You should upgrade or use an alternative browser.

Best Day Trading Strategy / Indicators For ThinkorSwim

- Thread starter Zedd

- Start date

start here:

https://usethinkscript.com/threads/where-to-start-with-thinkorswim-and-daytrading.20946/#post-152716

Daytrading / Scalping is not just about using the right indicators:

https://usethinkscript.com/threads/best-time-frame-for-trading-for-thinkorswim.12209/#post-152641

Best Indicators for daytrading and scalping:

https://usethinkscript.com/threads/what-are-the-best-indicators-in-thinkorswim.14498/#post-151586

Member's favorites:

https://usethinkscript.com/threads/...ogether-and-what-time-frames-do-you-use.9868/

Is it possible to be a profitable daytrader...

For example, if the market is in a hard trend, a reversal strategy probably isn't your best choice. If you cannot identify what price is doing in a general sense, you cannot select the best strategy or indicator to confirm your trade decisions.

Also, no indicator can make a trading plan for you. If you want to succeed, you need a trading plan that is based on time of day, type of instrument, timeframe, price action, etc. You need to know when your trading style is likely to work and when it's a day to stay out. You need to know what your strengths/weaknesses are as a trader so that your plan is based on your strengths and has safeguards around your weaknesses. No indicator can make that self-assessment for you and build it into your trade plan.

I don't mean to discourage you. I just think it's misguided to expect indicators to make you a good trader. Your ability to understand what the market is doing will make you a good trader, not bells and whistles on the chart.

Finally, it seems unfair to call something "shitty" just because it doesn't give the results you hoped for. There is no shortcut to successful trading. It takes a lot of study, a lot of discipline, and the ability to make mistakes and learn from them. If you're serious about learning, please try reading some good books on price action. Instead of calling something "shitty," perhaps you could watch the indicator for a while and see what it tells you about price. For example, plot a DMI on your chart watch what price does when the (+) and (-) cross the ADX or the ADX flattens. Plot an Ehlers MAMA on your chart and watch what happens when the lines cross. I wouldn't use those as trading signals, but they may help you learn about price action and get a feel for what indicators can--and can't--tell you.

Best wishes.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Been trading for many decades, trade for a living now.Can someone share me with a day trading strategy that has worked for them. I have tried many strategies and used many indicators from this site but ended up losing trades or the strategy didn't work good enough backtesting.

thx

As has been said there is no magic indicator or strategy. Keep in mind you are in a battle when you are trading! A battle for cash - in order for you to win someone is losing. With that said it is best to learn the game by doing.

I went years losing and breaking even. There is no one indicator that will make you a long term winner - the market is ever changing and you must use different indicators that work with the change. In closing you must learn how to read the trend and then create a method that is yours to take advantage of the current trend.

There are many people on this site that share their work - learn from them and then create your masterpiece for success. It may take you years but if you are wise with money management success will come.

sbryanvaughn

New member

Zedd, I think everyone has felt that way before at times...so something that has worked well for me (doing the type of trading you are talking about) is using the standard deviation channels (first in tradingview) in Thinkorswim on a 1 or 2 min timeframe. I am actually new to TOS but not to this strategy or trading in general. It just got way easier to do with TOS because the channels are auto calculated and you don't have to do them manually. The theory is that price will not exceed the -2 or +2 standard deviation 97% of the time. So if you watch the channels and wait until a sharp selloff or downtrend and price goes to one of these levels (mainly on an uptrend when the channels are sloping up), you can usually catch a really good bounce off of the -2 or even better the -3 standard deviation level. I use the 1, 2, and 3 channels on my charts in TOS. the idea is that these are low risk high probability entry areas. Even if you don't like trading reversals...say you like to trade patterns, these channels can tell you which patterns are likely to play out. For instance you would not trade a bull flag pattern right under the +1 or +2 levels which can act as resistance. If I trade patterns its always below or at the center line of the channels. There is obviously a lot more to it...like watching the yearly and 180 day levels and marking those on the charts and seeing if they will interact on the intraday chart, etc. If channels are sloping up, my exits are twice oversold, divergence on the RSI, rejection at key levels, or break of obvious trend...if channels are sloping down (and I am going long) I am just looking for a quick scalp and will get out at once oversold on the RSI, and I watch volume like crazy. When I see the sellers step in I will usually get out. But, like the others said, its hard to tell someone a strategy. you have to get into the weeds with it, put in the time, figure out your entry criteria, exit criteria, form a trade plan, and then learn to trade the plan well and not let emotions or decisions weigh into too much. You will literally get decision fatigue and you will start doubting every decision you make. Trading can head knick you for sure. But I will say, of all of the strategies that I have tried, and that is MANY, none of them have come close to this one in terms of reliability. In fact, when i am trading the index ETF's, when they hit a -2 level and the channels are sloping up (indicating a sharp pullback in a bullish day trend) I will back up the dumptruck and buy all I can. Did this today on UPRO (3x leveraged ETF of SPY) and cleaned house.appreciate the help. I am interested and trade emini's and stocks only. tried scalping but mostly ends up with loss or even. And then tried to look for intraday trend that I can ride for mins or even hours but its hard to predict. seems like the stock I chose to focus on with all the right indications that It will go my way takes an opposite turn the second I get in the trade.

