vince92615

New member

How come when I turn off the extended hours, the ORB range lines all go to the next day but the target lines still intact. tried multiple versions on this thread, all the same

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Thank you that one worked, doesn’t have targets included but I just overlayed another one with it.@vince92615 I have not experienced that problem but I am not trading on the ORB anymore. The highest All lag that ToS built into the latest upgrade makes this indicator unworkable.

Some posters have had better luck with this one. I haven't used it but perhaps it will fix your problems and it doesn't lag.

https://usethinkscript.com/threads/opening-range-breakout-orb-scanner-for-thinkorswim.68/

Supertrend link should work now. I had it listed under Exclusive which require manual approval to see. I just removed that. Should work now if you click on it againSorry about that. @Ezmane7

hi Ben, I just found this indicator today. its been great. been hearing a lot about it from others and many great review. Thank You!!

I cant see the red and green area in mine. what changes can I make to see that?

Click study, find your orb script. Click on gear icon then turn on cloud to yes just like this post.can you pls tell me how it's done. I am new to tos. thank you

That means RiskOn as per the indicator, and it shows up both sides for RiskOn for Long and Short.@BenTen on the study on tos what does the RO mean ?

I checked it, your script is corrupted, the cloud didn't turn on. Use this script which you can turn off and on the cloud. Hope this helps.Hey Ben- https://tos.mx/RiBfIw. Doesn't seem to be working. Could someone check on this?

Thank you in advance,

Ken

declare Hide_On_Daily;

declare Once_per_bar;

input OrMeanS = 0930.0; #hint OrMeanS: Begin Mean Period. Usually Market Open EST.

input OrMeanE = 0935.0; #hint OrMeanE: End Mean period. Usually End of first bar.

input OrBegin = 0930.0; #hint OrBegin: Beginning for Period of Opening Range Breakout.

input OrEnd = 1000.0; #hint OrEnd: End of Period of Opening Range Breakout.

input CloudOn = no; #hint CloudOn: Clouds Opening Range.

input AlertOn = yes; #hint AlertOn: Alerts on cross of Opening Range.

input ShowTodayOnly = {"No", default "Yes"};

input nAtr = 4; #hint nATR: Lenght for the ATR Risk and Target Lines.

input AtrTargetMult = 2.0; #hint ATRmult: Multiplier for the ATR calculations.

def h = high;

def l = low;

def c = close;

def bar = barNumber();

def s = ShowTodayOnly;

def ORActive = if secondsTillTime(OrMeanE) > 0 and

secondsFromTime(OrMeanS) >= 0

then 1

else 0;

def today = if s == 0

or getDay() == getLastDay() and

secondsFromTime(OrMeanS) >= 0

then 1

else 0;

def ORHigh = if ORHigh[1] == 0

or ORActive[1] == 0 and

ORActive == 1

then h

else if ORActive and

h > ORHigh[1]

then h

else ORHigh[1];

def ORLow = if ORLow[1] == 0

or ORActive[1] == 0 and

ORActive == 1

then l

else if ORActive and

l < ORLow[1]

then l

else ORLow[1];

def ORWidth = ORHigh - ORLow;

def na = double.nan;

def ORHA = if ORActive

or today < 1

then na

else ORHigh;

def ORLA = if ORActive

or today < 1

then na

else ORLow;

def O = ORHA - Round(((ORHA - ORLA) / 2) / TickSize(), 0) * TickSize();

def ORActive2 = if secondsTillTime(OREnd) > 0 and

secondsFromTime(ORBegin) >= 0

then 1

else 0;

def ORHigh2 = if ORHigh2[1] == 0

or ORActive2[1] == 0 and

ORActive2 == 1

then h

else if ORActive2 and

h > ORHigh2[1]

then h

else ORHigh2[1];

def ORLow2 = if ORLow2[1] == 0

or ORActive2[1] == 0 and

ORActive2 == 1

then l

else if ORActive2 and

l < ORLow2[1]

then l

else ORLow2[1];

def ORWidth2 = ORHigh2 - ORLow2;

def TimeLine = if secondsTillTime(OREnd) == 0

then 1

else 0;

def ORmeanBar = if !ORActive and ORActive[1]

then barNumber()

else ORmeanBar[1];

def ORendBar = if !ORActive2 and ORActive2[1]

then barNumber()

else ORendBar[1];

def ORL = if (o == 0 , na, o);

plot ORLext = if barNumber() >= highestAll(ORmeanBar)

then HighestAll(if isNaN(c[-1])

then ORL[1]

else double.nan)

else double.nan;

