RO= Risk on . PC = previous close ( yesterday closed price)Can someone please explain what "RO" means?

I've seen other people ask and no-one answers.

What is the point of the RO line? PC line? Etc?

A glossary would be great.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Opening Range Breakout Indicator for ThinkorSwim

- Thread starter BenTen

- Start date

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Great job to whoever wrote this code. I am not trying to step on any toes here as this is not my code. I edited the ORBI code as follows and it appears to work great with the super trend. Not sure if I did this correctly though. I took code from 2 different places In this thread if i remember. You have to remember to go to the settings of the study and turn on the cloud, alert, and show today only if you are only viewing a "today" chart, then also go to the chart settings in TOS, under equities and adjust to hide or show closed times. I just have not jumped in and started to use it yet. I tried once or twice with $tsla and find it is hard to be quick, so I have to play with my time frames, 2-3 min vs 5 min vs 15 min.

Code:

declare Hide_On_Daily;

declare Once_per_bar;

input OrMeanS = 0930.0; #hint OrMeanS: Begin Mean Period. Usually Market Open EST.

input OrMeanE = 0935.0; #hint OrMeanE: End Mean period. Usually End of first bar.

input OrBegin = 0930.0; #hint OrBegin: Beginning for Period of Opening Range Breakout.

input OrEnd = 1000.0; #hint OrEnd: End of Period of Opening Range Breakout.

input CloudOn = no; #hint CloudOn: Clouds Opening Range.

input AlertOn = yes; #hint AlertOn: Alerts on cross of Opening Range.

input ShowTodayOnly = {"No", default "Yes"};

input nAtr = 4; #hint nATR: Lenght for the ATR Risk and Target Lines.

input AtrTargetMult = 2.0; #hint ATRmult: Multiplier for the ATR calculations.

def h = high;

def l = low;

def c = close;

def bar = barNumber();

def s = ShowTodayOnly;

def ORActive = if secondsTillTime(OrMeanE) > 0 and

secondsFromTime(OrMeanS) >= 0

then 1

else 0;

def today = if s == 0

or getDay() == getLastDay() and

secondsFromTime(OrMeanS) >= 0

then 1

else 0;

def ORHigh = if ORHigh[1] == 0

or ORActive[1] == 0 and

ORActive == 1

then h

else if ORActive and

h > ORHigh[1]

then h

else ORHigh[1];

def ORLow = if ORLow[1] == 0

or ORActive[1] == 0 and

ORActive == 1

then l

else if ORActive and

l < ORLow[1]

then l

else ORLow[1];

def ORWidth = ORHigh - ORLow;

def na = double.nan;

def ORHA = if ORActive

or today < 1

then na

else ORHigh;

def ORLA = if ORActive

or today < 1

then na

else ORLow;

def O = ORHA - Round(((ORHA - ORLA) / 2) / TickSize(), 0) * TickSize();

def ORActive2 = if secondsTillTime(OREnd) > 0 and

secondsFromTime(ORBegin) >= 0

then 1

else 0;

def ORHigh2 = if ORHigh2[1] == 0

or ORActive2[1] == 0 and

ORActive2 == 1

then h

else if ORActive2 and

h > ORHigh2[1]

then h

else ORHigh2[1];

def ORLow2 = if ORLow2[1] == 0

or ORActive2[1] == 0 and

ORActive2 == 1

then l

else if ORActive2 and

l < ORLow2[1]

then l

else ORLow2[1];

def ORWidth2 = ORHigh2 - ORLow2;

def TimeLine = if secondsTillTime(OREnd) == 0

then 1

else 0;

def ORmeanBar = if !ORActive and ORActive[1]

then barNumber()

else ORmeanBar[1];

def ORendBar = if !ORActive2 and ORActive2[1]

then barNumber()

else ORendBar[1];

def ORL = if (o == 0 , na, o);

plot ORLext = if barNumber() >= highestAll(ORmeanBar)

then HighestAll(if isNaN(c[-1])

then ORL[1]

else double.nan)

else double.nan;

ORLext.SetDefaultColor(color.Yellow);

ORLext.SetStyle(curve.Long_DASH);

ORLext.SetLineWeight(3);

ORLext.HideTitle();

def ORH2 = if ORActive2

or today < 1

then na

else ORHigh2;

plot ORH2ext = if barNumber() >= highestAll(ORendBar)

then HighestAll(if isNaN(c[-1])

then ORH2[1]

else double.nan)

else double.nan;

ORH2ext.SetDefaultColor(color.Green);

ORH2ext.SetStyle(curve.Long_DASH);

ORH2ext.SetLineWeight(3);

ORH2ext.HideTitle();

def ORL2 = if ORActive2

or today < 1

then na

else ORLow2;

plot ORL2ext = if barNumber() >= highestAll(ORendBar)

then HighestAll(if isNaN(c[-1])

then ORL2[1]

else double.nan)

else double.nan;

ORL2ext.SetDefaultColor(color.Red);

ORL2ext.SetStyle(curve.Long_DASH);

ORL2ext.SetLineWeight(3);

ORL2ext.HideTitle();

def RelDay = (ORL - ORL2) / (ORH2 - ORL2);

def dColor = if RelDay > .5

then 5

else if RelDay < .5

then 6

else 4;

def pos = (ORH2 - ORL2)/10;

plot d1 = if (TimeLine , ORH2, na);

plot d2 = if (TimeLine , ORH2 - ( pos * 2), na);

plot d3 = if (TimeLine , ORH2 - ( pos * 3), na);

plot d4 = if (TimeLine , ORH2 - ( pos * 4), na);

plot d5 = if (TimeLine , ORH2 - ( pos * 5), na);

plot d6 = if (TimeLine , ORH2 - ( pos * 6), na);

plot d7 = if (TimeLine , ORH2 - ( pos * 7), na);

plot d8 = if (TimeLine , ORH2 - ( pos * 8), na);

plot d9 = if (TimeLine , ORH2 - ( pos * 9), na);

plot d10 = if (TimeLine ,(ORL2), na);

d1.SetPaintingStrategy(PaintingStrategy.POINTS);

d2.SetPaintingStrategy(PaintingStrategy.POINTS);

d3.SetPaintingStrategy(PaintingStrategy.POINTS);

d4.SetPaintingStrategy(PaintingStrategy.POINTS);

d5.SetPaintingStrategy(PaintingStrategy.POINTS);

d6.SetPaintingStrategy(PaintingStrategy.POINTS);

d7.SetPaintingStrategy(PaintingStrategy.POINTS);

d8.SetPaintingStrategy(PaintingStrategy.POINTS);

d9.SetPaintingStrategy(PaintingStrategy.POINTS);

d10.SetPaintingStrategy(PaintingStrategy.POINTS);

d1.AssignValueColor(GetColor(Dcolor));

d2.AssignValueColor(GetColor(Dcolor));

d3.AssignValueColor(GetColor(Dcolor));

d4.AssignValueColor(GetColor(Dcolor));

d5.AssignValueColor(GetColor(Dcolor));

d6.AssignValueColor(GetColor(Dcolor));

d7.AssignValueColor(GetColor(Dcolor));

d8.AssignValueColor(GetColor(Dcolor));

d9.AssignValueColor(GetColor(Dcolor));

d10.AssignValueColor(GetColor(Dcolor));

d1.HideBubble();

d2.HideBubble();

d3.HideBubble();

d4.HideBubble();

d5.HideBubble();

d6.HideBubble();

d7.HideBubble();

d8.HideBubble();

d9.HideBubble();

d10.HideBubble();

d1.HideTitle();

d2.HideTitle();

d3.HideTitle();

d4.HideTitle();

d5.HideTitle();

d6.HideTitle();

d7.HideTitle();

d8.HideTitle();

d9.HideTitle();

d10.HideTitle();

addCloud(if CloudOn == yes

then orl

else double.nan

, orl2,createColor(244,83,66), createColor(244,83,66));

addCloud(if CloudOn == yes

then orl

else double.nan

, orh2,createColor(66,244,131), createColor(66,244,131));

# Begin Risk Algorithm

# First Breakout or Breakdown bars

def Bubbleloc1 = isNaN(close[-1]);

def BreakoutBar = if ORActive

then double.nan

else if !ORActive and c crosses above ORH2

then bar

else if !isNaN(BreakoutBar[1]) and c crosses ORH2

then BreakoutBar[1]

else BreakoutBar[1];

def ATR = if ORActive2

then Round((Average(TrueRange(h, c, l), nATR)) / TickSize(), 0) * TickSize()

else ATR[1];

def cond1 = if h > ORH2 and

h[1] <= ORH2

then Round((ORH2 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else cond1[1];

plot ORLriskUP = if bar >= OREndBar and !ORActive and today

then HighestAll(ORH2ext - 2)

else double.nan;

ORLriskUP.SetStyle(Curve.Long_Dash);

ORLriskUP.SetDefaultColor(Color.Green);

ORLriskUP.HideTitle();

def crossUpBar = if close crosses above ORH2

then bar

else double.nan;

AddChartBubble(bar == HighestAll(crossUpBar), ORLriskUP, "RiskON ORH", color.green, no);

plot ORLriskDN = if bar >= OREndBar and !ORActive and close < ORL

then HighestAll(ORL2ext + 2)

else double.nan;

ORLriskDN.SetStyle(Curve.Long_Dash);

ORLriskDN.SetDefaultColor(Color.Red);

ORLriskDN.HideTitle();

def crossDnBar = if close crosses below ORL2ext

then bar

else double.nan;

AddChartBubble(bar == HighestAll(crossDnBar), HighestAll(ORLriskDN), "Risk ON ORL", color.red, yes);

# High Targets

plot Htarget = if bar >= BreakoutBar

then cond1

else double.nan;

Htarget.SetPaintingStrategy(paintingStrategy.Squares);

Htarget.SetLineWeight(1);

Htarget.SetDefaultColor(Color.White);

Htarget.HideTitle();

AddChartBubble(BubbleLoc1, Htarget, "RO", color.white, if c > Htarget then no else yes);

def condHtarget2 = if c crosses above cond1

then Round((cond1 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget2[1];

plot Htarget2 = if bar >= BreakoutBar

then condHtarget2

else double.nan;

Htarget2.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget2.SetLineWeight(1);

