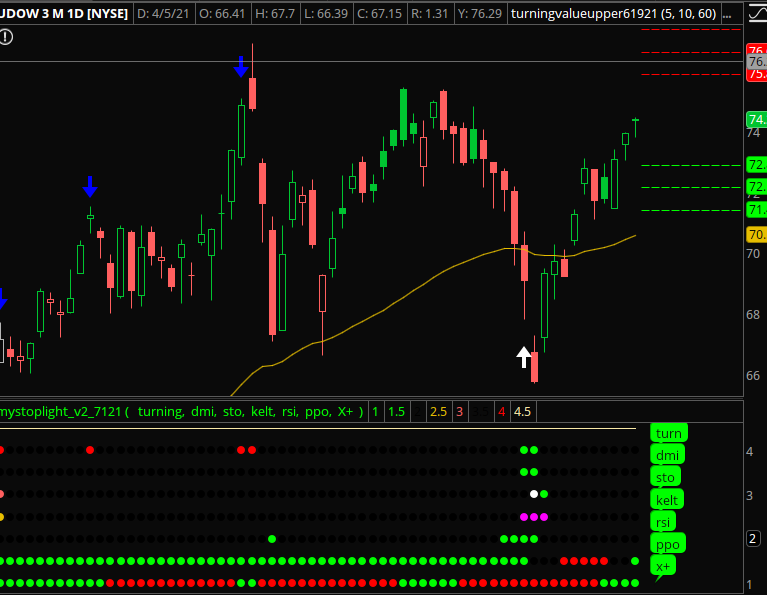

So, in the pic below you can see how the stoplight bubbles on the right aren't lining up properly. everything is shifted up just a bit, throwing everything off. is there a way to fix this, maybe with a simpler bubble? Thanks!

p.s. please to excuse the messiness of my coding. it's all a work in progress.

p.s. please to excuse the messiness of my coding. it's all a work in progress.

Code:

declare lower;

input name = " turning, dmi, sto, kelt, rsi, ppo, X+ ";

# move bubbles

def symbol1Signal = 1;

def symbol2Signal = 1.5;

def symbol3Signal = 2;

def symbol4Signal = 2.5;

def symbol5Signal = 3;

def symbol6Signal = 3.5;

def symbol7Signal = 4;

def x = -2;

def y = -2;

# bubbles

# X+

def highestBarSymbol1 = HighestAll( if IsNaN(close) then Double.NaN else barNumber() );

def referenceBarSymbol1 = highestBarSymbol1 - x;

AddChartBubble( barNumber() == referenceBarSymbol1,symbol1Signal,"x+"

,Color.GREEN);

# PPO

def highestBarSymbol2 = HighestAll( if IsNaN(close) then Double.NaN else barNumber() );

def referenceBarSymbol2 = highestBarSymbol2 - y;

AddChartBubble( barNumber() == referenceBarSymbol2,symbol2Signal,"ppo",Color.GREEN);

#RSI

def highestBarSymbol3 = HighestAll( if IsNaN(close) then Double.NaN else barNumber() );

def referenceBarSymbol3 = highestBarSymbol2 - x;

AddChartBubble( barNumber() == referenceBarSymbol3,symbol3Signal,"rsi",Color.GREEN);

#kelt

def highestBarSymbol4 = HighestAll( if IsNaN(close) then Double.NaN else barNumber() );

def referenceBarSymbol4 = highestBarSymbol3 - y;

AddChartBubble( barNumber() == referenceBarSymbol4,symbol4Signal,"kelt",Color.GREEN);

#sto

def highestBarSymbol5 = HighestAll( if IsNaN(close) then Double.NaN else barNumber() );

def referenceBarSymbol5 = highestBarSymbol4- x;

AddChartBubble( barNumber() == referenceBarSymbol5,symbol5Signal,"sto",Color.GREEN);

#dmi

def highestBarSymbol6 = HighestAll( if IsNaN(close) then Double.NaN else barNumber() );

def referenceBarSymbol6 = highestBarSymbol4 - y;

AddChartBubble( barNumber() == referenceBarSymbol6,symbol6Signal,"dmi",Color.GREEN);

#turn

def highestBarSymbol7 = HighestAll( if IsNaN(close) then Double.NaN else barNumber() );

def referenceBarSymbol7 = highestBarSymbol7 - x;

AddChartBubble( barNumber() == referenceBarSymbol7,symbol7Signal,"turn",Color.GREEN);

# signals

#ppo

def price = close;

def PPO_Period_Fast = 12;

def PPO_Period_Slow = 26;

def PPO_Period_Signal = 9;

def PPO_EMA_Fast = ExpAverage(price, PPO_Period_Fast);

def PPO_EMA_Slow = ExpAverage(price, PPO_Period_Slow);

def PPO_Line = ((PPO_EMA_Fast - PPO_EMA_Slow) / PPO_EMA_Slow) * 100;

def PPO_EMA = ExpAverage(PPO_Line, PPO_Period_Signal);

