Author Message: (Not Typical conversion, some scripts can't be converted to TOS)

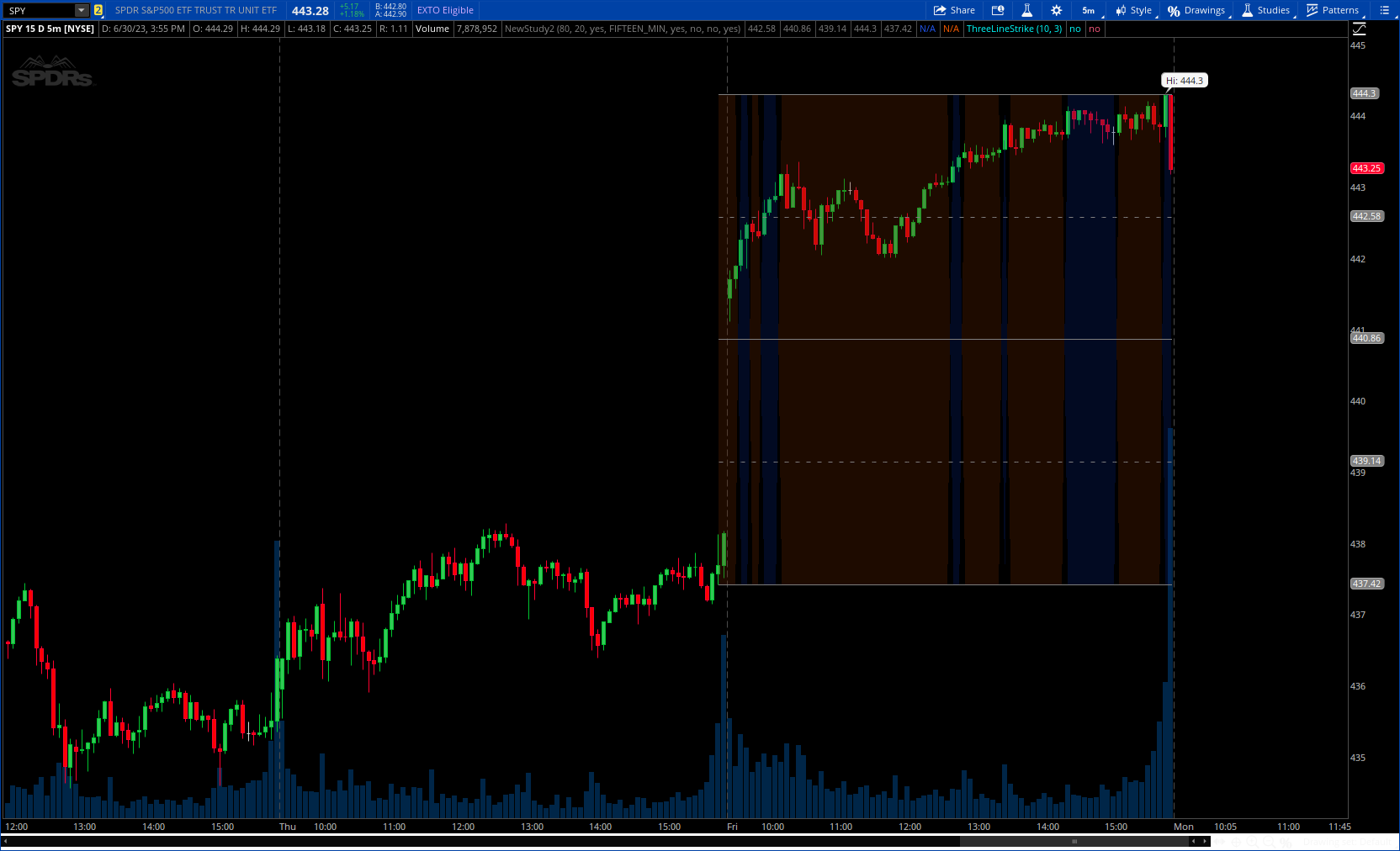

The Range Sentiment Profile indicator is inspired from the volume profile and aims to indicate the degree of bullish/bearish variations within equidistant price areas inside the most recent price range.