Htarget2.SetDefaultColor(Color.Plum);

Htarget2.HideTitle();

AddChartBubble(BubbleLoc1, Htarget2, "2nd T", color.plum, if c > Htarget2

then no

else yes);

def condHtarget3 = if c crosses above condHtarget2

then Round((condHtarget2 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget3[1];

plot Htarget3 = if bar >= BreakoutBar

then condHtarget3

else double.nan;

Htarget3.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget3.SetLineWeight(1);

Htarget3.SetDefaultColor(Color.Plum);

Htarget3.HideTitle();

AddChartBubble(isNaN(C[-1]), Htarget3, "3rd T", color.plum, if c > Htarget3 then no else yes);

def condHtarget4 = if c crosses above condHtarget3

then Round((condHtarget3 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget4[1];

plot Htarget4 = if bar >= HighestAll(BreakoutBar)

then condHtarget4

else double.nan;

Htarget4.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget4.SetLineWeight(1);

Htarget4.SetDefaultColor(Color.Plum);

Htarget4.HideTitle();

AddChartBubble(BubbleLoc1, Htarget4, "4th T", color.plum, if c > Htarget4 then no else yes);

def condHtarget5 = if c crosses above condHtarget4

then Round((condHtarget4 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget5[1];

plot Htarget5 = if bar >= BreakoutBar

then condHtarget5

else double.nan;

Htarget5.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget5.SetLineWeight(1);

Htarget5.SetDefaultColor(Color.Plum);

Htarget5.HideTitle();

AddChartBubble(BubbleLoc1, Htarget5, "5th T", color.plum, if c > Htarget5 then no else yes);

# Low Targets

def cond2 = if L < ORL2 and

L[1] >= ORL2

then Round((ORL2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else cond2[1];

plot Ltarget = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then cond2

else double.nan)

else double.nan;

Ltarget.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget.SetLineWeight(1);

Ltarget.SetDefaultColor(Color.White);

Ltarget.HideTitle();

AddChartBubble(BubbleLoc1, cond2, "RO", color.white, if c < Ltarget

then yes

else no);

def condLtarget2 = if c crosses below cond2

then Round((cond2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget2[1];

plot Ltarget2 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget2

else double.nan)

else double.nan;

Ltarget2.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget2.SetLineWeight(1);

Ltarget2.SetDefaultColor(Color.Plum);

Ltarget2.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget2, "2nd T", color.plum, if c < condLtarget2

then yes

else no);

def condLtarget3 = if c crosses below condLtarget2

then Round((condLtarget2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget3[1];

plot Ltarget3 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget3

else double.nan)

else double.nan;

Ltarget3.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget3.SetLineWeight(1);

Ltarget3.SetDefaultColor(Color.Plum);

Ltarget3.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget3, "3rd T", color.plum, if c < Ltarget3

then yes

else no);

def condLtarget4 = if c crosses condLtarget3

then Round((condLtarget3 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget4[1];

plot Ltarget4 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget4

else double.nan)

else double.nan;

Ltarget4.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget4.SetLineWeight(1);

Ltarget4.SetDefaultColor(Color.Plum);

Ltarget4.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget4, "4th T", color.plum, if c < Ltarget4

then yes

else no);

def condLtarget5 = if c crosses condLtarget4

then Round((condLtarget4 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget5[1];

plot Ltarget5 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget5

else double.nan)

else double.nan;

Ltarget5.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget5.SetLineWeight(1);

Ltarget5.SetDefaultColor(Color.Plum);

Ltarget5.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget5, "5th T", color.plum, if c < Ltarget5

then yes

else no);

def last = if secondsTillTime(1600) == 0 and

secondsFromTime(1600) == 0

then c[1]

else last[1];

plot LastClose = if Today and last != 0

then last

else Double.NaN;

LastClose.SetPaintingStrategy(PaintingStrategy.Dashes);

LastClose.SetDefaultColor(Color.White);

LastClose.HideBubble();

LastClose.HideTitle();

AddChartBubble(SecondsTillTime(0930) == 0, LastClose, "PC", color.gray, yes);

alert(c crosses above ORH2, "", Alert.Bar, Sound.Bell);

alert(c crosses below ORL2, "", Alert.Bar, Sound.Ring);

# End Code ORB with Risk and targetsvery good.Great job to whoever wrote this code. I am not trying to step on any toes here as this is not my code. I edited the ORBI code as follows and it appears to work great with the super trend. Not sure if I did this correctly though. I took code from 2 different places In this thread if i remember. You have to remember to go to the settings of the study and turn on the cloud, alert, and show today only if you are only viewing a "today" chart, then also go to the chart settings in TOS, under equities and adjust to hide or show closed times. I just have not jumped in and started to use it yet. I tried once or twice with $tsla and find it is hard to be quick, so I have to play with my time frames, 2-3 min vs 5 min vs 15 min.

declare Hide_On_Daily;

declare Once_per_bar;

input OrMeanS = 0930.0; #hint OrMeanS: Begin Mean Period. Usually Market Open EST.

input OrMeanE = 0935.0; #hint OrMeanE: End Mean period. Usually End of first bar.

input OrBegin = 0930.0; #hint OrBegin: Beginning for Period of Opening Range Breakout.

input OrEnd = 1000.0; #hint OrEnd: End of Period of Opening Range Breakout.

input CloudOn = no; #hint CloudOn: Clouds Opening Range.

input AlertOn = yes; #hint AlertOn: Alerts on cross of Opening Range.

input ShowTodayOnly = {"No", default "Yes"};

input nAtr = 4; #hint nATR: Lenght for the ATR Risk and Target Lines.

input AtrTargetMult = 2.0; #hint ATRmult: Multiplier for the ATR calculations.

def h = high;

def l = low;

def c = close;

def bar = barNumber();

def s = ShowTodayOnly;

def ORActive = if secondsTillTime(OrMeanE) > 0 and

secondsFromTime(OrMeanS) >= 0

then 1

else 0;

def today = if s == 0

or getDay() == getLastDay() and

secondsFromTime(OrMeanS) >= 0

then 1

else 0;

def ORHigh = if ORHigh[1] == 0

or ORActive[1] == 0 and

ORActive == 1

then h

else if ORActive and

h > ORHigh[1]

then h

else ORHigh[1];

def ORLow = if ORLow[1] == 0

or ORActive[1] == 0 and

ORActive == 1

then l

else if ORActive and

l < ORLow[1]

then l

else ORLow[1];

def ORWidth = ORHigh - ORLow;

def na = double.nan;

def ORHA = if ORActive

or today < 1

then na

else ORHigh;

def ORLA = if ORActive

or today < 1

then na

else ORLow;

def O = ORHA - Round(((ORHA - ORLA) / 2) / TickSize(), 0) * TickSize();

def ORActive2 = if secondsTillTime(OREnd) > 0 and

secondsFromTime(ORBegin) >= 0

then 1

else 0;

def ORHigh2 = if ORHigh2[1] == 0

or ORActive2[1] == 0 and

ORActive2 == 1

then h

else if ORActive2 and

h > ORHigh2[1]

then h

else ORHigh2[1];

def ORLow2 = if ORLow2[1] == 0

or ORActive2[1] == 0 and

ORActive2 == 1

then l

else if ORActive2 and

l < ORLow2[1]

then l

else ORLow2[1];

def ORWidth2 = ORHigh2 - ORLow2;

def TimeLine = if secondsTillTime(OREnd) == 0

then 1

else 0;

def ORmeanBar = if !ORActive and ORActive[1]

then barNumber()

else ORmeanBar[1];

def ORendBar = if !ORActive2 and ORActive2[1]

then barNumber()

else ORendBar[1];

def ORL = if (o == 0 , na, o);

plot ORLext = if barNumber() >= highestAll(ORmeanBar)

then HighestAll(if isNaN(c[-1])

then ORL[1]

else double.nan)

else double.nan;

ORLext.SetDefaultColor(color.Yellow);

ORLext.SetStyle(curve.Long_DASH);

ORLext.SetLineWeight(3);

ORLext.HideTitle();

def ORH2 = if ORActive2

or today < 1

then na

else ORHigh2;

plot ORH2ext = if barNumber() >= highestAll(ORendBar)

then HighestAll(if isNaN(c[-1])

then ORH2[1]

else double.nan)

else double.nan;

ORH2ext.SetDefaultColor(color.Green);

ORH2ext.SetStyle(curve.Long_DASH);

ORH2ext.SetLineWeight(3);

ORH2ext.HideTitle();

def ORL2 = if ORActive2

or today < 1

then na

else ORLow2;

plot ORL2ext = if barNumber() >= highestAll(ORendBar)

then HighestAll(if isNaN(c[-1])

then ORL2[1]

else double.nan)

else double.nan;

ORL2ext.SetDefaultColor(color.Red);

ORL2ext.SetStyle(curve.Long_DASH);

ORL2ext.SetLineWeight(3);