I was a member of the NYSE and I traded OEX a lot. They were very popular and very liquid at the time, being young with other sources of income I was able to extend my risk spectrum. I continue to add newer applications to my arsenal in order to improve my strategies. You must first assess who you are, how much risk you can take without blowing up and recognize that you can be right 50% or less as long as your gains outweigh your losses, preferably by 1 1/2 - 2 x.

You must not enter this field thinking that your going to catch the next GME. This is not easy it requires dedication, research, flexibility and extreme discipline to stick with YOUR rules. You must also have extreme self-confidence as this is like waves from the ocean. Sometimes you can ride them and other times you have to avoid them. Don't expect to reach the top of the mountain immediately it is a journey of many steps but once you get there it's a great view, until the next mountain. Good Luck read all previous posts, they are filled with gems formed from experience and common sense.

Hi @sunnybabu, I hope your trading has been profitable. All the indicators are available and you will find them here @usethinkscript.com. Just takes a little work for you to search and understand.@cabe1332 Love your charts.. squeezepro is that the default TTMsqueeze that is available in TOS? if not can u point me to where i can get that? actually how do i get all your indicators

@rad14733, @zeek, @Tripod-2020, @greenalert20. Does this strategy also work for long.. I figured I might stick to long trading (i.e.) holding stock for 2-3 days etc., as opposed to getting in/out several times a day.. so are there any techniques/tips/tricks that we can use for going long?