ORLext.SetDefaultColor(color.Yellow);

ORLext.SetStyle(curve.Long_DASH);

ORLext.SetLineWeight(3);

ORLext.HideTitle();

def ORH2 = if ORActive2

or today < 1

then na

else ORHigh2;

plot ORH2ext = if barNumber() >= highestAll(ORendBar)

then HighestAll(if isNaN(c[-1])

then ORH2[1]

else double.nan)

else double.nan;

ORH2ext.SetDefaultColor(color.Green);

ORH2ext.SetStyle(curve.Long_DASH);

ORH2ext.SetLineWeight(3);

ORH2ext.HideTitle();

def ORL2 = if ORActive2

or today < 1

then na

else ORLow2;

plot ORL2ext = if barNumber() >= highestAll(ORendBar)

then HighestAll(if isNaN(c[-1])

then ORL2[1]

else double.nan)

else double.nan;

ORL2ext.SetDefaultColor(color.Red);

ORL2ext.SetStyle(curve.Long_DASH);

ORL2ext.SetLineWeight(3);

ORL2ext.HideTitle();

def RelDay = (ORL - ORL2) / (ORH2 - ORL2);

def dColor = if RelDay > .5

then 5

else if RelDay < .5

then 6

else 4;

def pos = (ORH2 - ORL2)/10;

plot d1 = if (TimeLine , ORH2, na);

plot d2 = if (TimeLine , ORH2 - ( pos * 2), na);

plot d3 = if (TimeLine , ORH2 - ( pos * 3), na);

plot d4 = if (TimeLine , ORH2 - ( pos * 4), na);

plot d5 = if (TimeLine , ORH2 - ( pos * 5), na);

plot d6 = if (TimeLine , ORH2 - ( pos * 6), na);

plot d7 = if (TimeLine , ORH2 - ( pos * 7), na);

plot d8 = if (TimeLine , ORH2 - ( pos * 8), na);

plot d9 = if (TimeLine , ORH2 - ( pos * 9), na);

plot d10 = if (TimeLine ,(ORL2), na);

d1.SetPaintingStrategy(PaintingStrategy.POINTS);

d2.SetPaintingStrategy(PaintingStrategy.POINTS);

d3.SetPaintingStrategy(PaintingStrategy.POINTS);

d4.SetPaintingStrategy(PaintingStrategy.POINTS);

d5.SetPaintingStrategy(PaintingStrategy.POINTS);

d6.SetPaintingStrategy(PaintingStrategy.POINTS);

d7.SetPaintingStrategy(PaintingStrategy.POINTS);

d8.SetPaintingStrategy(PaintingStrategy.POINTS);

d9.SetPaintingStrategy(PaintingStrategy.POINTS);

d10.SetPaintingStrategy(PaintingStrategy.POINTS);

d1.AssignValueColor(GetColor(Dcolor));

d2.AssignValueColor(GetColor(Dcolor));

d3.AssignValueColor(GetColor(Dcolor));

d4.AssignValueColor(GetColor(Dcolor));

d5.AssignValueColor(GetColor(Dcolor));

d6.AssignValueColor(GetColor(Dcolor));

d7.AssignValueColor(GetColor(Dcolor));

d8.AssignValueColor(GetColor(Dcolor));

d9.AssignValueColor(GetColor(Dcolor));

d10.AssignValueColor(GetColor(Dcolor));

d1.HideBubble();

d2.HideBubble();

d3.HideBubble();

d4.HideBubble();

d5.HideBubble();

d6.HideBubble();

d7.HideBubble();

d8.HideBubble();

d9.HideBubble();

d10.HideBubble();

d1.HideTitle();

d2.HideTitle();

d3.HideTitle();

d4.HideTitle();

d5.HideTitle();

d6.HideTitle();

d7.HideTitle();

d8.HideTitle();

d9.HideTitle();

d10.HideTitle();

addCloud(if CloudOn == yes

then orl

else double.nan

, orl2,createColor(128,0,0), createColor(128,0,0));

addCloud(if CloudOn == yes

then orl

else double.nan

, orh2,createColor(0,90,0), createColor(0,90,0));