ORL2ext.HideTitle();

def RelDay = (ORL - ORL2) / (ORH2 - ORL2);

def dColor = if RelDay > .5

then 5

else if RelDay < .5

then 6

else 4;

def pos = (ORH2 - ORL2)/10;

plot d1 = if (TimeLine , ORH2, na);

plot d2 = if (TimeLine , ORH2 - ( pos * 2), na);

plot d3 = if (TimeLine , ORH2 - ( pos * 3), na);

plot d4 = if (TimeLine , ORH2 - ( pos * 4), na);

plot d5 = if (TimeLine , ORH2 - ( pos * 5), na);

plot d6 = if (TimeLine , ORH2 - ( pos * 6), na);

plot d7 = if (TimeLine , ORH2 - ( pos * 7), na);

plot d8 = if (TimeLine , ORH2 - ( pos * 8), na);

plot d9 = if (TimeLine , ORH2 - ( pos * 9), na);

plot d10 = if (TimeLine ,(ORL2), na);

d1.SetPaintingStrategy(PaintingStrategy.POINTS);

d2.SetPaintingStrategy(PaintingStrategy.POINTS);

d3.SetPaintingStrategy(PaintingStrategy.POINTS);

d4.SetPaintingStrategy(PaintingStrategy.POINTS);

d5.SetPaintingStrategy(PaintingStrategy.POINTS);

d6.SetPaintingStrategy(PaintingStrategy.POINTS);

d7.SetPaintingStrategy(PaintingStrategy.POINTS);

d8.SetPaintingStrategy(PaintingStrategy.POINTS);

d9.SetPaintingStrategy(PaintingStrategy.POINTS);

d10.SetPaintingStrategy(PaintingStrategy.POINTS);

d1.AssignValueColor(GetColor(Dcolor));

d2.AssignValueColor(GetColor(Dcolor));

d3.AssignValueColor(GetColor(Dcolor));

d4.AssignValueColor(GetColor(Dcolor));

d5.AssignValueColor(GetColor(Dcolor));

d6.AssignValueColor(GetColor(Dcolor));

d7.AssignValueColor(GetColor(Dcolor));

d8.AssignValueColor(GetColor(Dcolor));

d9.AssignValueColor(GetColor(Dcolor));

d10.AssignValueColor(GetColor(Dcolor));

d1.HideBubble();

d2.HideBubble();

d3.HideBubble();

d4.HideBubble();

d5.HideBubble();

d6.HideBubble();

d7.HideBubble();

d8.HideBubble();

d9.HideBubble();

d10.HideBubble();

d1.HideTitle();

d2.HideTitle();

d3.HideTitle();

d4.HideTitle();

d5.HideTitle();

d6.HideTitle();

d7.HideTitle();

d8.HideTitle();

d9.HideTitle();

d10.HideTitle();

addCloud(if CloudOn == yes

then orl

else double.nan

, orl2,createColor(244,83,66), createColor(244,83,66));

addCloud(if CloudOn == yes

then orl

else double.nan

, orh2,createColor(66,244,131), createColor(66,244,131));

# Begin Risk Algorithm

# First Breakout or Breakdown bars

def Bubbleloc1 = isNaN(close[-1]);

def BreakoutBar = if ORActive

then double.nan

else if !ORActive and c crosses above ORH2

then bar

else if !isNaN(BreakoutBar[1]) and c crosses ORH2

then BreakoutBar[1]

else BreakoutBar[1];

def ATR = if ORActive2

then Round((Average(TrueRange(h, c, l), nATR)) / TickSize(), 0) * TickSize()

else ATR[1];

def cond1 = if h > ORH2 and

h[1] <= ORH2

then Round((ORH2 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else cond1[1];

plot ORLriskUP = if bar >= OREndBar and !ORActive and today

then HighestAll(ORH2ext - 2)

else double.nan;

ORLriskUP.SetStyle(Curve.Long_Dash);

ORLriskUP.SetDefaultColor(Color.Green);

ORLriskUP.HideTitle();

def crossUpBar = if close crosses above ORH2

then bar

else double.nan;

AddChartBubble(bar == HighestAll(crossUpBar), ORLriskUP, "RiskON ORH", color.green, no);

plot ORLriskDN = if bar >= OREndBar and !ORActive and close < ORL

then HighestAll(ORL2ext + 2)

else double.nan;

ORLriskDN.SetStyle(Curve.Long_Dash);

ORLriskDN.SetDefaultColor(Color.Red);

ORLriskDN.HideTitle();

def crossDnBar = if close crosses below ORL2ext

then bar

else double.nan;

AddChartBubble(bar == HighestAll(crossDnBar), HighestAll(ORLriskDN), "Risk ON ORL", color.red, yes);

# High Targets

plot Htarget = if bar >= BreakoutBar

then cond1

else double.nan;

Htarget.SetPaintingStrategy(paintingStrategy.Squares);

Htarget.SetLineWeight(1);

Htarget.SetDefaultColor(Color.White);

Htarget.HideTitle();

AddChartBubble(BubbleLoc1, Htarget, "RO", color.white, if c > Htarget then no else yes);

def condHtarget2 = if c crosses above cond1

then Round((cond1 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget2[1];

plot Htarget2 = if bar >= BreakoutBar

then condHtarget2

else double.nan;

Htarget2.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget2.SetLineWeight(1);

Htarget2.SetDefaultColor(Color.Plum);

Htarget2.HideTitle();

AddChartBubble(BubbleLoc1, Htarget2, "2nd T", color.plum, if c > Htarget2

then no

else yes);

def condHtarget3 = if c crosses above condHtarget2

then Round((condHtarget2 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget3[1];

plot Htarget3 = if bar >= BreakoutBar

then condHtarget3

else double.nan;

Htarget3.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget3.SetLineWeight(1);

Htarget3.SetDefaultColor(Color.Plum);

Htarget3.HideTitle();

AddChartBubble(isNaN(C[-1]), Htarget3, "3rd T", color.plum, if c > Htarget3 then no else yes);

def condHtarget4 = if c crosses above condHtarget3

then Round((condHtarget3 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget4[1];

plot Htarget4 = if bar >= HighestAll(BreakoutBar)

then condHtarget4

else double.nan;

Htarget4.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget4.SetLineWeight(1);

Htarget4.SetDefaultColor(Color.Plum);

Htarget4.HideTitle();

AddChartBubble(BubbleLoc1, Htarget4, "4th T", color.plum, if c > Htarget4 then no else yes);

def condHtarget5 = if c crosses above condHtarget4

then Round((condHtarget4 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget5[1];

plot Htarget5 = if bar >= BreakoutBar

then condHtarget5

else double.nan;

Htarget5.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget5.SetLineWeight(1);

Htarget5.SetDefaultColor(Color.Plum);

Htarget5.HideTitle();

AddChartBubble(BubbleLoc1, Htarget5, "5th T", color.plum, if c > Htarget5 then no else yes);

# Low Targets

def cond2 = if L < ORL2 and

L[1] >= ORL2

then Round((ORL2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else cond2[1];

plot Ltarget = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then cond2

else double.nan)

else double.nan;

Ltarget.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget.SetLineWeight(1);

Ltarget.SetDefaultColor(Color.White);

Ltarget.HideTitle();

AddChartBubble(BubbleLoc1, cond2, "RO", color.white, if c < Ltarget

then yes

else no);

def condLtarget2 = if c crosses below cond2

then Round((cond2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget2[1];

plot Ltarget2 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget2

else double.nan)

else double.nan;

Ltarget2.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget2.SetLineWeight(1);

Ltarget2.SetDefaultColor(Color.Plum);

Ltarget2.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget2, "2nd T", color.plum, if c < condLtarget2

then yes

else no);

def condLtarget3 = if c crosses below condLtarget2

then Round((condLtarget2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget3[1];

plot Ltarget3 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget3

else double.nan)

else double.nan;

Ltarget3.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget3.SetLineWeight(1);

Ltarget3.SetDefaultColor(Color.Plum);

Ltarget3.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget3, "3rd T", color.plum, if c < Ltarget3

then yes

else no);

def condLtarget4 = if c crosses condLtarget3

then Round((condLtarget3 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget4[1];

plot Ltarget4 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget4

else double.nan)

else double.nan;

Ltarget4.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget4.SetLineWeight(1);

Ltarget4.SetDefaultColor(Color.Plum);

Ltarget4.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget4, "4th T", color.plum, if c < Ltarget4

then yes

else no);

def condLtarget5 = if c crosses condLtarget4

then Round((condLtarget4 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget5[1];

plot Ltarget5 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget5

else double.nan)

else double.nan;

Ltarget5.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget5.SetLineWeight(1);

Ltarget5.SetDefaultColor(Color.Plum);

Ltarget5.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget5, "5th T", color.plum, if c < Ltarget5

then yes

else no);

def last = if secondsTillTime(1600) == 0 and

secondsFromTime(1600) == 0

then c[1]

else last[1];

plot LastClose = if Today and last != 0

then last

else Double.NaN;

LastClose.SetPaintingStrategy(PaintingStrategy.Dashes);

LastClose.SetDefaultColor(Color.White);

LastClose.HideBubble();

LastClose.HideTitle();

AddChartBubble(SecondsTillTime(0930) == 0, LastClose, "PC", color.gray, yes);

alert(c crosses above ORH2, "", Alert.Bar, Sound.Bell);

alert(c crosses below ORL2, "", Alert.Bar, Sound.Ring);

# End Code ORB with Risk and targets

so you just merged supretrend with ORB, right?

what is that sell@ and buy@xx ? is that part of this script since does nto show up for me when I added to my TOS

Sorry, It is part of the Supertrend that I added after reading the entire thread multiple times. Again.. Not my code. Using words like buy and sell made more since to me. This is a great community and hope I am not stepping on any toes.very good.

so you just merged supretrend with ORB, right?

what is that sell@ and buy@xx ? is that part of this script since does nto show up for me when I added to my TOS

Code:

# SuperTrend

# Mobius

# Chat Room Request

# 11.20.2019 tomsk Enhanced and adjusted bubbles with coloring and description tag

input AtrMult = 1.0;

input nATR = 4;

input AvgType = AverageType.HULL;

input PaintBars = yes;

input n = 0;

def n1 = n + 1;

def ATR = MovingAverage(AvgType, TrueRange(high, close, low), nATR);

def UP = HL2 + (AtrMult * ATR);

def DN = HL2 + (-AtrMult * ATR);

def ST = if close < ST[1] then UP else DN;

plot SuperTrend = ST;

SuperTrend.AssignValueColor(if close < ST then Color.RED else Color.GREEN);

AssignPriceColor(if PaintBars and close < ST

then Color.RED

else if PaintBars and close > ST

then Color.GREEN

else Color.CURRENT);

AddChartBubble(close[n] crosses below ST[n], low[n+1] + TickSize() * n, "Sell @ " + low[n1], color.Cyan, yes);

AddChartBubble(close[n] crosses above ST[n], high[n+1] - TickSize() * n, "Buy @ " + high[n1], color.Yellow, no);

def bullish = close crosses below ST;

def bearish = close crosses above ST;

# Alerts

Alert(bullish, " ", Alert.Bar, Sound.Chimes);

Alert(bearish, " ", Alert.Bar, Sound.Bell);

# End Code SuperTrend@BenTen

I use the following script to plot Opening range based on first 30 min of price action. Is it possible to create an alert whenever price crosses ORL and ORH?

