netarchitech

Well-known member

@HighBredCloud GOT IT!  For your review:

For your review:

Code:

# filename: MR__EZ_PercentR_MAC_

# idea source: @HighBredCloud and https://usethinkscript.com/threads/moving-average-crossover-rsi-indicator-for-thinkorswim.185/

# Code: Thanson Stevens, @korygill and netarchitech

# V11.12.2019 - netarchitech added multiple-choice smoothing per HighBredCloud request

declare lower;

# PercentR_MAC

input length = 14;

input over_Bought = 80;

input over_Sold = 20;

input lowBand = 10; #Smoothing LowerBand

input data = close;

input lower = low; #Research Lower = Low?

def highest = Highest(high, length);

def divisor = highest - Lowest(low, length);

def PI = 3.14159265359;

def a1 = Exp(-PI * Sqrt(2) / lower);

def coeff2 = 2 * a1 * Cos(Sqrt(2) * PI / lower);

def coeff3 = - Power(a1, 2);

def coeff1 = 1 - coeff2 - coeff3;

def filt = coeff1 * (data + (data[1])) / 2 + coeff2 * (filt[1]) + coeff3 * (filt[2]);

input PercentRMALength5 = 5;

input PercentRMALength8 = 8;

#input PercentRMALength13 = 13;

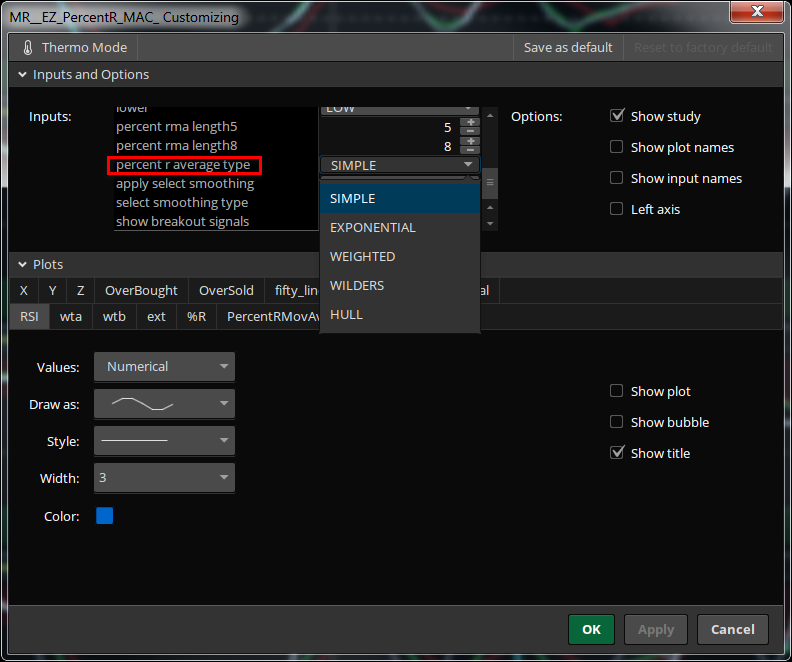

input PercentRAverageType = AverageType.SIMPLE;

# plot and smooth PercentR

plot "%R" = if divisor equals 0 then 0 else 100 - 100 * (highest - close) / divisor;

"%R".DefineColor("OverBought", GetColor(9)); #GetColor(9));

"%R".DefineColor("Normal", GetColor(7));

"%R".DefineColor("OverSold", GetColor(1)); #GetColor(1));

"%R".AssignValueColor(if "%R" > over_Bought then "%R".Color("OverBought") else if "%R" < over_Sold then "%R".Color("OverSold") else "%R".Color("Normal"));

"%R".SetLineWeight(3);

"%R".Hide();

# plot and smooth the PercentR Moving Averages

def PercentRMA5 = MovingAverage(PercentRAverageType, "%R", PercentRMALength5);

plot PercentRMovAvg5 = PercentRMA5;

PercentRMovAvg5.SetDefaultColor(Color.GREEN);

PercentRMovAvg5.SetLineWeight(3);

PercentRMovAvg5.hide();

def PercentRMA8 = MovingAverage(PercentRAverageType, "%R", PercentRMALength8);

plot PercentRMovAvg8 = PercentRMA8;

PercentRMovAvg8.SetDefaultColor(Color.RED);

PercentRMovAvg8.SetLineWeight(3);

PercentRMovAvg8.hide();

#def PercentRMA13 = MovingAverage(PercentRAverageType, "%R", PercentRMALength13);

#plot PercentRMovAvg13 = PercentRMA13;

#PercentRMovAvg13.SetDefaultColor(Color.ORANGE);

#PercentRMovAvg13.SetLineWeight(2);

#PercentRMovAvg13.hide();