# Begin Risk Algorithm

# First Breakout or Breakdown bars

def Bubbleloc1 = isNaN(close[-1]);

def BreakoutBar = if ORActive

then double.nan

else if !ORActive and c crosses above ORH2

then bar

else if !isNaN(BreakoutBar[1]) and c crosses ORH2

then BreakoutBar[1]

else BreakoutBar[1];

def ATR = if ORActive2

then Round((Average(TrueRange(h, c, l), nATR)) / TickSize(), 0) * TickSize()

else ATR[1];

def cond1 = if h > ORH2 and

h[1] <= ORH2

then Round((ORH2 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else cond1[1];

plot ORLriskUP = if bar >= OREndBar and !ORActive and today

then HighestAll(ORH2ext - 2)

else double.nan;

ORLriskUP.SetStyle(Curve.Long_Dash);

ORLriskUP.SetDefaultColor(Color.Green);

ORLriskUP.HideTitle();

def crossUpBar = if close crosses above ORH2

then bar

else double.nan;

AddChartBubble(bar == HighestAll(crossUpBar), ORLriskUP, "RiskON ORH", color.green, no);

plot ORLriskDN = if bar >= OREndBar and !ORActive and close < ORL

then HighestAll(ORL2ext + 2)

else double.nan;

ORLriskDN.SetStyle(Curve.Long_Dash);

ORLriskDN.SetDefaultColor(Color.Red);

ORLriskDN.HideTitle();

def crossDnBar = if close crosses below ORL2ext

then bar

else double.nan;

AddChartBubble(bar == HighestAll(crossDnBar), HighestAll(ORLriskDN), "Risk ON ORL", color.red, yes);

# High Targets

plot Htarget = if bar >= BreakoutBar

then cond1

else double.nan;

Htarget.SetPaintingStrategy(paintingStrategy.Squares);

Htarget.SetLineWeight(1);

Htarget.SetDefaultColor(Color.White);

Htarget.HideTitle();

AddChartBubble(BubbleLoc1, Htarget, "RO", color.white, if c > Htarget then no else yes);

def condHtarget2 = if c crosses above cond1

then Round((cond1 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget2[1];

plot Htarget2 = if bar >= BreakoutBar

then condHtarget2

else double.nan;

Htarget2.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget2.SetLineWeight(1);

Htarget2.SetDefaultColor(Color.Plum);

Htarget2.HideTitle();

AddChartBubble(BubbleLoc1, Htarget2, "2nd T", color.plum, if c > Htarget2

then no

else yes);

def condHtarget3 = if c crosses above condHtarget2

then Round((condHtarget2 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget3[1];

plot Htarget3 = if bar >= BreakoutBar

then condHtarget3

else double.nan;

Htarget3.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget3.SetLineWeight(1);

Htarget3.SetDefaultColor(Color.Plum);

Htarget3.HideTitle();

AddChartBubble(isNaN(C[-1]), Htarget3, "3rd T", color.plum, if c > Htarget3 then no else yes);

def condHtarget4 = if c crosses above condHtarget3

then Round((condHtarget3 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget4[1];

plot Htarget4 = if bar >= HighestAll(BreakoutBar)

then condHtarget4

else double.nan;

Htarget4.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget4.SetLineWeight(1);

Htarget4.SetDefaultColor(Color.Plum);

Htarget4.HideTitle();

AddChartBubble(BubbleLoc1, Htarget4, "4th T", color.plum, if c > Htarget4 then no else yes);

def condHtarget5 = if c crosses above condHtarget4

then Round((condHtarget4 + (ATR * AtrTargetMult)) / TickSize(), 0) * TickSize()

else condHtarget5[1];

plot Htarget5 = if bar >= BreakoutBar

then condHtarget5

else double.nan;

Htarget5.SetPaintingStrategy(PaintingStrategy.Squares);

Htarget5.SetLineWeight(1);

Htarget5.SetDefaultColor(Color.Plum);

Htarget5.HideTitle();

AddChartBubble(BubbleLoc1, Htarget5, "5th T", color.plum, if c > Htarget5 then no else yes);

# Low Targets

def cond2 = if L < ORL2 and

L[1] >= ORL2

then Round((ORL2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else cond2[1];

plot Ltarget = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then cond2

else double.nan)

else double.nan;