# Indicator Plots

# Indicator Statuses (1 = Up or Positive, 0 = Down or Negative)

def PPO_Status = if PPO_EMA >= 0 and PPO_Line >= 0 then 1 else 0;

def ppo_up = PPO_EMA >= 0 and PPO_Line >= 0;

def ppo_dn = PPO_EMA <= 0 and PPO_Line <= 0;

def x_up = PPO_Line crosses above PPO_EMA;

def x_dn = PPO_Line crosses below PPO_EMA;

def ox_up = PPO_EMA crosses above 0;

def ox_dn = PPO_EMA crosses below PPO_Line;

def xup2 = PPO_Line >= PPO_EMA;

def xdn2 = PPO_Line <= PPO_EMA;

plot ppoline = if IsNaN(close) then Double.NaN else 1;

ppoline.SetPaintingStrategy(PaintingStrategy.POINTS);

ppoline.SetLineWeight(5);

ppoline.AssignValueColor(if xup2 then Color.GREEN else if xdn2 then Color.RED else Color.black);

ppoline.HideBubble();

plot ppoline2 = if IsNaN(close) then Double.NaN else 1.5;

ppoline2.SetPaintingStrategy(PaintingStrategy.POINTS);

ppoline2.SetLineWeight(5);

ppoline2.AssignValueColor(if ppo_up then Color.GREEN else if ppo_dn then Color.RED else Color.black);

ppoline2.HideBubble();

#RSI

def rsilength = 5;

def rsitrigger = 30;

#input averageType = AverageType.WILDERS;

def NetChgAvg = MovingAverage(AverageType.WILDERS, price - price[1], rsilength);

def TotChgAvg = MovingAverage(AverageType.WILDERS, AbsValue(price - price[1]), rsilength);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

plot rsi_Line = if IsNaN(close) then Double.NaN else 2;

rsi_Line.SetPaintingStrategy(PaintingStrategy.POINTS);

rsi_Line.SetLineWeight(5);

rsi_Line.AssignValueColor(if RSI <= rsitrigger then Color.GREEN else Color.black);

# Keltner

def displace = 0;

def h = high;

def l = low;

def c = close;

# Keltner Channel set similar to BollingerBands PercentB by Lar (Longer Term Trend)

def factorKCLT = 1.800;

def lengthKCLT = 20.000;

def atr_length = 10;

def shiftKCLT = factorKCLT * MovingAverage(AverageType.WILDERS, TrueRange(high, close, low), atr_length);

def averageKCLT = MovingAverage(AverageType.EXPONENTIAL, close, lengthKCLT);

def AvgKCLT = averageKCLT[-displace];

def Upper_BandKCLT = averageKCLT[-displace] + shiftKCLT[-displace];

def Lower_BandKCLT = averageKCLT[-displace] - shiftKCLT[-displace];

def PercentkLT = (l - Lower_BandKCLT) / (Upper_BandKCLT - Lower_BandKCLT) * 100;

#PercentkLT.Hide();

def LTcross = PercentkLT crosses below 0;

def LT2 = PercentkLT < 0;

# keltner 2

# Keltner Channel set similar to BollingerBands PercentB by Lar (Shorter Term Trend)

def factorKCST = 3;

def lengthKCST = 20.000;

def shiftKCST = factorKCST * MovingAverage(AverageType.WILDERS, TrueRange(high, close, low), atr_length);

def averageKCST = MovingAverage(AverageType.EXPONENTIAL, close, lengthKCST);

def AvgKCST = averageKCST[-displace];

def Upper_BandKCST = averageKCST[-displace] + shiftKCST[-displace];

def Lower_BandKCST = averageKCST[-displace] - shiftKCST[-displace];

def PercentkST = (low - Lower_BandKCST) / (Upper_BandKCST - Lower_BandKCST) * 100;

def STcross = PercentkST crosses below 0;

plot pkst = if IsNaN(close) then Double.NaN else 2.5;

pkst.SetPaintingStrategy(PaintingStrategy.POINTS);

pkst.SetLineWeight(5);

pkst.AssignValueColor(if STcross then Color.GREEN else if LT2 then Color.MAGENTA else Color.black);

pkst.HideBubble();

# stochastic

def over_bought = 50;

def over_sold = 20;

def KPeriod = 5;

def DPeriod = 3;

def priceH = high;

def priceL = low;

def priceC = close;

def averageType = AverageType.SIMPLE;

def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, if (averageType == 1) then AverageType.SIMPLE else AverageType.EXPONENTIAL).FullK;

def SlowD = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, if (averageType == 1) then AverageType.SIMPLE else AverageType.EXPONENTIAL).FullD;

plot upk_Line = if IsNaN(close) then Double.NaN else 3;

upk_Line.SetPaintingStrategy(PaintingStrategy.POINTS);

upk_Line.SetLineWeight(5);

upk_Line.AssignValueColor(if SlowK < 20 then Color.WHITE else if SlowK crosses above 20 then Color.GREEN else Color.black);

upk_Line.HideBubble();