# Automatic Opening Range

#

def na=double.nan;

#

# Define time that OR begins (in hhmm format,

# 0930 is the default):

#

input ORBegin = 0930;

#

# Define time that OR is finished (in hhmm format,

# 10:00 is the default):

#

input OREnd = 0945;

#

# Show Today only? (Default Yes)

#

input ShowTodayOnly={"No", default "Yes"};

def s=ShowTodayOnly;

#

# Create logic for OR definition:

#

Def ORActive = if secondstilltime(OREnd)>0 AND secondsfromtime(ORBegin)>=0 then 1 else 0;

#

# Create logic to paint only current day post-open:

#

def today=if s==0 OR getday()==getlastday() AND secondsfromtime(ORBegin)>=0 then 1 else 0;

#

# Track OR High:

#

Rec ORHigh = if ORHigh[1]==0 or ORActive[1]==0 AND ORActive==1 then high else if ORActive AND high>ORHigh[1] then high else ORHigh[1];

#

# Track OR Low:

#

Rec ORLow = if ORLow[1]==0 or ORActive[1]==0 AND ORActive==1 then low else if ORActive AND low<ORLow[1] then low else ORLow[1];

#

# Calculate OR width:

#

Def ORWidth = ORHigh - ORLow;

#

# Define all the plots:

#

Plot ORH=if ORActive OR today<1 then na else ORHigh;

Plot ORL=if ORActive OR today<1 then na else ORLow;

# Formatting:

#

ORH.setdefaultcolor(color.green);

ORH.setStyle(curve.Long_DASH);

ORH.setlineweight(3);

ORL.setdefaultcolor(color.red);

ORL.setStyle(curve.Long_DASH);

ORL.setlineweight(3);

I use the following script to plot Opening range based on first 30 min of price action. Is it possible to create an alert whenever price crosses ORL and ORH?

# Automatic Opening Range

#

def na=double.nan;

#

# Define time that OR begins (in hhmm format,

# 0930 is the default):

#

input ORBegin = 0930;

#

# Define time that OR is finished (in hhmm format,

# 10:00 is the default):

#

input OREnd = 0945;

#

# Show Today only? (Default Yes)

#

input ShowTodayOnly={"No", default "Yes"};

def s=ShowTodayOnly;

#

# Create logic for OR definition:

#

Def ORActive = if secondstilltime(OREnd)>0 AND secondsfromtime(ORBegin)>=0 then 1 else 0;

#

# Create logic to paint only current day post-open:

#

def today=if s==0 OR getday()==getlastday() AND secondsfromtime(ORBegin)>=0 then 1 else 0;

#

# Track OR High:

#

Rec ORHigh = if ORHigh[1]==0 or ORActive[1]==0 AND ORActive==1 then high else if ORActive AND high>ORHigh[1] then high else ORHigh[1];

#

# Track OR Low:

#

Rec ORLow = if ORLow[1]==0 or ORActive[1]==0 AND ORActive==1 then low else if ORActive AND low<ORLow[1] then low else ORLow[1];

#

# Calculate OR width:

#

Def ORWidth = ORHigh - ORLow;

#

# Define all the plots:

#

Plot ORH=if ORActive OR today<1 then na else ORHigh;

Plot ORL=if ORActive OR today<1 then na else ORLow;

# Formatting:

#

ORH.setdefaultcolor(color.green);

ORH.setStyle(curve.Long_DASH);

ORH.setlineweight(3);

ORL.setdefaultcolor(color.red);

ORL.setStyle(curve.Long_DASH);

ORL.setlineweight(3);

@SMB777 Add the following code at the end of the script. Good luck! @cabe1332@BenTen

I use the following script to plot Opening range based on first 30 min of price action. Is it possible to create an alert whenever price crosses ORL and ORH?

# Automatic Opening Range

#

def na=double.nan;

#

# Define time that OR begins (in hhmm format,

# 0930 is the default):

#

input ORBegin = 0930;

#

# Define time that OR is finished (in hhmm format,

# 10:00 is the default):

#

input OREnd = 0945;

#

# Show Today only? (Default Yes)

#

input ShowTodayOnly={"No", default "Yes"};

def s=ShowTodayOnly;

#

# Create logic for OR definition:

#

Def ORActive = if secondstilltime(OREnd)>0 AND secondsfromtime(ORBegin)>=0 then 1 else 0;

#

# Create logic to paint only current day post-open:

#

def today=if s==0 OR getday()==getlastday() AND secondsfromtime(ORBegin)>=0 then 1 else 0;

#

# Track OR High:

#

Rec ORHigh = if ORHigh[1]==0 or ORActive[1]==0 AND ORActive==1 then high else if ORActive AND high>ORHigh[1] then high else ORHigh[1];

#

# Track OR Low:

#

Rec ORLow = if ORLow[1]==0 or ORActive[1]==0 AND ORActive==1 then low else if ORActive AND low<ORLow[1] then low else ORLow[1];

#

# Calculate OR width:

#

Def ORWidth = ORHigh - ORLow;

#

# Define all the plots:

#

Plot ORH=if ORActive OR today<1 then na else ORHigh;

Plot ORL=if ORActive OR today<1 then na else ORLow;

# Formatting:

#

ORH.setdefaultcolor(color.green);

ORH.setStyle(curve.Long_DASH);

ORH.setlineweight(3);

ORL.setdefaultcolor(color.red);

ORL.setStyle(curve.Long_DASH);

ORL.setlineweight(3);

# ORB Alerts added

def bullish_cross = close crosses above ORH;

def bearish_cross = close crosses below ORL;

Alert(bullish_cross, "ORB Bullish X ", Alert.Bar, Sound.bell);

Alert(bearish_cross, "ORB Bearish X ", Alert.Bar, Sound.Bell);

thealphabreed

Member

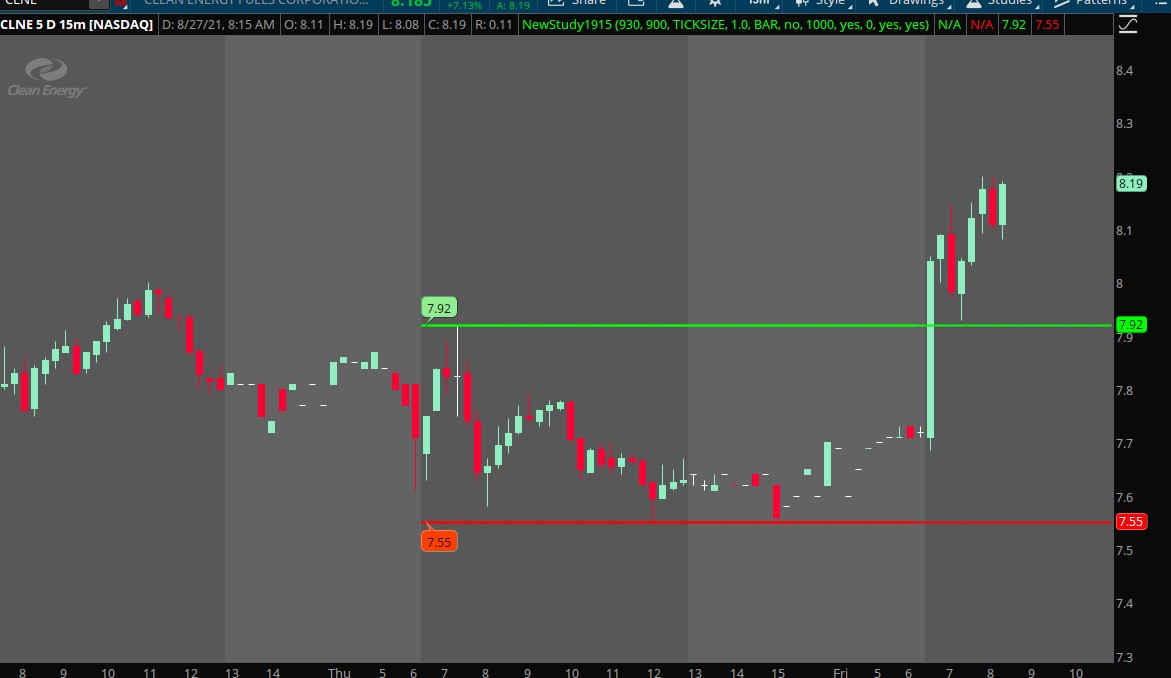

Hey @BenTen Thanks for sharing this info. I am backtesting it. Here is KXIN from this week. I am using candle sticks (not heikeinashi) and have used the other indicators you had mentioned. I have added three "WHITE" numbers on the chart to visually explain my questionsRecently came across this cool indicator called Opening Range Breakout by Mobius. This is more than just an indicator. There is also a strategy with risk and target lines included.

thinkScript Code

After adding the indicator, I couldn't quite understand it much. From looking at it, seems more like a support and resistance indicator to me. I watched a few YouTube videos about the Opening Range Breakout and was able to make some changes to the current code. As a result, I was able to have a clear picture of what this indicator does.

