Fedegrosso

New member

Hi Everyone,

I'm very new to ThinkScript and coding in general

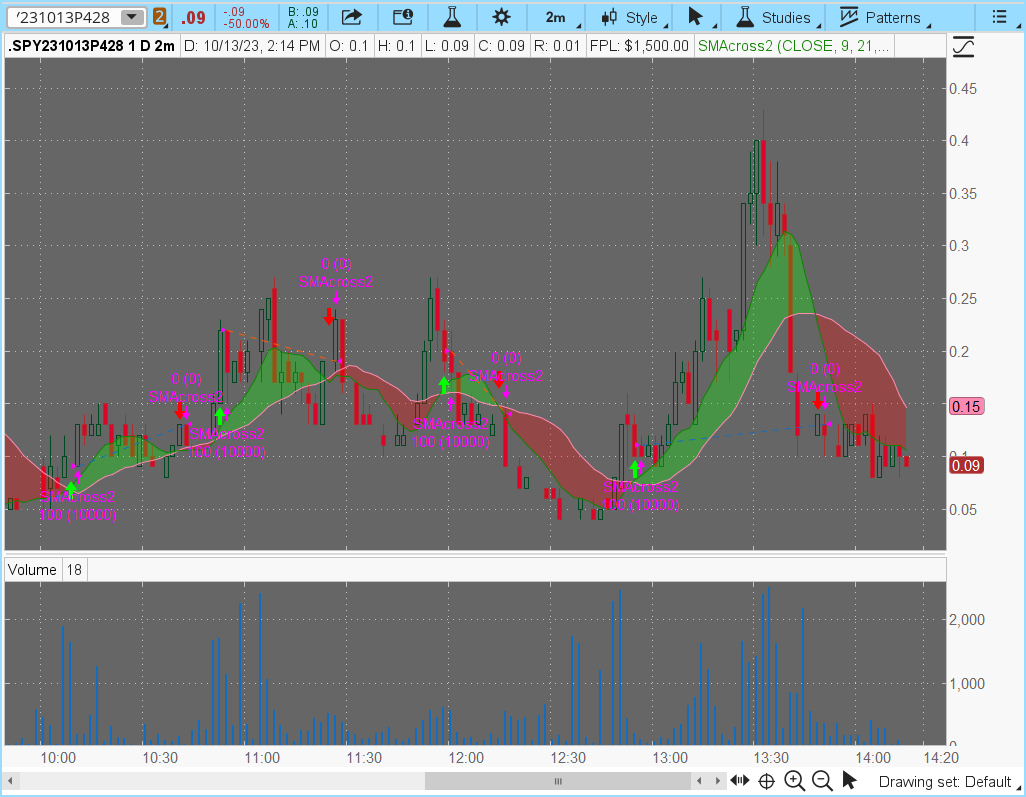

Have any of you ever made a very basic Moving average crossover strategy?

Eg. Buy/Sell When MA9 crosses MA20. Something very basic like that

If yes would you be so kind to share the code in order for me to start learning TS getting my hand dirty trying to tweak the code?

Thank you very much

PS: Exercise caution and be safe out there in these very uncertain days.

I'm very new to ThinkScript and coding in general

Have any of you ever made a very basic Moving average crossover strategy?

Eg. Buy/Sell When MA9 crosses MA20. Something very basic like that

If yes would you be so kind to share the code in order for me to start learning TS getting my hand dirty trying to tweak the code?

Thank you very much

PS: Exercise caution and be safe out there in these very uncertain days.