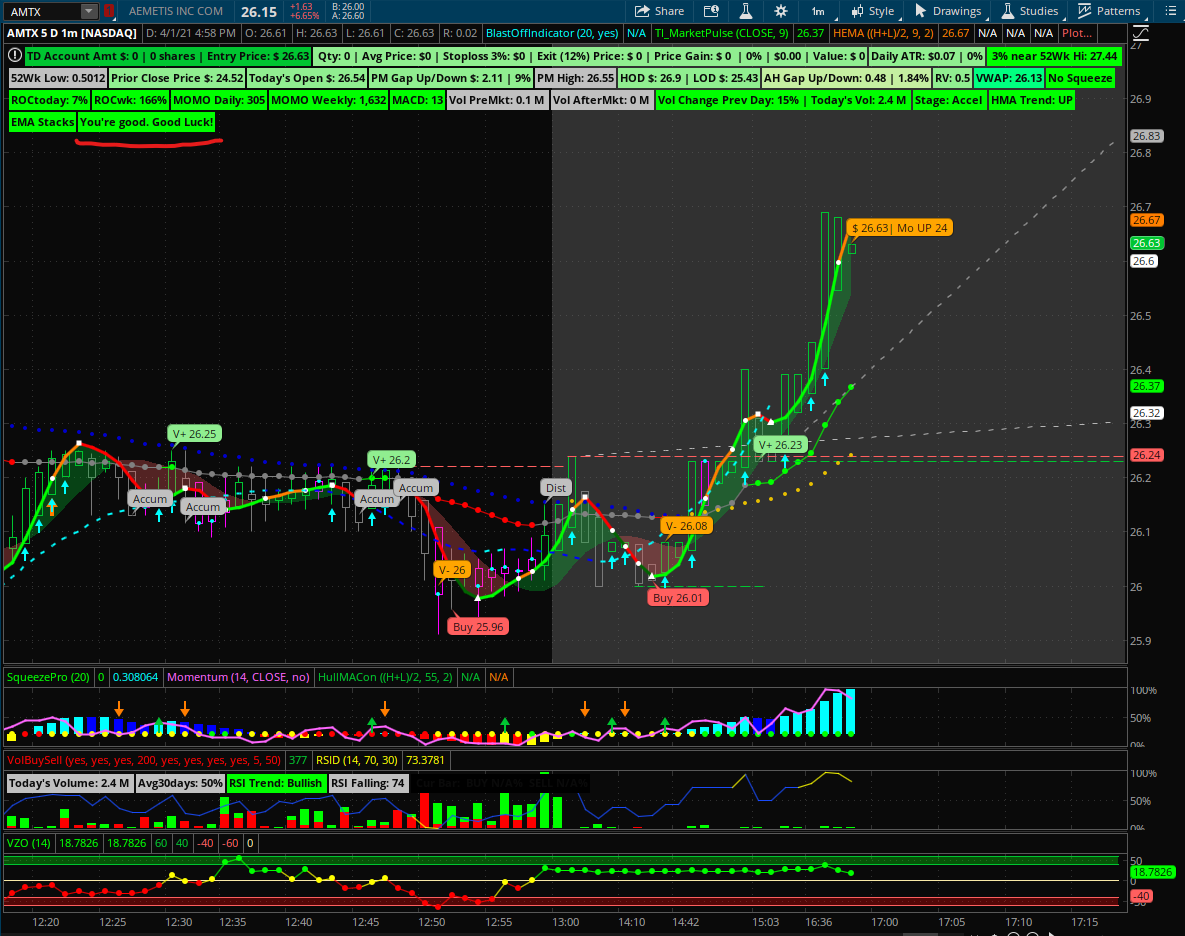

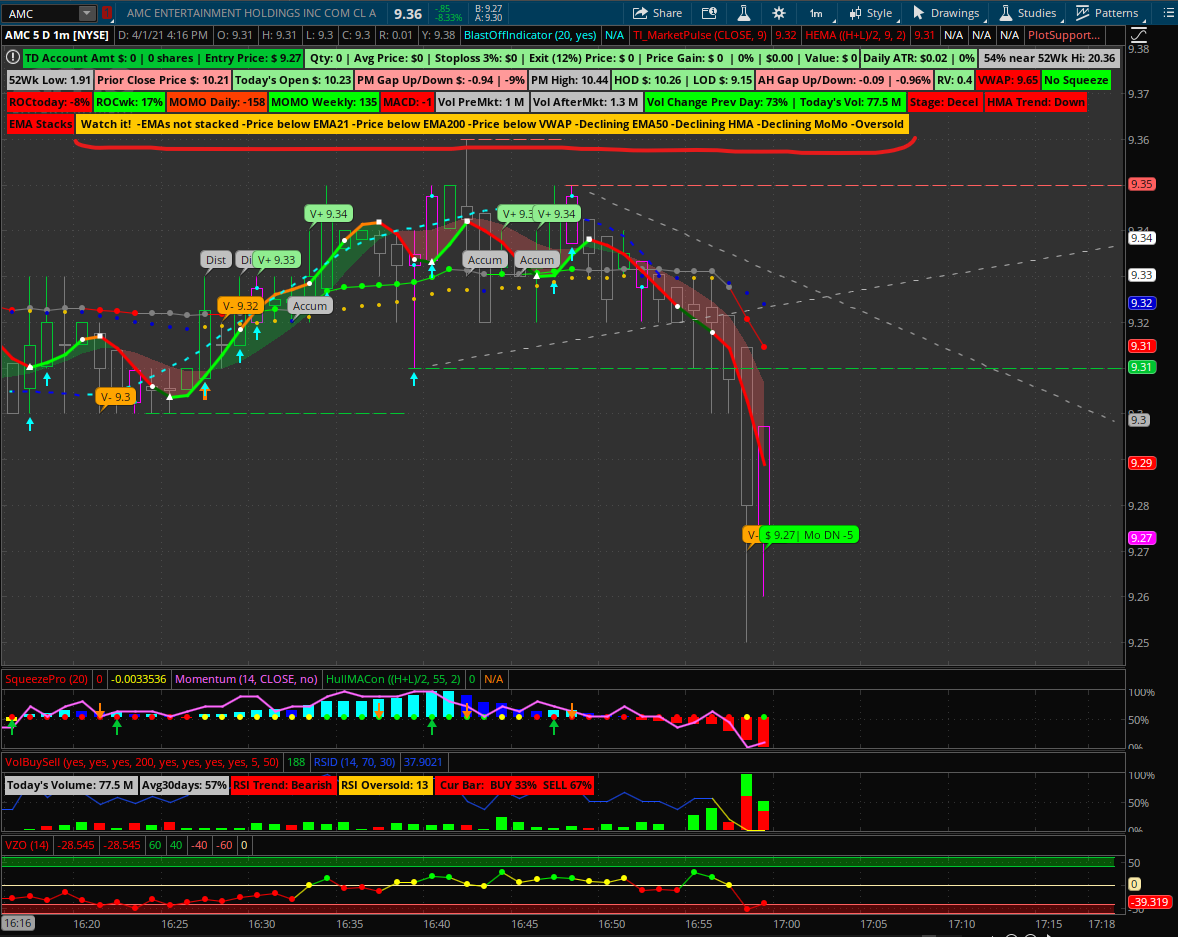

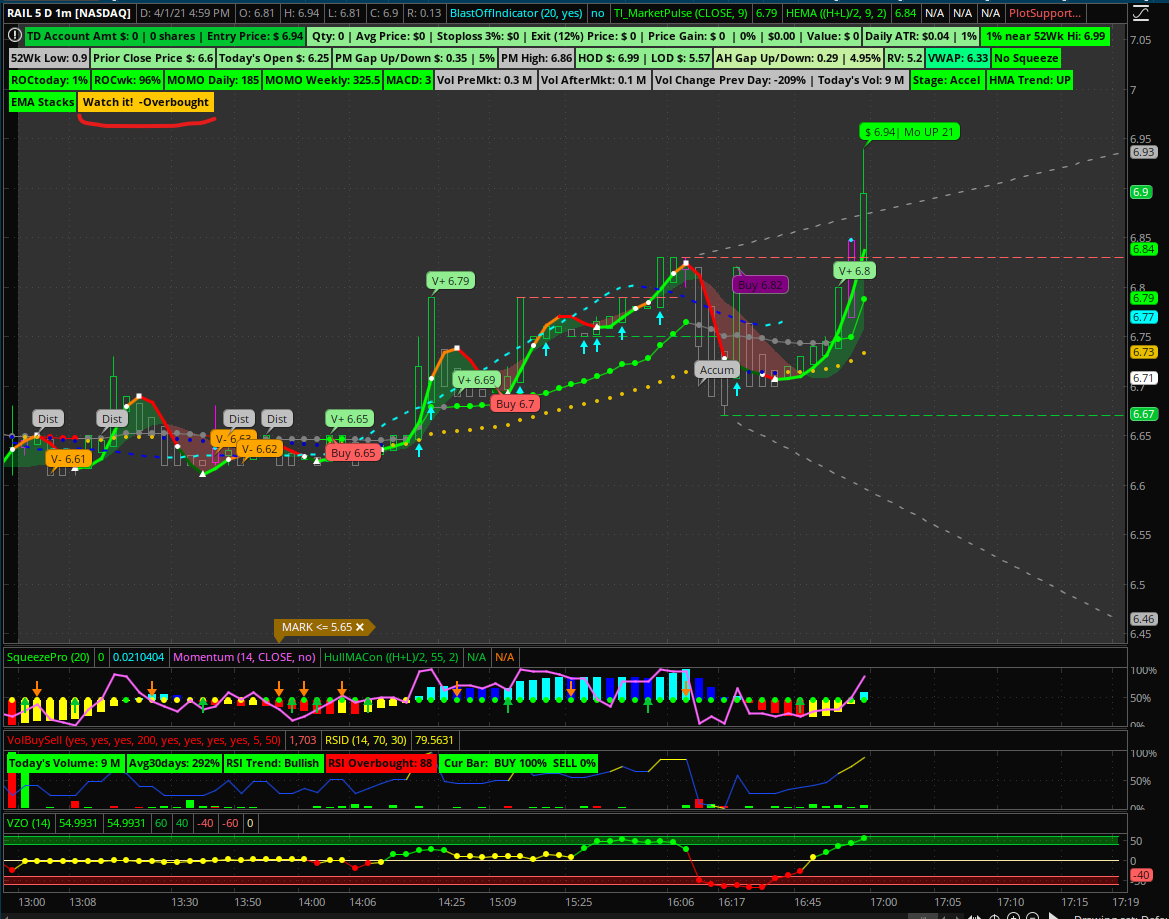

I like to keep things simple and easy systematically. Someone mentioned in the list "better entry" or "how can I avoid bad entry". Well, I wrote a script below I can share that may help all or at least the early traders. Yes, I do have a lot of indicators on my chart, but my consolidated decision (or AI) does a good job telling me to avoid entry or when certain situations to get out of the position. The label maybe will save you chart space and $$$ on all timeframes whether short or long trades. I have attached some screenshots of how it looks. I hope this helps you. Just let me know what you think and feedback or just thank you is appreciated. Good luck! @cabe1332

#PosEntry & Warning Label

# by cabe@1332

# Start of code

######### EMA21 - price below 21 ma

def dprice = close;

def dlength = 21;

def ddisplace = 0;

def EMA21 = MovingAverage(AverageType.eXPONENTIAL, dprice, dlength)[-ddisplace];

def v = if EMA21 > EMA21[1] then 1 else 0;

######### EMA50 - price below 50 ma

def eprice = close;

def elength = 50;

def edisplace = 0;

