoss.SetStyle(Curve.MEDIUM_DASH);

TakeProfit.SetDefaultColor(Color.CYAN);

stopLoss.SetDefaultColor(Color.MAGENTA);

plot supp = if !TradeOn and SCR then SCR else na;

plot ress = if !TradeOn and Res then Res else na;

#supp.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#ress.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

supp.SetDefaultColor(GlobalColor("Line"));

ress.SetDefaultColor(GlobalColor("Line"));

#--BarColor

def BearCon = TradeisON and ShortTrade;

def BullCon = TradeisON and LongTrade;

AssignPriceColor(if !colorBars then Color.CURRENT else

if BearCon then GlobalColor("RED") else

if BullCon then GlobalColor("GREEN") else GlobalColor("OFF"));

#-- Backtest

plot TradeEnd = if !TradeisON and TradeisON[1] then

if los > los[1] then SL[1] else TP[1] else na;

TradeEnd.AssignValueColor(if win > win[1] then Color.GREEN else Color.RED);

TradeEnd.SetPaintingStrategy(PaintingStrategy.SQUARES);

#-- Label

def totTrade = win + los;

def winRate = Round(win / totTrade * 100, 0);

def PandL = Round(profit - losses, 2);

AddLabel(showInfoLabel, "Tot Trade: " + totTrade, Color.WHITE);

AddLabel(showInfoLabel, "P/L: $" + PandL,

if PandL > 0 then Color.LIGHT_GREEN else

if PandL < 0 then Color.PINK else Color.GRAY);

AddLabel(showInfoLabel, "WinRate: " + winRate + "%",

if winRate > 50 then Color.GREEN else

if winRate < 50 then Color.RED else Color.GRAY);

AddLabel(showInfoLabel, "Win: " + win, Color.GREEN);

AddLabel(showInfoLabel, "Loss: " + los, Color.RED);

#-- Signals

def volH = VolCal(30);

def volL = VolCal(30);

def signH = if Long then volH else signH[1];

def signS = if Short then volL else signS[1];

def buyCond = BullCon and !BullCon[1];

def sellCond = BearCon and !BearCon[1];

#-- Signals

plot arrUp = if sigArrows and buyCond then low - minVol else na;

plot arrDn = if sigArrows and sellCond then high + minVol else na;

arrUp.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

arrDn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

arrUp.AssignValueColor(if signH > 0 then Color.CYAN else Color.VIOLET);

arrDn.AssignValueColor(if signS < 0 then Color.MAGENTA else Color.PLUM);

AddChartBubble(sigBubble and buyCond, low, "B" , if signH > 0 then Color.GREEN else Color.DARK_GREEN, no);

AddChartBubble(sigBubble and sellCond, high, "S", if signS < 0 then Color.RED else Color.DARK_RED);

#-- END of CODE