Im with you so far. Way too many false signals. My current setup seems way cleaner. For now though, this little experiment is just a covid time killerAlso, just my opinion here. But the more I inspect this indicator the less I like it. At least in the way the ST is promoting it. There is a lot of valuable signal data here from it's original incarnation (from FW Trade). I will be looking to use this but probably dissecting it some to match it up with my original Fish/CCI Combo signals as well as some other stuff I'm working on. Again, this is only my opinion.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

RAF (Ready Aim Fire) Indicator for ThinkorSwim

- Thread starter dvorakm

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

I am seeing a perfect match with the shaded areas. There are slightly more ready and aim signals, but not a deal breaker. I would say a good match for the original RAF. I have been looking into the soap lengths as possible thrust signals. The length of time a soap signal stays above ob/os. I agree with everyone else. This is something simple. I would not surprise me if power thrust bars are some form of the soap signals. LOL...the indicators they produced are not advanced just minor tweaks on what is available.

Last edited by a moderator:

@Investingtogive How was the class over the weekend? Does the new RAF Pro look to be worth the price tag in your opinion?

this is great stuff guys really. so....has anyone tried it in real life? how were the results?

like all indicators...it is another placebo. i Wouldn’t rely on it as the sole indicator. We are just trying to replicate the pro version as an exercise.

Also, just my opinion here. But the more I inspect this indicator the less I like it. At least in the way the ST is promoting it. There is a lot of valuable signal data here from it's original incarnation (from FW Trade). I will be looking to use this but probably dissecting it some to match it up with my original Fish/CCI Combo signals as well as some other stuff I'm working on. Again, this is only my opinion.

Have you been using 30min chart? Carter likes the 30min and daily chart for his trades, feels using charts on lower time frames is trying to fight against "10 million dollar algo machines."

All BS. I have seen him take trades on the one minute. His success this year came from Tesla...nothing else.Have you been using 30min chart? Carter likes the 30min and daily chart for his trades, feels using charts on lower time frames is trying to fight against "10 million dollar algo machines."

@madpuri I was reading your thread in regards to the THRUST DOT. I believe this is an indicator I use already built into TOS. This is referred to a TMV Study.

Take a look at it, it seems to match decently with RAF dots. Its basically a Kelter Channel study, with SMA, Volume spike and ADX over 10.

Cheers!

Take a look at it, it seems to match decently with RAF dots. Its basically a Kelter Channel study, with SMA, Volume spike and ADX over 10.

Cheers!

Is he not using the 39 minute tf anymore?Have you been using 30min chart? Carter likes the 30min and daily chart for his trades, feels using charts on lower time frames is trying to fight against "10 million dollar algo machines."

Just checked out the TMV. The dot that you see is only a portion of the indicator and basically just signifies a volume spike above a moving average threshold (the default is half a percent over the 20day volume SMA) I wouldn't be surprised in the slightest if the thrust dot is just a volume spike over a certain percent if anybody wants to check.@madpuri I was reading your thread in regards to the THRUST DOT. I believe this is an indicator I use already built into TOS. This is referred to a TMV Study.

Take a look at it, it seems to match decently with RAF dots. Its basically a Kelter Channel study, with SMA, Volume spike and ADX over 10.

Cheers!

Try adding this:

Code:

input volumeFastLength = 1;

input volumeSlowLength = 20;

input volumeOscThreshold = 0.5;

def volumeOsc = reference VolumeOsc("fast length" = volumeFastLength, "slow length" = volumeSlowLength, "diff type" = "percent");

plot VolumeSpike = if volumeOsc > volumeOscThreshold then 0 else Double.Nan;

VolumeSpike.SetDefaultColor(GetColor(1));

VolumeSpike.SetLineWeight(3);

VolumeSpike.SetPaintingStrategy(PaintingStrategy.Points);

Last edited:

Is he not using the 39 minute tf anymore?

what ever is convienent...lol. His recent videos show 30 minute, 2 hour four, and other standard timeframes. Not dissing, but he uses what ever will work.

Anyways, I tested the code. Not seeing a match, but I think you are on to something with the dots code. I wonder if we can use this with the soap stochastics when they get above or below OB/OS. Another member mentioned ADX. Let me see if I can get anything working by tweaking @wtf_dude 's code. I will post if I get somewhere.