def EMA50 = MovingAverage(AverageType.eXPONENTIAL, eprice, elength)[-edisplace];

def x = if EMA50 > EMA50[1] then 1 else 0;

######### EMA200 - price below 200 ma - losing stock don't buy

def fprice = close;

def flength = 200;

def fdisplace = 0;

def EMA200 = MovingAverage(AverageType.eXPONENTIAL, fprice, flength)[-fdisplace];

def t = if EMA200 > EMA200[1] then 1 else 0;

############ HMA

def hprice = close;

def hlength = 20;

def displace = 0;

def HMA = MovingAverage(AverageType.HULL, hprice, hlength)[-displace];

def y = if HMA > HMA[1] then 1 else 0;

############ EMAs Stacked - a must for a good setup and entry

def stackedUp = MovAvgExponential("length" = 8)."AvgExp" is greater than MovAvgExponential("length" = 21)."AvgExp"

and MovAvgExponential("length" = 21)."AvgExp" is greater than MovAvgExponential("length" = 34)."AvgExp"

and MovAvgExponential("length" = 34)."AvgExp" is greater than MovAvgExponential("length" = 55)."AvgExp"

and MovAvgExponential("length" = 55)."AvgExp" is greater than MovAvgExponential("length" = 89)."AvgExp";

def e = if stackedUp then 1 else 0;

####### TTM_Squeeze - momo must be light blue

def H = reference TTM_Squeeze().Histogram;

def tt = if H > 0 and H > H[1] then 1 else 0;

#VWAPvalue