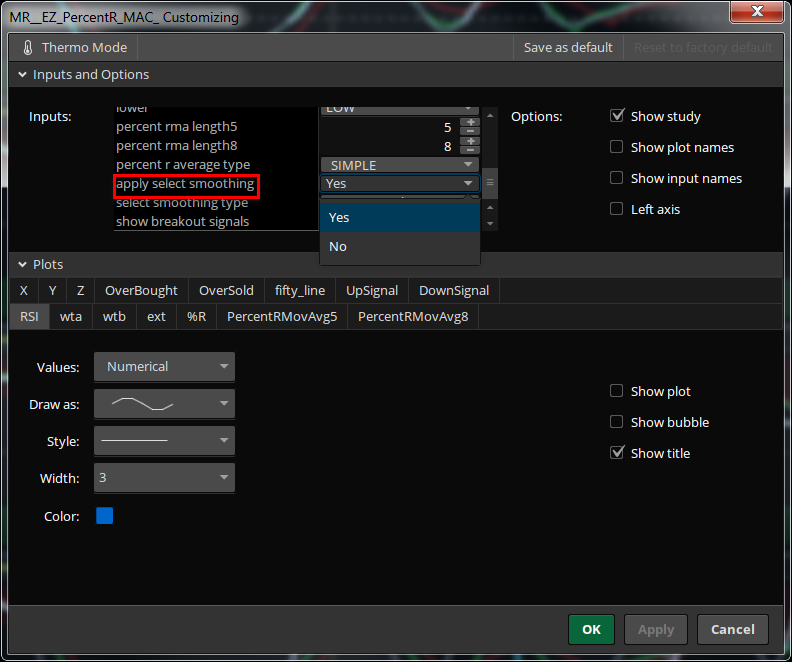

input applySelectSmoothing = yes;

def smooth_it = EhlersSuperSmootherFilter(if divisor equals 0 then 0 else 100 - 100 * (highest - close) / divisor, lowBand);

def smooth_MA5 = EhlersSuperSmootherFilter(MovingAverage(PercentRAverageType, "%R", PercentRMALength5));

def smooth_MA8 = EhlersSuperSmootherFilter(MovingAverage(PercentRAverageType, "%R", PercentRMALength8));

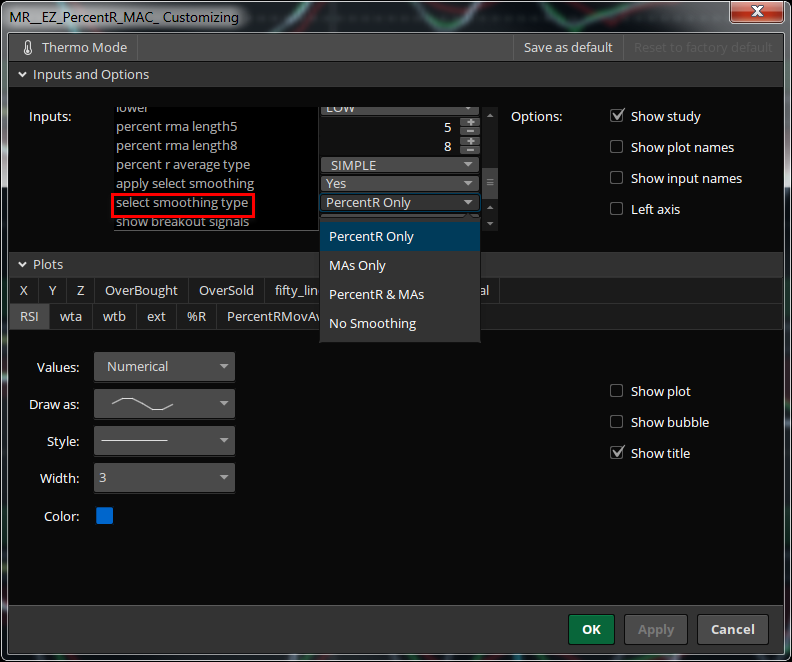

input SelectSmoothingType = {default "PercentR Only", "MAs Only", "PercentR & MAs", "No Smoothing"};

plot X;

X.AssignValueColor(if "%R" > over_Bought then "%R".Color("OverBought") else if "%R" < over_Sold then "%R".Color("OverSold") else "%R".Color("Normal"));

X.SetLineWeight(3);

plot Y;

Y.SetDefaultColor(Color.GREEN);

Y.SetLineWeight(2);

plot Z;

Z.SetDefaultColor(Color.RED);

Z.SetLineWeight(2);

switch (SelectSmoothingType) {

case "PercentR Only":

X = if applySelectSmoothing and "%R" then smooth_it else "%R";

Y = if applySelectSmoothing and PercentRMA5 then PercentRMA5 else PercentRMA5;

Z = if applySelectSmoothing and PercentRMA8 then PercentRMA8 else PercentRMA8;

case "MAs Only":

X = if applySelectSmoothing and "%R" then "%R" else "%R";

Y = if applySelectSmoothing and PercentRMA5 then smooth_MA5 else PercentRMA5;

Z = if applySelectSmoothing and PercentRMA8 then smooth_MA8 else PercentRMA8;

case "PercentR & MAs":

X = if applySelectSmoothing and "%R" then smooth_it else "%R";

Y = if applySelectSmoothing and PercentRMA5 then smooth_MA5 else PercentRMA5;

Z = if applySelectSmoothing and PercentRMA8 then smooth_MA8 else PercentRMA8;

case "No Smoothing":

X = if applySelectSmoothing and"%R" then "%R" else "%R";