# DMI ADX

def dmi = reference DIPlus(length = 5);

def signal = dmi <= 5;

def adx = reference ADX(length = 3);

def signal2 = adx >= 70 and dmi <= 10;

def crossing = Crosses (signal2, CrossingDirection.ABOVE);

def signal3 = adx >= 80 and dmi <= 5;

#crossing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#def BS2 = if Signal2 then 0 else Double.NaN

#def UpSignal = if crossing then 0 else Double.NaN;

plot dmiline = if IsNaN(close) then Double.NaN else 3.5;

dmiline.SetPaintingStrategy(PaintingStrategy.POINTS);

dmiline.SetLineWeight(5);

dmiline.AssignValueColor(if signal2 then Color.GREEN else Color.black);

dmiline.HideBubble();

# Turning Value

def length = 5;

def VarP = Round(length / 5);

def VarA = Highest(high, VarP) - Lowest(low, VarP);

def VarR1 = if VarA == 0 and VarP == 1 then AbsValue(close - close[VarP]) else VarA;

def VarB = Highest(high, VarP)[VarP + 1] - Lowest(low, VarP)[VarP];

def VarR2 = if VarB == 0 and VarP == 1 then AbsValue(close[VarP] - close[VarP * 2]) else VarB;

def VarC = Highest(high, VarP)[VarP * 2] - Lowest(low, VarP)[VarP * 2];

def VarR3 = if VarC == 0 and VarP == 1 then AbsValue(close[VarP * 2] - close[VarP * 3]) else VarC;

def VarD = Highest(high, VarP)[VarP * 3] - Lowest(low, VarP)[VarP * 3];

def VarR4 =

if VarD == 0 and VarP == 1 then AbsValue(close[VarP * 3] - close[VarP * 4]) else VarD;

def VarE = Highest(high, VarP)[VarP * 4] - Lowest(low, VarP)[VarP * 4];

def VarR5 = if VarE == 0 and VarP == 1 then AbsValue(close[VarP * 4] - close[VarP * 5]) else VarE;

def LRange = ((VarR1 + VarR2 + VarR3 + VarR4 + VarR5) / 5) * 0.2;

def Var0 = if AbsValue(close - close[1]) > (high - low) then AbsValue(close - close[1]) else (high - low);

def LRange2 = if high == low then Average(AbsValue(close - close[1]), 5) * 0.2 else Average(Var0, 5) * 0.2;

def range = high + low;

def delta = high - low;

def median = range / 2;

def floatingAxis = Average(median, length);

def dynamicVolatilityUnit = if length <= 7 then LRange2 else LRange;

def relativeHigh = (high - floatingAxis) / dynamicVolatilityUnit;

def relativeLow = (low - floatingAxis) / dynamicVolatilityUnit;

def relativeOpen = (open - floatingAxis) / dynamicVolatilityUnit;

def relativeClose = (close - floatingAxis) / dynamicVolatilityUnit;

def "High" = relativeHigh;

def "Low" = relativeLow;

def length2 = 10;

def stdLength = 60;

def rolling = (close - close[length2]) * 100 / close[length2];

def updev = StDev(rolling, stdLength);

def twoupdev = 2 * StDev(rolling, stdLength);

def downdev = -StDev(rolling, stdLength);

def twodowndev = -2 * StDev(rolling, stdLength);

def combined = rolling <= downdev and "Low" <= -8;

def sell = rolling >= updev and "High" >= 8;

#combined.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

#sell.setpaintingstrategy (paintingstrategy.histogram);

#combined.AssignValueColor (if combined then Color.GREEN else if sell then Color.RED else color.yellow);

#combined.SetLineWeight(2);

plot roll = if IsNaN(close) then Double.NaN else 4;

roll.SetPaintingStrategy(PaintingStrategy.POINTS);

roll.SetLineWeight(5);

roll.AssignValueColor(if combined then Color.GREEN else if sell then Color.RED else Color.black);

roll.HideBubble();

#========== Bubbles ==========

plot Filler = if IsNaN(close) then Double.NaN else 4.5;

#Filler.Hide();

def barNum = BarNumber();

def offset = 30;

def LastBar = !IsNaN(open) and IsNaN(open [-1]);

def BubbleLocation = LastBar[offset];

def FirstBar = barNum == 1;

def FirstBarValue = barNum == 1;

def LastBarValue = if LastBar then barNum else 0;

def MidBar = if LastBar then barNum == (BarNumber() / 2) else 0;

#AddChartBubble(FirstBar, 1, "X+", Color.PINK);

#AddChartBubble(FirstBar, 1.5, "ppo", Color.PINK);

#AddChartBubble(FirstBar, 2, "rsi", Color.BLUE);

#AddChartBubble(FirstBar, 2.5, "kelt", Color.MAGENTA);

#AddChartBubble(FirstBar, 3, "sto", Color.YELLOW);

#AddChartBubble(FirstBar, 3.5, "dmi", Color.YELLOW);

#AddChartBubble(FirstBar, 4, "turning", Color.GREEN);

#def upK = SlowK crosses above 20;

#def signal2 = slowk < 20;