def vwapValue = reference VWAP();

def vw = if close > vwapValue then 1 else 0;

############ RSI

def rsilength = 5;

def rsi = reference RSI(length = rsilength)."RSI";

def rsioversold = if rsi < 20 then 1 else 0;

def rsioverbought = if rsi > 80 then 1 else 0;

def r = if rsioversold or rsioverbought then 1 else 0;

############ Label

def z = if tt== 1 and x == 1 and y == 1 and e and 1 and r == 0 and t == 1 and vw == 1 then 1 else 0;

addlabel(yes, if z == 1 then "You're good. Good Luck!" else " Watch it! " + (if e == 0 then "-EMAs not stacked " else "") + (if v == 0 then "-Price below EMA21 " else "") + (if t == 0 then "-Price below EMA200 " else "") + (if vw == 0 then "-Price below VWAP " else "")+ (if x == 0 then "-Declining EMA50 " else "") + (if y == 0 then "-Declining HMA " else "") + (if tt == 0 then "-Declining MoMo " else "") + (if rsioversold == 1 then "-Oversold " else "") + (if rsioverbought == 1 then "-Overbought " else ""), if z == 1 then color.green else color.orange);

#End of codeHi @sunnybabu, I hope your trading has been profitable. All the indicators are available and you will find them here @usethinkscript.com. Just takes a little work for you to search and understand.