Last edited:

So since I started experimenting with this and getting a bunch of squeeze scanner requests, I started reading his book Mastering the Trade. It's actually pretty damn good, but its also almost 500 pages. I'm guessing he ran into the ever so common "cant you just tell me when to buy and sell" requests vs people actually reading his book and putting years into learning the market. That being said, I definitely can't fault him for just charging people out the *** for pointy placebo arrows and half baked broadcasts. If customers wanna be lazy, they can go ahead and waste capital.what ever is convienent...lol. His recent videos show 30 minute, 2 hour four, and other standard timeframes. Not dissing, but he uses what ever will work.

Anyways, I tested the code. Not seeing a match, but I think you are on to something with the dots code. I wonder if we can use this with the soap stochastics when they get above or below OB/OS. Another member mentioned ADX. Let me see if I can get anything working by tweaking @wtf_dude 's code. I will post if I get somewhere.

So the code I posted is straight from simpler trading website. Use that code if you want to do a scan.Is there a scan that pinpoint the reversal signals that you have labeled on the chart?

I get the feeling many here see this as the holy grail or close to it. I am gonna throw some cold water on this. The ”creator” David Starr says he would not solely use this or use the scan since too many false signals are generated. David Elliot on the other hand stressed reading the chart and seeing how the indicator is reacting.

Stockmarker

Member

Dear everyone, Good evening!Wow, it's so cool !

Just wanted to check the following requirement. I'm trying to setup the following scan which is not working. Can you pls. help to setup the same?

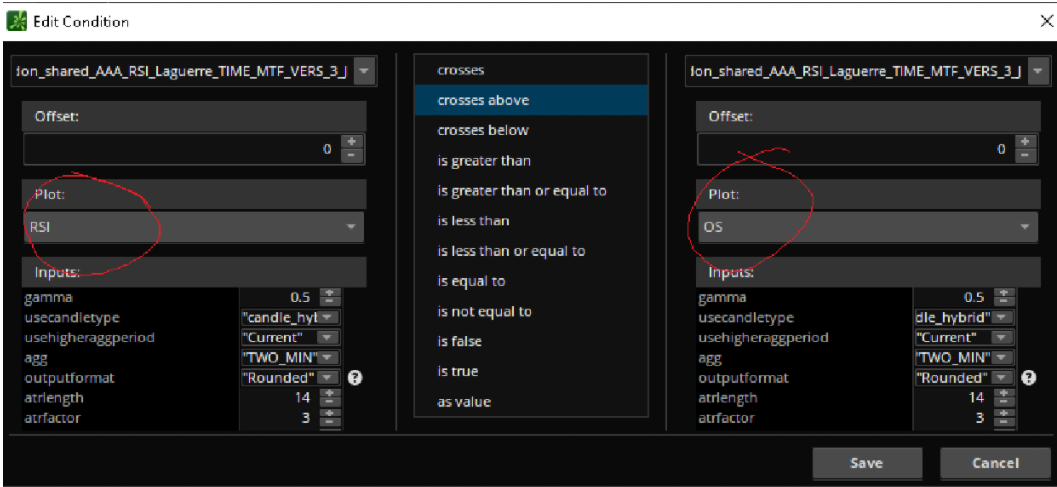

Just checking, can anyone help with this case? I would like to setup a scan for AAA_RSO_Laguerre_TOME_MTF_VERS_3_* indicator when the RSI crosses OS plot , should get alert.

Last edited:

Can you point me to the video your referring too? I saw and he only uses TSLA and those thrust dots are a perfect match on Tesla with the TMV study. So since you are stating you will exclude Tesla and select a range bound stock, I am interested to see what other stocks JC illustrates the thrust dots on.@bisrama I am not seeing it. I am specifically avoiding TSLA because many suggestions will match a trending stock. I am looking at range bound stocks Carter showed in his videos. So far no match.

Below is a comparison on his chart and my TMV

- Status

- Not open for further replies.

BenTen's Watchlist + Setup + Trade Recaps

Get access to Ben's watchlist, swing trading strategy, ThinkorSwim setup, and trade examples.

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

592

Online

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.