Here is my own version of it:

Rich (BB code):declare Hide_On_Daily; declare Once_per_bar; input OrMeanS = 0930.0; #hint OrMeanS: Begin Mean Period. Usually Market Open EST. input OrMeanE = 0935.0; #hint OrMeanE: End Mean period. Usually End of first bar. input OrBegin = 0930.0; #hint OrBegin: Beginning for Period of Opening Range Breakout. input OrEnd = 1000.0; #hint OrEnd: End of Period of Opening Range Breakout. input CloudOn = no; #hint CloudOn: Clouds Opening Range. input AlertOn = yes; #hint AlertOn: Alerts on cross of Opening Range. input ShowTodayOnly = {"No", default "Yes"}; input nAtr = 4; #hint nATR: Lenght for the ATR Risk and Target Lines. input AtrTargetMult = 2.0; #hint ATRmult: Multiplier for the ATR calculations. def h = high; def l = low; def c = close; def bar = barNumber(); def s = ShowTodayOnly; def ORActive = if secondsTillTime(OrMeanE) > 0 and secondsFromTime(OrMeanS) >= 0 then 1 else 0; def today = if s == 0 or getDay() == getLastDay() and secondsFromTime(OrMeanS) >= 0 then 1 else 0; def ORHigh = if ORHigh[1] == 0 or ORActive[1] == 0 and ORActive == 1 then h else if ORActive and h > ORHigh[1] then h else ORHigh[1]; def ORLow = if ORLow[1] == 0 or ORActive[1] == 0 and ORActive == 1 then l else if ORActive and l < ORLow[1] then l else ORLow[1]; def ORWidth = ORHigh - ORLow; def na = double.nan; def ORHA = if ORActive or today < 1 then na else ORHigh; def ORLA = if ORActive or today < 1 then na else ORLow; def O = ORHA - Round(((ORHA - ORLA) / 2) / TickSize(), 0) * TickSize(); def ORActive2 = if secondsTillTime(OREnd) > 0 and secondsFromTime(ORBegin) >= 0 then 1 else 0; def ORHigh2 = if ORHigh2[1] == 0 or ORActive2[1] == 0 and ORActive2 == 1 then h else if ORActive2 and h > ORHigh2[1] then h else ORHigh2[1]; def ORLow2 = if ORLow2[1] == 0 or ORActive2[1] == 0 and ORActive2 == 1 then l else if ORActive2 and l < ORLow2[1] then l else ORLow2[1]; def ORWidth2 = ORHigh2 - ORLow2; def TimeLine = if secondsTillTime(OREnd) == 0 then 1 else 0; def ORmeanBar = if !ORActive and ORActive[1] then barNumber() else ORmeanBar[1]; def ORendBar = if !ORActive2 and ORActive2[1] then barNumber() else ORendBar[1]; def ORL = if (o == 0 , na, o); plot ORLext = if barNumber() >= highestAll(ORmeanBar) then HighestAll(if isNaN(c[-1]) then ORL[1] else double.nan) else double.nan; ORLext.SetDefaultColor(color.Yellow); ORLext.SetStyle(curve.Long_DASH); ORLext.SetLineWeight(3); ORLext.HideTitle(); def ORH2 = if ORActive2 or today < 1 then na else ORHigh2; plot ORH2ext = if barNumber() >= highestAll(ORendBar) then HighestAll(if isNaN(c[-1]) then ORH2[1] else double.nan) else double.nan; ORH2ext.SetDefaultColor(color.Green); ORH2ext.SetStyle(curve.Long_DASH); ORH2ext.SetLineWeight(3); ORH2ext.HideTitle(); def ORL2 = if ORActive2 or today < 1 then na else ORLow2; plot ORL2ext = if barNumber() >= highestAll(ORendBar) then HighestAll(if isNaN(c[-1]) then ORL2[1] else double.nan) else double.nan; ORL2ext.SetDefaultColor(color.Red); ORL2ext.SetStyle(curve.Long_DASH); ORL2ext.SetLineWeight(3); ORL2ext.HideTitle(); def RelDay = (ORL - ORL2) / (ORH2 - ORL2); def dColor = if RelDay > .5 then 5 else if RelDay < .5 then 6 else 4; def pos = (ORH2 - ORL2)/10; plot d1 = if (TimeLine , ORH2, na); plot d2 = if (TimeLine , ORH2 - ( pos * 2), na); plot d3 = if (TimeLine , ORH2 - ( pos * 3), na); plot d4 = if (TimeLine , ORH2 - ( pos * 4), na); plot d5 = if (TimeLine , ORH2 - ( pos * 5), na); plot d6 = if (TimeLine , ORH2 - ( pos * 6), na); plot d7 = if (TimeLine , ORH2 - ( pos * 7), na); plot d8 = if (TimeLine , ORH2 - ( pos * 8), na); plot d9 = if (TimeLine , ORH2 - ( pos * 9), na); plot d10 = if (TimeLine ,(ORL2), na); d1.SetPaintingStrategy(PaintingStrategy.POINTS); d2.SetPaintingStrategy(PaintingStrategy.POINTS); d3.SetPaintingStrategy(PaintingStrategy.POINTS); d4.SetPaintingStrategy(PaintingStrategy.POINTS); d5.SetPaintingStrategy(PaintingStrategy.POINTS); d6.SetPaintingStrategy(PaintingStrategy.POINTS); d7.SetPaintingStrategy(PaintingStrategy.POINTS); d8.SetPaintingStrategy(PaintingStrategy.POINTS); d9.SetPaintingStrategy(PaintingStrategy.POINTS); d10.SetPaintingStrategy(PaintingStrategy.POINTS); d1.AssignValueColor(GetColor(Dcolor)); d2.AssignValueColor(GetColor(Dcolor)); d3.AssignValueColor(GetColor(Dcolor)); d4.AssignValueColor(GetColor(Dcolor)); d5.AssignValueColor(GetColor(Dcolor)); d6.AssignValueColor(GetColor(Dcolor)); d7.AssignValueColor(GetColor(Dcolor)); d8.AssignValueColor(GetColor(Dcolor)); d9.AssignValueColor(GetColor(Dcolor)); d10.AssignValueColor(GetColor(Dcolor)); d1.HideBubble(); d2.HideBubble(); d3.HideBubble(); d4.HideBubble(); d5.HideBubble(); d6.HideBubble(); d7.HideBubble(); d8.HideBubble(); d9.HideBubble(); d10.HideBubble(); d1.HideTitle(); d2.HideTitle(); d3.HideTitle(); d4.HideTitle(); d5.HideTitle(); d6.HideTitle(); d7.HideTitle(); d8.HideTitle(); d9.HideTitle(); d10.HideTitle(); addCloud(if CloudOn == yes then orl else double.nan , orl2,createColor(244,83,66), createColor(244,83,66)); addCloud(if CloudOn == yes then orl else double.nan , orh2,createColor(66,244,131), createColor(66,244,131)); # Begin Risk Algorithm # First Breakout or Breakdown bars def Bubbleloc1 = isNaN(close[-1]); def BreakoutBar = if ORActive then double.nan else if !ORActive and c crosses above ORH2 then bar else if !isNaN(BreakoutBar[1]) and c crosses ORH2 then BreakoutBar[1] else BreakoutBar[1]; def ATR = if ORActive2 then Round((Average(TrueRange(h, c, l), nATR)) / TickSize(), 0) * TickSize() else ATR[1]; def cond1 = if h > ORH2 and h[1] <= ORH2 then Round((ORH2 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize() else cond1[1]; plot ORLriskUP = if bar >= OREndBar and !ORActive and today then HighestAll(ORH2ext - 2) else double.nan; ORLriskUP.SetStyle(Curve.Long_Dash); ORLriskUP.SetDefaultColor(Color.Green); ORLriskUP.HideTitle(); def crossUpBar = if close crosses above ORH2 then bar else double.nan; AddChartBubble(bar == HighestAll(crossUpBar), ORLriskUP, "RiskON ORH", color.green, no); plot ORLriskDN = if bar >= OREndBar and !ORActive and close < ORL then HighestAll(ORL2ext + 2) else double.nan; ORLriskDN.SetStyle(Curve.Long_Dash); ORLriskDN.SetDefaultColor(Color.Red); ORLriskDN.HideTitle(); def crossDnBar = if close crosses below ORL2ext then bar else double.nan; AddChartBubble(bar == HighestAll(crossDnBar), HighestAll(ORLriskDN), "Risk ON ORL", color.red, yes); # High Targets plot Htarget = if bar >= BreakoutBar then cond1 else double.nan; Htarget.SetPaintingStrategy(paintingStrategy.Squares); Htarget.SetLineWeight(1); Htarget.SetDefaultColor(Color.White); Htarget.HideTitle(); AddChartBubble(BubbleLoc1, Htarget, "RO", color.white, if c > Htarget then no else yes); def condHtarget2 = if c crosses above cond1 then Round((cond1 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize() else condHtarget2[1]; plot Htarget2 = if bar >= BreakoutBar then condHtarget2 else double.nan; Htarget2.SetPaintingStrategy(PaintingStrategy.Squares); Htarget2.SetLineWeight(1); Htarget2.SetDefaultColor(Color.Plum); Htarget2.HideTitle(); AddChartBubble(BubbleLoc1, Htarget2, "2nd T", color.plum, if c > Htarget2 then no else yes); def condHtarget3 = if c crosses above condHtarget2 then Round((condHtarget2 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize() else condHtarget3[1]; plot Htarget3 = if bar >= BreakoutBar then condHtarget3 else double.nan; Htarget3.SetPaintingStrategy(PaintingStrategy.Squares); Htarget3.SetLineWeight(1); Htarget3.SetDefaultColor(Color.Plum); Htarget3.HideTitle(); AddChartBubble(isNaN(C[-1]), Htarget3, "3rd T", color.plum, if c > Htarget3 then no else yes); def condHtarget4 = if c crosses above condHtarget3 then Round((condHtarget3 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize() else condHtarget4[1]; plot Htarget4 = if bar >= HighestAll(BreakoutBar) then condHtarget4 else double.nan; Htarget4.SetPaintingStrategy(PaintingStrategy.Squares); Htarget4.SetLineWeight(1); Htarget4.SetDefaultColor(Color.Plum); Htarget4.HideTitle(); AddChartBubble(BubbleLoc1, Htarget4, "4th T", color.plum, if c > Htarget4 then no else yes); def condHtarget5 = if c crosses above condHtarget4 then Round((condHtarget4 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize() else condHtarget5[1]; plot Htarget5 = if bar >= BreakoutBar then condHtarget5 else double.nan; Htarget5.SetPaintingStrategy(PaintingStrategy.Squares); Htarget5.SetLineWeight(1); Htarget5.SetDefaultColor(Color.Plum); Htarget5.HideTitle(); AddChartBubble(BubbleLoc1, Htarget5, "5th T", color.plum, if c > Htarget5 then no else yes); # Low Targets def cond2 = if L < ORL2 and L[1] >= ORL2 then Round((ORL2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize() else cond2[1]; plot Ltarget = if bar >= HighestAll(OREndBar) then highestAll(if isNaN(c[-1]) then cond2 else double.nan) else double.nan; Ltarget.SetPaintingStrategy(PaintingStrategy.Squares); Ltarget.SetLineWeight(1); Ltarget.SetDefaultColor(Color.White); Ltarget.HideTitle(); AddChartBubble(BubbleLoc1, cond2, "RO", color.white, if c < Ltarget then yes else no); def condLtarget2 = if c crosses below cond2 then Round((cond2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize() else condLtarget2[1]; plot Ltarget2 = if bar >= HighestAll(OREndBar) then highestAll(if isNaN(c[-1]) then condLtarget2 else double.nan) else double.nan; Ltarget2.SetPaintingStrategy(PaintingStrategy.Squares); Ltarget2.SetLineWeight(1); Ltarget2.SetDefaultColor(Color.Plum); Ltarget2.HideTitle(); AddChartBubble(BubbleLoc1, condLtarget2, "2nd T", color.plum, if c < condLtarget2 then yes else no); def condLtarget3 = if c crosses below condLtarget2 then Round((condLtarget2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize() else condLtarget3[1]; plot Ltarget3 = if bar >= HighestAll(OREndBar) then highestAll(if isNaN(c[-1]) then condLtarget3 else double.nan) else double.nan; Ltarget3.SetPaintingStrategy(PaintingStrategy.Squares); Ltarget3.SetLineWeight(1); Ltarget3.SetDefaultColor(Color.Plum); Ltarget3.HideTitle(); AddChartBubble(BubbleLoc1, condLtarget3, "3rd T", color.plum, if c < Ltarget3 then yes else no); def condLtarget4 = if c crosses condLtarget3 then Round((condLtarget3 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize() else condLtarget4[1]; plot Ltarget4 = if bar >= HighestAll(OREndBar) then highestAll(if isNaN(c[-1]) then condLtarget4 else double.nan) else double.nan; Ltarget4.SetPaintingStrategy(PaintingStrategy.Squares); Ltarget4.SetLineWeight(1); Ltarget4.SetDefaultColor(Color.Plum); Ltarget4.HideTitle(); AddChartBubble(BubbleLoc1, condLtarget4, "4th T", color.plum, if c < Ltarget4 then yes else no); def condLtarget5 = if c crosses condLtarget4 then Round((condLtarget4 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize() else condLtarget5[1]; plot Ltarget5 = if bar >= HighestAll(OREndBar) then highestAll(if isNaN(c[-1]) then condLtarget5 else double.nan) else double.nan; Ltarget5.SetPaintingStrategy(PaintingStrategy.Squares); Ltarget5.SetLineWeight(1); Ltarget5.SetDefaultColor(Color.Plum); Ltarget5.HideTitle(); AddChartBubble(BubbleLoc1, condLtarget5, "5th T", color.plum, if c < Ltarget5 then yes else no); def last = if secondsTillTime(1600) == 0 and secondsFromTime(1600) == 0 then c[1] else last[1]; plot LastClose = if Today and last != 0 then last else Double.NaN; LastClose.SetPaintingStrategy(PaintingStrategy.Dashes); LastClose.SetDefaultColor(Color.White); LastClose.HideBubble(); LastClose.HideTitle(); AddChartBubble(SecondsTillTime(0930) == 0, LastClose, "PC", color.gray, yes); alert(c crosses above ORH2, "", Alert.Bar, Sound.Bell); alert(c crosses below ORL2, "", Alert.Bar, Sound.Ring); # End Code ORB with Risk and targets