I like to keep things simple and easy systematically. Someone mentioned in the list "better entry" or "how can I avoid bad entry". Well, I wrote a script below I can share that may help all or at least the early traders. Yes, I do have a lot of indicators on my chart, but my consolidated decision (or AI) does a good job telling me to avoid entry or when certain situations to get out of the position. The label maybe will save you chart space and $$$ on all timeframes whether short or long trades. I have attached some screenshots of how it looks. I hope this helps you. Just let me know what you think and feedback or just thank you is appreciated. Good luck! @cabe1332

Code:#PosEntry & Warning Label # by cabe@1332 # Start of code ######### EMA21 - price below 21 ma def dprice = close; def dlength = 21; def ddisplace = 0; def EMA21 = MovingAverage(AverageType.eXPONENTIAL, dprice, dlength)[-ddisplace]; def v = if EMA21 > EMA21[1] then 1 else 0; ######### EMA50 - price below 50 ma def eprice = close; def elength = 50; def edisplace = 0; def EMA50 = MovingAverage(AverageType.eXPONENTIAL, eprice, elength)[-edisplace]; def x = if EMA50 > EMA50[1] then 1 else 0; ######### EMA200 - price below 200 ma - losing stock don't buy def fprice = close; def flength = 200; def fdisplace = 0; def EMA200 = MovingAverage(AverageType.eXPONENTIAL, fprice, flength)[-fdisplace]; def t = if EMA200 > EMA200[1] then 1 else 0; ############ HMA def hprice = close; def hlength = 20; def displace = 0; def HMA = MovingAverage(AverageType.HULL, hprice, hlength)[-displace]; def y = if HMA > HMA[1] then 1 else 0; ############ EMAs Stacked - a must for a good setup and entry def stackedUp = MovAvgExponential("length" = 8)."AvgExp" is greater than MovAvgExponential("length" = 21)."AvgExp" and MovAvgExponential("length" = 21)."AvgExp" is greater than MovAvgExponential("length" = 34)."AvgExp" and MovAvgExponential("length" = 34)."AvgExp" is greater than MovAvgExponential("length" = 55)."AvgExp" and MovAvgExponential("length" = 55)."AvgExp" is greater than MovAvgExponential("length" = 89)."AvgExp"; def e = if stackedUp then 1 else 0; ####### TTM_Squeeze - momo must be light blue def H = reference TTM_Squeeze().Histogram; def tt = if H > 0 and H > H[1] then 1 else 0; #VWAPvalue def vwapValue = reference VWAP(); def vw = if close > vwapValue then 1 else 0; ############ RSI def rsilength = 5; def rsi = reference RSI(length = rsilength)."RSI"; def rsioversold = if rsi < 20 then 1 else 0; def rsioverbought = if rsi > 80 then 1 else 0; def r = if rsioversold or rsioverbought then 1 else 0; ############ Label def z = if tt== 1 and x == 1 and y == 1 and e and 1 and r == 0 and t == 1 and vw == 1 then 1 else 0; addlabel(yes, if z == 1 then "You're good. Good Luck!" else " Watch it! " + (if e == 0 then "-EMAs not stacked " else "") + (if v == 0 then "-Price below EMA21 " else "") + (if t == 0 then "-Price below EMA200 " else "") + (if vw == 0 then "-Price below VWAP " else "")+ (if x == 0 then "-Declining EMA50 " else "") + (if y == 0 then "-Declining HMA " else "") + (if tt == 0 then "-Declining MoMo " else "") + (if rsioversold == 1 then "-Oversold " else "") + (if rsioverbought == 1 then "-Overbought " else ""), if z == 1 then color.green else color.orange); #End of code