Ltarget.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget.SetLineWeight(1);

Ltarget.SetDefaultColor(Color.White);

Ltarget.HideTitle();

AddChartBubble(BubbleLoc1, cond2, "RO", color.white, if c < Ltarget

then yes

else no);

def condLtarget2 = if c crosses below cond2

then Round((cond2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget2[1];

plot Ltarget2 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget2

else double.nan)

else double.nan;

Ltarget2.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget2.SetLineWeight(1);

Ltarget2.SetDefaultColor(Color.Plum);

Ltarget2.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget2, "2nd T", color.plum, if c < condLtarget2

then yes

else no);

def condLtarget3 = if c crosses below condLtarget2

then Round((condLtarget2 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget3[1];

plot Ltarget3 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget3

else double.nan)

else double.nan;

Ltarget3.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget3.SetLineWeight(1);

Ltarget3.SetDefaultColor(Color.Plum);

Ltarget3.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget3, "3rd T", color.plum, if c < Ltarget3

then yes

else no);

def condLtarget4 = if c crosses condLtarget3

then Round((condLtarget3 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget4[1];

plot Ltarget4 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget4

else double.nan)

else double.nan;

Ltarget4.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget4.SetLineWeight(1);

Ltarget4.SetDefaultColor(Color.Plum);

Ltarget4.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget4, "4th T", color.plum, if c < Ltarget4

then yes

else no);

def condLtarget5 = if c crosses condLtarget4

then Round((condLtarget4 - (AtrTargetMult * ATR)) / TickSize(), 0) * TickSize()

else condLtarget5[1];

plot Ltarget5 = if bar >= HighestAll(OREndBar)

then highestAll(if isNaN(c[-1])

then condLtarget5

else double.nan)

else double.nan;

Ltarget5.SetPaintingStrategy(PaintingStrategy.Squares);

Ltarget5.SetLineWeight(1);

Ltarget5.SetDefaultColor(Color.Plum);

Ltarget5.HideTitle();

AddChartBubble(BubbleLoc1, condLtarget5, "5th T", color.plum, if c < Ltarget5

then yes

else no);

def last = if secondsTillTime(1600) == 0 and

secondsFromTime(1600) == 0

then c[1]

else last[1];

plot LastClose = if Today and last != 0

then last

else Double.NaN;

LastClose.SetPaintingStrategy(PaintingStrategy.Dashes);

LastClose.SetDefaultColor(Color.White);

LastClose.HideBubble();

LastClose.HideTitle();

AddChartBubble(SecondsTillTime(0930) == 0, LastClose, "PC", color.gray, yes);

alert(c crosses above ORH2, "", Alert.Bar, Sound.Bell);

alert(c crosses below ORL2, "", Alert.Bar, Sound.Ring);

# End Code ORB with Risk and targetsyeah ofcourse i would just use two open range breakouts, and change the times of one indicator. here is the indicator, i would also change it to show today only. https://usethinkscript.com/threads/opening-range-breakout-indicator-for-thinkorswim.16/Hey guys, I wanted to see if someone could please put something together for me. I'd like something like some of @BenTen opening range breakout indicators, but that just plots lines of where the price range during the morning from 930am-1005am and again from 1330-1405pm.

It would be awesome if we could also make a watchlist like the opening range breakout column that makes a column to show if the price is in the Afternoon Range, between the morning and afternoon or in the morning range. If thats too much, then just the watchlist column showing if the price is within the afternoon range or not.

I would like to backtest a strategy with this. and if it works how I theorize it will perhaps we could work together to make an indicator and strategy out of it. If you are interested in this strategy please let me know and I can explain it.

Thanks for your help!