Shareable Link: https://tos.mx/qu3Cu0

Now that you have the indicator added, let's get some terminology out of the way.

- The green shadow is called the Bull Zone

- The red shadow is called Bear Zone

- Anywhere above the Bull Zone is called the Breakout Zone

- Anywhere below the Bear Zone is called the Breakdown Zone

Hopefully you were able to understand those terms from this picture.

The Setup

- 5 or 15 minutes timeframe

- Heikin-Ashi candlestick

- Disable pre-market and after-hour market

- TEMA (30)

- EMA (20)

- Supertrend Indicator

Usage #1: Taking Advantage of Breakout Zone

Once the stock reaches above the breakout zone, we buy calls.

Usage #2: Taking Advantage of Breakdown Zone

Do the same as above. If the stock start to go from Bear Zone to breakdown zone, we start shorting it.

Usage #3: Avoid Misleading Signals given by Supertrend

A lot of people brought up a really good point about Supertrend. That is sometimes it would give false signals. And I also seen it first hand too. The Opening Range Breakout Indicator will allows us to resolve that.

Example #1: Don't short when the candles are still in the Bull Zone.

The only time that it is reasonable to short while the candles are still in Bull Zone is: IF the candle are by the border of Bull Zone and Bear Zone. Even better if it's already crossing the border into Bear Zone.

Example #2: Don't Buy Calls in Breakdown Zone

If you think the Bear Zone is worst, wait until you buy calls in the Breakdown Zone. That's a hard pass.

Again, sometimes it may be reasonable to buy calls if the candles are crossing the border going back to Bear Zone, then you may have a chance to pull thru and get above it. But anywhere between the Bear Zone and Breakdown Zone, be cautious, especially if you're already deep down in the Breakdown Zone.

Here is another example of "don't buy calls in the Breakdown zone"

The following screenshot will tell us a few things.

- When the Supertrend is giving us a buy signal, and that candle is crossing from Bear Zone into Bull Zone, then it's potentially setting up for a call play. (circle #1)

- Unlike the rule of not buying calls when you're in Breakdown Zone, shorting when in Breakout Zone could potentially be profitable too. But only if it's reasonable. Look at circle #2. It rejected the white dotted line, which is an additional border to enter another Breakout Zone. Since it rejected the second breakout area, we could take advantage of the Supertrend signal to go short.

- Circle #3 and #4, don't short in Breakout Zone without reasonable evidence (I like to use Support and Resistance during the Breakout and Breakdown Zone).

When the Supertrend is showing a buy signal while the candle is in Bull Zone then it's fairly safe to take it. When Supertrend is showing a short signal while the candle s in Bear Zone, then it's fairly safe to short at that point. Treat these zones as the home of Bears and Bulls.

I think the concept is pretty simple and straightforward here. Give it a spin and let me know how it goes for you guys.

Feel free to post questions, ideas, or any additional finding from this indicator.

P.S: I'll let Steve talk more about the usage of TEMA and EMA when he's on.

Update: A different version with Fibonacci Levels.

Here is the scanner for anyone interested.

Question: In this case, the opening range breakout was above the Green dotted line : "2" . So as per the study one should go long only when the chart is above the "2" area right? But the area above the dotted yellow "1" and "2" looks like ta better R/R for going long. Thoughts?

@thealphabreed One should go long only when the chart is above the "2" is what the strategy is based on. Not all stocks have read the book, they sometimes plot differently. There is no reason you can't test out alternate conditions. This thread is chock-full of flavors members have found successful.

JamesBond007

New member

Is it possible to draw an opening range from 9:30 am Eastern of the previous day to 9:00 am the current day? I am trying to automate the process. TIA.

Here is a specific modification to this script which has previously been posted to address your request. The option to extend your timeframe's range to the current day has been activated. You can select no at the input extendedlines, to better test the accuracy of the script.Is it possible to draw an opening range from 9:30 am Eastern of the previous day to 9:00 am the current day? I am trying to automate the process. TIA.

Ruby:

Ruby:input afterbegin = 0930; input afterend = 0900; def sec1 = SecondsFromTime(afterbegin); def sec2 = SecondsFromTime(afterend); def isTime1 = getday()==getlastday()-1 and (sec1 >= 0 and sec1[1] <= 0) or (sec1 < sec1[1] and sec1 >= 0); def isTime2 = getday()==getlastday() and (sec2 > 0 and sec2[1] <= 0) or (sec2 < sec2[1] and sec2 > 0); def aftermarket = CompoundValue(1, if isTime1 then 1 else if isTime2 then 0 else aftermarket[1], 0); def bars = 2000; input pricePerRowHeightMode = { AUTOMATIC, default TICKSIZE, CUSTOM}; input customRowHeight = 1.0; input timePerProfile = {default BAR}; input onExpansion = no; input profiles = 1000; def period; switch (timePerProfile) { case BAR: period = BarNumber() - 1; } def count = CompoundValue(1, if aftermarket and period != period[1] then (count[1] + period - period[1]) % bars else count[1], 0); def cond = count < count[1] + period - period[1]; def height; switch (pricePerRowHeightMode) { case AUTOMATIC: height = PricePerRow.AUTOMATIC; case TICKSIZE: height = PricePerRow.TICKSIZE; case CUSTOM: height = customRowHeight; } profile vol = VolumeProfile("startNewProfile" = cond, "onExpansion" = no, "numberOfProfiles" = 1000, "pricePerRow" = height, "value area percent" = 0); def con = CompoundValue(1, onExpansion, no); def hProfile = if aftermarket and IsNaN(vol.GetHighest()) and con then hProfile[1] else vol.GetHighest(); def lProfile = if aftermarket and IsNaN(vol.GetLowest()) and con then lProfile[1] else vol.GetLowest(); def plotsDomain = IsNaN(close) == onExpansion; def ProfileHigh = if aftermarket and plotsDomain then hProfile else Double.NaN; def ProfileLow = if aftermarket and plotsDomain then lProfile else Double.NaN; plot hrange = ProfileHigh; plot lrange = ProfileLow; hrange.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); lrange.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); hrange.SetDefaultColor(Color.GREEN); lrange.SetDefaultColor(Color.RED); hrange.SetLineWeight(2); lrange.SetLineWeight(2); input extendedlines = yes; def PHighext = if IsNaN(Max(hrange, lrange)) then PHighext[1] else hrange; def PLowext = if IsNaN(Max(hrange, lrange)) then PLowext[1] else lrange; plot hrangeext = if extendedlines then PHighext else Double.NaN; plot lrangeext = if extendedlines then PLowext else Double.NaN; hrangeext.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); lrangeext.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); hrangeext.SetDefaultColor(Color.GREEN); lrangeext.SetDefaultColor(Color.RED); hrangeext.SetLineWeight(2); lrangeext.SetLineWeight(2); input bubblemover = 0; def b = bubblemover; def b1 = b + 1; input showbubbles = yes; AddChartBubble(showbubbles and (IsNaN(hrange[b1]) and hrange[b]) , hrange, AsText(hrange), Color.LIGHT_GREEN); AddChartBubble(showbubbles and (IsNaN(hrange[b1]) and hrange[b]) , lrange, AsText(lrange), Color.LIGHT_RED, up = no); input showverticalline = yes; AddVerticalLine(showverticalline and hrange != hrange[1], "", Color.BLUE, stroke = Curve.FIRM);

Last edited:

_Merch_Man_

Active member

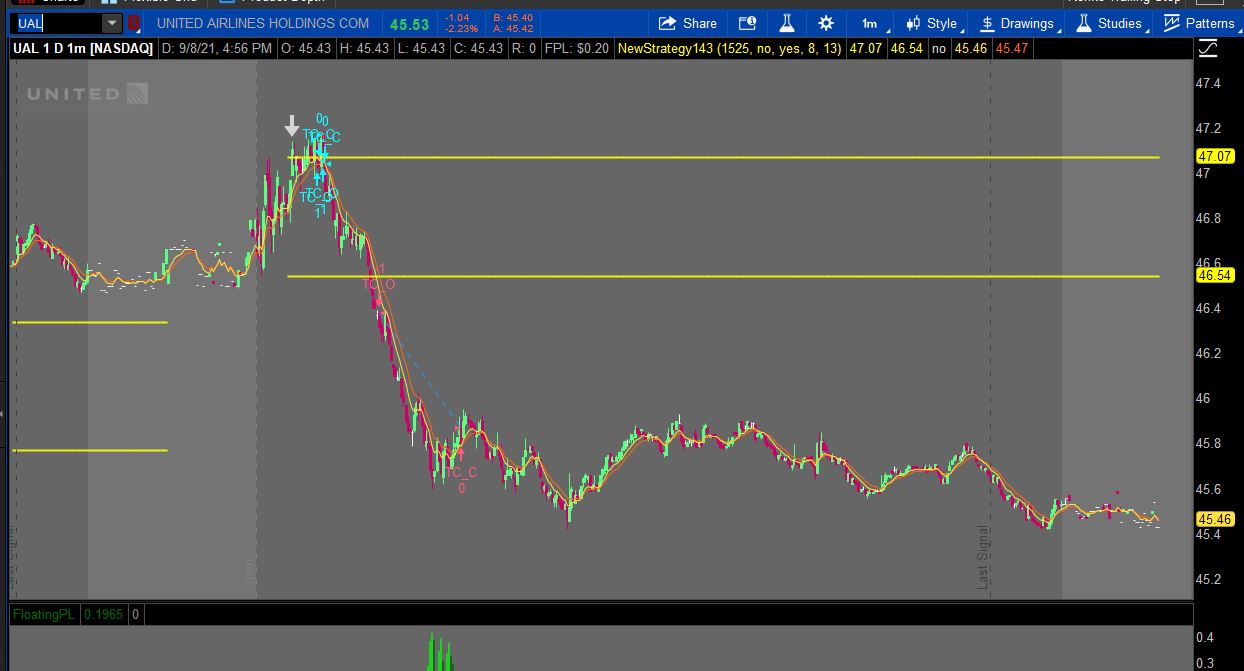

Hey guys - I am playing around with the useThinkScript Opening Range Breakout (ORB) strategy and FloatingPL is not behaving as expected. In the video you will see:

1. Change the style

2. Change the ticker to /SIL

3. FloatingPL shows +$2740

4. I change the timeframe from 5 min to 15 min

5. I change the timeframe back to 5 min

6. FloatingPL now shows -$30

Could someone explain this behavior to me please?

Many thanks,

Matt.

1. Change the style

2. Change the ticker to /SIL

3. FloatingPL shows +$2740

4. I change the timeframe from 5 min to 15 min

5. I change the timeframe back to 5 min

6. FloatingPL now shows -$30

Could someone explain this behavior to me please?

Many thanks,

Matt.

@_Merch_Man_ You went from 90D 5M to 5D 5M.

_Merch_Man_

Active member

Mmm. I don't believe I did. Regardless, why would the FloatingPL be different between the first time I am set to 5min (screenshot 1) and the second time I am set to 5min (screenshot 2)? Nothing else has changed. (It's difficult to read the FloatingPL number, but the FloatingPL graph shows it clearly enough). I have also included the script.@_Merch_Man_ You went from 90D 5M to 5D 5M.

Ruby:

# 30 min opening range Market Volatility V1.1

# Robert Payne

# Adapted to strategy by WalkingBallista and BenTen

# https://usethinkscript.com/threads/opening-range-breakout-strategy-with-market-volatility-for-thinkorswim.164/

script MV {

input atrlength = 14;

input avglength = 500;

input plotlower = {default "yes", "no"};

def vol = reference ATR(atrlength, averageType = AverageType.SIMPLE);

def avgvol = Average(vol, avglength);

def calm = vol < avgvol - (avgvol * .1);

def neutral = avgvol + (avgvol * .1) > vol > avgvol - (avgvol * .1);

def Volatile = vol > avgvol + (avgvol * .1);

AddLabel(yes, Concat("Market is Currently ", (if calm then "Calm" else if neutral then "Neutral" else if Volatile then "Volatile" else "Neutral")), if calm then Color.GREEN else if neutral then Color.BLUE else if Volatile then Color.RED else Color.GRAY);

declare lower;

plot window = vol - avgvol;

window.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

window.AssignValueColor(if Volatile then Color.RED else if calm then Color.GREEN else if neutral then Color.BLUE else Color.GRAY);

plot zeroline = 0;

};

def volatile = MV().volatile;

def OpenRangeMinutes = 15;

def MarketOpenTime = 0930;

def LastBar = SecondsFromTime(1530) == 0;

input TimeToStopSignal = 1525;

def TradeTimeFilter = SecondsFromTime(TimeToStopSignal);

input ShowTodayOnly = no;

input UseEMACross = yes;

input ema1_len = 8;

input ema2_len = 13;

AddVerticalLine(SecondsFromTime(0930)==0,"Open",Color.Gray,Curve.SHORT_DASH);

AddVerticalLine(!TradeTimeFilter,"Last Signal",Color.Dark_Gray,Curve.SHORT_DASH);

def Today = if GetDay() == GetLastDay() then 1 else 0;

def FirstMinute = if SecondsFromTime(MarketOpenTime) < 60 then 1 else 0;

def OpenRangeTime = if SecondsFromTime(MarketOpenTime) < 60 * OpenRangeMinutes then 1 else 0;

def ORHigh = if FirstMinute then high else if OpenRangeTime and high > ORHigh[1] then high else ORHigh[1];

def ORLow = if FirstMinute then low else if OpenRangeTime and low < ORLow[1] then low else ORLow[1];

plot OpenRangeHigh = if ShowTodayOnly and !Today then Double.NaN else if !OpenRangeTime then ORHigh else Double.NaN;

plot OpenRangeLow = if ShowTodayOnly and !Today then Double.NaN else if !OpenRangeTime then ORLow else Double.NaN;

OpenRangeHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

OpenRangeHigh.SetDefaultColor(Color.YELLOW);

OpenRangeHigh.SetLineWeight(2);

OpenRangeLow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

OpenRangeLow.SetDefaultColor(Color.YELLOW);

OpenRangeLow.SetLineWeight(2);

def dailyRange = high(period = "day" )[1] - low(period = "day" )[1];

def range = Average(dailyRange, 10);

plot ema1 = MovAvgExponential(length=ema1_len);

plot ema2 = MovAvgExponential(length=ema2_len);

# Bullish

AddOrder(OrderType.BUY_TO_OPEN, ((!UseEmaCross AND close crosses above OpenRangeHigh) OR (UseEMACross AND ema1 crosses above OpenRangeHigh)) and TradeTimeFilter < 1 and volatile, tradeSize = 1, tickcolor = GetColor(1), arrowcolor = GetColor(1), name = "TC_O");

alert(((!UseEmaCross AND close crosses above OpenRangeHigh) OR (UseEMACross AND ema1 crosses above OpenRangeHigh)) and TradeTimeFilter < 1 and volatile,"B2O",alert.bar,sound.RING);

AddOrder(OrderType.SELL_TO_CLOSE, ema1 crosses below ema2 or (close < OpenRangeHigh) or LastBar, tickcolor = GetColor(1), arrowcolor = GetColor(1), name = "TC_C");

#alert(!isNaN(entryPrice()) and ema1 crosses below ema2 or (close < OpenRangeHigh) or LastBar, "S2C", alert.bar, sound.RING);

# Bearish

AddOrder(OrderType.SELL_TO_OPEN, ((!UseEmaCross AND close crosses below OpenRangeLow) OR (UseEMACross AND ema1 crosses below OpenRangeLow)) and TradeTimeFilter < 1 and volatile, tradeSize = 1, tickcolor = GetColor(2), arrowcolor = GetColor(2), name = "TC_O");

alert( ((!UseEmaCross AND close crosses below OpenRangeLow) OR (UseEMACross AND ema1 crosses below OpenRangeLow)) and TradeTimeFilter < 1 and volatile, "S2O", alert.bar, sound.RING);

AddOrder(OrderType.BUY_TO_CLOSE, ema1 crosses above ema2 or (close > OpenRangeLow) or LastBar, tickcolor = GetColor(2), arrowcolor = GetColor(2), name = "TC_C");

#alert( !isNaN(entryprice()) and ema1 crosses above ema2 or (close > OpenRangeLow) or LastBar, "B2C:"+entryprice(), alert.bar, sound.RING);

Last edited by a moderator:

@_Merch_Man_ 30 seconds into the video, it shows 90D 5M and then you switched to 5D 15M to 5D 5M. You're looking at 90 days worth of trades vs 5 days, why would it be the same.

I am stuck. Working on an ORB strategy, but cannot seem to figure this out.

Q: How can I paint an arrow on the first bar (intraday chart) - and only the first bar - that crosses above the Opening Range High (or below the Low)?

It's simple enough to code for open < ORH and close > ORH. No problem there.

But I do not want to see arrows on any other candles the rest of the day - just that first instance.

Feeling like it should be possible, but thus far cannot find the answer. HELP!

Q: How can I paint an arrow on the first bar (intraday chart) - and only the first bar - that crosses above the Opening Range High (or below the Low)?

It's simple enough to code for open < ORH and close > ORH. No problem there.

But I do not want to see arrows on any other candles the rest of the day - just that first instance.

Feeling like it should be possible, but thus far cannot find the answer. HELP!

I am stuck. Working on an ORB strategy, but cannot seem to figure this out.

Q: How can I paint an arrow on the first bar (intraday chart) - and only the first bar - that crosses above the Opening Range High (or below the Low)?

It's simple enough to code for open < ORH and close > ORH. No problem there.