Thank you for the explanation and label! I was curious if you were willing to share your workspace so we could try more of the labels and indicators? Would love to try them out on SPX options. Thank you so much!

start here:

https://usethinkscript.com/threads/where-to-start-with-thinkorswim-and-daytrading.20946/#post-152716

Daytrading / Scalping is not just about using the right indicators:

https://usethinkscript.com/threads/best-time-frame-for-trading-for-thinkorswim.12209/#post-152641

Best Indicators for daytrading and scalping:

https://usethinkscript.com/threads/what-are-the-best-indicators-in-thinkorswim.14498/#post-151586

Member's favorites:

https://usethinkscript.com/threads/...ogether-and-what-time-frames-do-you-use.9868/

Is it possible to be a profitable daytrader?

https://usethinkscript.com/threads/thinkorswim-profitable.17469/

A caution about "backtesting"

https://usethinkscript.com/threads/backtesting-forum-indicators-in-thinkorswim.20621/

A few VIP links:

What happens when the market lacks clear direction:

https://usethinkscript.com/threads/how-to-use-technical-indicators.19303/#post-144767

Learning from your past trades:

https://usethinkscript.com/threads/learning-from-past-trades.18250/

tradebyday

Active member

https://usethinkscript.com/threads/es-trading-strategy-on-thinkorswim.987/

Keep in mind even the best strategy will not work all the time. A profitable strategy for someone may not be profitable for you because it fits their trading style and the market they're trading among other things. Learn to spot areas of support and resistance and how price reacts around those areas. Make sure you're entering where your stop loss is the amount you're comfortable with losing to find out if the price doesn't hit your target. Lastly, wait for a pullback and trade in the direction of the overall trend. Money and risk management is key to staying in the game.

I feel mesmerized by indicators that look like they predict the market perfectly, but when I try to use them it doesn't work out that well. Even being strict, using various indicators to help with entry/exits.

Every time I looked at some professional's charts from a picture taken from a trading desk they always have very little indicators. It looks like some sort of EMA/SMA cross, VWAP, volume, multiple time frames from a single stock, and the news bar.

So if these people doing 100K+ a month are using so little then what is their edge?

There must be so many different edges out there. If you are a successful trader, can you share your edge?

example: I scalp /ES on the 3m when RSI is below 30 and see a bump in volume. or I trade options verticle spreads with a %70 delta.

I just cant find my edge and its frustrating. I've been at this for over a year.. every day... I tried Futures now im trying to learn options.

Now I'm trying to learn about volume because I've always seemed to neglect that and turn it off on my charts. When I search "volume" in Thinkorswim there are so many volume indicators, I also see some are created here. Do you have a favorite volume indicator?

1. You may want to read Virtu's ipo and other docs to see what they do. One of the important observations is that break even trades are as important as win/loss.

2. When you see a "professionals" chart, be aware that real pros wont let you near their screen due to NDAs. There are many "pros", my guess is they make a living from selling tools not trading. I'd also add consider changing colors on indicators as alot of apps use similar colors as casinos which affect your decisions. Many highly paid 'pros' eg, market makers, are executing customer orders and take very little exposure to the mkt.

2.a. If a "pro" shows a screen and says they make x, ask for their audited 1040s, I've never seen a guru respond to that.

2.b. Theres an academic paper posted here, somewhere, which describes the vaious MAs and rates the, worth a read even if you disagree.

3. Volume/money flow can be misleading as you simply dont know whats on the other side of the trade

4. Consider looking at the latest fad, and the mechanics of it, eg, gamma/vanna , its a big deal (for now)

And, never forget, as well-intentioned as some are, its your money, your decisions. I could be the biggest clown in the trading world, you simply dont know and should be a skeptic.

Vince Field

Active member

scott69

Active member

Similar threads

-

-

-

When target price is met start a trail stop order - what's the best way to set this up?

- Started by Grayfox87

- Replies: 1

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

When target price is met start a trail stop order - what's the best way to set this up?

- Started by Grayfox87

- Replies: 1

-

-

Similar threads

-

-

-

When target price is met start a trail stop order - what's the best way to set this up?

- Started by Grayfox87

- Replies: 1

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/