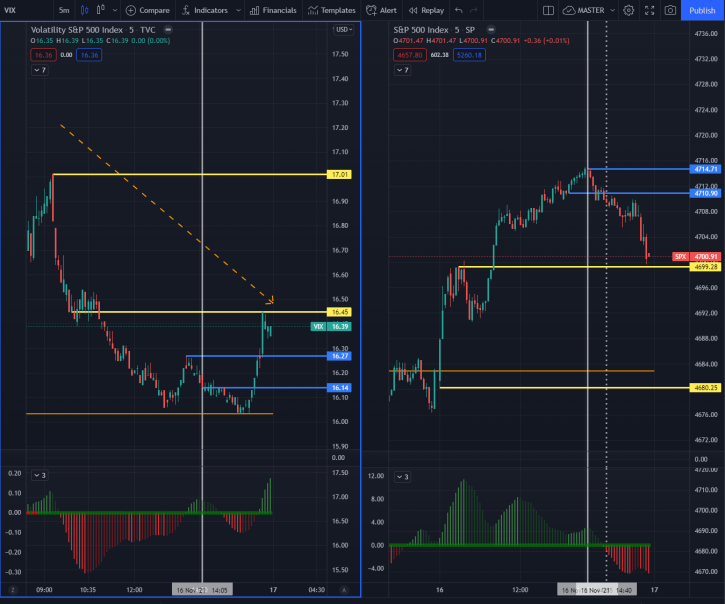

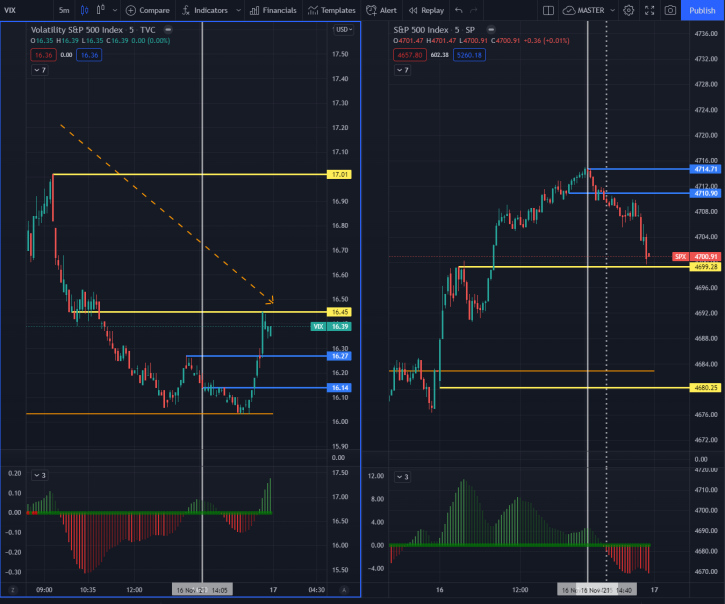

Here is a pic of an indicator that does the same thing, but on TradingView that I saw someone post.

This might be a noob question. Can somebody please explain what does below means and how they are used for trading.

- RO

- 1st T, 2nd T etc.

- Risk on ORL and Risk ORH

- PC

- The thicker green and the red lines are range for the first 30 mins (Understood). What are the yellow and thin red & green lines for.

The yellow dashed line is the Day Filter Line and is used to determin the trend direction for the day. The dominant time spent above or below this line during the Opening Range Period typically determines the days trend. The Opening Range is plotted with a green and red dashed line. Trades can be taken when there is an open outside these range lines. Up to 5 Targets are generated using Average True Range to plot target lines. When price crosses the first target line part of the trade should be taken as Risk Off profit and a stop should be placed at the entry point ensuring a profitable trade.

Can you point me to the shareable link for the supertrend indicator.@Playstation Last I checked, the Supertrend indicator is not delayed.

Yes, you should also treat the upper and lower ORB as support and resistance, as well.

https://usethinkscript.com/search/609603/?q=Supertrend&t=post&c[title_only]=1&o=repliesCan you point me to the shareable link for the supertrend indicator.

@michigandolf has a nice 30min OR on tradingview just fyi if you ae looking for anotherHey guys, I wanted to see if someone could please put something together for me. I'd like something like some of @BenTen opening range breakout indicators, but that just plots lines of where the price range during the morning from 930am-1005am and again from 1330-1405pm.

It would be awesome if we could also make a watchlist like the opening range breakout column that makes a column to show if the price is in the Afternoon Range, between the morning and afternoon or in the morning range. If thats too much, then just the watchlist column showing if the price is within the afternoon range or not.

I would like to backtest a strategy with this. and if it works how I theorize it will perhaps we could work together to make an indicator and strategy out of it. If you are interested in this strategy please let me know and I can explain it.

Thanks for your help!

Here is a pic of an indicator that does the same thing, but on TradingView that I saw someone post.

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.