But I do not want to see arrows on any other candles the rest of the day - just that first instance.

Feeling like it should be possible, but thus far cannot find the answer. HELP!

See if this addition to the following strategy helps

Ruby:

#Arrow -----------------------------------------------------------

def orh_cross = lowestall(if today and close crosses above orhigh then barnumber() else double.nan);

def orl_cross = lowestall(if today and close crosses below orlow then barnumber() else double.nan);

plot orh_orl = if !isnan(orh_cross) and !isnan(orl_cross) then barnumber()==min(orh_cross,orl_cross) else if isnan(orh_cross) then barnumber()==orl_cross else barnumber()==orh_cross;

orh_orl.setpaintingStrategy(paintingstrategy.BOOLEAN_ARROW_down);

orh_orl.setlineweight(5);

#----------------------------------------------------------------- Ruby:

Ruby:# 30 min opening range Market Volatility V1.1 # Robert Payne # Adapted to strategy by WalkingBallista and BenTen # https://usethinkscript.com/threads/opening-range-breakout-strategy-with-market-volatility-for-thinkorswim.164/ script MV { input atrlength = 14; input avglength = 500; input plotlower = {default "yes", "no"}; def vol = reference ATR(atrlength, averageType = AverageType.SIMPLE); def avgvol = Average(vol, avglength); def calm = vol < avgvol - (avgvol * .1); def neutral = avgvol + (avgvol * .1) > vol > avgvol - (avgvol * .1); def Volatile = vol > avgvol + (avgvol * .1); AddLabel(yes, Concat("Market is Currently ", (if calm then "Calm" else if neutral then "Neutral" else if Volatile then "Volatile" else "Neutral")), if calm then Color.GREEN else if neutral then Color.BLUE else if Volatile then Color.RED else Color.GRAY); declare lower; plot window = vol - avgvol; window.SetPaintingStrategy(PaintingStrategy.HISTOGRAM); window.AssignValueColor(if Volatile then Color.RED else if calm then Color.GREEN else if neutral then Color.BLUE else Color.GRAY); plot zeroline = 0; }; def volatile = MV().volatile; def OpenRangeMinutes = 15; def MarketOpenTime = 0930; def LastBar = SecondsFromTime(1530) == 0; input TimeToStopSignal = 1525; def TradeTimeFilter = SecondsFromTime(TimeToStopSignal); input ShowTodayOnly = no; input UseEMACross = yes; input ema1_len = 8; input ema2_len = 13; AddVerticalLine(SecondsFromTime(0930)==0,"Open",Color.Gray,Curve.SHORT_DASH); AddVerticalLine(!TradeTimeFilter,"Last Signal",Color.Dark_Gray,Curve.SHORT_DASH); def Today = if GetDay() == GetLastDay() then 1 else 0; def FirstMinute = if SecondsFromTime(MarketOpenTime) < 60 then 1 else 0; def OpenRangeTime = if SecondsFromTime(MarketOpenTime) < 60 * OpenRangeMinutes then 1 else 0; def ORHigh = if FirstMinute then high else if OpenRangeTime and high > ORHigh[1] then high else ORHigh[1]; def ORLow = if FirstMinute then low else if OpenRangeTime and low < ORLow[1] then low else ORLow[1]; plot OpenRangeHigh = if ShowTodayOnly and !Today then Double.NaN else if !OpenRangeTime then ORHigh else Double.NaN; plot OpenRangeLow = if ShowTodayOnly and !Today then Double.NaN else if !OpenRangeTime then ORLow else Double.NaN; OpenRangeHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); OpenRangeHigh.SetDefaultColor(Color.YELLOW); OpenRangeHigh.SetLineWeight(2); OpenRangeLow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); OpenRangeLow.SetDefaultColor(Color.YELLOW); OpenRangeLow.SetLineWeight(2); #Arrow ----------------------------------------------------------- def orh_cross = lowestall(if today and close crosses above orhigh then barnumber() else double.nan); def orl_cross = lowestall(if today and close crosses below orlow then barnumber() else double.nan); plot orh_orl = if !isnan(orh_cross) and !isnan(orl_cross) then barnumber()==min(orh_cross,orl_cross) else if isnan(orh_cross) then barnumber()==orl_cross else barnumber()==orh_cross; orh_orl.setpaintingStrategy(paintingstrategy.BOOLEAN_ARROW_down); orh_orl.setlineweight(5); #----------------------------------------------------------------- def dailyRange = high(period = "day" )[1] - low(period = "day" )[1]; def range = Average(dailyRange, 10); plot ema1 = MovAvgExponential(length=ema1_len); plot ema2 = MovAvgExponential(length=ema2_len); # Bullish AddOrder(OrderType.BUY_TO_OPEN, ((!UseEmaCross AND close crosses above OpenRangeHigh) OR (UseEMACross AND ema1 crosses above OpenRangeHigh)) and TradeTimeFilter < 1 and volatile, tradeSize = 1, tickcolor = GetColor(1), arrowcolor = GetColor(1), name = "TC_O"); alert(((!UseEmaCross AND close crosses above OpenRangeHigh) OR (UseEMACross AND ema1 crosses above OpenRangeHigh)) and TradeTimeFilter < 1 and volatile,"B2O",alert.bar,sound.RING); AddOrder(OrderType.SELL_TO_CLOSE, ema1 crosses below ema2 or (close < OpenRangeHigh) or LastBar, tickcolor = GetColor(1), arrowcolor = GetColor(1), name = "TC_C"); #alert(!isNaN(entryPrice()) and ema1 crosses below ema2 or (close < OpenRangeHigh) or LastBar, "S2C", alert.bar, sound.RING); # Bearish AddOrder(OrderType.SELL_TO_OPEN, ((!UseEmaCross AND close crosses below OpenRangeLow) OR (UseEMACross AND ema1 crosses below OpenRangeLow)) and TradeTimeFilter < 1 and volatile, tradeSize = 1, tickcolor = GetColor(2), arrowcolor = GetColor(2), name = "TC_O"); alert( ((!UseEmaCross AND close crosses below OpenRangeLow) OR (UseEMACross AND ema1 crosses below OpenRangeLow)) and TradeTimeFilter < 1 and volatile, "S2O", alert.bar, sound.RING); AddOrder(OrderType.BUY_TO_CLOSE, ema1 crosses above ema2 or (close > OpenRangeLow) or LastBar, tickcolor = GetColor(2), arrowcolor = GetColor(2), name = "TC_C"); #alert( !isNaN(entryprice()) and ema1 crosses above ema2 or (close > OpenRangeLow) or LastBar, "B2C:"+entryprice(), alert.bar, sound.RING);

See if this addition to the following strategy helps

Ruby:#Arrow ----------------------------------------------------------- def orh_cross = lowestall(if today and close crosses above orhigh then barnumber() else double.nan); def orl_cross = lowestall(if today and close crosses below orlow then barnumber() else double.nan); plot orh_orl = if !isnan(orh_cross) and !isnan(orl_cross) then barnumber()==min(orh_cross,orl_cross) else if isnan(orh_cross) then barnumber()==orl_cross else barnumber()==orh_cross; orh_orl.setpaintingStrategy(paintingstrategy.BOOLEAN_ARROW_down); orh_orl.setlineweight(5); #-----------------------------------------------------------------

@SleepyZ that was just PERFECT. Thank you very much!

One other question: could I separate into two plots?

The reason being - if it crossed the High, I'd want an UP arrow; if it crossed the Low, I'd want a DOWN arrow.

Thank you again!!!

You're welcome. Replace the following code to get directional arrows@SleepyZ that was just PERFECT. Thank you very much!

One other question: could I separate into two plots?

The reason being - if it crossed the High, I'd want an UP arrow; if it crossed the Low, I'd want a DOWN arrow.

Thank you again!!!

Ruby:#Arrow ----------------------------------------------------------- def orh_cross = lowestall(if today and close crosses above orhigh then barnumber() else double.nan); def orl_cross = lowestall(if today and close crosses below orlow then barnumber() else double.nan); def orh_orl = if !isnan(orh_cross) and !isnan(orl_cross) then barnumber()==min(orh_cross,orl_cross) else if isnan(orh_cross) then barnumber()==orl_cross else barnumber()==orh_cross; plot orhcross = if orh_orl == 1 and barnumber()==orh_cross then orh_cross else double.nan; orhcross.setpaintingStrategy(paintingstrategy.BOOLEAN_ARROW_up); orhcross.setdefaultColor(color.yellow); orhcross.setlineweight(5); plot orlcross = if orh_orl == 1 and barnumber()==orl_cross then orl_cross else double.nan; orlcross.setpaintingStrategy(paintingstrategy.BOOLEAN_ARROW_down); orlcross.setdefaultColor(color.yellow); orlcross.setlineweight(5); #-----------------------------------------------------------------

You're welcome. Replace the following code to get directional arrows

Just terrific. Sincerest thanks to you.

Only one more condition to go for me. Back to work.

_Merch_Man_

Active member

OMG I'm so stupid. Thanks @generic.@_Merch_Man_ 30 seconds into the video, it shows 90D 5M and then you switched to 5D 15M to 5D 5M. You're looking at 90 days worth of trades vs 5 days, why would it be the same.

Ben's Swing Trading Strategy + Indicator

I wouldn't call this a course. My goal is zero fluff. I will jump right into my current watchlist, tell you the ThinkorSwim indicator that I'm using, and past trade setups to help you understand my swing trading strategy.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

Opening Range Breakout with Directional Day Filter for ThinkorSwim

- Started by BenTen

- Replies: 6

-

-

-

Opening Range Indicator with Measured Moves and VWAP For ThinkOrSwim

- Started by FutureTony

- Replies: 46

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1848

Online

Similar threads

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

Opening Range Breakout with Directional Day Filter for ThinkorSwim

- Started by BenTen

- Replies: 6

-

-

-

Opening Range Indicator with Measured Moves and VWAP For ThinkOrSwim

- Started by FutureTony

- Replies: 46

Similar threads

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

Opening Range Breakout with Directional Day Filter for ThinkorSwim

- Started by BenTen

- Replies: 6

-

-

-

Opening Range Indicator with Measured Moves and VWAP For ThinkOrSwim

- Started by FutureTony

- Replies: 46

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.