Y = if applySelectSmoothing and PercentRMA5 then PercentRMA5 else PercentRMA5;

Z = if applySelectSmoothing and PercentRMA8 then PercentRMA8 else PercentRMA8;

}

plot OverBought = over_Bought;

OverBought.SetDefaultColor(Color.DARK_RED);

OverBought.HideTitle();

plot OverSold = over_Sold;

OverSold.SetDefaultColor(Color.DARK_GREEN);

OverSold.HideTitle();

plot fifty_line = 50;

fifty_line.SetDefaultColor(GetColor(8));

fifty_line.HideTitle();

fifty_line.SetStyle(Curve.SHORT_DASH);

# plot the Breakout Signals

input showBreakoutSignals = yes;

plot UpSignal = if "%R" crosses above OverSold then OverSold else Double.NaN;

UpSignal.SetHiding(!showBreakoutSignals);

UpSignal.SetDefaultColor(Color.UPTICK);

UpSignal.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

UpSignal.SetLineWeight(3);

UpSignal.HideTitle();

plot DownSignal = if "%R" crosses below OverBought then OverBought else Double.NaN;

DownSignal.SetHiding(!showBreakoutSignals);

DownSignal.SetDefaultColor(Color.DOWNTICK);

DownSignal.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

DownSignal.SetLineWeight(3);

DownSignal.HideTitle();

AddCloud(0, over_Sold, Color.DARK_GREEN, Color.DARK_GREEN);

AddCloud(over_Bought, 100, Color.DARK_RED, Color.DARK_RED);

# Gmode

def lengthRSI = 14;

def price = close;

input averageType = AverageType.WILDERS;

def NetChgAvg = MovingAverage(averageType, price - price[1], lengthRSI);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), lengthRSI);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

plot RSI = 50 * (ChgRatio + 1);

RSI.SetDefaultColor(CreateColor(0, 102, 204));

RSI.SetLineWeight(3);

#RSI.HideTitle();

RSI.HideBubble();

RSI.Hide();

input n1 = 9; #Channel Length

input n2 = 26; #Average Length

input n3 = 13; #Short length

def multi = no; #Multi-exchange?

def src0 = hlc3;

def src1 = hlc3(period = AggregationPeriod.MONTH);

def src2 = hlc3(period = AggregationPeriod.MONTH);

def src3 = hlc3(period = AggregationPeriod.MONTH);

def src4 = hlc3(period = AggregationPeriod.MONTH);

script tci {

input src = hlc3;

input n1 = 9; #Channel Length

input n2 = 26; #Average Length

plot tci = MovAvgExponential((src - MovAvgExponential(src, n1)) / (0.025 * MovAvgExponential(AbsValue(src - MovAvgExponential(src, n1)), n1)), n2) + 50;

tci.Hide();

}

#mf(src) => rsi(sum(volume * (change(src) <= 0 ? 0 : src), n3), sum(volume * (change(src) >= 0 ? 0 : src), n3))

script mf {

input src = hlc3;

input n3 = 13; #Short length

def rsi = reference RSI();

#plot mf = rsi(Sum(volume * (if Average(src) <= 0 then 0 else src), n3), Sum(volume * (if Average(src) >= 0 then 0 else src), n3));

plot mf = RSI(n3, src);

mf.Hide();

}

script willy {

input src = hlc3;

input n2 = 26; #Average Length

plot willy = 60 * (src - Highest(src, n2)) / (Highest(src, n2) - Lowest(src, n2)) + 80;

willy.Hide();

}

#csi(src) => avg(rsi(src, n3),tsi(src0,n1,n2)*50+50)

script csi {

input src = hlc3;

input n1 = 9; #Channel Length

input n2 = 26; #Average Length

input n3 = 13; #Short length

def rsi = reference RSI();

plot csi = RSI(n3, src) + TrueStrengthIndex(n1, n2) / 2 * 50 + 50;

csi.Hide();

}

script godmode {

input src = hlc3;

def rsi = reference RSI();

plot godmode = (tci(src) + CSI(src) + mf(src) + willy(src)) / 4;

godmode.Hide();

}

script tradition {

input src = hlc3;

input n3 = 13; #Short length

def rsi = reference RSI();

plot tradition = (tci(src) + mf(src) + RSI(n3, src)) / 3;

tradition.Hide();

}

def wt1 = if multi then (godmode(src0) + godmode(src1) + godmode(src2) + godmode(src3) + godmode(src4) / 5) else tradition(src0);

def wt2 = SimpleMovingAvg(wt1, 6);

def extended = if wt2 < 20 then wt2 + 5 else if wt2 > 80 then wt2 - 5 else Double.NaN;

plot wta = wt1;

wta.SetDefaultColor(Color.GREEN);

wta.SetLineWeight(2);

wta.Hide();

plot wtb = wt2;

wtb.SetDefaultColor(Color.RED);

wtb.SetLineWeight(2);

wtb.Hide();

plot ext = extended; #Caution!

ext.SetPaintingStrategy(PaintingStrategy.POINTS);

ext.SetDefaultColor(Color.YELLOW);

ext.SetLineWeight(3);