CSS:

#// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) #https://creativecommons.org/licenses/by-nc-sa/4.0/

#// © LuxAlgo

#indicator("Range Sentiment Profile [LuxAlgo]", overlay = true, max_boxes_count = 500)

# Converted by Sam4Cok@Samer800 - 07/2023 - Not exact results!

#//Settings

input length = 80;

input rows = 20;

input useChartTimeframe = {Default "yes", "No"};

input manualTimeframe = AggregationPeriod.FIFTEEN_MIN;

input showRange = yes; # 'Show Range Levels'

input bullMax = no; # 'Maximum'

input bearMax = no; # 'Minimum'

input showFill = yes; # 'Show Fill'

#//Function

def na = Double.NaN;

def c;

def h;

def l;

def o;

Switch (useChartTimeframe) {

Case "Yes" :

c = close;

h = high;

l = low;

o = open;

Case "No" :

c = close(Period=manualTimeframe);

h = high(Period=manualTimeframe);

l = low(Period=manualTimeframe);

o = open(Period=manualTimeframe);

}

#def get_close = close(Period=tf);

#def get_open = open(Period=tf);

def last = isNaN(close);

def int = inertiaAll(c, length);

def islast = !last;#!isNaN(int) and isNaN(int[-1]);#!isNaN(close);

#def isfirst = !isNaN(int) and isNaN(int[1]);

def rng = !isNaN(int);

def n = AbsValue(CompoundValue(1, BarNumber(), 0));

#--- Colors

DefineGlobalColor("up" , CreateColor(33,87,243));

DefineGlobalColor("dn" , CreateColor(255,93,0));

DefineGlobalColor("dup" , CreateColor(6,34,113));

DefineGlobalColor("ddn" , CreateColor(98,36,0));

def upper = highest(h, length);

def lower = lowest(l, length);

def sumad = sum(AbsValue(c - o), length);

def avg;def avg75; def avg25;def top; def btm;

def ltop;

def l75;

def l50;

def l25;

def lbtm;

#/Set profile

if islast {

avg = (upper + lower) / 2;

avg75 = (upper + avg) / 2;

avg25 = (lower + avg) / 2;

top = upper;

btm = lower;

} else {

avg = avg[1];

avg75 = avg75[1];

avg25 = avg25[1];

top = top[1];

btm = btm[1];

}

def toplvl = if !rng then na else highestAll(inertiaAll(top, 2));

def botlvl = if !rng then na else highestAll(inertiaAll(btm, 2));

def lvl75 = if !rng then na else highestAll(inertiaAll(avg75, 2));

def lvl50 = if !rng then na else highestAll(inertiaAll(avg, 2));

def lvl25 = if !rng then na else highestAll(inertiaAll(avg25, 2));

#//Display range levels

if showRange {

ltop = toplvl;

lbtm = botlvl;

l75 = lvl75;

l50 = lvl50;

l25 = lvl25;

} else {

ltop = na;

lbtm = na;

l75 = na;

l50 = na;

l25 = na;

}

plot l75_ = l75;

plot l50_ = l50;

plot l25_ = l25;

plot ltop_ = ltop;

plot lbtm_ = lbtm;

l75_.SetStyle(Curve.SHORT_DASH);

l25_.SetStyle(Curve.SHORT_DASH);

l75_.SetDefaultColor(Color.GRAY);

l50_.SetDefaultColor(Color.GRAY);

l25_.SetDefaultColor(Color.GRAY);

ltop_.SetDefaultColor(Color.GRAY);

lbtm_.SetDefaultColor(Color.GRAY);

#//Loop trough most recent bars

def introw = inertiaAll(c, rows-1);

def rngrow = isNaN(introw);

def dn = if rngrow then upper else

dn[1] - (upper - lower) / rows;

def sum = fold i = 0 to rows -1 with q=upper do

fold j = 0 to length -1 with p do

p + if h[j] > GetValue(dn,rows - i-1) and l[j] < if(i==0,upper, GetValue(dn,rows-i))

then c[j] - o[j] else 0;

def sums = sum>0;

def css = if showFill then sums else na;

AddCloud(if css then toplvl else botlvl, if css then botlvl else toplvl, GlobalColor("dup"), GlobalColor("ddn"));

def sums_abs = AbsValue(sum);

def max = highest(sum, rows);

def min = lowest(sum, rows);

def up = fold k = 0 to rows -1 with r=(dn+dn[1])/2 do

if GetValue(sum,rows-k) == max then (GetValue(dn,rows-k-1) + GetValue(dn,rows-k))/2 else r;

def dn1 = fold k1 = 0 to rows -1 with r1=(dn+dn[1])/2 do

if GetValue(sum,rows-k1) == min then (GetValue(dn,rows-k1-1) + GetValue(dn,rows-k1))/2 else r1;

def lvlMax = up;#if sum == max then up else lvlMax[1];

def lvlMin = dn1;#if sum == min then dn1 else lvlMin[1];

plot BullBin = if !bullMax or !rng then na else highestAll(inertiaAll(lvlMax, 2));

plot BearBin = if !bearMax or !rng then na else highestAll(inertiaAll(lvlMin, 2));

BullBin.SetDefaultColor(GlobalColor("up"));

BearBin.SetDefaultColor(GlobalColor("dn"));

#--- END of CODE